|

市场调查报告书

商品编码

1716498

素食蛋白粉市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vegan Protein Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

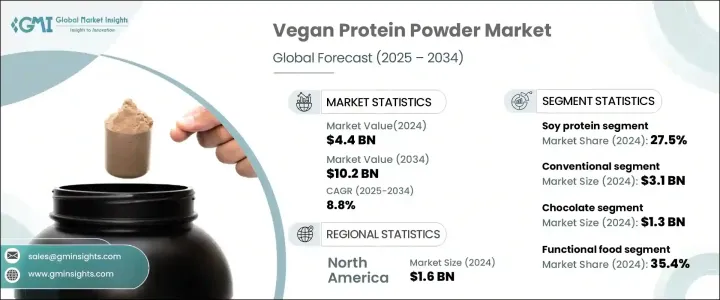

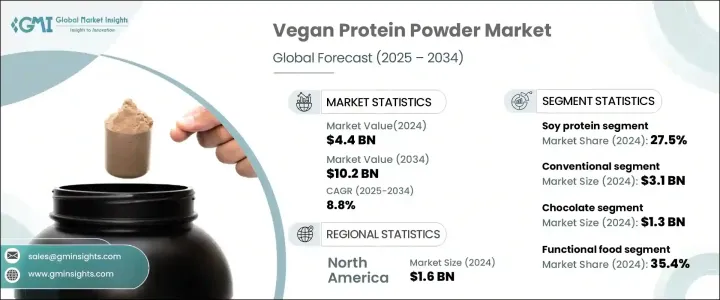

2024 年全球纯素蛋白粉市场规模达 44 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 8.8%。这一强劲增长得益于人们对植物蛋白替代品的日益偏好,尤其是运动员、注重健康的个人以及坚持纯素或素食饮食的人。随着消费者养成更道德和可持续的饮食习惯,对非动物蛋白质来源的需求激增。此外,人们对环境永续性和传统畜牧业不利影响的日益担忧促使消费者探索符合其价值观的替代蛋白质来源。素食蛋白粉市场的公司正在利用这一趋势,提供具有增强氨基酸成分、改善消化率和额外健康益处的创新产品,以满足更广泛的受众的需求。

健身文化的兴起以及人们对植物性蛋白质的健康优势的认识不断提高,进一步促进了市场的发展。植物蛋白粉通常添加必需的维生素和矿物质,吸引了追求更健康生活方式的消费者。随着对功能性食品的需求不断增长,製造商越来越注重生产不仅能满足营养需求而且还能提供肌肉恢復、体重管理和增强免疫力等益处的蛋白粉。这项持续的创新持续吸引多样化的消费者群体,从健身爱好者和职业运动员到只想改善整体健康的个人。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 44亿美元 |

| 预测值 | 102亿美元 |

| 复合年增长率 | 8.8% |

市场按蛋白质来源分类,包括豌豆、大豆、大米、大麻和其他品种。占据相当大市场份额的大豆浓缩蛋白预计到 2034 年将以 9.7% 的复合年增长率增长。它之所以广受欢迎,是因为其卓越的氨基酸组成、优异的溶解性和价格实惠,使其成为运动营养和功能性食品的理想选择。此外,大豆浓缩蛋白的多功能性和易得性增强了它的主导地位,使其成为素食蛋白粉产业成长的关键驱动力。

从性质上讲,市场分为有机和传统类别。传统领域在 2024 年创造了 31 亿美元的收入,预计到 2034 年将以 8.4% 的复合年增长率成长。传统纯素蛋白粉因其价格实惠且广泛可用,仍然是首选。製造商青睐传统蛋白质来源,因为它们的生产成本较低且功能含量高。这些产品在主流食品和饮料应用中占有重要地位,并得到强大的零售网路的支持,推动市场持续扩张。

2024 年,北美占了纯素蛋白粉市场的 16 亿美元,预计到 2034 年将以 3.6% 的复合年增长率成长。该地区对植物性营养的强劲需求,加上成熟的健康和保健产业,使其成为全球最大的市场。加拿大对有机和清洁标籤产品的日益青睐,加上政府支持植物性产业的倡议,大大促进了该地区在市场上的领导地位。素食主义、健身文化和功能性食品需求的兴起进一步加强了北美在素食蛋白粉市场的主导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 由于纯素食人口不断增长,对植物性食品和饮料的需求不断增加,推动了市场成长

- 对高蛋白功能性食品和健康产品的需求不断增加

- 运动营养市场不断成长

- 产业陷阱与挑战

- 生产成本高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 大麻蛋白

- 大豆分离蛋白

- 大豆浓缩蛋白

- 米分离蛋白

- 米浓缩蛋白

- 豌豆分离蛋白

- 豌豆蛋白浓缩物

- 螺旋藻蛋白

- 藜麦蛋白

- 蛋白质混合物

第六章:市场规模及预测:依性质,2021 - 2034

- 主要趋势

- 有机的

- 传统的

第七章:市场规模及预测:依口味,2021 - 2034

- 主要趋势

- 无味

- 巧克力

- 香草

- 草莓

- 其他

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 运动营养

- 饮料

- 功能性食品

- 其他的

第九章:市场规模及预测:按配销通路,2021 - 2034

- 主要趋势

- 大型超市和超市

- 专卖店

- 网路零售

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Archer-Daniels-Midland Company

