|

市场调查报告书

商品编码

1716515

4K 卫星广播市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测4K Satellite Broadcasting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

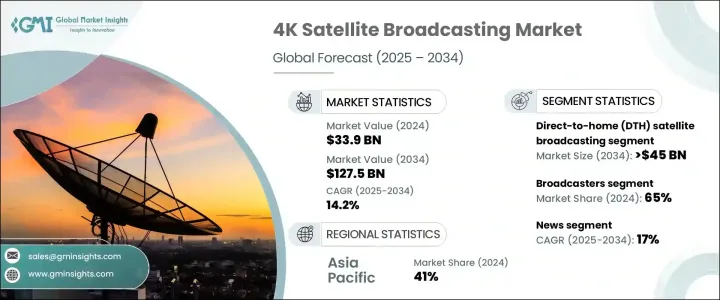

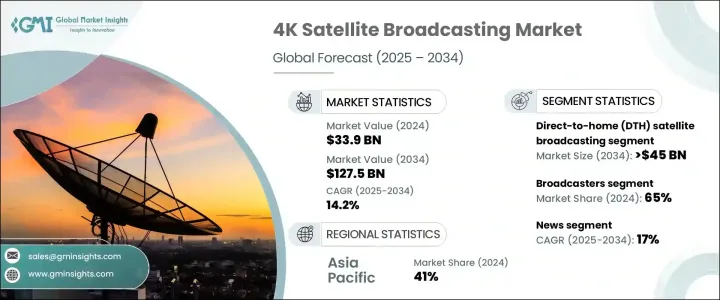

2024 年全球 4K 卫星广播市场价值为 339 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 14.2%。随着消费者寻求无与伦比的观看体验,对超高清 (UHD) 内容的需求不断增长,将继续推动 4K 卫星广播的广泛采用。随着显示技术的快速进步,4K解析度已经从奢侈品变成了必需品,为高品质内容消费树立了新的标准。增强的影像清晰度、更高的影格速率和卓越的细节使得 UHD 内容成为全球娱乐平台不可或缺的内容。随着电视萤幕尺寸不断扩大以及对高解析度视觉效果的需求不断增强,广播公司和卫星营运商正在扩大其 4K 产品以满足消费者的期望。

行业主要参与者正在利用技术创新来提高内容传输效率,确保跨各个平台的无缝超高清串流播放。此外,4K 智慧电视的普及率不断提高,以及卫星通讯技术的进步,正在推动全球采用 UHD 内容。受可支配收入增加和对优质内容需求不断增长的推动,新兴市场(尤其是亚太和拉丁美洲)的 4K 广播服务正在快速增长。政府和产业利益相关者正在积极投资卫星基础设施,以扩大超高清内容分发,进一步推动产业成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 339亿美元 |

| 预测值 | 1275亿美元 |

| 复合年增长率 | 14.2% |

随着越来越多的消费者选择 4K 机上盒来享受卓越的画质,直接到户 (DTH) 卫星广播领域将在 2024 年占据 40% 的市场份额。 DTH 广播即使在宽频存取有限的地区也能够提供不间断的 4K 内容,因此仍然是 UHD 内容传输的首选。主要服务提供者正在扩大其 DTH 产品范围以满足更广泛的受众,确保在国内和国际市场上无缝提供内容。新兴经济体越来越多地采用 4K DTH 服务,这巩固了该领域的主导地位,其中亚太地区、拉丁美洲和非洲在市场扩张方面处于领先地位。

根据服务提供者的数据,由于对国际体育赛事、电影大片和现场音乐会等优质 4K 内容的独家权利,广播公司部门在 2024 年占据了 65% 的主导份额。随着对高品质内容的需求激增,广播公司正在利用其市场影响力扩大 UHD 产品范围。消费者继续向领先的广播公司寻求身临其境的高解析度体验,进一步巩固了该领域在 4K 卫星广播领域的地位。随着越来越多的现场活动采用超高清串流媒体播放,广播公司正在增加对尖端传输技术的投资,以增强内容传递并保持观众的参与。

2024年,中国4K卫星广播市场规模将达53亿美元,成为全球超高画质内容生态系统的主导力量。受政府措施和智慧电视广泛普及的推动,中国对超高清内容的需求强劲,使其成为 4K 媒体消费的领先市场。随着越来越多的消费者接受超高清技术,中国在推动卫星广播扩张方面继续发挥关键作用。政府支持的倡议和消费者对高解析度内容日益增长的兴趣正在加速 4K 的普及,使中国成为全球 4K 内容分发和观看领域的重要参与者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 平台提供者

- 通路伙伴

- 分销商/物流

- 最终用途

- 利润率分析

- 供应商格局

- 技术与创新格局

- 专利分析

- 监管格局

- 价格趋势

- 成本明细

- 衝击力

- 成长动力

- 消费者对 4K 内容的需求不断增长

- 卫星系统的技术进步

- 内容创作者与卫星营运商之间的合作

- 政府措施和法规

- 现场体育赛事和活动日益流行

- 产业陷阱与挑战

- 生产和运输成本高

- 4K 内容有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按广播平台,2021-2034 年

- 主要趋势

- 直接到户(DTH)卫星广播

- 直播卫星(DBS)

