|

市场调查报告书

商品编码

1708233

马匹影像服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Equine Imaging Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

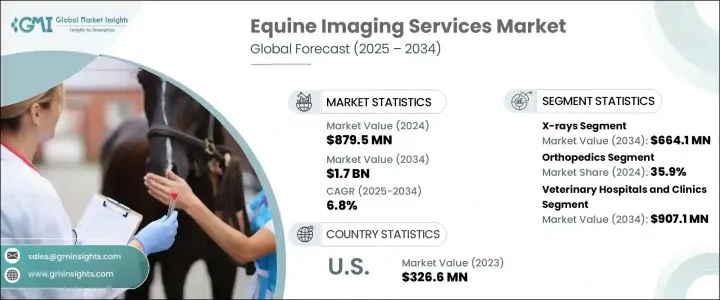

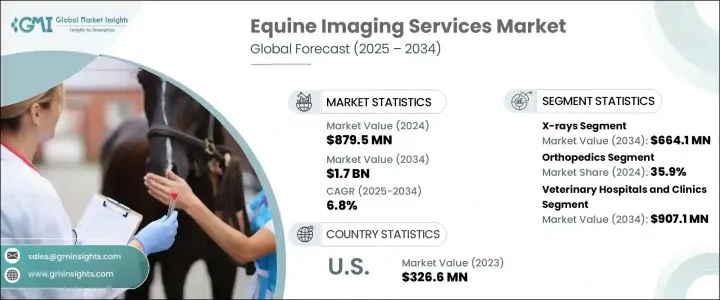

2024 年全球马匹影像服务市场价值为 8.795 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.8%。这一增长是由马匹中关节炎、韧带损伤等肌肉骨骼疾病患病率上升所推动的。 3D 成像、数位放射成像和便携式机器等诊断成像技术的进步已获得广泛认可,促进了市场扩张。此外,马术运动和赛马产业的快速发展也加剧了对用于预防和治疗伤害的先进影像解决方案的需求。加强兽医研究和致力于开发创新影像技术的合作伙伴关係进一步推动了市场的发展。人工智慧诊断工具的接受度不断提高也提高了马匹影像的效率和准确性,使其成为兽医实践的宝贵补充。

马匹影像服务涉及可视化马匹解剖结构的诊断技术,以支持诊断和治疗。这些服务利用 X 光、超音波、磁振造影 (MRI)、电脑断层扫描 (CT) 和核子成像来检测肌肉骨骼问题、韧带损伤和内部异常。根据影像方式,全球市场分为 X 光、超音波、MRI、核子造影系统、CT 扫描和其他方式。 X 射线部门在 2024 年创造了 3.552 亿美元的最高收入,预计到 2034 年将达到 6.641 亿美元,复合年增长率为 6.5%。 X 光仍然是诊断骨折、关节问题和肌肉骨骼疾病最常用的影像方法。它们价格实惠、易于获取,并且能够快速提供诊断结果,因此成为马兽医的首选。便携式X光机允许进行现场评估,进一步简化了诊断过程,减少了将马匹运送到专门设施的需要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.795亿美元 |

| 预测值 | 17亿美元 |

| 复合年增长率 | 6.8% |

根据应用,市场分为骨科、肿瘤科、心臟科、神经病学和其他应用。 2024 年,骨科领域占了 35.9% 的市场份额,这反映了运动马、赛马和农场马中肌肉骨骼损伤和关节疾病的盛行率很高。 X 光和 MRI 扫描经常用于诊断马科动物骨科中的韧带损伤、骨折、肌腱异常和骨关节炎。随着诊断准确性和治疗计划的不断提高,先进成像技术的应用也将不断扩大,预计将推动这一领域的扩张。对马匹医疗保健和诊断的投资增加推动了对骨科影像服务的需求,巩固了其市场地位。

根据最终用途,全球市场分为兽医院和诊所、兽医诊断中心以及学术和研究机构。预计兽医医院和诊所将占据主导地位,成长率为 6.6%,到 2034 年将达到 9.071 亿美元。这种主导地位归因于这些设施中广泛使用先进的影像技术,例如 X 光、CT 扫描、MRI 和其他模式。这些医院和诊所专门诊断和治疗马的肌肉骨骼、神经和内科疾病,是影像服务的首选。此外,马匹医疗保健支出的增加和马主数量的增加也刺激了这些机构提供的影像服务的需求。兽医医院和研究机构在先进诊断应用方面的策略合作正在进一步推动市场成长。

2024 年,美国成为北美马匹影像服务市场的领导者,估值从 2023 年的 3.266 亿美元成长至 3.465 亿美元。这一领先地位归功于该国先进的兽医基础设施、较高的马匹数量以及在马匹医疗保健方面的大量投资。配备有 MRI、CT 和数位放射成像等先进影像技术的专科诊所和医院的存在正在促进国家层面的发展。政府对兽医研究的支持和资助,加上不断的技术进步,进一步促进了美国市场的扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 马病发生率上升

- 成像技术的进步

- 不断发展的马术运动产业

- 扩展移动影像服务

- 产业陷阱与挑战

- 先进成像设备成本高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依影像方式,2021 - 2034 年

- 主要趋势

- X射线

- 超音波

- MRI扫描

- 核子造影系统

- CT扫描

- 其他成像方式

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 骨科

- 肿瘤学

- 心臟病学

- 神经病学

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 兽医医院和诊所

- 兽医诊断中心

- 学术及研究机构

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Chaparral Veterinary Medical Center

- Chine House Veterinary Hospital

- Daniel Equine Services

- Hagyard Equine Medical Institute

- IDEXX Laboratories

- IMV Imaging

- Mid-Atlantic Equine Medical Center

- Moore Equine PC

- National Research Center on Equines.

