|

市场调查报告书

商品编码

1740890

牛奶包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Milk Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

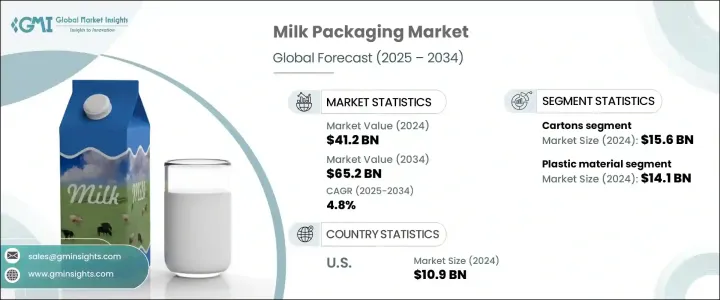

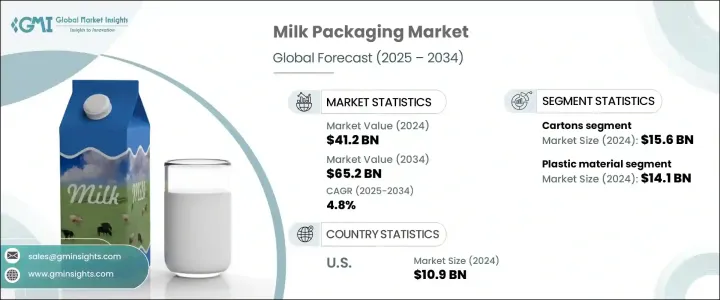

2024 年全球牛奶包装市场价值为 412 亿美元,预计到 2034 年将以 4.8% 的复合年增长率增长至 652 亿美元。受乳製品消费量上升、有组织零售业快速成长以及电子商务爆炸式扩张的推动,该市场发展势头强劲。随着消费者越来越多地选择网购新鲜包装乳製品,包装也不断发展以满足耐用性、防漏性和运输便利性的新标准。现在,对既能确保产品安全,又能提高品牌知名度和消费者参与度的包装的需求达到了前所未有的高度。在消费者驱动的环境中,人们的偏好围绕着便利性、永续性和透明度,包装在影响购买决策方面起着至关重要的作用。企业正在投资创新的包装形式,以便在实体货架和数位店面中脱颖而出。

对可持续、轻质且易于回收的材料日益增长的需求正在重塑竞争格局,包装不再被视为成本因素,而是战略性品牌资产。人们对食品安全、可追溯性和原料来源的认识不断提高,进一步提升了包装的作用。这种转变也为智慧包装技术创造了机会,这些技术提供二维码和智慧标籤等功能,使消费者能够做出更明智的选择。随着零售商和电商平台寻求兼具视觉吸引力、功能性和环保性的包装,利乐包和环保纸盒等包装形式正在线上线下管道广泛流行。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 412亿美元 |

| 预测值 | 652亿美元 |

| 复合年增长率 | 4.8% |

牛奶包装市场按包装类型细分为瓶装、纸盒、袋装、罐装等。纸盒包装仍然是最大的市场,2024 年市场价值将达到 156 亿美元。其成长动力源自于消费者对无菌包装解决方案日益增长的需求,这些解决方案能够延长保质期,同时使用再生纸板等永续材料。纸盒包装还节省空间,可降低运输成本和排放,使其成为传统塑胶包装的更环保替代品。纸盒包装尤其适用于高端加值乳製品,例如无乳糖牛奶和强化牛奶,因为强光和氧气阻隔性能至关重要。

根据材料,市场细分为塑胶、玻璃、金属、纸板和其他材料。塑胶占据主导地位,2024 年市场价值达 141 亿美元。高密度聚乙烯 (HDPE) 和 PET 等材料因其轻质结构、抗衝击性以及在长途物流和电商配送中卓越的易处理性,仍然是首选。可重复密封的瓶盖和符合人体工学的设计等特性提高了使用者的便利性,并最大限度地减少了损耗。人们对回收的日益关注,促使製造商使用再生塑胶 (rPET),在维持产品功能性的同时,解决环境问题。

2024年,德国牛奶包装市场规模达23亿美元,反映出严格的监管标准以及消费者对可回收和可生物降解包装的日益增长的偏好。有机乳製品消费的日益增长趋势进一步推动了对优质、永续包装解决方案的需求。智慧标籤和增强阻隔材料等技术创新正在对保质期和可追溯性产生实际的影响。

全球市场的主要参与者包括利乐、SIG、Smurfit Kappa、WestRock、Sonoco Products、Elopak、Ecolean、Berry Global、CDF Corporation 和 Alfipa。为了保持竞争力,这些公司正在大力投资永续包装创新,开发可生物降解复合材料、可回收纸板以及针对电商物流量身定制的解决方案。研发工作重点在于延长保存期限、减少环境足迹,并为有机和高端乳製品等利基市场提供客製化包装,最终增强品牌忠诚度。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(销售价格)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 乳製品消费量增加

