|

市场调查报告书

商品编码

1708192

行动通讯天线市场机会、成长动力、产业趋势分析及2025-2034年预测Mobile Communication Antenna Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

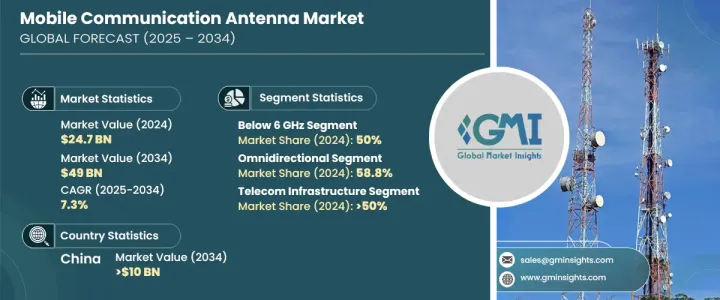

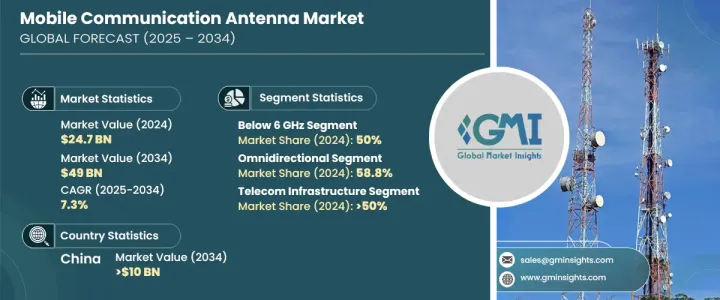

2024 年全球行动通讯天线市场规模达 247 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 7.3%。随着 5G 技术的普及和各行各业的快速数字化,智慧型手机需求不断增长,推动着市场成长。随着智慧型手机不断发展,支援高速互联网、无缝串流媒体和即时应用,对先进、高效能行动通讯天线的需求不断上升。随着 5G 设备的普及,电信业者正在迅速扩展天线网络,以确保更好的讯号品质和更强的连接性。此外,物联网 (IoT) 和智慧型装置推动了对可靠行动通讯基础设施的需求,进一步推动了对天线的需求。

世界各国政府和电信业者正大力投资5G部署,升级现有的网路基础设施,并专注于开发6G等下一代技术,推动天线设计的持续创新。人们越来越重视提高网路效率和降低能耗,这导致人们采用节能天线系统,为城乡地区提供无缝覆盖和增强的连接。此外,智慧城市计画的兴起以及智慧家庭系统和工业自动化等连网设备的日益普及,正在促进行动通讯天线市场的持续扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 247亿美元 |

| 预测值 | 490亿美元 |

| 复合年增长率 | 7.3% |

市场按频率分类,其中 6 GHz 以下部分在 2024 年将占 50% 的份额。该频率范围在支援 4G LTE 和 5G 部署的初始阶段发挥着至关重要的作用。 6 GHz 以下的频率提供强大的覆盖范围、出色的室内穿透力和可靠的连接性,使其成为全国行动网路的理想选择。随着行动营运商努力确保不间断的服务并优化不同地区的效能,对这些频率的需求持续成长。 6GHz以下与毫米波频率融合的混合网路的发展,确保了无缝连接,进一步推动了市场扩张。

就天线类型而言,市场分为全向天线和定向天线,其中全向天线在 2024 年将占据 58.8% 的市场份额。全向天线广泛应用于电信基础设施,特别是基地台和宏蜂窝,因为它们能够提供 360 度覆盖范围。行动网路、物联网应用和智慧型装置的不断增长的部署正在推动全向天线的采用。多频段和节能天线设计的技术进步正在提高网路效能,同时最大限度地降低功耗,进一步推动对这些天线的需求。

2024 年,亚太地区行动通讯天线市场将占据全球 35% 的份额,预计到 2034 年中国将创造 100 亿美元的市场规模。中国在该市场的领导地位得益于其积极推出 5G 技术、对电信基础设施进行大量投资以及政府对数位化计画的大力支持。中国加速 5G 部署和推进 6G 和人工智慧技术创新的努力继续推动对先进行动通讯天线的需求,巩固了其作为该地区主要成长动力的地位。

目录

第一章:方法论与范围

- 研究设计

- 研究方法

- 资料收集方法

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 预测模型

- 初步研究和验证

- 主要来源

- 资料探勘来源

- 市场范围和定义

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 网路营运商

- 基础设施提供者

- 监管机构

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 案例研究

- 成本細項分析

- 监管格局

- 衝击力

- 成长动力

- 智慧型手机普及率不断提高

- 物联网设备日益普及

- 5G网路部署

- 行动资料使用量上升

- 产业陷阱与挑战

- 开发和部署成本高

- 技术复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按天线,2021 年至 2034 年

- 主要趋势

- 全向

- 定向

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 基地台

- 行动装置天线

- 室内分散式天线

- 小型蜂巢天线

第七章:市场估计与预测:依频率,2021 年至 2034 年

- 主要趋势

- 低于 6 GHz

- 6 GHz 至 24 GHz

- 24 GHz 至 100 GHz

- 100 GHz以上

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 电信基础设施

- 物联网和智慧设备

- 汽车

- 防御

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Alpha Wireless

- Amphenol Antenna Solutions

- Baylin Technologies

- Cobham Wireless

- CommScope

- Ericsson

- Huawei Technologies

- Infinite Electronics

- Laird Connectivity

- Molex

- Nokia

- PCTEL

- Qualcomm

- RFS (Radio Frequency Systems)

