|

市场调查报告书

商品编码

1708156

滴水盘市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Drip Trays Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

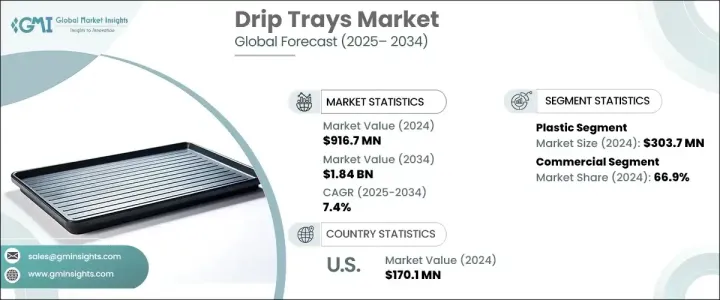

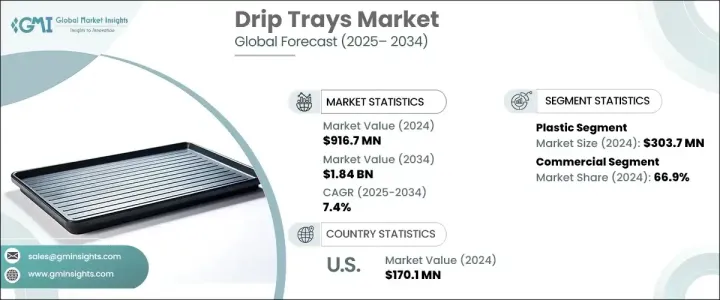

2024 年全球滴水盘市场规模达到 9.167 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.4%。这项扩张得益于材料和设计的不断进步,使滴水盘更加耐用、高效,并适合商业和工业应用。向环保解决方案的转变进一步推动了市场成长,製造商专注于铝和高密度聚乙烯(HDPE)等永续和高性能材料。这些创新有助于开发轻质、耐腐蚀、耐用的滴水盘,以满足不同的产业需求。

各行各业对工作场所安全和洩漏控制的日益重视,促使企业采用先进的滴水盘解决方案。对客製化和专业设计的需求正在增加,特别是在需要严格遵守法规的行业,例如汽车、食品加工和製造。公司正在寻求高效且经济的控制解决方案,以最大限度地降低环境风险并提高营运效率。此外,技术进步在滴水盘中引入了自动洩漏检测和防溢出功能,提高了其功能性和对最终用户的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.167亿美元 |

| 预测值 | 18.4亿美元 |

| 复合年增长率 | 7.4% |

2024 年塑胶产业产值达 3.037 亿美元,凸显其在市场上的强劲地位。塑胶滴水盘因其成本效益、多功能性和重量轻的特性而受到广泛青睐,这增强了在不同环境中的移动性和适应性。该材料固有的抗化学性和抗降解性使其成为汽车、製造和食品加工等行业的理想选择。此外,该行业对永续性的日益关注刺激了再生塑胶和生物塑胶的创新,扩大了环保解决方案的机会。随着监管压力的增加和企业寻求更环保的替代品,製造商正在投资研发以创造符合永续发展目标的耐用、无毒、可重复使用的塑胶滴水盘。

2024 年,商业领域占了 66.9% 的市场份额,凸显了各行各业对遏制解决方案的需求日益增长。食品加工、汽车和製造业的企业正在采用滴水盘来提高安全性、法规遵循和营运效率。材料科学和产品设计的不断进步使得这些解决方案更有效地防止溢出和洩漏,从而减少工作场所的危害和环境责任。由于公司优先考虑安全性和具有成本效益的洩漏管理,预计商业部门将继续成为滴水盘市场的主导力量。

在各行业严格的环境法规和安全协议的支持下,美国滴水盘市场价值在 2024 年达到 1.701 亿美元。由于针对特定行业需求客製化滴水盘的采用率不断提高,市场正在稳步增长。材料技术的创新,例如耐腐蚀和轻量化选择,正在增强产品吸引力并推动需求。该公司正在增加对高品质、耐用的滴水盘的投资,以满足合规标准并提高营运效率,这使得美国成为全球滴水盘市场扩张的主要贡献者。

目录

第一章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算。

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 提高对工作场所安全和环境法规的认识

- 汽车和製造业等行业的需求不断增长

- 材料创新与环保设计

- 产业陷阱与挑战

- 市场参与者竞争激烈

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 技术概述

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依材料类型,2021-2034

- 主要趋势

- 塑胶

- 金属

- 不銹钢

- 铝

- 其他的

- 玻璃纤维

- 其他(橡胶、复合材料等)

第六章:市场估计与预测:依设计,2021-2034

- 主要趋势

- 平坦的

- 磨碎的

- 可堆迭

- 其他(嵌入式等)

第七章:市场估计与预测:依规模,2021-2034

- 主要趋势

- 标准尺寸

- 自订尺寸

- 模组化系统

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 工业的

- 工具机

- 生产设备

- 化工厂

- 石油和天然气

- 食品加工

- 公用事业

- 其他(电子元件等)

