|

市场调查报告书

商品编码

1708205

奶粉包装市场机会、成长动力、产业趋势分析及2025-2034年预测Milk Powder Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

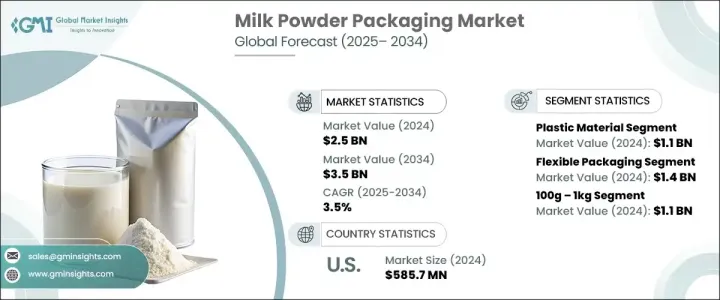

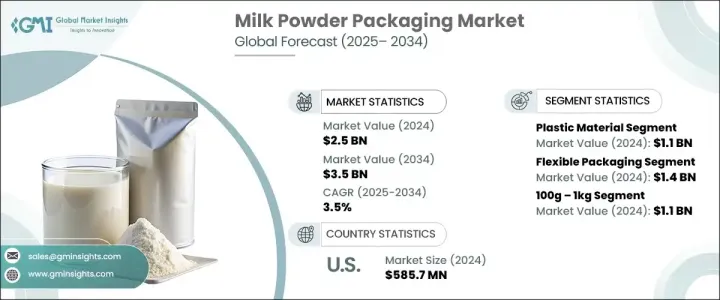

2024 年全球奶粉包装市场规模达 25 亿美元,预估 2025-2034 年期间复合年增长率为 3.5%。这一增长主要得益于全球对乳製品需求的不断增长以及婴儿营养品行业的不断扩大。随着消费者偏好更健康、更方便和更持久的选择,对维持产品安全和卫生并延长保质期的专用包装的需求正在激增。婴儿配方奶粉市场不断变化的需求,加上城市化进程的加速和生活方式的改变,正在加速这一趋势。此外,可支配收入的增加和强化婴儿配方奶粉意识的增强也推动了对安全和实用包装解决方案的需求。提供屏障保护和增强产品完整性的先进包装技术正在推动该领域的投资。电子商务平台的激增也推动了对耐用、防篡改包装的需求,以确保运输过程中的产品安全。这些因素共同促进了全球奶粉包装产业的稳定成长。

随着人们对婴儿健康和营养意识的不断提高,奶粉包装市场正在经历显着成长。随着越来越多的父母强调满足婴儿营养需求的重要性,强化婴儿配方奶粉的需求持续成长。这种日益增长的趋势要求包装解决方案不仅能保护产品,还能长期维持其营养价值。因此,对能够提供优异的防潮、防氧、防光阻隔保护的包装的需求日益增加。功能性和保护性包装,特别是密封包装,确保了奶粉的保质期和安全性,对市场扩张做出了重大贡献。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 35亿美元 |

| 复合年增长率 | 3.5% |

奶粉包装所使用的材料对确保产品品质和寿命起着至关重要的作用。 2024 年,塑胶产业创造了 11 亿美元的收入,其关键优势推动了其在市场上的主导地位。塑胶包装具有防潮、密封、避光等特点,是维持奶粉品质和保存期限的理想选择。此外,对方便、可重新密封的包装解决方案(如自立袋和带嘴袋)的需求不断增长,进一步加速了塑胶包装在该行业的应用。这些形式迎合了人们对单份和分装产品日益增长的偏好,符合现代消费者的生活方式。

市场也按包装类型细分,其中软包装在 2024 年创造 14 亿美元的市场价值。软包装因其能够为消费者提供轻巧、经济高效且便携的解决方案而获得了显着的吸引力。随着便携式奶粉包装(如单份小袋和旅行装)的需求不断增长,人们对弹性包装的偏好也日益增加。随着电子商务的持续蓬勃发展,对耐用、防篡改和防漏包装的需求日益增长,以确保运输和储存过程中产品的完整性。这些因素正在促进行业内软包装解决方案的持续成长。

受乳製品产业对便利、持久包装解决方案的需求所推动,北美奶粉包装市场在 2024 年占据 28.3% 的份额。随着越来越多的消费者寻求易于储存和运输的乳製品替代品,对能够长期维持产品品质的包装的需求刺激了创新包装技术的采用。随着消费者对高品质、可重新密封和便携式包装解决方案的偏好日益增加,北美仍然是推动奶粉包装市场成长的关键参与者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球乳製品需求不断成长

