|

市场调查报告书

商品编码

1708173

农业设备融资市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Agricultural Equipment Finance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

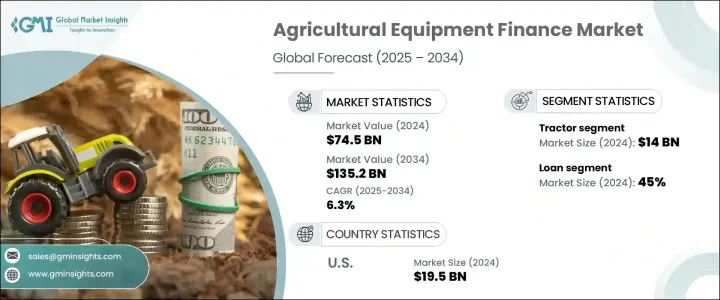

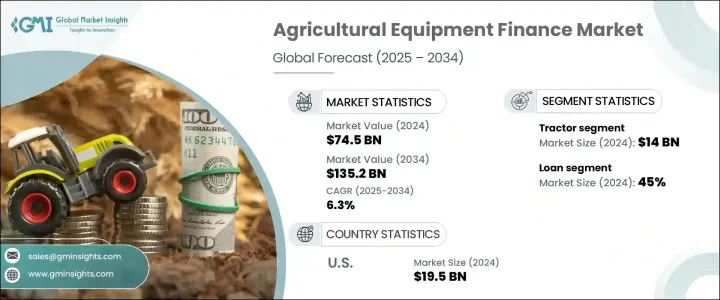

2024 年全球农业设备融资市场规模达 745 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.3%。这一显着增长主要得益于全球人口的不断增长,这直接刺激了对粮食生产不断增长的需求。随着粮食需求的不断增长,世界各地的农民被迫提高农业产量,严重依赖拖拉机、收割机、灌溉系统和精准农业技术等先进机械。然而,随着技术的发展和现代农业设备成本的提高,许多农民无法直接购买这些机器。这时,融资解决方案就变得至关重要,它使农民能够使用高科技机械,而无需承担全部前期成本的负担。

农业设备融资市场在促进农业实践现代化方面发挥着至关重要的作用,特别是在新兴经济体的政府鼓励机械化以确保粮食安全的情况下。此外,旨在提高产量和减少资源浪费的精准农业的持续转变进一步增加了对先进农具和采购这些农具所需的资金支持的需求。农民对机械化农业益处的认识不断提高,再加上政府对农业设备补贴和税收优惠等支持性倡议,为该市场的成长增添了巨大的动力。随着气候变迁和劳动力短缺继续影响全球农业部门,对高效能、高容量机械和灵活融资选择的需求变得比以往任何时候都更加重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 745亿美元 |

| 预测值 | 1352亿美元 |

| 复合年增长率 | 6.3% |

农业设备市场分为多个类别,包括拖拉机、收割机、灌溉系统和精准农业技术。其中,拖拉机仍占主导地位,2024 年产值将达 140 亿美元。拖拉机对于耕作、种植和收割等各种农场作业都是必不可少的,使其成为最受欢迎的机械之一。随着拖拉机技术的不断进步(例如 GPS 系统、自动功能和提高的燃油效率),拖拉机的价格持续上涨。因此,农民越来越依赖融资选择来购买这些必需的工具,从而推动了对农业设备融资解决方案的稳定需求。

在融资选择方面,农业设备融资市场主要分为贷款、租赁、分期付款购买和其他替代方案。其中,贷款部分在2024年占了45%的市场。农业设备贷款通常由商业银行和专业农场贷款机构提供,尤其受到发展中地区农民的欢迎。这些贷款提供灵活的还款条件和长期所有权的优势,使其成为旨在建立可持续高效经营的农民的理想选择。此类客製化贷款产品的提供确保农民能够投资尖端机械来提高生产力和获利能力。

从地区来看,2024 年北美农业设备融资市场占全球 35% 的份额。美国凭藉其强劲的农业部门,成为全球最大的农产品生产国和出口国之一。为了满足国内和国际的粮食需求,美国农民严重依赖现代化、高容量的设备,这大大推动了对融资解决方案的需求。随着美国农业继续优先考虑技术升级和提高生产效率以保持在全球市场的竞争力,预计这一需求将进一步增长。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 农业设备製造商

- 金融机构及贷款机构

- 经销商和分销商

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 用例

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 政府对农业活动的支持与补贴

- 人口成长导致粮食需求增加

- 向大规模商业化农业转变

- 农业设备的技术进步

- 产业陷阱与挑战

- 动盪的农业市场

- 金融科技采用缓慢

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按设备,2021 - 2034 年

- 主要趋势

- 联结机

- 收割机

- 畜牧设备

- 灌溉系统

- 种植和播种设备

- 施肥喷药设备

- 精准农业技术

- 其他的

第六章:市场估计与预测:按融资,2021 - 2034 年

- 主要趋势

- 贷款

- 租赁

- 分期付款

- 其他的

第七章:市场估计与预测:按借款人,2021 - 2034 年

- 主要趋势

- 个体农户

- 大型农业企业

- 合作社和农业团体

第八章:市场估计与预测:按融资供应商,2021 - 2034 年

- 主要趋势

- 商业银行

- 政府机构

- 设备製造商

- 专业农场贷款机构

- 其他的

第九章:市场估计与预测:依融资期限,2021 - 2034 年

- 主要趋势

- 短期(最长3年)

- 中期(3-5年)

- 长期(5年以上)

