|

市场调查报告书

商品编码

1708214

医药冷链包装市场机会、成长动力、产业趋势分析及2025-2034年预测Pharmaceutical Cold Chain Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

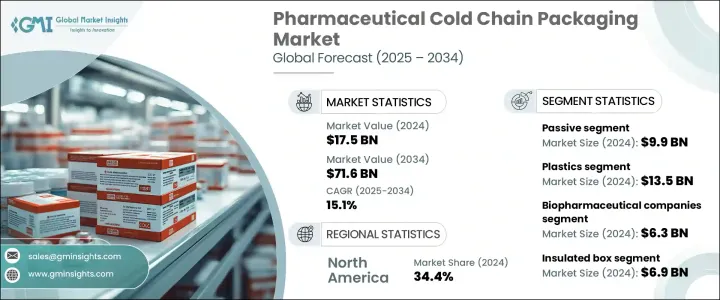

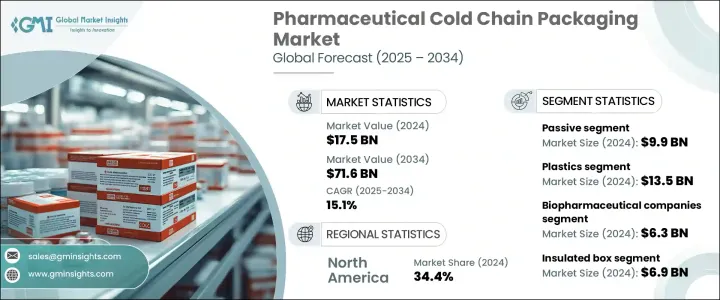

2024 年全球医药冷链包装市场规模达 175 亿美元,预估 2025 年至 2034 年期间的复合年增长率为 15.1%。这一增长主要得益于先进疗法的日益普及,例如基于 mRNA 的治疗、细胞疗法和基因疗法,这些疗法需要在整个供应链中进行严格的温度控制。随着製药公司增加产量以满足对这些创新疗法日益增长的需求,对可靠的冷链包装解决方案的需求变得更加重要。冷链包装确保对温度敏感的药物(包括生物製剂和疫苗)在从生产地运输到最终用户的过程中的安全性、稳定性和有效性。

此外,慢性病的增加和个人化医疗的日益增长趋势也增加了对专门包装解决方案的需求,以维持复杂生物製剂的效力。人们越来越重视在储存和运输过程中保持对温度敏感的药品的品质和合规性,这进一步促进了市场的扩张。监管审查的加强和遵守严格分销协议的需要促使製造商投资先进的冷链包装技术,确保产品安全和合规性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 175亿美元 |

| 预测值 | 716亿美元 |

| 复合年增长率 | 15.1% |

医药冷链包装市场按材料细分,主要类别为塑胶、金属和纸张。 2024 年,塑胶产业的产值达到 135 亿美元。塑胶的主导地位可以归因于其优异的隔热性能,这对于在运输过程中维持所需的温度至关重要。其重量轻且具有成本效益,使其成为旨在降低运输成本同时保持产品完整性的製药公司的理想选择。塑胶材料以其耐用性和可扩展性而闻名,为确保生物製剂和其他敏感药物的安全运输提供了实用的解决方案。随着对生物製剂的需求增加,对能够在整个供应链中保持精确温度控制的塑胶包装的需求预计将增长,从而加强该领域在市场上的地位。

市场进一步依最终用户分类,包括物流和配送中心、生物製药公司、医院、临床研究组织、研究机构等。 2024 年生物製药公司的收入为 63 亿美元,反映了该领域的快速扩张。基因和 mRNA 疗法的日益普及推动了对能够保持敏感药物的稳定性和功效的专用包装解决方案的需求。严格的监管准则在推动对先进冷链包装解决方案的需求方面发挥着至关重要的作用,这些解决方案可确保整个分销过程符合安全标准。随着生物製药公司扩大生产能力,对可靠、高品质的冷链包装的需求预计将上升,从而加强市场的上升趋势。

2024 年,北美医药冷链包装市场占有 34.4% 的份额。该地区强劲的市场地位主要归因于对生物製剂和细胞疗法日益增长的需求,这些产品需要在储存和运输过程中进行严格的温度管理。包括 FDA 在内的监管机构执行严格的指导方针,推动采用冷链包装解决方案,确保药品在整个供应链中保持其安全性、有效性和合规性。北美对精准医疗的日益重视和生物製剂产品组合的不断扩大,增强了该地区在全球医药冷链包装市场的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 生物製剂和特种药物的需求不断增长

- mRNA 和细胞/基因疗法的扩展

- 严格的监管要求

- 电子商务和网路药局的成长

- 製药业的扩张

- 产业陷阱与挑战

- 冷链基础设施成本高

- 温度超标和产品变质的风险

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 塑胶

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚对苯二甲酸乙二酯(PET)

- 聚氨酯(PU)

