|

市场调查报告书

商品编码

1801848

货运无人机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cargo Drones Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

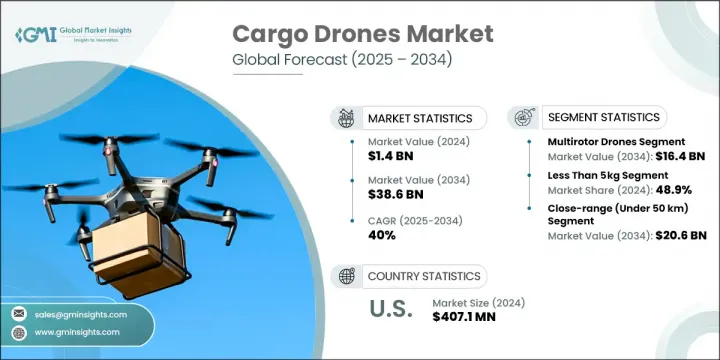

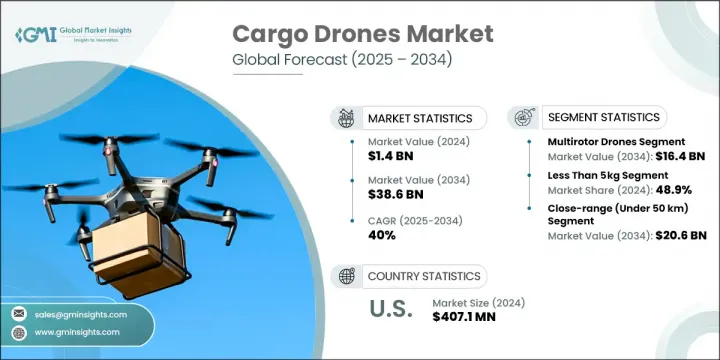

2024 年全球货运无人机市场规模达 14 亿美元,预计到 2034 年将以 40% 的复合年增长率成长至 386 亿美元。这一增长主要得益于无人机网路即服务 (DNaaS) 模式的日益普及、电子商务行业的蓬勃发展以及最后一英里物流日益增长的重要性。随着电子商务活动的不断升级,对快速、经济高效且自动化的配送系统的需求变得至关重要。货运无人机已成为一种高效的替代方案,它能够以低营运成本提供快速服务,并且只需要极少的地面基础设施。它们能够支援短程航线和最后一哩配送,使其成为不断发展的物流生态系统中的关键组成部分。通用对接和充电系统的引入正在简化无人机操作并增强跨平台相容性。主要行业组织为引入统一标准所做的努力,进一步为无人机在商业物流中的更广泛应用和简化部署铺平了道路。

多旋翼无人机市场凭藉其垂直起降能力和城市运作的灵活性,到2034年将创造164亿美元的市场价值。这些无人机尤其适合人口密集的城市环境,因为在这种环境中,精准度、机动性和最小空间占用至关重要。为了提高市场渗透率,製造商正致力于透过改进电池技术和减轻无人机重量来优化飞行时间并提高有效载荷能力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 386亿美元 |

| 复合年增长率 | 40% |

2024年,有效载荷低于5公斤的无人机市场占据了48.9%的市场。小包裹配送需求的不断增长,尤其是在医疗保健和线上零售领域,正推动这一细分市场的发展。儘管存在监管障碍,且需要更先进的推进系统,但高性能紧凑型无人机的需求仍然强劲。该领域的公司正优先开发可靠、灵活的无人机,以满足人们对更快、更有效率的最后一哩服务的期望。

预计2025年至2034年,加拿大货运无人机市场将以38.1%的复合年增长率成长。政府致力于克服偏远和偏远地区物流限制的项目,对这一成长做出了重大贡献。随着优惠政策和试点计画的不断推出,无人机在「最后一哩路」供应链、资源配送和医疗物流的应用日益广泛,并日益受到关注。

影响全球货运无人机市场的关键公司包括 Elroy Air、Sabrewing Aircraft Company、Natilus、Silent Arrow 和 Dronamics。货运无人机市场的领导企业正在采取多种策略方法来巩固其市场地位。许多企业正在大力投资研发,以提高无人机的有效载荷能力、增加飞行续航时间并透过先进材料减轻重量。企业正在利用与物流公司和政府机构的合作与伙伴关係来加速实际部署和监管审批。企业还专注于建立无人机基础设施网路并整合 AI 以优化路线规划。此外,一些企业正在寻求航空当局的认证,以建立信任并扩大营运范围。策略性地理扩张,特别是向偏远和服务欠缺地区扩张,以及对可扩展 DNaaS 平台的投资,正在成为获取长期价值和确保持续成长的关键倡议。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 无人机网路即服务(DNaaS)模式的出现

