|

市场调查报告书

商品编码

1716517

林业及土地利用碳信用市场机会、成长动力、产业趋势分析及2025-2034年预测Forestry and Land Use Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

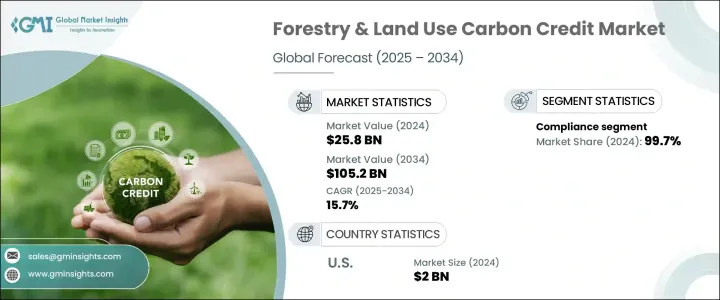

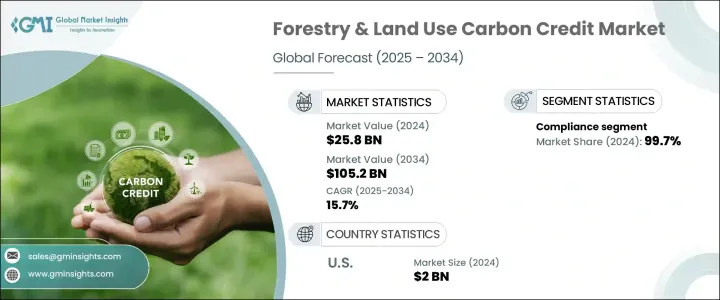

2024 年全球林业和土地利用碳信用市场价值为 258 亿美元,预计 2025 年至 2034 年期间将以 15.7% 的强劲复合年增长率扩张。这一显着增长是由全球对减缓气候变迁的关注度不断上升以及对碳信用作为减少温室气体排放的重要机制的日益认可所推动的。随着各行各业面临越来越大的与全球气候目标保持一致的压力,碳信用额在激励永续土地管理和保护实践方面正迅速变得不可或缺。世界各国政府、企业和环保组织都在采用碳信用来抵销排放并实现碳中和目标。随着利益相关者优先考虑有助于生物多样性保护、环境修復和长期碳封存的项目,公众意识的不断增强和投资者对基于自然的解决方案的兴趣进一步推动了这一需求。随着气候变迁缓解策略的动能增强,林业和土地利用碳信用市场将成为全球脱碳努力的核心支柱。

除此之外,越来越多的恢復湿地、泥炭地和红树林等关键生态系统的措施也推动了市场成长。这些生态系统在自然碳封存中发挥着至关重要的作用,可以长期捕获和储存大量的二氧化碳。因此,各组织正在积极探索专门针对保护和恢復这些景观的碳信用计划,从而提升对林业和土地使用碳信用服务的需求。各行各业也正在采用可持续的土地管理策略,以符合不断变化的环境法规并实现雄心勃勃的减排目标。抵销排放和遵守《巴黎协定》等国际框架的需求日益增长,促使企业投资于经过验证的透明碳信用计划,以促进环境和经济的永续发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 258亿美元 |

| 预测值 | 1052亿美元 |

| 复合年增长率 | 15.7% |

遥感、无人机、人工智慧 (AI)、机器学习、区块链和卫星影像等先进技术的融合正在彻底改变碳信用的监控和验证方式。这些创新简化了追踪减排的过程并确保了碳信用计画的完整性。碳捕获验证的准确性和效率的提高使得企业和土地所有者更容易参与这些市场,从而鼓励更广泛的采用并促进市场成长。随着数位技术的不断发展,预计它们将在增强透明度、降低验证成本和提高碳信用体系的整体可扩展性方面发挥关键作用。

林业和土地使用碳信用市场分为自愿信用和合规信用。 2024 年,合规碳信用部分将占据市场主导地位,占高达 99.7% 的份额。这些信用额是在政府机构或国际组织建立的严格监管框架下发放的,以确保行业遵守规定的减排目标。强而有力的政府支持加上有利的法规,继续推动合规领域发展,使各组织能够努力满足严格的环境标准。

2024 年,美国林业和土地使用碳信用市场创造了 20 亿美元的收入。这一增长主要得益于该国日益增长的工业活动、对碳排放上升的担忧加剧以及能源需求飙升。随着监管框架更加严格以及对永续性的关注度不断加强,随着企业努力履行国家和全球气候承诺,美国市场预计将保持上升趋势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模与预测:依类型,2021 年至 2034 年

- 主要趋势

- 自愿

- 遵守

第六章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第七章:公司简介

- 3Degrees

- ALLCOT

- Atmosfair

- CarbonClear

- Climate Impact Partners

- ClimeCo LLC.