- Rainbow Equine Hospital

- Royal Veterinary College's Equine Referral Hospital

- Tennessee Equine Hospital

- VET.CT

- Vets Pets

- Virginia Equine Imaging

The Global Equine Imaging Services Market was valued at USD 879.5 million in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2034. This growth is driven by the rising prevalence of musculoskeletal disorders such as arthritis, ligament injuries, and other conditions in horses. Advances in diagnostic imaging technologies, including 3D imaging, digital radiography, and portable machines, have gained widespread acceptance, contributing to market expansion. Moreover, the rapid growth of the equine sports and racing sectors has intensified the need for advanced imaging solutions for injury prevention and treatment. Increased veterinary research and partnerships focused on developing innovative imaging technologies are further driving the market. Higher acceptance of AI-powered diagnostic tools is also enhancing the efficiency and accuracy of equine imaging, making it a valuable addition to veterinary practices.

Equine imaging services involve diagnostic techniques that visualize a horse's anatomy to support diagnosis and treatment. These services utilize X-rays, ultrasound, magnetic resonance imaging (MRI), computed tomography (CT), and nuclear imaging to detect musculoskeletal issues, ligament injuries, and internal abnormalities. By imaging modality, the global market is segmented into X-rays, ultrasound, MRI, nuclear imaging systems, CT scans, and other modalities. The X-rays segment generated the highest revenue of USD 355.2 million in 2024 and is expected to reach USD 664.1 million by 2034, growing at a CAGR of 6.5%. X-rays remain the most commonly used imaging method for diagnosing fractures, joint problems, and musculoskeletal disorders. Their affordability, availability, and ability to deliver rapid diagnostic results make them a preferred choice for equine veterinarians. Portable X-ray machines have further simplified the diagnostic process by allowing on-site evaluations, reducing the need to transport horses to specialized facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $879.5 Million |

| Forecast Value | $1.7 Billion |

| CAGR | 6.8% |

Based on application, the market is categorized into orthopedics, oncology, cardiology, neurology, and other applications. The orthopedics segment accounted for 35.9% of the market share in 2024, reflecting the high prevalence of musculoskeletal injuries and joint disorders in sport, racing, and farm horses. X-rays and MRI scans are frequently used for diagnosing ligament injuries, fractures, tendon abnormalities, and osteoarthritis in equine orthopedics. The growing adoption of advanced imaging technologies for diagnostic accuracy and treatment planning is expected to fuel the expansion of this segment. Increased investments in equine healthcare and diagnostics are driving the demand for orthopedic imaging services, reinforcing their market position.

By end use, the global market is segmented into veterinary hospitals and clinics, veterinary diagnostic centers, and academic and research institutes. Veterinary hospitals and clinics are expected to hold a dominant position with a growth rate of 6.6%, reaching USD 907.1 million by 2034. This dominance is attributed to the extensive availability of advanced imaging technologies such as X-rays, CT scans, MRI, and other modalities in these facilities. These hospitals and clinics specialize in diagnosing and treating equine musculoskeletal, neurological, and internal disorders, making them the preferred choice for imaging services. Additionally, increasing expenditure on equine healthcare and the rising population of horse owners have fueled the demand for imaging services offered by these facilities. Strategic collaborations between veterinary hospitals and research organizations for advanced diagnostic applications are further driving market growth.

In 2024, the US emerged as a leader in the North American equine imaging services market, with a valuation of USD 346.5 million, up from USD 326.6 million in 2023. This leadership is attributed to the country's advanced veterinary infrastructure, high equine population, and significant investments in equine healthcare. The presence of specialized clinics and hospitals equipped with advanced imaging technologies such as MRI, CT, and digital radiography is fostering growth at the country level. Government support and funding for veterinary research, combined with continuous technological enhancements, are further contributing to market expansion in the US.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of equine diseases

- 3.2.1.2 Advancements in imaging technologies

- 3.2.1.3 Growing equine sports industry

- 3.2.1.4 Expansion of mobile imaging services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced imaging equipment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Imaging Modality, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 X-rays

- 5.3 Ultrasound

- 5.4 MRI scans

- 5.5 Nuclear imaging systems

- 5.6 CT scans

- 5.7 Other imaging modalities

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Orthopedics

- 6.3 Oncology

- 6.4 Cardiology

- 6.5 Neurology

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Veterinary hospitals & clinics

- 7.3 Veterinary diagnostic centers

- 7.4 Academic & research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Chaparral Veterinary Medical Center

- 9.2 Chine House Veterinary Hospital

- 9.3 Daniel Equine Services

- 9.4 Hagyard Equine Medical Institute

- 9.5 IDEXX Laboratories

- 9.6 IMV Imaging

- 9.7 Mid-Atlantic Equine Medical Center

- 9.8 Moore Equine P.C

- 9.9 National Research Center on Equines.

- 9.10 Rainbow Equine Hospital

- 9.11 Royal Veterinary College's Equine Referral Hospital

- 9.12 Tennessee Equine Hospital

- 9.13 VET.CT

- 9.14 Vets Pets

- 9.15 Virginia Equine Imaging