- 电子商务和最后一英里物流的扩张

- 支持性监管发展和无人机政策

- 无人物流的军事与国防应用

- 需要改善偏远和难以到达地区的交通

- 产业陷阱与挑战

- 监管不确定性和空域限制

- 有限的有效载荷能力和航程

- 市场机会

- 偏远地区物流需求不断成长

- 与智慧城市和城市空中交通计画的整合

- 人工智慧和 BVLOS 操作自主性的进步

- 在离岸和工业供应链中的应用

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 重点国防现代化项目

- 预算预测(2025-2034)

- 对产业成长的影响

- 各国国防预算

- 供应链弹性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 合併、收购和策略伙伴关係格局

- 风险评估与管理

- 主要合约授予(2021-2024)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按无人机类型,2021 - 2034 年

- 主要趋势

- 固定翼无人机

- 多旋翼无人机

- 混合无人机

第六章:市场估计与预测:按有效载荷容量,2021 - 2034 年

- 主要趋势

- 少于5公斤

- 5公斤至20公斤

- 20公斤至50公斤

- 50公斤以上

第七章:市场估计与预测:按范围,2021 - 2034 年

- 主要趋势

- 近距离(50公里以内)

- 短程(50-149公里)

- 中程(150-650公里)

- 长距离(超过650公里)

第八章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 自主无人机

- 遥控无人机

第九章:市场估计与预测:依最终用途应用,2021 - 2034

- 主要趋势

- 医疗保健和紧急服务

- 医疗物资配送

- 血液和器官运输

- 紧急应变和救灾

- 其他的

- 零售与电子商务

- 最后一哩配送

- 枢纽间货物运输

- 仓库转移作业

- 其他的

- 国防和安全

- 野外补给

- 边境巡逻后勤

- 灾害疏散支援

- 其他的

- 农业

- 基础设施和建筑

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 全球关键参与者

- Natilus

- DRONAMICS

- Sabrewing Aircraft Company

- Elroy Air

- Silent Arrow

- 区域关键参与者

- 北美洲

- DroneUp

- Flirtey

- UPS Flight Forward

- Zipline International

- 欧洲

- Wingcopter

- Manna Aero

- FlyingBasket

- 亚太地区

- Chengdu JOUAV Automation Tech

- SZ DJI Technology

- Throttle Aerospace Systems

- 北美洲

- 利基市场参与者/颠覆者

- Skye Air Mobility

- H3 Dynamics Holdings

- Matternet

- Wing Aviation

- UAVOS

The Global Cargo Drones Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 40% to reach USD 38.6 billion by 2034. This growth is largely driven by the increasing adoption of drone-network-as-a-service (DNaaS) models, a booming e-commerce industry, and the growing importance of last-mile logistics. As e-commerce activities escalate, the need for fast, cost-effective, and automated delivery systems becomes essential. Cargo drones have emerged as an efficient alternative, offering fast service with low operating costs and requiring minimal ground-based infrastructure. Their ability to support short-haul routes and last-mile delivery positions them as a crucial component in the evolving logistics ecosystem. The introduction of universal docking and charging systems is streamlining drone operations and enhancing cross-platform compatibility. Efforts from key industry groups to introduce unified standards are further paving the way for wider-scale adoption and streamlined deployment in commercial logistics.

The multirotor drones segment will generate USD 16.4 billion by 2034 due to their vertical takeoff and landing capabilities and agility in urban operations. These drones are particularly well-suited for dense city environments where precision, maneuverability, and minimal space usage are vital. To increase market penetration, manufacturers are focusing on optimizing flight duration and enhancing payload capacity by advancing battery technologies and minimizing drone weight.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $38.6 Billion |

| CAGR | 40% |

In 2024, the less than 5 kg payload segment held 48.9% share. The growing demand for small parcel deliveries, especially in healthcare and online retail sectors, is fueling the momentum of this segment. Despite regulatory hurdles and the need for more sophisticated propulsion systems, compact drones delivering high performance are in demand. Companies in this space are prioritizing the development of reliable and agile drones to meet expectations for faster and more efficient last-mile services.

