|

市场调查报告书

商品编码

1716512

指甲护理产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Nail Care Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

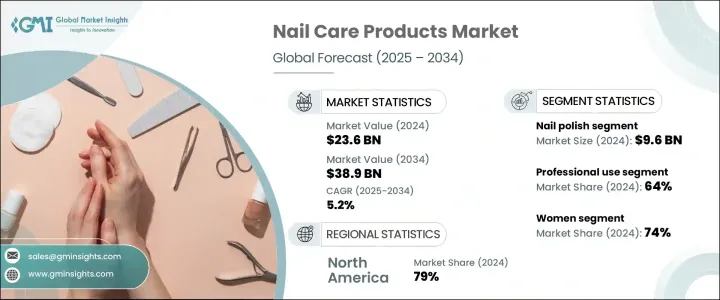

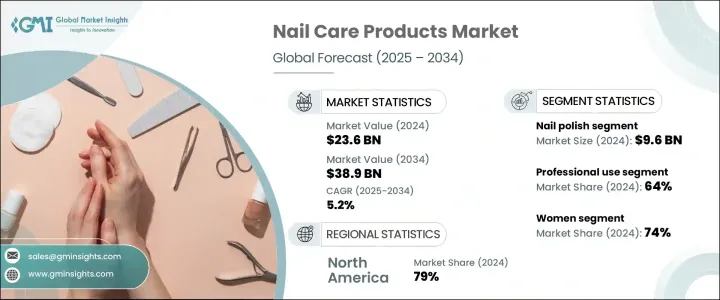

2024 年全球指甲护理产品市场规模达到 236 亿美元,预计 2025 年至 2034 年期间的复合年增长率将达到 5.2%。个人护理需求的不断增长,加上对自我照顾和美容习惯的日益关注,推动着这一成长轨迹。消费者越来越注重外观和指甲健康,将指甲护理变成日常美容的重要组成部分。随着社群媒体趋势的发展,指甲护理产品变得越来越创新,迎合了追求独特和富有表现力设计的时尚前卫人士的需求。

市场也正向天然、无毒和环保配方转变,各大品牌推出不含刺激性化学物质的产品,使其更安全,并吸引更广泛的客户群。此外,年轻一代,尤其是 Z 世代和千禧世代,透过追随指甲彩绘影响者和采用流行的美甲设计来推动需求,从而塑造新的购买行为。社交活动频率的增加、职业女性人口的增长以及对外表保养的关注使得指甲护理产品市场持续保持活跃。此外,随着家庭专业级套装的普及,DIY 指甲护理解决方案的日益普及,进一步扩大了不同人群的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 236亿美元 |

| 预测值 | 389亿美元 |

| 复合年增长率 | 5.2% |

指甲护理产品市场分为不同的产品类别,包括指甲油、指甲护理产品、去除剂、人造指甲和延长指甲。其中,指甲油仍是领先的细分市场,2024 年市场规模达 96 亿美元。随着潮流转向精緻大胆的指甲彩绘,各种色调和饰面的指甲油在销售排行榜上名列前茅。另一方面,由于消费者强调指甲的强度、保湿和生长,预计 2025 年至 2034 年期间指甲护理的复合年增长率将达到 5.3%。精緻指甲彩绘的流行趋势日益明显,融合了从简约设计到复杂的 3D 图案等各种元素,也促进了市场扩张。随着消费者寻求更安全的美容替代品,可生物降解和纯素指甲油正在占据一席之地,各大品牌透过提供注入天然成分和环保包装的产品来优先考虑永续性。

从最终用户角度分析市场,专业用途市场在 2024 年将占据 64% 的份额,这归因于对提供客製化设计和优质护理的指甲彩绘服务的需求旺盛。然而,随着家用指甲护理套装的流行,市场正在迅速转变,为消费者提供了一种方便且经济实惠的美容沙龙替代方案。这些 DIY 套装配有指甲刀、抛光器、UV/LED 灯和凝胶抛光剂,让人们可以在家中实现沙龙般的美甲效果,使指甲护理比以往任何时候都更容易实现。

美国指甲护理产品市场占据主导地位,占有 79% 的份额,2024 年的产值达 56 亿美元。职业女性数量的不断增长,加上人们强烈倾向于在家中进行护理,推动了这个市场的成长。随着消费者寻求节省时间和金钱的方法,DIY 美甲套装正在成为家庭必需品。此外,Instagram 和 TikTok 等社群媒体平台在推广创意指甲彩绘潮流方面发挥关键作用,激励数百万人尝试新的外观和风格,从而提升了全国对创新指甲护理产品的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 供应商格局

- 技术格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 人们对个人美容和自我照顾的兴趣日益浓厚

- 对天然产品的需求不断增长

- 产业陷阱与挑战

- 健康问题

- 竞争激烈,价格敏感

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 指甲油

- 普通指甲油

- 凝胶指甲油

- 聚凝胶

- 浸粉

- 其他(增色凝胶、硬凝胶指甲油等)

- 指甲护理

- 指甲强化剂

- 角质层油和霜

- 指甲生长治疗

- 其他(指甲修復治疗等)

- 指甲油去除剂

- 丙酮类去除剂

- 非丙酮去除剂

- 其他(大豆类指甲油去除剂、凝胶指甲油去除剂等)

- 人造指甲和接髮

- 水晶指甲

- 按压式指甲

- 其他(丝绸包巾、指甲贴等)