- 有线电视头端

- 其他的

第六章:市场估计与预测:依内容,2021-2034

- 主要趋势

- 运动的

- 电影

- 讯息

- 音乐

- 其他的

第七章:市场估计与预测:按服务供应商,2021-2034 年

- 主要趋势

- 卫星营运商

- 广播公司

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅

- 商业的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Amazon Prime

- ARRIS International

- ATEME

- Canal+ Group

- Charter Communications

- Cisco Systems

- DirecTV

- DISH Network

- Ericsson Media Solutions

- Eutelsat Communications

- Globecast

- Harmonic

- Hispasat

- Intelsat

- Netflix

- SES

- Sky Group

- Telesat

- Verizon Communications

- Viasat

The Global 4K Satellite Broadcasting Market was valued at USD 33.9 billion in 2024 and is projected to grow at a CAGR of 14.2% between 2025 and 2034. The increasing demand for ultra-high-definition (UHD) content continues to drive the widespread adoption of 4K satellite broadcasting as consumers seek an unparalleled viewing experience. With the rapid advancements in display technologies, 4K resolution has transitioned from a luxury to a necessity, setting a new standard for high-quality content consumption. Enhanced picture clarity, higher frame rates, and superior details are making UHD content indispensable for entertainment platforms worldwide. As television screen sizes continue to expand and demand for high-resolution visuals intensifies, broadcasters and satellite operators are scaling up their 4K offerings to meet consumer expectations.

Major players in the industry are leveraging technological innovations to improve content transmission efficiency, ensuring seamless UHD streaming across various platforms. Furthermore, the rising penetration of 4K-enabled smart TVs, along with advancements in satellite communication technologies, is fueling the adoption of UHD content on a global scale. Emerging markets, particularly in Asia-Pacific and Latin America, are witnessing rapid growth in 4K broadcasting services, driven by increasing disposable incomes and a growing appetite for premium content. Governments and industry stakeholders are actively investing in satellite infrastructure to expand UHD content distribution, further propelling the industry's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $33.9 Billion |

| Forecast Value | $127.5 Billion |

| CAGR | 14.2% |

The direct-to-home (DTH) satellite broadcasting segment accounted for 40% of the market share in 2024, as more consumers opt for 4K-ready set-top boxes to enjoy superior picture quality. With its ability to deliver uninterrupted 4K content even in regions with limited broadband access, DTH broadcasting remains the preferred choice for UHD content delivery. Major service providers are expanding their DTH offerings to cater to a wider audience, ensuring seamless content availability across national and international markets. The increasing adoption of 4K-enabled DTH services in emerging economies is reinforcing the segment's dominance, with Asia-Pacific, Latin America, and Africa leading the way in market expansion.

Based on service providers, the broadcasters segment held a commanding 65% share in 2024, owing to exclusive rights over premium 4K content, including international sports events, blockbuster movies, and live concerts. As the demand for high-quality content surges, broadcasters are capitalizing on their market influence by expanding UHD offerings. Consumers continue to turn to leading broadcasters for immersive, high-resolution experiences, further solidifying the segment's role in the 4K satellite broadcasting landscape. With the growing number of live events being streamed in UHD, broadcasters are intensifying their investments in cutting-edge transmission technologies to enhance content delivery and retain viewer engagement.

China 4K satellite broadcasting market generated USD 5.3 billion in 2024, emerging as a dominant force in the global UHD content ecosystem. The country's strong demand for UHD content, bolstered by government initiatives and widespread adoption of smart TVs, positions it as a leading market for 4K media consumption. As more consumers embrace UHD technology, China continues to play a crucial role in driving satellite broadcasting expansion. Government-backed initiatives and increasing consumer interest in high-resolution content are accelerating 4K adoption, making China a key player in the global 4K content distribution and viewing sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Platform Providers

- 3.1.1.2 Channel Partners

- 3.1.1.3 Distributors/Logistics

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trends

- 3.6 Cost breakdown

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing consumer demand for 4K content

- 3.7.1.2 Technological advancements in satellite systems

- 3.7.1.3 Partnerships between content creators and satellite operators

- 3.7.1.4 Government initiatives and regulations

- 3.7.1.5 Increasing popularity of live sports & events

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High costs of production and transmission

- 3.7.2.2 Limited 4K content availability

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Broadcasting Platform, 2021-2034 ($Bn)

- 5.1 Key trends

- 5.2 Direct-to-Home (DTH) satellite broadcasting

- 5.3 Direct Broadcast Satellite (DBS)

- 5.4 Cable headend

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Content, 2021-2034 ($Bn)

- 6.1 Key trends

- 6.2 Sports

- 6.3 Movies

- 6.4 News

- 6.5 Music

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Service Provider, 2021-2034 ($Bn)

- 7.1 Key trends

- 7.2 Satellite operators

- 7.3 Broadcasters

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Amazon Prime

- 10.2 ARRIS International

- 10.3 ATEME

- 10.4 Canal+ Group

- 10.5 Charter Communications

- 10.6 Cisco Systems

- 10.7 DirecTV

- 10.8 DISH Network

- 10.9 Ericsson Media Solutions

- 10.10 Eutelsat Communications

- 10.11 Globecast

- 10.12 Harmonic

- 10.13 Hispasat

- 10.14 Intelsat

- 10.15 Netflix

- 10.16 SES

- 10.17 Sky Group

- 10.18 Telesat

- 10.19 Verizon Communications

- 10.20 Viasat