- Rohde & Schwarz

- Mobile Mark

- TAOGLAS

- TE Connectivity

- Tongyu Communication

- ZTE

The Global Mobile Communication Antenna Market generated USD 24.7 billion in 2024 and is expected to grow at a CAGR of 7.3% between 2025 and 2034. The rising demand for smartphones, fueled by the increasing adoption of 5G technology and the rapid digitalization of various industries, is driving market growth. As smartphones evolve to support high-speed internet, seamless streaming, and real-time applications, the need for advanced and high-performance mobile communication antennas continues to rise. With the proliferation of 5G-enabled devices, telecom operators are rapidly expanding antenna networks to ensure better signal quality and stronger connectivity. In addition, the Internet of Things (IoT) and smart devices have fueled the need for reliable mobile communication infrastructure, further boosting demand for antennas.

Governments and telecom operators worldwide are investing heavily in 5G deployments, upgrading existing network infrastructure, and focusing on developing next-generation technologies like 6G, driving continuous innovations in antenna designs. The growing emphasis on improving network efficiency and reducing energy consumption is leading to the adoption of energy-efficient antenna systems that provide seamless coverage and enhanced connectivity in urban and rural regions. Furthermore, the rise of smart city initiatives and the increasing use of connected devices, including smart home systems and industrial automation, are contributing to the ongoing expansion of the mobile communication antenna market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.7 Billion |

| Forecast Value | $49 Billion |

| CAGR | 7.3% |

The market is categorized by frequency, with the below 6 GHz segment holding a 50% share in 2024. This frequency range plays a crucial role in supporting 4G LTE and the initial phases of 5G deployments. Frequencies below 6 GHz provide strong coverage, excellent indoor penetration, and reliable connectivity, making them ideal for nationwide mobile networks. As mobile operators work to ensure uninterrupted service and optimize performance across diverse regions, the demand for these frequencies continues to grow. The development of hybrid networks that integrate below 6 GHz and millimeter-wave frequencies ensures seamless connectivity, further driving market expansion.

In terms of antenna types, the market is divided into omnidirectional and directional antennas, with the omnidirectional segment accounting for 58.8% of the market share in 2024. Omnidirectional antennas are widely used in telecom infrastructure, particularly in base stations and macro cells, due to their ability to provide 360-degree coverage. The growing deployment of mobile networks, IoT applications, and smart devices is driving the adoption of omnidirectional antennas. Technological advancements in multi-band and energy-efficient antenna designs are enhancing network performance while minimizing power consumption, further boosting demand for these antennas.

The Asia Pacific mobile communication antenna market held 35% of the global share in 2024, with China projected to generate USD 10 billion by 2034. China's leadership in the market is driven by its aggressive rollout of 5G technology, substantial investments in telecom infrastructure, and strong government support for digitalization initiatives. The country's push to accelerate 5G deployment and advance innovations in 6G and AI technologies continues to fuel demand for advanced mobile communication antennas, solidifying its position as a major growth driver in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Network operators

- 3.1.2 Infrastructure providers

- 3.1.3 Regulatory bodies

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Cost breakdown analysis

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing smartphone adoption

- 3.10.1.2 Growing proliferation of IoT devices

- 3.10.1.3 Deployment of 5G networks

- 3.10.1.4 Rise in mobile data usage

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High costs of development and deployment

- 3.10.2.2 Technical complexity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Antenna, 2021 – 2034 (USD Billion, Units)

- 5.1 Key trends

- 5.2 Omnidirectional

- 5.3 Directional

Chapter 6 Market Estimates & Forecast, By Application, 2021 – 2034 (USD Billion, Units)

- 6.1 Key trends

- 6.2 Base station

- 6.3 Mobile device antennas

- 6.4 Indoor distributed antennas

- 6.5 Small cell antennas

Chapter 7 Market Estimates & Forecast, By Frequency, 2021 – 2034 (USD Billion, Units)

- 7.1 Key trends

- 7.2 Below 6 GHz

- 7.3 6 GHz to 24 GHz

- 7.4 24 GHz to 100 GHz

- 7.5 Above 100 GHz

Chapter 8 Market Estimates & Forecast, By End Use, 2021 – 2034 (USD Billion, Units)

- 8.1 Key trends

- 8.2 Telecom infrastructure

- 8.3 IoT and smart devices

- 8.4 Automotive

- 8.5 Defense

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alpha Wireless

- 10.2 Amphenol Antenna Solutions

- 10.3 Baylin Technologies

- 10.4 Cobham Wireless

- 10.5 CommScope

- 10.6 Ericsson

- 10.7 Huawei Technologies

- 10.8 Infinite Electronics

- 10.9 Laird Connectivity

- 10.10 Molex

- 10.11 Nokia

- 10.12 PCTEL

- 10.13 Qualcomm

- 10.14 RFS (Radio Frequency Systems)

- 10.15 Rohde & Schwarz

- 10.16 Mobile Mark

- 10.17 TAOGLAS

- 10.18 TE Connectivity

- 10.19 Tongyu Communication

- 10.20 ZTE