- EcoAct

- Ecosecurities

- Green Mountain Energy Company

- PwC

- South Pole

- Sterling Planet Inc.

- TerraPass

- The Carbon Collective Company

- The Carbon Trust

- VERRA

- WGL Holdings, Inc.

The Global Forestry & Land Use Carbon Credit Market was valued at USD 25.8 billion in 2024 and is projected to expand at a robust CAGR of 15.7% between 2025 and 2034. This significant growth is driven by the surging global focus on climate change mitigation and the increasing recognition of carbon credits as a crucial mechanism for reducing greenhouse gas emissions. As industries across sectors face mounting pressure to align with global climate goals, carbon credits are quickly becoming indispensable in incentivizing sustainable land management and conservation practices. Governments, corporations, and environmental organizations worldwide are embracing carbon credits to offset emissions and achieve carbon neutrality targets. The demand is further fueled by growing public awareness and investor interest in nature-based solutions, as stakeholders prioritize projects that contribute to biodiversity conservation, environmental restoration, and long-term carbon sequestration. With climate change mitigation strategies gaining momentum, the forestry & land use carbon credit market is set to become a central pillar in global decarbonization efforts.

In addition to this, increasing initiatives to restore critical ecosystems such as wetlands, peatlands, and mangroves are also fueling market growth. These ecosystems play a vital role in natural carbon sequestration, capturing and storing vast amounts of carbon dioxide over extended periods. As a result, organizations are actively exploring carbon credit programs specifically aimed at preserving and rehabilitating these landscapes, thereby elevating the demand for forestry and land use carbon credit services. Industries are also adopting sustainable land management strategies to align with evolving environmental regulations and meet ambitious emission reduction goals. The rising need to offset emissions and comply with international frameworks like the Paris Agreement is prompting companies to invest in verified and transparent carbon credit programs that contribute to both environmental and economic sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.8 Billion |

| Forecast Value | $105.2 Billion |

| CAGR | 15.7% |

The integration of advanced technologies such as remote sensing, drones, artificial intelligence (AI), machine learning, blockchain, and satellite imagery is revolutionizing the way carbon credits are monitored and verified. These innovations are streamlining the process of tracking emissions reductions and ensuring the integrity of carbon credit programs. Enhanced accuracy and efficiency in carbon capture validation are making it easier for industries and landowners to participate in these markets, thereby encouraging wider adoption and boosting market growth. As digital technologies continue to evolve, they are expected to play a critical role in strengthening transparency, reducing verification costs, and improving the overall scalability of carbon credit systems.

The forestry & land use carbon credit market is segmented into voluntary and compliance credits. In 2024, the compliance carbon credits segment dominated the market, accounting for a massive 99.7% share. These credits are issued under strict regulatory frameworks established by government agencies or international organizations to ensure that industries comply with mandated emission reduction targets. Strong governmental backing, coupled with favorable regulations, continues to drive the compliance segment as organizations work toward meeting stringent environmental standards.

United States Forestry & Land Use Carbon Credit Market generated USD 2 billion in 2024. The growth is primarily driven by the country's increasing industrial activities, heightened concerns over rising carbon emissions, and soaring energy demands. With stricter regulatory frameworks and an intensified focus on sustainability, the U.S. market is expected to maintain its upward trajectory as businesses strive to meet national and global climate commitments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.3 Europe

- 6.4 Asia Pacific

- 6.5 Middle East & Africa

- 6.6 Latin America

Chapter 7 Company Profiles

- 7.1 3Degrees

- 7.2 ALLCOT

- 7.3 Atmosfair

- 7.4 CarbonClear

- 7.5 Climate Impact Partners

- 7.6 ClimeCo LLC.

- 7.7 EcoAct

- 7.8 Ecosecurities

- 7.9 Green Mountain Energy Company

- 7.10 PwC

- 7.11 South Pole

- 7.12 Sterling Planet Inc.

- 7.13 TerraPass

- 7.14 The Carbon Collective Company

- 7.15 The Carbon Trust

- 7.16 VERRA

- 7.17 WGL Holdings, Inc.