- 其他(指甲彩绘产品、美甲配件等)

第六章:市场估计与预测:依消费者群体,2021-2034 年

- 主要趋势

- 男士

- 女性

第七章:市场估计与预测:按价格,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 个人使用

- 专业用途

- 美甲沙龙

- 美容专业人士

- 水疗服务

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市

- 专卖店

- 其他(百货商场等)

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Avon

- Colorbar Cosmetics

- Coty

- Cover Girl

- Cutex

- Essie

- Estee Lauder

- Gelish

- Kinetics Nail Systems

- L'Oreal

- OPI

- Revlon

- Sally Hansen

- Shiseido

- Unilever

The Global Nail Care Products Market reached USD 23.6 billion in 2024 and is projected to expand at a CAGR of 5.2% between 2025 and 2034. The rising demand for personal grooming, coupled with an increasing focus on self-care and beauty routines, is driving this growth trajectory. Consumers are becoming more conscious about appearance and nail health, turning nail care into an essential part of daily grooming. As social media trends evolve, nail care products are becoming more innovative, catering to fashion-forward individuals looking for unique and expressive designs.

The market is also seeing a major shift toward natural, non-toxic, and eco-friendly formulations, with brands introducing products free from harsh chemicals, making them safer and appealing to a wider customer base. Moreover, the younger generation, especially Gen Z and millennials, are fueling demand by following nail art influencers and adopting trendy nail designs, thereby shaping new purchase behaviors. The increasing frequency of social events, growing working women population, and focus on well-maintained appearances continue to keep the nail care products market vibrant. Besides, the rising popularity of DIY nail care solutions, supported by the growing accessibility of professional-grade kits for home use, is further amplifying demand across various demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.6 Billion |

| Forecast Value | $38.9 Billion |

| CAGR | 5.2% |

The nail care products market is segmented into diverse product categories, including nail polish, nail care treatments, removers, artificial nails, and extensions. Among these, nail polish remains the leading segment, generating USD 9.6 billion in 2024. With trends shifting toward sophisticated and bold nail art, nail polishes in an array of shades and finishes are topping the sales charts. On the other hand, nail care treatments are expected to grow at a CAGR of 5.3% between 2025 and 2034, as consumers emphasize nail strength, hydration, and growth. The rising trend of elaborate nail art, incorporating everything from minimalist designs to intricate 3D patterns, has also contributed to market expansion. As customers seek safer beauty alternatives, biodegradable and vegan nail polishes are carving a niche, with brands prioritizing sustainability by offering products infused with natural ingredients and eco-friendly packaging.

Analyzing the market by the end user, the professional use segment accounted for a 64% share in 2024, owing to the booming demand for salon-based nail art services that offer customized designs and premium treatments. However, the market is rapidly transforming as at-home nail care kits gain traction, offering consumers a convenient and affordable alternative to salon visits. These DIY kits, equipped with nail clippers, buffers, UV/LED lamps, and gel polishes, empower individuals to achieve salon-like manicures at home, making nail care more accessible than ever.

The U.S. nail care products market dominated with a 79% share and generated USD 5.6 billion in 2024. The growing number of working women, combined with a strong inclination toward at-home grooming routines, is fueling this market growth. As consumers look for ways to save time and money, DIY nail kits are emerging as a household essential. Additionally, social media platforms like Instagram and TikTok are playing a pivotal role in popularizing creative nail art trends, inspiring millions to experiment with new looks and styles, thereby elevating the demand for innovative nail care products across the country.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Surging interest in personal grooming and self-care

- 3.6.1.2 Rising demand for natural products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Health concerns

- 3.6.2.2 High competition and price sensitivity

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Nail polish

- 5.2.1 Regular nail polish

- 5.2.2 Gel nail polish

- 5.2.3 Polygel

- 5.2.4 Dip powder

- 5.2.5 Others (builder gel, hard gel nail polish etc.)

- 5.3 Nail care treatments

- 5.3.1 Nail strengtheners

- 5.3.2 Cuticle oils and creams

- 5.3.3 Nail growth treatments

- 5.3.4 Others (nail repair treatments, etc.)

- 5.4 Nail polish removers

- 5.4.1 Acetone-based removers

- 5.4.2 Non-acetone removers

- 5.4.3 Others (soy-based nail polish remover, gel nail polish remover etc.)

- 5.5 Artificial nails & extensions

- 5.5.1 Acrylic nails

- 5.5.2 Press-on nails

- 5.5.3 Others (silk wraps, nail tips etc.)

- 5.6 Others (nail art products, nail accessories etc.)

Chapter 6 Market Estimates & Forecast, By Consumer Group, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Men

- 6.3 Women

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Personal use

- 8.3 Professional use

- 8.3.1 Nail salons

- 8.3.2 Beauty professionals

- 8.3.3 Spa services

- 8.3.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Supermarkets

- 9.3.2 Specialty stores

- 9.3.3 Others (departmental stores, etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Avon

- 11.2 Colorbar Cosmetics

- 11.3 Coty

- 11.4 Cover Girl

- 11.5 Cutex

- 11.6 Essie

- 11.7 Estee Lauder

- 11.8 Gelish

- 11.9 Kinetics Nail Systems

- 11.10 L'Oreal

- 11.11 OPI

- 11.12 Revlon

- 11.13 Sally Hansen

- 11.14 Shiseido

- 11.15 Unilever