- 商业的

- 餐厅和咖啡馆

- 饭店及餐饮业

- 零售店

- 办公大楼

- 机构

- 医院

- 其他(政府设施等)

- 住宅

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Brewfitt

- DENIOS

- Drrader Manufacturing

- Eagle Manufacturing

- Haws

- Justrite

- MFG Tray

- Micro Matic

- New Pig

- Raffeiner GmbH

- Riverside Sheet Metal & Fabrications

- Short Run Pro

- SP Bel-Art

- Weber

- WirthCo Engineering

The Global Drip Trays Market reached USD 916.7 million in 2024 and is projected to grow at a CAGR of 7.4% between 2025 and 2034. This expansion is driven by continuous advancements in material and design, making drip trays more durable, efficient, and suited for commercial and industrial applications. The shift toward eco-friendly solutions is further fueling market growth, with manufacturers focusing on sustainable and high-performance materials such as aluminum and High-Density Polyethylene (HDPE). These innovations contribute to the development of lightweight, corrosion-resistant, and long-lasting drip trays that cater to diverse industry needs.

A rising emphasis on workplace safety and spill containment across multiple industries is pushing businesses to adopt advanced drip tray solutions. The demand for customized and specialized designs is increasing, particularly in industries that require stringent regulatory compliance, such as automotive, food processing, and manufacturing. Companies are seeking efficient and cost-effective containment solutions to minimize environmental risks and enhance operational efficiency. Furthermore, technological advancements have introduced automated leak detection and spill prevention features in drip trays, improving their functionality and appeal to end users.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $916.7 million |

| Forecast Value | $1.84 billion |

| CAGR | 7.4% |

The plastic segment generated USD 303.7 million in 2024, highlighting its strong presence in the market. Plastic drip trays are widely preferred due to their cost-effectiveness, versatility, and lightweight nature, which enhances mobility and adaptability in different settings. The material's inherent resistance to chemicals and degradation makes it an ideal choice for sectors such as automotive, manufacturing, and food processing. Additionally, the industry's growing focus on sustainability has spurred innovations in recycled plastics and bioplastics, expanding opportunities for environmentally conscious solutions. As regulatory pressures mount and businesses seek greener alternatives, manufacturers are investing in research and development to create durable, non-toxic, and reusable plastic drip trays that align with sustainability goals.

The commercial sector held a commanding 66.9% market share in 2024, emphasizing the increasing need for containment solutions across various industries. Businesses in the food processing, automotive, and manufacturing sectors are adopting drip trays to enhance safety, regulatory compliance, and operational efficiency. The ongoing advancements in material science and product design are making these solutions more effective in preventing spills and leaks, thus reducing workplace hazards and environmental liabilities. As companies prioritize safety and cost-effective spill management, the commercial sector is expected to remain a dominant force in the drip trays market.

The U.S. drip trays market was valued at USD 170.1 million in 2024, supported by stringent environmental regulations and safety protocols across industries. The market is experiencing steady growth due to the rising adoption of customized drip trays tailored to specific industry requirements. Innovations in material technology, such as corrosion-resistant and lightweight options, are enhancing product appeal and driving demand. Companies are increasingly investing in high-quality, durable drip trays to meet compliance standards and improve operational efficiencies, making the U.S. a key contributor to the global drip trays market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing awareness of workplace safety and environmental regulations

- 3.6.1.2 Rising demand from industries such as automotive and manufacturing

- 3.6.1.3 Innovation in materials and eco-friendly designs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High competition among market players

- 3.6.2.2 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technology overview

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Metal

- 5.3.1 Stainless steel

- 5.3.2 Aluminum

- 5.3.3 Others

- 5.4 Fiberglass

- 5.5 Others (Rubber, Composite, etc.)

Chapter 6 Market Estimates & Forecast, By Design, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Flat

- 6.3 Grated

- 6.4 Stackable

- 6.5 Others (Recessed, etc.)

Chapter 7 Market Estimates & Forecast, By Size, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Standard sizes

- 7.3 Custom sizes

- 7.4 Modular systems

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Industrial

- 8.2.1 Machine tools

- 8.2.2 Production equipment

- 8.2.3 Chemical plants

- 8.2.4 Oil & gas

- 8.2.5 Food processing

- 8.2.6 Utilities

- 8.2.7 Others (Electronic component, etc.)

- 8.3 Commercial

- 8.3.1 Restaurants & cafes

- 8.3.2 Hotels & hospitality

- 8.3.3 Retail stores

- 8.3.4 Office buildings

- 8.3.5 Institutional

- 8.3.6 Hospitals

- 8.3.7 Others (Government facilities, etc.)

- 8.4 Residential

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Brewfitt

- 11.2 DENIOS

- 11.3 Drrader Manufacturing

- 11.4 Eagle Manufacturing

- 11.5 Haws

- 11.6 Justrite

- 11.7 MFG Tray

- 11.8 Micro Matic

- 11.9 New Pig

- 11.10 Raffeiner GmbH

- 11.11 Riverside Sheet Metal & Fabrications

- 11.12 Short Run Pro

- 11.13 SP Bel-Art

- 11.14 Weber

- 11.15 WirthCo Engineering