- AMCO Proteins

- Bunge Global SA

- Cargill, Incorporated

- Garden Of Life

- Glanbia plc

- Ingredion Incorporated

- Now Foods

- Orgain

- PlantFusion

- Vitaco Health Group

- Wilmar International Limited

The Global Vegan Protein Powder Market reached USD 4.4 billion in 2024 and is projected to grow at a CAGR of 8.8% between 2025 and 2034. This robust growth is fueled by the increasing preference for plant-based protein alternatives, especially among athletes, health-conscious individuals, and those adhering to vegan or vegetarian diets. As consumers embrace more ethical and sustainable eating habits, the demand for non-animal-based protein sources has skyrocketed. Additionally, growing concerns about environmental sustainability and the adverse effects of traditional livestock farming have pushed consumers to explore alternative protein sources that align with their values. Companies in the vegan protein powder market are capitalizing on this trend by offering innovative products with enhanced amino acid profiles, improved digestibility, and additional health benefits, catering to a broader audience.

The rise of fitness culture and the growing awareness of the health advantages associated with plant-based proteins have further bolstered the market. Plant-based protein powders, often fortified with essential vitamins and minerals, appeal to consumers seeking healthier lifestyles. As the demand for functional foods grows, manufacturers are increasingly focusing on creating protein powders that not only meet nutritional requirements but also provide benefits such as muscle recovery, weight management, and enhanced immunity. This ongoing innovation continues to attract a diverse consumer base, ranging from fitness enthusiasts and professional athletes to individuals simply looking to improve their overall well-being.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $10.2 Billion |

| CAGR | 8.8% |

The market is categorized by the source of protein, including pea, soy, rice, hemp, and other varieties. Soy protein concentrate, which holds a substantial share of the market, is expected to grow at a CAGR of 9.7% by 2034. Its widespread popularity is due to its superior amino acid profile, excellent solubility, and affordability, making it an ideal choice for sports nutrition and functional foods. Additionally, soy protein concentrate's versatility and accessibility enhance its dominance, positioning it as a pivotal driver of growth in the vegan protein powder industry.

In terms of nature, the market is segmented into organic and conventional categories. The conventional segment generated USD 3.1 billion in 2024 and is projected to grow at a CAGR of 8.4% through 2034. Conventional vegan protein powders remain the preferred choice due to their affordability and widespread availability. Manufacturers favor conventional protein sources because of their lower production costs and high functional content. These products enjoy a strong presence in mainstream food and beverage applications, supported by robust retail networks that drive continued market expansion.

North America accounted for USD 1.6 billion of the vegan protein powder market in 2024 and is expected to grow at a CAGR of 3.6% by 2034. The region's strong demand for plant-based nutrition, coupled with a well-established health and wellness sector, has made it the largest market globally. Canada's growing preference for organic and clean-label products, along with government initiatives supporting plant-based industries, contributes significantly to the region's leadership in the market. The rise in veganism, fitness culture, and the demand for functional foods further strengthens North America's dominant position in the vegan protein powder market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for plant-based food & beverages due to growing vegan population is driving market growth

- 3.6.1.2 Increasing demand for functional food and healthy products with high protein content

- 3.6.1.3 Growing market for sports nutrition

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Hemp protein

- 5.3 Soy protein isolate

- 5.4 Soy protein concentrate

- 5.5 Rice protein isolate

- 5.6 Rice protein concentrate

- 5.7 Pea protein isolate

- 5.8 Pea protein concentrate

- 5.9 Spirulina protein

- 5.10 Quinoa protein

- 5.11 Protein blends

Chapter 6 Market Size and Forecast, By Nature, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Conventional

Chapter 7 Market Size and Forecast, By Flavor, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Unflavoured

- 7.3 Chocolate

- 7.4 Vanilla

- 7.5 Strawberry

- 7.6 Other

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Sports nutrition

- 8.3 Beverages

- 8.4 Functional food

- 8.5 Others

Chapter 9 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 Hypermarkets & supermarkets

- 9.3 Specialty stores

- 9.4 Online retail

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Archer-Daniels-Midland Company

- 11.2 AMCO Proteins

- 11.3 Bunge Global SA

- 11.4 Cargill, Incorporated

- 11.5 Garden Of Life

- 11.6 Glanbia plc

- 11.7 Ingredion Incorporated

- 11.8 Now Foods

- 11.9 Orgain

- 11.10 PlantFusion

- 11.11 Vitaco Health Group

- 11.12 Wilmar International Limited