|

市场调查报告书

商品编码

1708190

食品服务一次性用品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Food Service Disposable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

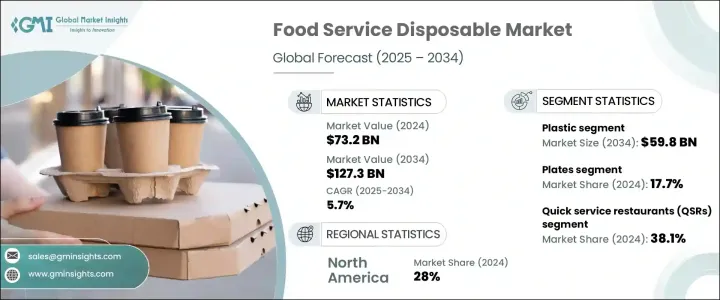

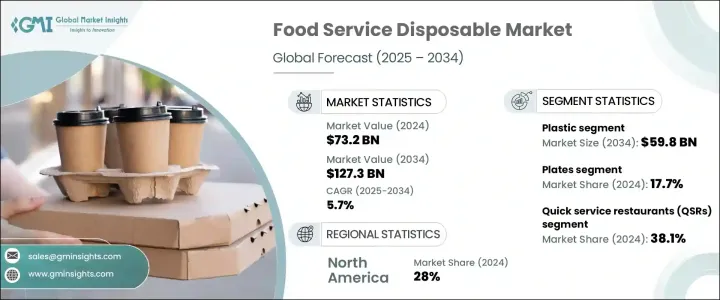

2024 年全球食品服务一次性用品市场价值为 732 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.7%。这一成长主要得益于快餐店 (QSR) 的快速扩张和线上食品配送平台的激增。城市化和消费者生活方式的改变增加了对便利性的偏好,促使快餐店采用各种各样的食品服务一次性用品,以确保卫生、营运效率和成本效益。该领域的製造商必须专注于生产高品质、经济高效且环保的一次性产品,以满足 QSR 日益增长的需求。随着市场不断扩大,对环保材料和增强卫生和功能的创新设计的投资对于满足食品服务行业不断变化的需求至关重要。

同时,全球线上食品配送服务的兴起也推动了对耐用、安全的一次性包装的需求。数位订购、基于应用程式的食品服务和云端厨房的日益普及,促使包装供应商开发持久、防漏和防篡改的包装解决方案,以确保食品安全和配送效率。随着消费者健康意识的增强,对食品安全、永续和可生物降解材料的关注度也越来越高。食品服务一次性产品生产商必须重视包装的开发,不仅要支持线上食品订购系统的快速成长,还要符合消费者对环保选择的偏好。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 732亿美元 |

| 预测值 | 1273亿美元 |

| 复合年增长率 | 5.7% |

市场按材料分为纸和纸板、塑胶、铝和其他。预计到 2034 年塑胶产业产值将达到 598 亿美元。由于永续性方面的担忧和日益增加的监管压力,塑胶产业正在向可回收和可生物降解解决方案的开发转变。随着企业努力平衡客户对环保包装的需求与食品服务业对便利性和耐用性的需求,可堆肥塑胶和先进回收技术的创新正在获得发展动力。

根据产品类型,市场分为盘子、托盘、碗、杯子、蛤壳、包装和薄膜、箔纸等。 2024 年,餐盘占了 17.7% 的市占率。由于快餐店、街头食品摊贩和线上食品服务的成长,人们对便利、随时随地的饮食解决方案的需求不断增加,餐盘的需求也不断上升。消费者对一次性卫生饮食解决方案的偏好进一步促进了该领域的成长。此外,对永续替代品的追求也促进了由纸、竹子和甘蔗渣等材料製成的可堆肥和可生物降解的盘子的开发。

根据最终用途,市场还细分为 QSR、全方位服务餐厅 (FSR)、餐饮服务、线上配送等。 2024 年,QSR 领域占据了市场主导地位,占有 38.1% 的份额。全球和区域 QSR 连锁店的扩张,加上快速的现代化,刺激了轻质、耐用和灵活材料的采用,这些材料提高了便携性,同时在外卖和送餐过程中保持了食品质量。

2024 年,北美占据全球市场份额的 28%。该地区的消费者越来越倾向于永续包装解决方案,推动了可生物降解和可堆肥包装材料的采用。光是美国食品服务一次性市场在 2024 年就创造了 166 亿美元的产值,反映出对坚固、防漏、防篡改包装的需求日益增长,以满足消费者对便利性、卫生和永续性的期望。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 方便食品需求不断成长

- 网路食品配送平台的成长

- 新兴经济体可支配所得不断增加

- 速食店(QSR)的扩张

- 企业和机构部门餐饮服务的兴起

- 产业陷阱与挑战

- 一次性塑胶的环境问题和法规

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 塑胶

- 聚丙烯(PP)

- 聚乙烯(PE)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚苯乙烯(PS)

- 可生物降解塑料

- 其他的

- 纸和纸板

- 铝

- 其他的

第六章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 盘子

- 托盘

- 碗

- 杯子

- 蛤壳

- 包装和薄膜

- 箔

- 其他的

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 速食店(QSR)

- 全方位服务餐厅(FSR)

