|

市场调查报告书

商品编码

1708202

肺炎链球菌疫苗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pneumococcal Vaccine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

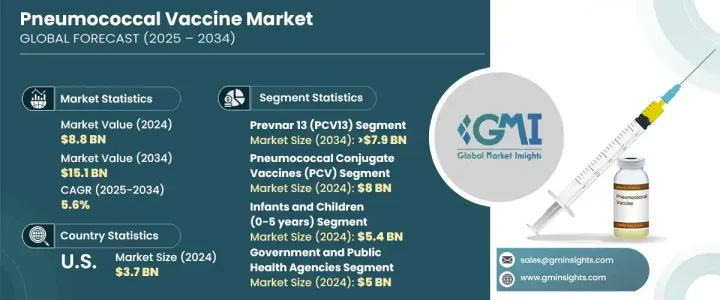

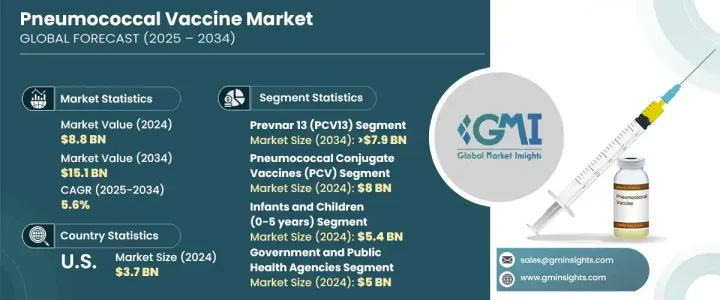

2024 年全球肺炎链球菌疫苗市场价值为 88 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 5.6%。推动这一增长的因素有几个,包括肺炎球菌感染患病率的上升、公众对疫苗接种重要性的认识的提高,以及政府在全球范围内推广免疫计划的有利倡议。疫苗接种率的激增可以归因于卫生当局加强实施强制疫苗接种计划,特别是针对儿童和高风险族群。研发领域的不断进步正在推动生产更有效、更具创新性的肺炎球菌疫苗,以满足更广泛的血清型需求。这些疫苗在降低肺炎链球菌引起的肺炎、脑膜炎和败血症等危及生命的疾病的发生率方面发挥着至关重要的作用。

随着各国政府优先考虑预防性医疗保健并将肺炎球菌疫苗纳入常规免疫计划,市场需求将大幅上升。人们对免疫功能低下者和老年族群的免疫接种日益关注,这为疫苗製造商创造了新的机会。此外,製药公司正在与全球卫生组织密切合作,以扩大低收入地区获得这些疫苗的机会,而肺炎球菌疾病在这些地区仍然是主要的公共卫生问题。疫苗研究资金的增加,加上开发涵盖新兴血清型的广谱疫苗的倡议,预计将在未来十年进一步推动市场成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 88亿美元 |

| 预测值 | 151亿美元 |

| 复合年增长率 | 5.6% |

市场根据产品进行细分,各种肺炎球菌疫苗对预防严重细菌感染做出了重大贡献。作为最广泛使用的疫苗之一,预计将经历显着增长,预计复合年增长率为 5.8%,到 2034 年将产生 79 亿美元的产值。该疫苗在预防多种肺炎链球菌血清型方面已被证实有效,因此得到了广泛采用,尤其是在儿童和高风险成人群体中。该疫苗能够提供长期免疫力,使其成为医疗保健提供者和政府疫苗接种运动的首选。该疫苗广泛涵盖肺炎、败血症和脑膜炎等严重肺炎球菌疾病,在全球免疫计画中的地位不断加强。

肺炎链球菌疫苗市场主要分为两种:结合疫苗和多醣体疫苗。结合疫苗在 2024 年占据了市场主导地位,由于其能够提供对肺炎球菌感染的长期保护,其市场价值达到 80 亿美元。它们在预防肺炎球菌疾病方面非常有效,尤其是对五岁以下儿童,这推动了它们的需求不断增长。此外,在成年人群中,特别是免疫系统较弱的人群和老年人中,应用范围的扩大正在加速结合疫苗的采用。它们能够减轻肺炎球菌疾病的整体负担,因此成为常规免疫计划的首选疫苗。

2024 年,美国肺炎链球菌疫苗市场产值达 37 亿美元。美国老龄人口的增加是这一增长的主要驱动力,因为老年人由于免疫功能下降而面临更高的感染肺炎球菌的风险。预防性医疗保健工作和全国范围的疫苗接种计划大大提高了疫苗接种率,确保了高危险群得到更好的保护。製药公司和政府机构不断提高疫苗覆盖率,不断努力开发更广泛的肺炎链球菌血清型疫苗,进一步支持市场的长期扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 肺炎链球菌疾病盛行率不断上升

- 政府免疫计划和倡议

- 人口老化日益加剧

- 技术进步和新产品发布

- 产业陷阱与挑战

- 疫苗成本高昂

- 疫苗犹豫和认知度低

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 管道分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 肺炎链球菌 (PCV10)

- 肺炎链球菌疫苗 23 (PPSV23)

- 前列腺癌疫苗 13 (PCV13)

- 沛儿 20 (PCV20)

- Synflorix(PCV10)

- 疫苗 (PCV15)

- 其他产品

第六章:市场估计与预测:依疫苗类型,2021 年至 2034 年

- 主要趋势

- 肺炎链球菌结合疫苗(PCV)

- 肺炎链球菌多醣体疫苗(PPSV)

第七章:市场估计与预测:依年龄组,2021 年至 2034 年

- 主要趋势

- 婴儿和儿童(0-5岁)

- 成人(18-64岁)

- 老年人(65岁以上)

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 政府和公共卫生机构

- 电子商务

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Beijing Minhai Biological Technology

- Bio-Manguinhos/Fiocruz

- GlaxoSmithKline

- Merck & Co.

