|

市场调查报告书

商品编码

1689701

滴灌-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Drip Irrigation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

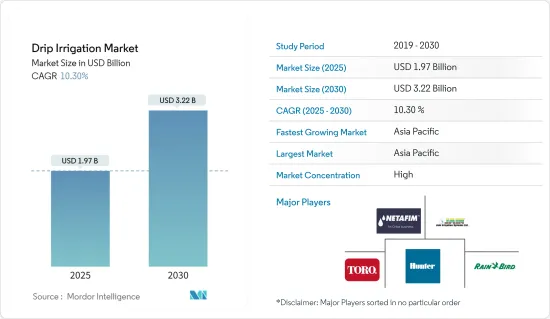

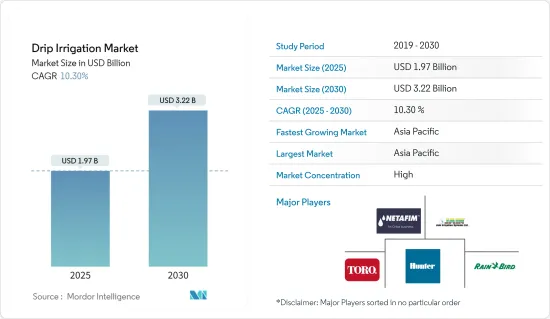

滴灌市场规模预计在 2025 年为 19.7 亿美元,预计到 2030 年将达到 32.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.3%。

关键亮点

- 灌溉是农业和作物生产的重要组成部分。製造商已经创造了设备和技术,为农民提供最必要的滴灌系统。政府补贴和政策、技术创新以及对水资源短缺日益增长的担忧等因素正在推动市场的发展。

- 随着水资源短缺问题日益严重,滴灌系统的需求也越来越大。农民正在寻找创新思路,以便用同样的水量种植更多的作物。预计这将促进所研究市场的成长。例如,滴灌技术的应用正在加拿大各地扩大,特别是在水资源匮乏且农业生产用水量高的省份。加拿大统计局的数据显示,2022 年加拿大农民用于农作物灌溉的用水量与 2020 年相比增加了 23%。

- 近年来,各地采用滴灌的现像日益增加。亚太地区是滴灌产业最大的市场。亚太地区最大的滴灌市场是印度。 2021年2月,印度农业和农民福利部表示,该国净灌溉面积为68,649,000公顷。农地微灌面积12908440公顷,其中滴灌面积6112050公顷,喷水灌溉6796390公顷。换句话说,全国只有19%的灌溉土地是微灌溉。滴灌系统可以帮助减少种植甘蔗、香蕉、秋葵、木瓜、苦瓜和其他几种作物所需的水量高达 60%。

- 滴灌系统市场的参与企业主要市场参与者包括 Jain Irrigation Systems Limited、Netafim Limited、Toro Company 等,使得全球滴灌市场成为一个整合的市场。这些市场参与企业参与了多项策略计划、产品开发活动和併购,促进了市场的成长。最近,Rivulis Irrigation India Ltd 和 Jain Irrigation Systems Limited 于 2022 年 6 月合併,成为全球最大的滴灌系统供应商之一。

滴灌市场趋势

按作物类型划分,农田作物是主要部分

根据粮农组织统计,约70%的可耕地用于种植谷物。这是因为许多谷物,例如米和玉米,都是耗水量很大的作物。全球人口的成长迫使全球农民加强农作物生产,导致该领域精准灌溉的使用增加。根据粮农组织报告,预计2022年世界谷物产量将达30.596亿吨,高于2020年的30.036亿吨,创历史新高。

米、小麦和玉米是世界主要种植的谷物。这些作物传统上依靠雨水生长,但为评估灌溉的正面影响而进行的各种实地测试和研究导致对灌溉系统的需求增加。例如,2023年波兰进行的一项研究表明,与传统灌溉方法相比,玉米平均产量增加了25%。在同一试验中,也实施了滴灌,结果每公顷平均产量增加了 2.35 吨,证明了这种方法的效率的重要性。

科学技术的进步使得物联网和自动化技术在田间滴灌系统中得到应用。这样的时刻对农民和滴灌供应商和公司很有吸引力,因为它提供了灌溉的便利性和省时的好处。政府也采取倡议,透过节约用水实现永续发展。最近,印度启动了一项名为 PMKSY(Pradhan Mantri Krishi Sinchayi Yojana)的特别计划,透过提高农民的用水意识和向他们提供补贴来促进精准灌溉。此外,2022年,耐特菲姆启动了在日本旱田引进滴灌水稻种植的计划。该系统减少了水和肥料的浪费,并鼓励向减少甲烷排放的可持续生产转变。