- 婴儿营养品产业蓬勃发展

- 电子商务和直接面向消费者的销售成长

- 延长保质期的要求

- 法规合规性和食品安全标准

- 产业陷阱与挑战

- 包装成本高

- 供应链中断

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按包装类型,2021 - 2034 年

- 主要趋势

- 软包装

- 袋装

- 小袋

- 其他的

- 硬质包装

- 罐头

- 罐子

- 其他的

第六章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 塑胶

- 纸和纸板

- 金属

- 其他的

第七章:市场估计与预测:按产能,2021 - 2034 年

- 主要趋势

- 最多 100 克

- 100克 – 1公斤

- 1公斤以上

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Advanced Industries Packaging

- Bowe Pack

- CarePac

- Constantia Flexibles

- Coveris

- Evergreen Goods

- Hassia-Redatron

- Honokage

- Huhtamaki

- Mondi

- NNZ

- Novel

- Premier Polymers

- Sadhi Krupa Polysacks

- Sonoco Product Company

The Global Milk Powder Packaging Market generated USD 2.5 billion in 2024 and is projected to grow at a CAGR of 3.5% during 2025-2034. This growth is primarily driven by the increasing global demand for dairy products and the expanding infant nutrition sector. As consumer preferences lean towards healthier, more convenient, and long-lasting options, the demand for specialized packaging that maintains product safety and hygiene and extends shelf life is surging. The evolving needs in the infant formula segment, coupled with growing urbanization and changing lifestyles, are accelerating this trend. Furthermore, rising disposable incomes and increased awareness of fortified baby formula are boosting the demand for secure and functional packaging solutions. Advanced packaging technologies that offer barrier protection and enhance product integrity are driving investments in the sector. The surge in e-commerce platforms has also fueled the need for durable and tamper-proof packaging that ensures product safety during transit. These factors are collectively contributing to the steady growth of the milk powder packaging industry worldwide.

The milk powder packaging market is witnessing remarkable growth due to the rising awareness of infant health and nutrition. With more parents emphasizing the importance of meeting their babies' nutritional needs, the demand for fortified baby formula continues to grow. This growing trend requires packaging solutions that not only protect the product but also preserve its nutritional value over time. As a result, there is an increasing demand for packaging that provides superior barrier protection against moisture, oxygen, and light. Functional and protective packaging, particularly those offering airtight seals, ensures the longevity and safety of milk powder, contributing significantly to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 3.5% |

Materials used in milk powder packaging play a crucial role in ensuring product quality and longevity. The plastic segment generated USD 1.1 billion in 2024, with its key advantages driving its dominance in the market. Plastic packaging offers moisture resistance, airtight sealing, and protection from light exposure, making it ideal for preserving the quality and shelf life of milk powder. Additionally, the rising demand for convenient, resealable packaging solutions, such as stand-up pouches and spouted pouches, is further accelerating the adoption of plastic packaging in the industry. These formats cater to the increasing preference for single-serve and portion-sized products, aligning with modern consumer lifestyles.

The market is also segmented by packaging type, with flexible packaging generating USD 1.4 billion in 2024. Flexible packaging is gaining significant traction due to its ability to provide lightweight, cost-effective, and portable solutions for consumers. The rise in demand for on-the-go milk powder packaging, such as single-serve sachets and travel-friendly packs, has led to an increased preference for flexible options. As e-commerce continues to flourish, there is a growing need for durable, tamper-proof, and leak-proof packaging that safeguards product integrity during transportation and storage. These factors are contributing to the sustained growth of flexible packaging solutions within the industry.

North America milk powder packaging market captured a 28.3% share in 2024, driven by the demand for convenient, long-lasting packaging solutions in the dairy sector. As more consumers seek easy-to-store and transport dairy alternatives, the need for packaging that maintains product quality over extended periods has spurred the adoption of innovative packaging technologies. With increasing consumer preferences for high-quality, resealable, and portable packaging solutions, North America remains a key player in driving the growth of the milk powder packaging market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global demand for dairy products

- 3.2.1.2 Growing infant nutrition industry

- 3.2.1.3 E-Commerce and Direct-to-Consumer Sales Growth

- 3.2.1.4 Extended shelf-life requirements

- 3.2.1.5 Regulatory compliance and food safety standards

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High packaging costs

- 3.2.2.2 Supply chain disruptions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Flexible packaging

- 5.2.1 Pouches

- 5.2.2 Sachets

- 5.2.3 Others

- 5.3 Rigid packaging

- 5.3.1 Cans

- 5.3.2 Jars

- 5.3.3 Others

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Paper & paperboard

- 6.4 Metal

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Up to 100g

- 7.3 100g – 1kg

- 7.4 Above 1kg

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Advanced Industries Packaging

- 9.2 Bowe Pack

- 9.3 CarePac

- 9.4 Constantia Flexibles

- 9.5 Coveris

- 9.6 Evergreen Goods

- 9.7 Hassia-Redatron

- 9.8 Honokage

- 9.9 Huhtamaki

- 9.10 Mondi

- 9.11 NNZ

- 9.12 Novel

- 9.13 Premier Polymers

- 9.14 Sadhi Krupa Polysacks

- 9.15 Sonoco Product Company