|

市场调查报告书

商品编码

1716477

送货无人机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Delivery Drone Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

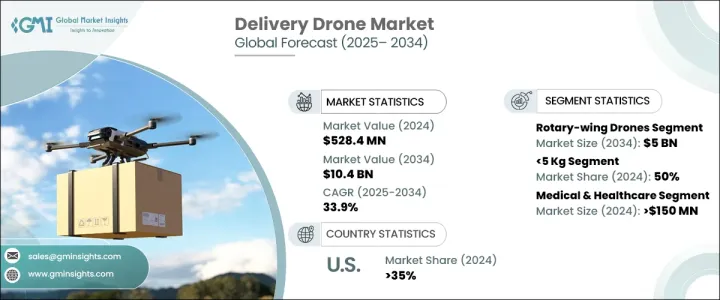

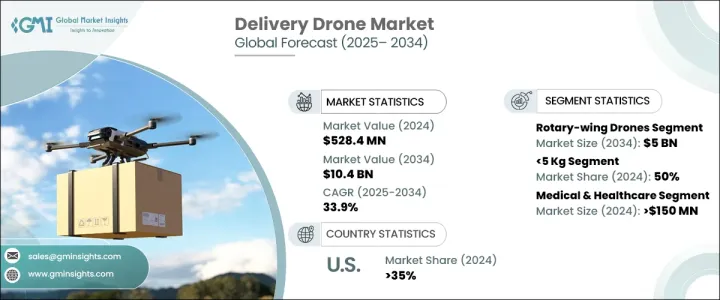

2024 年全球送货无人机市场规模达到 5.284 亿美元,预计 2025 年至 2034 年期间将以 33.9% 的强劲复合年增长率成长。各行各业对更快、更具成本效益、更有效率的送货解决方案的需求不断增长,推动了无人机技术的重大进步。随着城市化的快速发展和电子商务的扩张,企业越来越多地转向无人机物流,以满足消费者对快速送货日益增长的期望。无人机中人工智慧 (AI) 和自动化的融合增强了导航、障碍物检测和整体运作效率,使其成为传统运送方式的首选替代方案。

医疗保健是送货无人机最具变革性的领域之一,事实证明,它们对于向偏远或受灾地区运送医疗用品、疫苗和紧急药物至关重要。在基础设施有限的地区,无人机是确保及时医疗救助的有效手段。此外,零售和食品配送服务正在经历无人机物流的激增,该公司正在尝试自动配送系统来优化最后一英里的营运。全球各地的监管机构也透过实施鼓励创新同时确保安全和合规的政策,在简化无人机使用方面发挥关键作用。随着技术的不断进步,送货无人机的部署预计将进一步扩大,从而彻底改变全球供应链网路并改变各行各业的货物运输方式。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.284亿美元 |

| 预测值 | 104亿美元 |

| 复合年增长率 | 33.9% |

市场主要分为两大类无人机:旋翼无人机和固定翼无人机。 2024年,旋翼无人机的收入将达到3亿美元。由于具有垂直起飞和降落的能力,这些无人机在最后一英里的送货服务中,尤其是在城市地区,占据了主导地位。它们的灵活性和机动性使其成为在拥挤的城市景观和复杂环境中导航的理想解决方案。人工智慧自动化进一步提高了他们的营运效率,使他们能够即时检测障碍物并确保安全可靠的交付。物流公司和电子商务巨头对旋翼无人机的依赖日益增加,这将推动未来几年市场扩张。

送货无人机也依酬载能力分类,分为三个段落:5公斤、5-10公斤、10公斤以上。 2024 年,5 公斤类别占据市场主导地位,占有 50% 的份额。体积更小、重量更轻的无人机在城市和郊区的最后一英里物流中越来越受欢迎,事实证明,它在运输小型消费品、食品和医疗用品方面非常有效。它们能够简化交付流程,同时降低营运成本,从而推动寻求创新且环保的供应链优化解决方案的企业广泛采用。

2024 年,美国送货无人机市场占全球市场份额的 35%。该国仍然处于无人机技术发展的前沿,公共和私营部门的大量投资促进了无人机物流网路的创新。自主导航系统、人工智慧驱动的军用无人机应用和民用无人机物流的进步进一步推动了市场成长。美国政府的支持性监管框架和持续的资助措施正在巩固美国作为塑造全球送货无人机产业未来的关键参与者的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 零件供应商

- 技术提供者

- 服务提供者

- 最终用途

- 利润率分析

- 技术与创新格局

- 重要新闻和倡议

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 对更快、更有效率的最后一哩配送解决方案的需求日益增长

- 电子商务呈指数级成长

- 无人机技术的持续进步

- 提高环境永续性

- 产业陷阱与挑战

- 安全问题

- 监管挑战

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:无人机市场评估与预测,2021 - 2034

- 主要趋势

- 旋翼无人机

- 固定翼无人机

第六章:市场估计与预测:依酬载容量,2021 - 2034 年

- 主要趋势

- 5公斤

- 5-10公斤

- 超过10公斤

第七章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 推进系统

- 导航与控制系统

- 感测器和成像设备

- 航空电子设备和飞行控制系统

- 电源电池

- 其他的

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 电子商务与零售

- 医疗保健

- 送餐

- 包裹和邮政投递

- 工业和货运

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Amazon Prime Air

- DHL

- DJI

- EHang

- FedEx

- Flytrex

- Manna Drone Delivery

- Matternet

- Rakuten

- SkyCart

- Skyports

- UPS Flight Forward

- Wing (Alphabet Inc.)

