|

市场调查报告书

商品编码

1716487

一次性盘子市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Disposable Plates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

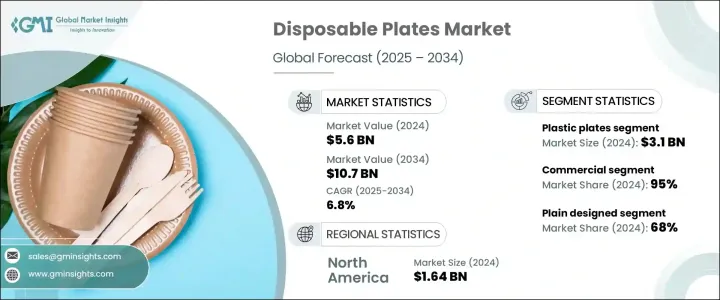

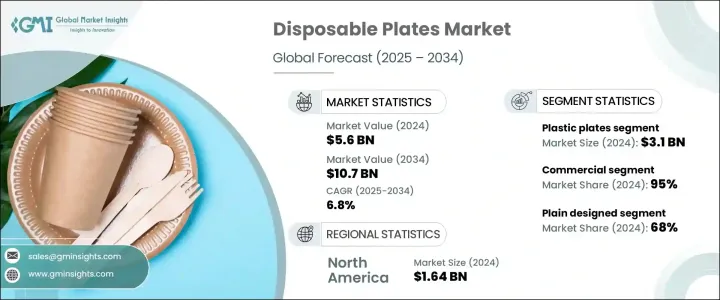

2024 年全球一次性盘子市场规模达到 56 亿美元,预计 2025 年至 2034 年的复合年增长率为 6.8%。市场成长主要受到向永续生活方式转变的日益增加以及对传统餐具环保替代品的需求不断增长的推动。随着消费者环保意识的增强,人们明显偏好由可生物降解、可堆肥和可回收材料製成的一次性盘子。人们越来越关注减少碳足迹和减少一次性塑胶垃圾,这是影响该市场发展轨蹟的关键驱动因素。此外,食品配送服务、餐饮业务和快餐店的激增也增加了对便利性和永续餐饮解决方案的需求。

随着越来越多的消费者优先考虑符合永续性和道德采购的产品,製造商正在透过开发由甘蔗渣、竹子、棕榈叶和玉米淀粉基材料等可再生资源製成的盘子。这些环保盘子提供了实用的替代品,同时又不影响耐用性和美观性。此外,政府日益加强的旨在遏制塑胶垃圾和鼓励绿色包装实践的法规为市场参与者创造了新的机会。大型活动、公司聚会和公共场所越来越多地采用环保餐盘,这反映出更广泛的文化转向,即人们越来越重视环境责任。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 56亿美元 |

| 预测值 | 107亿美元 |

| 复合年增长率 | 6.8% |

市场按产品类型细分,包括塑胶、铝、纸和其他材料,预计纸盘在 2025 年至 2034 年期间的复合年增长率为 7.3%。纸盘因其可生物降解、易于处理以及与多种食品的兼容性而广受欢迎。消费者越来越远离塑胶盘子,因为塑胶盘子因其对环境的不利影响而受到严格审查。该行业正在迅速转向创新的可生物降解替代品,包括由植物性塑胶和生物涂层材料製成的产品,这些产品模仿塑胶的特性,但会自然分解而不会留下有毒残留物。因此,纸盘逐渐成为追求实用和环保解决方案的消费者和企业的首选。

根据最终用途,一次性盘子市场分为住宅和商业领域,其中商业应用占 2024 年总份额的 95%。商业领域包括食品服务提供者、餐饮公司和饮料中心,由于其便利性和成本效益,对一次性盘子的需求持续高涨。越来越多的餐厅开始采用棕榈叶盘子,因为棕榈叶盘子坚固耐用、外观优雅,而且可以盛装冷热食物,不会洩漏或破损。采用这种永续的选择也能让企业吸引有环保意识的顾客,进而提高他们的品牌声誉。

美国一次性盘子市场占据全球主导地位,占有 76% 的份额,2024 年创造的价值为 16.4 亿美元。美国市场受益于对环境永续性的大力推动以及消费者对环保产品的明显转变。随着人们忙碌生活节奏的加快,以及外带餐饮的流行,国内对一次性盘子的需求不断增加。随着消费者优先考虑便利性和环境影响,一次性盘子等一次性产品继续提供符合现代快节奏生活的实用解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 增强环保意识

- 消费者对环保产品的需求

- 产业陷阱与挑战

- 转向可重复使用的替代品

- 来自传统塑胶的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 塑胶盘子

- 铝板

- 纸磁碟

- 其他(树叶盘、麦秸盘等)