亚太地区占市场主导地位

近年来,亚太地区农业领域滴灌的应用呈现显着成长。这主要是由于微灌计划的扩大,减少了水资源消费量,从而增加了灌溉面积。根据印度国家倡议委员会预测,到2022-2023年,灌溉面积将达7,300万公顷,占印度农业用地总面积的52%。同样,根据中国国家统计局的数据,预计2021年中国灌溉面积将达到6,961万公顷,2022年将增加7,036万公顷。

此外,安得拉邦的滴灌面积最多,其次是马哈拉斯特拉邦、古吉拉突邦和旁遮普邦。为了在这些州促进有利的农业环境并实施成功的滴灌模式,Netafim 正在提供滴灌系统。 2023年,Netafim透过位于中央邦Shivpuri区的Khajuri、Kolaras和Pokhari地区的四个Better Life Farming (BLF)中心为番茄种植者提供滴灌系统。这项措施使马哈拉斯特拉邦的番茄产量提高了 40%,并推动了滴灌系统的采用。

中国是世界上最大的滴灌设备市场和消费国之一。这主要是因为政府制定了五年计划,要在农场引入高效节水灌溉技术和系统,到2030年至少在75%的总灌溉面积上引入微灌系统。此外,政府经常与滴灌公司合作,以增加对农民的节水设备供应。例如,2022年11月,昆明市元木地方政府与大禹灌溉集团签署协议,以官民合作关係计划模式合作,到2038年投放滴灌管道333万余公尺、滴头120万隻。

滴灌行业概况

全球滴灌市场正在整合,领先公司占据大部分市场占有率。市场上主要企业包括 Netafim Limited、Jain Irrigation Systems Limited、The Toro Company、Hunter Industries、Rain Bird Corporation 等。最常用的策略是透过在市场上推出创新新产品来扩大产品系列。其他主要企业也透过联盟和合併巩固了其地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 缺水威胁

- 优惠的政府政策和补贴

- 扩大灌溉应用

- 市场限制

- 初始资本投入高

- 复杂的设定可能会损害滴灌

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 应用

- 地面滴灌

- 地下滴灌

- 作物类型

- 田间作物

- 蔬菜作物

- 果园作物

- 葡萄园

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Jain Irrigation Systems Ltd

- The Toro Company

- Netafim Limited

- Rain Bird Corporation

- Chinadrip Irrigation Equipment Co. Ltd

- Antelco Pty Ltd

- TL Irrigation

- Sistema Azud

- Metzer Group

- Hunter Industries Inc.

第七章 市场机会与未来趋势

The Drip Irrigation Market size is estimated at USD 1.97 billion in 2025, and is expected to reach USD 3.22 billion by 2030, at a CAGR of 10.3% during the forecast period (2025-2030).

Key Highlights

- Irrigation is a critical component of agriculture and crop production. Manufacturers have created equipment and techniques to provide farmers with paramount drip irrigation systems. Factors such as government subsidies and policies, technological innovations, and increasing concern over water scarcity drive the market.

- The drip irrigation system is witnessing high demand as water has increasingly become scarce. Farmers have been seeking novel ideas to grow more crops with the same quantity of water. This is anticipated to augment the growth of the market studied. For instance, the adoption of drip irrigation is growing across Canada, particularly in provinces with water scarcity and high water usage for agricultural production. According to Statistics Canada, Canadian farmers increased their water usage for crop irrigation by 23% in 2022 compared to 2020, which is majorly attributed to the drier climatic conditions in various regions throughout the country.

- In recent years, drip irrigation implementation has increased in different regions. The Asia-Pacific has the largest market for the drip irrigation industry. India is the largest market in Asia-Pacific for drip irrigation. In February 2021, the Ministry of Agriculture and Farmers Welfare, India, showed that the net irrigated area in the country is 68,649 thousand ha. The agricultural land covered under micro-irrigation is 12,908.44 thousand ha, in which drip irrigation is 6,112.05 thousand ha and sprinkler irrigation is 6,796.39 thousand ha. This means that out of the total irrigated land in the country, only 19% is under micro-irrigation. Up to 60% of water used for sugarcane, banana, okra, papaya, bitter gourd, and a few other crops could be saved if a drip irrigation system is employed for cultivation.

- The major market players operating in the drip irrigation systems market include Jain Irrigation Systems Limited, Netafim Limited, the Toro Company, etc., making the global drip irrigation market a consolidated marketplace. These market players are involved in several strategic planning, product development activities, and mergers and acquisitions, catalyzing the market's growth. Recently, in June 2022, Rivulis Irrigation India Ltd and Jain Irrigation Systems Limited merged their business and will be one of the largest global drip irrigation system providers.