- Wingcopter

- Zipline

The Global Delivery Drone Market reached USD 528.4 million in 2024 and is projected to grow at a robust CAGR of 33.9% between 2025 and 2034. The surging demand for faster, cost-effective, and more efficient delivery solutions across various industries is driving significant advancements in drone technology. With rapid urbanization and the expansion of e-commerce, businesses are increasingly turning to drone logistics to meet rising consumer expectations for swift deliveries. The integration of artificial intelligence (AI) and automation in drones is enhancing navigation, obstacle detection, and overall operational efficiency, making them a preferred alternative to traditional delivery methods.

One of the most transformative sectors for delivery drones is healthcare, where they are proving indispensable for transporting medical supplies, vaccines, and emergency medications to remote or disaster-stricken regions. In areas with limited infrastructure, drones provide an efficient means of ensuring timely medical assistance. Moreover, retail and food delivery services are witnessing a surge in drone-based logistics, with companies experimenting with autonomous delivery systems to optimize last-mile operations. Regulatory bodies across the globe are also playing a crucial role in streamlining drone usage by implementing policies that encourage innovation while ensuring safety and compliance. As technological advancements continue, the deployment of delivery drones is expected to expand further, revolutionizing global supply chain networks and transforming the way goods are transported across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $528.4 Million |

| Forecast Value | $10.4 Billion |

| CAGR | 33.9% |

The market is segmented into two primary drone categories: rotary-wing and fixed-wing drones. In 2024, rotary-wing drones accounted for USD 300 million in revenue. These drones have gained prominence in last-mile delivery services, particularly in urban areas, due to their ability to take off and land vertically. Their agility and maneuverability make them an ideal solution for navigating congested cityscapes and complex environments. AI-powered automation is further enhancing their operational efficiency, allowing them to detect obstacles in real-time and ensure safe, reliable deliveries. The growing reliance on rotary-wing drones by logistics companies and e-commerce giants is set to fuel market expansion in the coming years.

Delivery drones are also classified based on payload capacity, falling into three segments: 5 Kg, 5-10 Kg, and more than 10 Kg. The 5 Kg category dominated the market in 2024, holding a 50% share. Smaller, lightweight drones are gaining traction for last-mile logistics in urban and suburban areas, proving highly effective for transporting small consumer goods, food, and medical supplies. Their ability to streamline delivery processes while reducing operational costs is driving widespread adoption among businesses seeking innovative and eco-friendly solutions for supply chain optimization.

U.S. Delivery Drone Market accounted for 35% of the global market share in 2024. The country remains at the forefront of drone technology development, with substantial investments from both public and private sectors fostering innovation in drone logistics networks. Advancements in autonomous navigation systems, AI-driven military drone applications, and civilian drone logistics are further propelling market growth. The U.S. government's supportive regulatory framework and continued funding initiatives are solidifying the nation's position as a key player in shaping the future of the global delivery drone industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Component suppliers

- 3.2.3 Technology providers

- 3.2.4 Service providers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Patent analysis

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising need for faster and more efficient last-mile delivery solutions

- 3.8.1.2 Exponential growth of e-commerce

- 3.8.1.3 Ongoing advancements in drone technology

- 3.8.1.4 Increasing environmental sustainability

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Safety concerns

- 3.8.2.2 Regulatory challenges

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Drone, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Rotary-wing drones

- 5.3 Fixed-wing drones

Chapter 6 Market Estimates & Forecast, By Payload Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 5 kg

- 6.3 5-10 kg

- 6.4 More than 10 kg

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Propulsion system

- 7.3 Navigation & control system

- 7.4 Sensors & imaging device

- 7.5 Avionics & flight control system

- 7.6 Power source battery

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 E-commerce & retail

- 8.3 Medical & healthcare

- 8.4 Food delivery

- 8.5 Parcel & postal delivery

- 8.6 Industrial & cargo

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Amazon Prime Air

- 10.2 DHL

- 10.3 DJI

- 10.4 EHang

- 10.5 FedEx

- 10.6 Flytrex

- 10.7 Manna Drone Delivery

- 10.8 Matternet

- 10.9 Rakuten

- 10.10 SkyCart

- 10.11 Skyports

- 10.12 UPS Flight Forward

- 10.13 Wing (Alphabet Inc.)

- 10.14 Wingcopter

- 10.15 Zipline