第六章:市场估计与预测:依设计,2021-2034

- 主要趋势

- 隔间

- 清楚的

第七章:市场估计与预测:按价格,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅

- 商业的

- 食品和饮料

- 饭店和咖啡馆

- 接待和活动

- 其他(快餐店等)

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 在线的

- 公司网站

- 电子商务

- 离线

- 超市/大卖场

- 专卖店

- 其他(食品服务供应商等)

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- D&W Fine Pack

- Dart Container Corporation

- Dopla

- Duni

- Fast Plast

- Genpak

- Georgia-Pacific

- Hotpack Group

- Huhtamaki

- International Paper

- Pactiv

- Polar Plastic

- Poppies Europe

- Seow Khim Polythelene

- Vegware

The Global Disposable Plates Market reached USD 5.6 billion in 2024 and is projected to expand at a CAGR of 6.8% from 2025 to 2034. The market growth is largely fueled by the rising shift toward sustainable living and the increasing demand for eco-friendly alternatives to traditional tableware. With growing environmental awareness among consumers, there is a notable preference for disposable plates made from biodegradable, compostable, and recycled materials. The expanding focus on reducing carbon footprints and minimizing single-use plastic waste has been a key driver shaping this market's trajectory. Additionally, the surge in food delivery services, catering businesses, and quick-service restaurants has amplified the need for convenient and sustainable dining solutions.

As more consumers prioritize products aligned with sustainability and ethical sourcing, manufacturers are responding by developing plates from renewable resources such as sugarcane bagasse, bamboo, palm leaves, and cornstarch-based materials. These eco-friendly plates offer a practical alternative without compromising on durability and aesthetics. Furthermore, increasing governmental regulations aimed at curbing plastic waste and encouraging green packaging practices are creating new opportunities for market players. The rising adoption of eco-friendly plates at large-scale events, corporate gatherings, and public venues reflects a broader cultural shift toward environmental responsibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.6 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 6.8% |

The market is segmented by product type, including plastic, aluminum, paper, and other materials, with paper plates expected to witness a 7.3% CAGR from 2025 to 2034. Paper plates are gaining massive popularity due to their biodegradable nature, ease of disposal, and compatibility with a wide range of food products. Consumers are increasingly steering away from plastic plates, which are under heavy scrutiny for their adverse environmental impact. The industry is seeing a rapid shift toward innovative biodegradable alternatives, including products made from plant-based plastics and bio-coated materials that mimic the properties of plastic but break down naturally without leaving toxic residues. As a result, paper plates are emerging as the preferred choice for both consumers and businesses aiming for practical and eco-conscious solutions.

Based on end-use, the disposable plates market is classified into residential and commercial sectors, with commercial applications accounting for 95% of the overall share in 2024. The commercial segment, which includes food service providers, catering companies, and beverage centers, continues to drive high demand for disposable plates due to their convenience and cost-effectiveness. Increasingly, these establishments are adopting palm leaf plates, drawn to their sturdiness, elegant appearance, and ability to hold both hot and cold foods without leakage or breakage. The use of such sustainable options also allows businesses to appeal to environmentally aware customers, thereby enhancing their brand reputation.

U.S. Disposable Plates Market dominated the global landscape with a 76% share, generating USD 1.64 billion in 2024. The U.S. market benefits from a strong push toward environmental sustainability and a marked consumer shift toward eco-friendly products. The increasing pace of on-the-go lifestyles, along with the popularity of takeout meals and beverages, has significantly contributed to the rising demand for disposable plates in the country. With consumers prioritizing convenience and environmental impact, single-use products such as disposable plates continue to offer practical solutions that align with modern, fast-paced living.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Increased environmental awareness

- 3.5.1.2 Consumer demand for eco-friendly products

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Shift toward reusable alternatives

- 3.5.2.2 Competition from traditional plastics

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Plastic plates

- 5.3 Aluminum plates

- 5.4 Paper plates

- 5.5 Others (leaf plates, wheat straw plates etc.)

Chapter 6 Market Estimates & Forecast, By Design, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Compartmental

- 6.3 Plain

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Food & beverage

- 8.3.2 Hotels and cafes

- 8.3.3 Hospitality and events

- 8.3.4 Others (quick-service restaurants etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 Company websites

- 9.2.2 E-commerce

- 9.3 Offline

- 9.3.1 Supermarkets/hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Others (foodservice suppliers etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 D&W Fine Pack

- 11.2 Dart Container Corporation

- 11.3 Dopla

- 11.4 Duni

- 11.5 Fast Plast

- 11.6 Genpak

- 11.7 Georgia-Pacific

- 11.8 Hotpack Group

- 11.9 Huhtamaki

- 11.10 International Paper

- 11.11 Pactiv

- 11.12 Polar Plastic

- 11.13 Poppies Europe

- 11.14 Seow Khim Polythelene

- 11.15 Vegware