- 餐饮服务

- 网路配送

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Anchor Packaging

- Berry Global

- Billerud

- Contital

- D&W Fine Pack

- Dart Container

- Georgia-Pacific

- Graphic Packaging International

- Huhtamaki

- Oji Fibre Solutions

- Pactiv Evergreen

- Plus Pack

- ProAmpac

- Stora Enso

- Vegware

- WestRock

- WinCup

The Global Food Service Disposable Market was valued at USD 73.2 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2034. This growth is primarily driven by the rapid expansion of quick-service restaurants (QSRs) and the surge in online food delivery platforms. Urbanization and changing consumer lifestyles have increased the preference for convenience, prompting QSRs to adopt a wide range of food service disposables to ensure hygiene, operational efficiency, and cost-effectiveness. Manufacturers in this space must focus on producing high-quality, cost-effective, and environmentally sustainable disposable products to cater to the growing demand from QSRs. As the market continues to expand, investments in eco-friendly materials and innovative designs that enhance hygiene and functionality will be pivotal in meeting the evolving requirements of the food service industry.

Simultaneously, the global rise in online food delivery services is fueling the demand for durable and secure disposable packaging. The increasing popularity of digital ordering, app-based food services, and cloud kitchens has pushed packaging providers to develop long-lasting, leak-proof, and tamper-evident packaging solutions that maintain food safety and delivery efficiency. As health consciousness grows among consumers, the focus on food-safe, sustainable, and biodegradable materials is becoming more pronounced. Food service disposable producers must emphasize the development of packaging that not only supports the rapid growth of online food ordering systems but also aligns with consumers' preferences for environmentally friendly options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $73.2 Billion |

| Forecast Value | $127.3 Billion |

| CAGR | 5.7% |

The market is segmented by material into paper and paperboard, plastic, aluminum, and others. The plastic segment is anticipated to generate USD 59.8 billion by 2034. Due to sustainability concerns and increasing regulatory pressures, the plastic segment is witnessing a shift towards the development of recyclable and biodegradable solutions. New innovations in compostable plastics and advanced recycling technologies are gaining traction as businesses strive to balance customer demand for eco-friendly packaging with the need for convenience and durability in the food service sector.

By product type, the market is divided into plates, trays, bowls, cups, clamshells, wraps and films, foils, and others. Plates accounted for 17.7% of the market share in 2024. Demand for plates is rising due to the increasing need for convenient, on-the-go eating solutions, driven by the growth of QSRs, street food vendors, and online food services. Consumers' preference for single-use, hygienic eating solutions is further contributing to segment growth. Moreover, the push for sustainable alternatives has led to the development of compostable and biodegradable plates made from materials such as paper, bamboo, and bagasse.

The market is also segmented by end-use into QSRs, full-service restaurants (FSRs), catering services, online delivery, and others. The QSR segment dominated the market with a 38.1% share in 2024. Global and regional QSR chain expansion, combined with rapid modernization, has spurred the adoption of lightweight, durable, and flexible materials that enhance portability while maintaining food quality during takeout and delivery.

North America accounted for 28% of the global market share in 2024. Consumer preferences in the region are increasingly leaning towards sustainable packaging solutions, driving the adoption of biodegradable and compostable packaging materials. The US food service disposable market alone generated USD 16.6 billion in 2024, reflecting the growing demand for robust, leak-proof, and tamper-evident packaging that meets consumer expectations for convenience, hygiene, and sustainability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for convenience food

- 3.2.1.2 Growth of online food delivery platforms

- 3.2.1.3 Rising disposable income in emerging economies

- 3.2.1.4 Expansion of quick-service restaurants (QSRs)

- 3.2.1.5 Rise of catering services in corporate and institutional sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental concerns and regulations on single-use plastics

- 3.2.2.2 Fluctuating raw material prices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 GAP analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Bn & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.2.1 Polypropylene (PP)

- 5.2.2 Polyethylene (PE)

- 5.2.3 Polyethylene terephthalate (PET)

- 5.2.4 Polystyrene (PS)

- 5.2.5 Biodegradable plastic

- 5.2.6 Others

- 5.3 Paper & paperboard

- 5.4 Aluminum

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Bn & Kilo Tons)

- 6.1 Key trends

- 6.2 Plates

- 6.3 Trays

- 6.4 Bowls

- 6.5 Cups

- 6.6 Clamshells

- 6.7 Wraps & films

- 6.8 Foils

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Bn & Kilo Tons)

- 7.1 Key trends

- 7.2 Quick service restaurants (QSRs)

- 7.3 Full-service restaurants (FSRs)

- 7.4 Catering services

- 7.5 Online delivery

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anchor Packaging

- 9.2 Berry Global

- 9.3 Billerud

- 9.4 Contital

- 9.5 D&W Fine Pack

- 9.6 Dart Container

- 9.7 Georgia-Pacific

- 9.8 Graphic Packaging International

- 9.9 Huhtamaki

- 9.10 Oji Fibre Solutions

- 9.11 Pactiv Evergreen

- 9.12 Plus Pack

- 9.13 ProAmpac

- 9.14 Stora Enso

- 9.15 Vegware

- 9.16 WestRock

- 9.17 WinCup