Drip Irrigation Market Trends

Field Crops is the Significant Segment by Crop Type

According to the FAO, about 70% of the cultivated land was used to grow cereals, as most cereals, such as rice and maize, are water-intensive crops. The increasing global population is pressuring farmers to enhance cereal production worldwide, thus leading to the increased use of precision irrigation in this segment. As per the FAO report, world cereal production in 2022 reached a record high of 3,059.6 million metric tons from 3,003.6 million metric tons in 2020.

Rice, wheat, and maize account for the prominent cereal crops cultivated around the globe. Though these crops were grown as rainfed traditionally, results of various field trials and studies conducted to evaluate the positive impacts of irrigating these crops have strengthened the demand for irrigation systems. For instance, in a study conducted in Poland in 2023, the average yield of maize was increased by 25% compared to traditional irrigation methods. In the same experiment, fertigation through drip was also practiced, increasing the average yield by 2.35 metric tons per hectare, concluding the significance of this method's efficiency.

Advances in science and technology led to the application of IoTs and automation in drip systems at the field level. These moments attract farmers, creating a scope for drip irrigation suppliers and companies where the point of attraction is easier irrigation with no labor and time boundness. Governments are also taking initiatives for sustainable growth practices by conserving water. Recently, in India, Pradhan Mantri Krishi Sinchayi Yojana (PMKSY) is a special scheme that promotes precision irrigation practices by subsidizing and improving farmers' awareness of water use efficiency. Besides, in 2022, Netafim started an introductory rice cultivation project in dry fields in Japan using drip irrigation. The system reduces water and fertilizer waste and encourages a shift to sustainable production that reduces methane gas emissions.

Asia-Pacific Dominates the Market

The drip irrigation usage in the Asia Pacific agriculture sector witnessed significant growth during recent years, which is majorly due to the growing area under irrigation due to the expansion of micro-irrigation projects, which can reduce water consumption. In 2022-2023, the area under irrigation was expected to reach 73 million hectares, accounting for 52% of the total agricultural land, which is 41% higher than in 2016, according to the Niti Aayog. Likewise, according to the National Bureau of Statistics of China, the irrigated area in China accounted for 69.61 million hectares in 2021 and had risen by 70.36 million hectares in 2022, thereby delivering high demand for drip irrigation in the market.

Besides, the area under drip irrigation was higher in Andra Pradesh, followed by Maharashtra, Gujarat, and Punjab. To encourage a conductive farming environment and implement the successful drip irrigation model across these states, Netafim is providing drip irrigation systems. In 2023, under the initiative, Netafim provided drip irrigation systems for tomato growers through four Better Life Farming (BLF) Centers present in the Khajuri, Kolaras, and Pohari regions of the Shivpuri district in Madhya Pradesh. This initiative increased the tomato crop yield by 40%, resulting in higher adoption of drip irrigation systems in Maharashtra.

China is one of the world's largest markets and consumers of drip irrigation equipment. This is mainly attributed to the government's aim to equip farms with highly efficient water-saving irrigation technology and systems as part of its five-year plans to equip at least 75% of the total irrigated area with micro-irrigation systems by 2030. Further, The government often works with drip irrigation companies to increase the availability of water-saving equipment to farmers. For instance, in November 2022, the Local Government of Yuanmou in Yunnan Province partnered with Dayu Irrigation Group Co. Ltd, which will work together in a PPP (Public-Private Partnership) Project mode for the distribution of drip irrigation pipes of over 3.33 million meters and 1.2 million drippers till 2038.

Drip Irrigation Industry Overview

The global drip irrigation market is consolidated, with major players occupying most of the market share. Some key players in the market include Netafim Limited, Jain Irrigation Systems Limited, The Toro Company, Hunter Industries, and Rain Bird Corporation. The most adopted strategy is broadening the product portfolio by introducing new and innovative products into the market. The other prominent players are strengthening their position through partnerships and mergers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Threat of Water Scarcity

- 4.2.2 Favorable Policies and Subsidies from the Government

- 4.2.3 Increasing Adaptation of Fertigation

- 4.3 Market Restraints

- 4.3.1 High Initial Capital Investments

- 4.3.2 Damages in Drip Irrigation Due to the Complex Set-up

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Surface Drip Irrigation

- 5.1.2 Subsurface Drip Irrigation

- 5.2 Crop Types

- 5.2.1 Field Crops

- 5.2.2 Vegetable Crops

- 5.2.3 Orchard Crops

- 5.2.4 Vineyards

- 5.2.5 Other Crops

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Jain Irrigation Systems Ltd

- 6.3.2 The Toro Company

- 6.3.3 Netafim Limited

- 6.3.4 Rain Bird Corporation

- 6.3.5 Chinadrip Irrigation Equipment Co. Ltd

- 6.3.6 Antelco Pty Ltd

- 6.3.7 T-L Irrigation

- 6.3.8 Sistema Azud

- 6.3.9 Metzer Group

- 6.3.10 Hunter Industries Inc.