- 有组织的零售和电子商务的扩张

- 植物奶替代品日益流行

- 对方便、用户友好的包装的需求

- 包装技术的进步

- 产业陷阱与挑战

- 环境问题和监管压力

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依包装类型,2021 年至 2034 年

- 主要趋势

- 瓶子

- 纸箱

- 袋装

- 罐头

- 其他的

第六章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 玻璃

- 塑胶

- 金属

- 纸板

- 其他的

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第八章:公司简介

- Alfipa

- Berry Global

- CDF Corporation

- CKS Packaging

- Ecolean

- Elopak

- Global Polybags Industries

- IPI

- Jagannath Polymers

- Nippon Paper Industries

- Parksons Packaging

- SIG

- Smurfit Kappa

- Sonoco Products

- Stanpac

- Stora Enso

- Tetra Pak

- WestRock

The Global Milk Packaging Market was valued at USD 41.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 65.2 billion by 2034. The market is witnessing strong momentum driven by rising dairy product consumption, rapid growth in organized retail, and the explosive expansion of e-commerce. As consumers increasingly opt for online shopping for fresh and packaged dairy goods, packaging is evolving to meet new standards of durability, leak resistance, and ease of transport. The need for packaging that ensures product safety while enhancing brand visibility and consumer engagement is now at an all-time high. In a consumer-driven environment where preferences revolve around convenience, sustainability, and transparency, packaging plays a critical role in shaping purchasing decisions. Companies are investing in innovative packaging formats that can stand out on physical shelves and in digital storefronts alike.

The growing demand for sustainable, lightweight, and easily recyclable materials is reshaping the competitive landscape, with packaging no longer seen as a cost factor but as a strategic brand asset. Increasing awareness around food safety, traceability, and the origin of ingredients further elevates the role of packaging. This shift has also created opportunities for smart packaging technologies, offering features such as QR codes and smart labels that empower consumers to make better-informed choices. As retailers and e-commerce platforms seek packaging that is visually appealing, functional, and environmentally responsible, formats like tetra packs and eco-friendly cartons are gaining widespread traction across both online and offline channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $41.2 Billion |

| Forecast Value | $65.2 Billion |

| CAGR | 4.8% |

The milk packaging market is segmented by packaging type into bottles, cartons, pouches, cans, and others. The cartons segment remains the largest, valued at USD 15.6 billion in 2024. Its growth is fueled by rising consumer demand for aseptic packaging solutions that extend shelf life while utilizing sustainable materials such as renewable paperboard. Cartons are also space-efficient, cutting down on transportation costs and emissions, making them a greener alternative to traditional plastic options. They are especially preferred for premium and value-added milk products like lactose-free and fortified milk, where strong light and oxygen barrier properties are critical.

Based on material, the market is segmented into plastic, glass, metal, paperboard, and others. Plastic dominates the material segment, with a market value of USD 14.1 billion in 2024. Materials like HDPE and PET remain top choices for their lightweight structure, impact resistance, and superior ease of handling across long-distance logistics and e-commerce distribution. Features such as resealable caps and ergonomic designs enhance user convenience and minimize spoilage. A growing focus on recycling is pushing manufacturers toward using recycled plastics (rPET), addressing environmental concerns while maintaining functionality.

Germany Milk Packaging Market was valued at USD 2.3 billion in 2024, reflecting strong regulatory standards and heightened consumer preference for recyclable and biodegradable packaging. The growing trend of organic dairy consumption further drives demand for premium, sustainable packaging solutions. Technological innovations such as smart labels and enhanced barrier materials are making a tangible impact on shelf life and traceability.

Key players in the global market include Tetra Pak, SIG, Smurfit Kappa, WestRock, Sonoco Products, Elopak, Ecolean, Berry Global, CDF Corporation, and Alfipa. To stay competitive, these companies are heavily investing in sustainable packaging innovations, developing biodegradable composites, recyclable paperboards, and solutions tailored for e-commerce logistics. Research and development efforts are focused on extending shelf life, reducing environmental footprint, and offering customized packaging for niche markets such as organic and premium dairy segments, ultimately strengthening brand loyalty.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (Raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (Selling Price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (Raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing consumption of dairy products

- 3.3.1.2 Expansion of organized retail and e-commerce

- 3.3.1.3 Rising popularity of plant-based milk alternatives

- 3.3.1.4 Demand for convenient and user-friendly packaging

- 3.3.1.5 Advancements in packaging technology

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Environmental concerns and regulatory pressures

- 3.3.2.2 Fluctuating raw material prices

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Bottles

- 5.3 Cartons

- 5.4 Pouches

- 5.5 Cans

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Glass

- 6.3 Plastic

- 6.4 Metal

- 6.5 Paperboard

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 ANZ

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 Middle East and Africa

- 7.6.1 UAE

- 7.6.2 Saudi Arabia

- 7.6.3 South Africa

Chapter 8 Company Profiles

- 8.1 Alfipa

- 8.2 Berry Global

- 8.3 CDF Corporation

- 8.4 CKS Packaging

- 8.5 Ecolean

- 8.6 Elopak

- 8.7 Global Polybags Industries

- 8.8 IPI

- 8.9 Jagannath Polymers

- 8.10 Nippon Paper Industries

- 8.11 Parksons Packaging

- 8.12 SIG

- 8.13 Smurfit Kappa

- 8.14 Sonoco Products

- 8.15 Stanpac

- 8.16 Stora Enso

- 8.17 Tetra Pak

- 8.18 WestRock