|

市场调查报告书

商品编码

1708157

急性细菌性皮肤和皮肤结构感染 (ABSSI) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Acute Bacterial Skin and Skin Structure Infections (ABSSIs) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

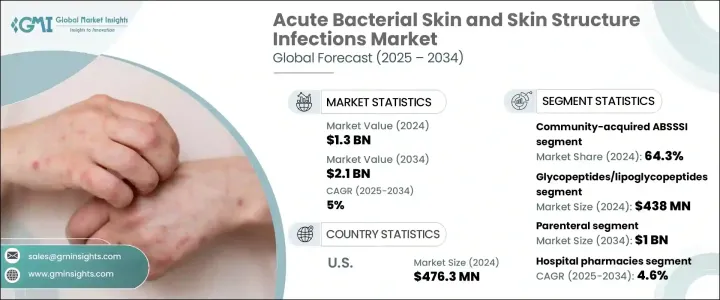

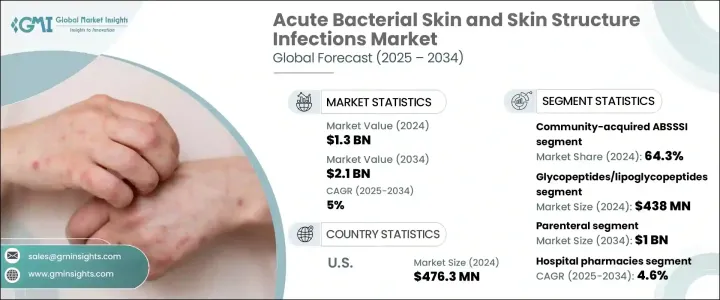

2024 年,全球急性细菌性皮肤和皮肤结构感染市场规模达到 13 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5%。受细菌抗药性上升、皮肤和软组织感染盛行率上升以及抗生素配方和给药方法的快速进步的推动,市场有望稳步增长。越来越多的免疫功能低下的人,包括接受化疗或器官移植的患者,对有效治疗方案的需求不断增加。糖尿病和周边血管疾病等慢性疾病的激增使患者更容易受到复杂的皮肤感染,这进一步支持了市场扩张。

此外,人们对皮肤感染早期诊断和治疗的认识不断提高,加上针对抗药性病原体的创新疗法的开发,正在极大地影响市场前景。製药公司正在大力投资研发,以推出能够对抗 MRSA(耐甲氧西林金黄色葡萄球菌)等多重抗药性细菌的新型抗生素,这种细菌仍然是全球关注的一大议题。这导致了更先进的抗生素的引入,包括糖肽、噁唑烷酮和脂肽,它们可以针对抗药性细菌采取针对性行动,改善患者的治疗效果并提高治疗成功率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 13亿美元 |

| 预测值 | 21亿美元 |

| 复合年增长率 | 5% |

根据感染类型,市场主要分为两类:社区获得性 ABSSSI 和医院获得性 ABSSSI。 2024 年,社区型感染占比高达 64.3%,因为这些感染在一般人群中更为普遍,并且经常发生在医院环境之外。蜂窝性组织炎、伤口感染和脓肿等病症是每年病例数的重要原因。这些感染经常需要医疗干预,但通常在门诊进行治疗,因此对有效且易于管理的抗生素疗法的需求持续存在。随着生活方式疾病导致的皮肤损伤和皮肤完整性受损的发生率不断上升,社区获得性部分继续推动 ABSSSI 市场显着增长。

根据给药途径,市场分为肠外给药、口服给药及外用给药。预计到 2034 年,肠外给药领域将创造 10 亿美元的收入,继续保持其作为抗生素输送首选途径的地位,尤其是在严重和复杂的情况下。肠外给药将抗生素直接输送到血液中,对于治疗由多重抗药性病原体引起的危及生命的 ABSSSI 仍然至关重要。它能够快速发挥治疗作用,对于医院内感染和重症监护病房的患者尤其重要,因为及时干预对于避免全身性併发症至关重要。

2024 年,美国急性细菌性皮肤和皮肤结构感染 (ABSSSI) 市场价值为 4.763 亿美元,这主要是由于皮肤感染发病率高以及糖尿病和肥胖症等慢性健康状况的增加,这增加了 ABSSSI 的风险。人口老化导致免疫防御能力下降,更容易发生皮肤感染,这继续影响市场动态。此外,耐多药细菌(尤其是抗甲氧西林金黄色葡萄球菌)带来的持续挑战,维持了对先进的下一代抗生素疗法的需求,并支持了美国市场的持续成长