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- AGCO Finance

- Agricultural Bank of China

- American AgCredit

- Banco Santander

- Bayer

- BMO Harris Equipment Finance

- BNP Paribas Leasing Solutions

- CNH Industrial Capital

- CoBank

- DLL Group

- Farm Credit Canada

- FNB Agriculture

- John Deere Capital

- Kubota Credit

- Mahindra Finance

- Northland Capital Equipment Finance

- Rabo AgriFinance

- Regions Bank

- TD Equipment Finance

- Wells Fargo

The Global Agricultural Equipment Finance Market generated USD 74.5 billion in 2024 and is projected to expand at a CAGR of 6.3% between 2025 and 2034. This remarkable growth is primarily driven by the continuously rising global population, which directly fuels an ever-growing demand for food production. As food demand escalates, farmers worldwide are compelled to boost their agricultural output, relying heavily on advanced machinery such as tractors, harvesters, irrigation systems, and precision farming technologies. However, with evolving technologies and higher costs associated with modern agricultural equipment, many farmers are unable to afford these machines outright. This is where financing solutions become critical, enabling farmers to access high-tech machinery without bearing the burden of full upfront costs.

The agricultural equipment finance market plays a crucial role in facilitating the modernization of farming practices, particularly as governments in emerging economies encourage mechanization to ensure food security. In addition, the ongoing shift toward precision agriculture, aimed at improving yields and minimizing resource wastage, further heightens the demand for sophisticated farming tools and the financial support necessary to procure them. Rising awareness among farmers regarding the benefits of mechanized farming, coupled with supportive government initiatives such as subsidies and tax benefits for agricultural equipment, adds significant momentum to the growth of this market. As climate change and labor shortages continue to impact the agriculture sector globally, the need for efficient, high-capacity machinery backed by flexible financing options becomes more critical than ever.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $74.5 Billion |

| Forecast Value | $135.2 Billion |

| CAGR | 6.3% |

The market for agricultural equipment is segmented into various categories, including tractors, harvesters, irrigation systems, and precision agriculture technologies. Among these, tractors remain a dominant segment, generating USD 14 billion in 2024. Tractors are indispensable for diverse farm operations like plowing, planting, and harvesting, making them one of the most sought-after machines. With constant advancements in tractor technology-such as GPS-enabled systems, autonomous functionality, and enhanced fuel efficiency-the price of tractors continues to rise. As a result, farmers increasingly depend on financing options to afford these essential tools, driving steady demand for agricultural equipment finance solutions.

When it comes to financing options, the agricultural equipment finance market is largely divided into loans, leasing, hire purchase, and other alternatives. Among these, the loan segment accounted for 45% of the market share in 2024. Loans for agricultural equipment, usually offered by commercial banks and specialized farm lenders, are especially popular among farmers in developing regions. These loans provide flexible repayment terms and the advantage of long-term ownership, making them an ideal choice for farmers aiming to build sustainable and efficient operations. The availability of such tailored loan products ensures that farmers can invest in cutting-edge machinery to boost productivity and profitability.

Regionally, North America Agricultural Equipment Finance Market held 35% of the global share in 2024. The United States, with its robust agricultural sector, stands out as one of the largest producers and exporters of agricultural goods worldwide. To keep pace with both domestic and international food demands, American farmers rely heavily on modern, high-capacity equipment, significantly driving the need for financing solutions. This demand is expected to grow further as U.S. agriculture continues to prioritize technological upgrades and enhanced production efficiency to remain competitive in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Agricultural equipment manufacturers

- 3.2.2 Financial institutions and lenders

- 3.2.3 Dealers and distributors

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Government support and subsidies for agricultural activities

- 3.9.1.2 Growing food demand due to rising population

- 3.9.1.3 Shift towards large-scale commercial farming

- 3.9.1.4 Technological advancements in farm equipment

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Volatile agricultural markets

- 3.9.2.2 Slow adoption of financial technology

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Tractor

- 5.3 Harvester

- 5.4 Livestock equipment

- 5.5 Irrigation systems

- 5.6 Planting and seeding equipment

- 5.7 Fertilizing and spraying equipment

- 5.8 Precision Agriculture Technology

- 5.9 Others

Chapter 6 Market Estimates & Forecast, By Financing, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Loan

- 6.3 Leasing

- 6.4 Hire purchase

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Borrower, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Individual farmers

- 7.3 Large agricultural corporations

- 7.4 Cooperatives and farming groups

Chapter 8 Market Estimates & Forecast, By Finance Provider, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Commercial banks

- 8.3 Government agencies

- 8.4 Equipment manufacturers

- 8.5 Specialized farm lenders

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Financing Term, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Short term (up to 3 years)

- 9.3 Medium term (3-5 years)

- 9.4 Long term (more than 5 years)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AGCO Finance

- 11.2 Agricultural Bank of China

- 11.3 American AgCredit

- 11.4 Banco Santander

- 11.5 Bayer

- 11.6 BMO Harris Equipment Finance

- 11.7 BNP Paribas Leasing Solutions

- 11.8 CNH Industrial Capital

- 11.9 CoBank

- 11.10 DLL Group

- 11.11 Farm Credit Canada

- 11.12 FNB Agriculture

- 11.13 John Deere Capital

- 11.14 Kubota Credit

- 11.15 Mahindra Finance

- 11.16 Northland Capital Equipment Finance

- 11.17 Rabo AgriFinance

- 11.18 Regions Bank

- 11.19 TD Equipment Finance

- 11.20 Wells Fargo