Canada Cargo Drones Market is expected to grow at a 38.1% CAGR from 2025 to 2034. Government programs focused on overcoming logistical limitations in isolated and hard-to-reach regions are contributing significantly to this growth. The increasing use of drones in last-mile supply chains, resource distribution, and medical logistics is gaining traction as favorable policies and pilot initiatives continue to roll out.

Key companies shaping the Global Cargo Drones Market include Elroy Air, Sabrewing Aircraft Company, Natilus, Silent Arrow, and Dronamics. Leading players in the cargo drones market are adopting several strategic approaches to solidify their market position. Many are investing heavily in R&D to enhance drone payload capacity, increase flight endurance, and reduce weight through advanced materials. Collaborations and partnerships with logistics firms and government agencies are being leveraged to accelerate real-world deployment and regulatory approvals. Companies are also focusing on establishing drone infrastructure networks and integrating AI for optimized route planning. Additionally, several players are pursuing certification from aviation authorities to build trust and expand operational range. Strategic geographic expansion, particularly into remote and underserved areas, and investment in scalable DNaaS platforms are becoming key moves to capture long-term value and ensure consistent growth.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Drone type trends

- 2.2.2 Payload capacity trends

- 2.2.3 Range trends

- 2.2.4 Technology trends

- 2.2.5 End use application trends

- 2.2.6 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Emergence of drone-network-as-a-service (DNaaS) models

- 3.2.1.2 Expansion of e-commerce and last-mile logistics

- 3.2.1.3 Supportive regulatory developments and UAV policies

- 3.2.1.4 Military and defense applications for unmanned logistics

- 3.2.1.5 Need for improved access in remote and hard-to-reach areas

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory uncertainty and airspace restrictions

- 3.2.2.2 Limited payload capacity and range

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for remote area logistics

- 3.2.3.2 Integration with smart city and urban air mobility programs

- 3.2.3.3 Advancements in AI and autonomy for BVLOS operations

- 3.2.3.4 Application in offshore and industrial supply chains

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Drone Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fixed-wing drones

- 5.3 Multirotor drones

- 5.4 Hybrid drones

Chapter 6 Market Estimates and Forecast, By Payload Capacity, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Less than 5 kg

- 6.3 5 kg to 20 kg

- 6.4 20 kg to 50 kg

- 6.5 Above 50 kg

Chapter 7 Market Estimates and Forecast, By Range, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Close-range (under 50 km)

- 7.3 Short-range (50-149 km)

- 7.4 Mid-range (150-650 km)

- 7.5 Long range (more than 650 km)

Chapter 8 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Autonomous drones

- 8.3 Remote-controlled drones

Chapter 9 Market Estimates and Forecast, By End Use Application, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Healthcare and emergency services

- 9.2.1 Medical supply delivery

- 9.2.2 Blood and organ transport

- 9.2.3 Emergency response and disaster relief

- 9.2.4 Others

- 9.3 Retail and e-commerce

- 9.3.1 Last-mile delivery

- 9.3.2 Inter-hub cargo transport

- 9.3.3 Warehouse transfer operations

- 9.3.4 Others

- 9.4 Defense and security

- 9.4.1 Field resupply

- 9.4.2 Border patrol logistics

- 9.4.3 Disaster evacuation support

- 9.4.4 Others

- 9.5 Agriculture

- 9.6 Infrastructure and construction

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Natilus

- 11.1.2 DRONAMICS

- 11.1.3 Sabrewing Aircraft Company

- 11.1.4 Elroy Air

- 11.1.5 Silent Arrow

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 DroneUp

- 11.2.1.2 Flirtey

- 11.2.1.3 UPS Flight Forward

- 11.2.1.4 Zipline International

- 11.2.2 Europe

- 11.2.2.1 Wingcopter

- 11.2.2.2 Manna Aero

- 11.2.2.3 FlyingBasket

- 11.2.3 APAC

- 11.2.3.1 Chengdu JOUAV Automation Tech

- 11.2.3.2 SZ DJI Technology

- 11.2.3.3 Throttle Aerospace Systems

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 Skye Air Mobility

- 11.3.2 H3 Dynamics Holdings

- 11.3.3 Matternet

- 11.3.4 Wing Aviation

- 11.3.5 UAVOS