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- ABSSSI 发生率不断上升

- 抗生素研发取得进展,研发药物数量不断增加

- 医疗保健投资不断增加,医疗服务可近性不断改善

- 产业陷阱与挑战

- 新型抗生素成本高昂

- 与某些抗生素相关的副作用

- 成长动力

- 成长潜力分析

- 监管格局

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依感染类型,2021 年至 2034 年

- 主要趋势

- 社区型 ABSSSI

- 医院获得性ABSSSI

第六章:市场估计与预测:依药物类别,2021 年至 2034 年

- 主要趋势

- 醣肽/脂糖肽

- 噁唑烷酮

- β-内酰胺类

- 脂肽

- 四环素类

- 其他药物类别

第七章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 肠外

- 口服

- 外用

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Basilea Pharmaceutica

- Cipher Pharmaceuticals

- Endo Pharmaceuticals

- Glenmark Pharmaceuticals

- Melinta Therapeutics

- Menarini Group

- Merck

- Nabriva Therapeutics

- Paratek Pharmaceuticals

- Pfizer

- Sandoz

The Global Acute Bacterial Skin and Skin Structure Infections Market reached USD 1.3 billion in 2024 and is projected to expand at a CAGR of 5% between 2025 and 2034. The market is poised for steady growth, driven by rising bacterial resistance, the increasing prevalence of skin and soft tissue infections, and rapid advancements in antibiotic formulations and delivery methods. A growing number of immunocompromised individuals, including patients undergoing chemotherapy or organ transplantation, are contributing to the escalating demand for effective treatment options. The surge in chronic diseases such as diabetes and peripheral vascular disorders, which make patients more susceptible to complicated skin infections, is further supporting market expansion.

Additionally, growing awareness regarding early diagnosis and treatment of skin infections, coupled with the development of innovative therapies targeting resistant pathogens, is significantly shaping the market outlook. Pharmaceutical companies are investing heavily in research and development to launch novel antibiotics capable of tackling multidrug-resistant organisms like MRSA (Methicillin-resistant Staphylococcus aureus), which remains a major concern globally. This has led to the introduction of more advanced antibiotics, including glycopeptides, oxazolidinones, and lipopeptides, that offer targeted action against resistant bacteria, improving patient outcomes and enhancing treatment success rates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 5% |

The market is segmented into two primary categories based on infection type: community-acquired and hospital-acquired ABSSSIs. Community-acquired infections accounted for a dominant 64.3% share in 2024, as these infections are far more prevalent in the general population and often occur outside hospital environments. Conditions such as cellulitis, wound infections, and abscesses contribute significantly to the number of cases seen annually. These infections frequently require medical intervention but are typically managed in outpatient settings, creating sustained demand for effective and easily administrable antibiotic therapies. With the rising incidence of skin injuries and compromised skin integrity due to lifestyle diseases, the community-acquired segment continues to drive notable growth in the ABSSSIs market.

Based on drug administration routes, the market is classified into parenteral, oral, and topical formulations. The parenteral segment is projected to generate USD 1 billion by 2034, maintaining its stronghold as the preferred route for delivering antibiotics, especially in severe and complicated cases. Parenteral administration, which delivers antibiotics directly into the bloodstream, remains critical for treating life-threatening ABSSSIs caused by multidrug-resistant pathogens. It enables rapid therapeutic action and is especially vital for hospital-acquired infections and patients in intensive care units, where timely intervention is crucial to avoid systemic complications.

The U.S. Acute Bacterial Skin and Skin Structure Infections (ABSSSIs) market was valued at USD 476.3 million in 2024, largely driven by the high incidence of skin infections and rising chronic health conditions, including diabetes and obesity, which elevate the risk of developing ABSSSIs. An aging population, more prone to skin infections due to weakened immune defenses, continues to influence market dynamics. Moreover, the persistent challenge posed by multidrug-resistant bacteria, particularly MRSA, sustains the demand for advanced, next-generation antibiotic therapies and supports continued market growth in the U.S.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of ABSSSIs

- 3.2.1.2 Advancements in antibiotic development and expanding number of pipeline drugs

- 3.2.1.3 Rising healthcare investments and improved access to medical treatments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of novel antibiotics

- 3.2.2.2 Side effects associated with certain antibiotics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Infection Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Community-acquired ABSSSI

- 5.3 Hospital- acquired ABSSSI

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Glycopeptides/lipoglycopeptides

- 6.3 Oxazolidinones

- 6.4 Beta-lactams

- 6.5 Lipopeptide

- 6.6 Tetracyclines

- 6.7 Other drug classes

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Parenteral

- 7.3 Oral

- 7.4 Topical

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Basilea Pharmaceutica

- 10.3 Cipher Pharmaceuticals

- 10.4 Endo Pharmaceuticals

- 10.5 Glenmark Pharmaceuticals

- 10.6 Melinta Therapeutics

- 10.7 Menarini Group

- 10.8 Merck

- 10.9 Nabriva Therapeutics

- 10.10 Paratek Pharmaceuticals

- 10.11 Pfizer

- 10.12 Sandoz