- 其他的

- 金属

- 纸

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 积极的

- 被动的

第七章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 保温箱

- 容器

- 冷却剂

- 托盘

- 其他的

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 生物製药公司

- 临床研究组织

- 医院

- 研究机构

- 物流配送公司

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Chill-Pak

- Cold Chain Technologies

- CoolPac

- Cryopak

- CSafe

- Envirotainer

- Haier Biomedical

- Insulated Products Corporation

- Intelsius

- Nordic Cold Chain Solutions

- Sealed Air

- Smurfit Kappa

- Sofrigam Group

- Sonoco ThermoSafe

- Tessol

- Va-Q-Tec Thermal Solutions

- Vericool

The Global Pharmaceutical Cold Chain Packaging Market generated USD 17.5 billion in 2024 and is projected to grow at a CAGR of 15.1% between 2025 and 2034. This growth is primarily driven by the increasing adoption of advanced therapies, such as mRNA-based treatments, cell therapies, and gene therapies, which require strict temperature control throughout the supply chain. As pharmaceutical companies ramp up production to meet the rising demand for these innovative treatments, the need for reliable cold chain packaging solutions becomes more critical. Cold chain packaging ensures the safety, stability, and efficacy of temperature-sensitive drugs, including biologics and vaccines, during transportation from manufacturing sites to end users.

Additionally, the rise in chronic diseases and the growing trend of personalized medicine have heightened the need for specialized packaging solutions to maintain the potency of complex biologics. The growing focus on maintaining the quality and compliance of temperature-sensitive pharmaceutical products during storage and transit further contributes to the market's expansion. Increased regulatory scrutiny and the need to adhere to strict distribution protocols push manufacturers to invest in advanced cold chain packaging technologies, ensuring product safety and compliance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.5 Billion |

| Forecast Value | $71.6 Billion |

| CAGR | 15.1% |

The pharmaceutical cold chain packaging market is segmented by material, with plastic, metal, and paper being the primary categories. The plastic segment generated USD 13.5 billion in 2024. Plastic's dominance can be attributed to its superior thermal insulation properties, which are essential for maintaining the required temperatures during transit. Its lightweight nature and cost-effectiveness make it an ideal choice for pharmaceutical companies aiming to reduce shipping costs while preserving product integrity. Plastic materials, known for their durability and scalability, provide a practical solution for ensuring the safe transportation of biologics and other sensitive drugs. As the demand for biologics increases, the need for plastic packaging that can maintain precise temperature control throughout the supply chain is expected to grow, strengthening the segment's position in the market.

The market is further categorized by end users, including logistics and distribution centers, biopharmaceutical companies, hospitals, clinical research organizations, research institutes, and others. Biopharmaceutical companies generated USD 6.3 billion in 2024, reflecting the rapid expansion of this segment. The growing adoption of gene and mRNA therapies has fueled the demand for specialized packaging solutions capable of preserving the stability and efficacy of sensitive pharmaceuticals. Strict regulatory guidelines play a crucial role in driving the need for advanced cold chain packaging solutions that ensure compliance with safety standards throughout the distribution process. As biopharmaceutical companies expand their production capabilities, the demand for reliable and high-quality cold chain packaging is expected to rise, reinforcing the market's upward trajectory.

North America's pharmaceutical cold chain packaging market held a 34.4% share in 2024. The region's strong market presence is largely attributed to the growing demand for biologics and cell therapies, which require stringent temperature management during storage and transportation. Regulatory authorities, including the FDA, enforce strict guidelines that drive the adoption of cold chain packaging solutions, ensuring that pharmaceutical products maintain their safety, efficacy, and compliance throughout the supply chain. The increasing emphasis on precision medicine and the expanding portfolio of biologics in North America contribute to the region's stronghold in the global pharmaceutical cold chain packaging market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for biologics & specialty drugs

- 3.2.1.2 Expansion of mRNA & cell/gene therapies

- 3.2.1.3 Stringent regulatory requirement

- 3.2.1.4 Growth of e-commerce and online pharmacies

- 3.2.1.5 Expansion of the pharmaceutical industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of cold chain infrastructure

- 3.2.2.2 Risk of temperature excursions & product spoilage

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastics

- 5.2.1 Polyethylene (PE)

- 5.2.2 Polypropylene (PP)

- 5.2.3 Polyethylene Terephthalate (PET)

- 5.2.4 Polyurethane (PU)

- 5.2.5 Others

- 5.3 Metal

- 5.4 Paper

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Active

- 6.3 Passive

Chapter 7 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Insulated box

- 7.3 Containers

- 7.4 Coolants

- 7.5 Pallets

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Biopharmaceutical companies

- 8.3 Clinical research organizations

- 8.4 Hospitals

- 8.5 Research institutes

- 8.6 Logistics and distribution companies

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Chill-Pak

- 10.2 Cold Chain Technologies

- 10.3 CoolPac

- 10.4 Cryopak

- 10.5 CSafe

- 10.6 Envirotainer

- 10.7 Haier Biomedical

- 10.8 Insulated Products Corporation

- 10.9 Intelsius

- 10.10 Nordic Cold Chain Solutions

- 10.11 Sealed Air

- 10.12 Smurfit Kappa

- 10.13 Sofrigam Group

- 10.14 Sonoco ThermoSafe

- 10.15 Tessol

- 10.16 Va-Q-Tec Thermal Solutions

- 10.17 Vericool