- Pfizer

- Serum Institute of India

- Walvax Biotechnology

The Global Pneumococcal Vaccine Market was valued at USD 8.8 billion in 2024 and is projected to grow at a CAGR of 5.6% between 2025 and 2034. Several factors are driving this growth, including the increasing prevalence of pneumococcal infections, rising public awareness about the importance of vaccination, and favorable government initiatives promoting immunization programs worldwide. The surge in vaccination rates can be attributed to growing efforts by healthcare authorities to implement mandatory vaccination schedules, particularly for children and high-risk populations. Ongoing advancements in research and development are leading to the production of more effective and innovative pneumococcal vaccines, catering to a wider range of serotypes. These vaccines play a crucial role in reducing the incidence of life-threatening conditions such as pneumonia, meningitis, and sepsis caused by Streptococcus pneumoniae.

As governments prioritize preventive healthcare and integrate pneumococcal vaccines into routine immunization schedules, market demand is set to rise significantly. The increasing focus on immunizing immunocompromised individuals and elderly populations is creating new opportunities for vaccine manufacturers. Furthermore, pharmaceutical companies are working closely with global health organizations to expand access to these vaccines in low-income regions, where pneumococcal diseases remain a major public health concern. Rising funding for vaccine research, coupled with initiatives to develop broad-spectrum vaccines that cover emerging serotypes, is expected to further boost market growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $15.1 Billion |

| CAGR | 5.6% |

The market is segmented based on product, with various pneumococcal vaccines contributing significantly to preventing severe bacterial infections. One of the most widely used vaccines is expected to experience notable growth, with a projected CAGR of 5.8%, generating USD 7.9 billion by 2034. Its proven efficacy in protecting against multiple Streptococcus pneumoniae serotypes has led to widespread adoption, especially in pediatric and high-risk adult populations. The vaccine's ability to provide long-term immunity makes it a preferred choice among healthcare providers and government vaccination campaigns. With its broad coverage against severe pneumococcal diseases, including pneumonia, sepsis, and meningitis, this vaccine continues to strengthen its position in global immunization programs.

The pneumococcal vaccine market is divided into two main types: conjugate vaccines and polysaccharide vaccines. Conjugate vaccines dominated the market in 2024, generating USD 8 billion due to their ability to offer long-lasting protection against pneumococcal infections. Their high effectiveness in preventing pneumococcal diseases, especially among children under five years old, has fueled their growing demand. Additionally, expanding applications among adult populations, particularly those with weakened immune systems and elderly individuals, are accelerating the adoption of conjugate vaccines. Their ability to reduce the overall burden of pneumococcal diseases has established them as the preferred choice for routine immunization schedules.

The U.S. pneumococcal vaccine market generated USD 3.7 billion in 2024. The rising elderly population in the country has been a key driver of this growth, as aging individuals face a higher risk of contracting pneumococcal infections due to declining immune function. Preventive healthcare efforts and nationwide vaccination programs have significantly increased vaccine uptake, ensuring better protection for high-risk populations. Pharmaceutical companies and government agencies continue to enhance vaccine coverage, with ongoing efforts to develop newer vaccines that target a broader range of pneumococcal serotypes, further supporting the market's long-term expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of pneumococcal diseases

- 3.2.1.2 Government immunization programs and initiatives

- 3.2.1.3 Growing aging population

- 3.2.1.4 Technological advancements and new product launches

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of vaccines

- 3.2.2.2 Vaccine hesitancy and low awareness

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pneumosil (PCV10)

- 5.3 Pneumovax 23 (PPSV23)

- 5.4 Prevnar 13 (PCV13)

- 5.5 Prevnar 20 (PCV20)

- 5.6 Synflorix (PCV10)

- 5.7 Vaxneuvance (PCV15)

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Vaccine Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pneumococcal conjugate vaccines (PCV)

- 6.3 Pneumococcal polysaccharide vaccines (PPSV)

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Infants and children (0–5 years)

- 7.3 Adults (18–64 years)

- 7.4 Elderly (65+ years)

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Government and public health agencies

- 8.5 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Beijing Minhai Biological Technology

- 10.2 Bio-Manguinhos/Fiocruz

- 10.3 GlaxoSmithKline

- 10.4 Merck & Co.

- 10.5 Pfizer

- 10.6 Serum Institute of India

- 10.7 Walvax Biotechnology