|

市场调查报告书

商品编码

1716540

行动配件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Mobile Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球手机配件市场规模达到 897 亿美元,预计 2025 年至 2034 年间将以 6% 的复合年增长率稳定成长。随着智慧型手机成为日常生活中不可或缺的一部分,全球对手机配件的需求正在大幅增长。行动技术的不断发展,加上智慧型手机个人化趋势的兴起,为行动配件製造商创造了巨大的机会。从时尚的保护壳到高性能的音讯设备,消费者越来越寻求不仅能增强功能而且能体现其风格的配件。具有先进功能的高阶智慧型手机的日益普及,推动了对相容、高品质配件的需求。

此外,快速充电解决方案、无线和蓝牙设备以及智慧穿戴装置等技术进步正在重塑市场,迫使企业不断创新。随着越来越多的用户采用支援 5G 的智慧型手机和物联网设备,对下一代配件的需求预计将急剧上升。行动配件中人工智慧和语音控制功能的整合也越来越受欢迎,以满足寻求无缝智慧体验的技术型消费者的需求。此外,永续性正成为一个关注点,消费者表现出对环保配件的偏好,促使製造商探索可回收和可生物降解的材料进行产品开发。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 897亿美元 |

| 预测值 | 1614亿美元 |

| 复合年增长率 | 6% |

无线充电板、蓝牙耳机和先进的手机游戏配件等尖端创新的兴起继续推动市场成长。公司提供嵌入现代功能的各种产品,以促进更高的个人化和功能性。这种向更客製化和技术驱动的配件的转变不仅提高了消费者满意度,而且还增加了使用频率,从而刺激了持续的需求。

市场按产品类型细分为耳机和耳麦、充电器和电缆、行动电源、保护套和其他配件。其中,保护套占据了相当大的份额,2024 年的市场规模为 269 亿美元,预计到 2034 年将达到 453 亿美元。随着智慧型手机价格越来越高、功能越来越丰富,保护套的需求也越来越强劲,可以防止设备意外跌落、刮擦和损坏。该细分市场的设计涵盖了从坚固的装甲外壳到时尚简约的外壳等各种类型,并持续受到消费者的强烈关注。由于用户追求身临其境的音讯体验,除保护套外,耳机和耳麦也构成了市场的主要组成部分。降噪、人体工学设计和增强音质等功能推动了音乐爱好者、游戏玩家和专业人士对这些产品的需求。

手机配件的分销分为线上和线下管道,其中线下销售占2024年66.6%的市场份额。线下管道允许客户在购买前进行实物评估和测试产品,并透过店内协助提供支持,从而增强信任度和满意度。

光是美国行动配件市场在 2024 年的价值就将达到 123 亿美元,这得益于大量渴望采用最新技术的用户群。北美消费者强大的购买力促进了对高端、功能丰富的手机配件的日益偏好,鼓励品牌推出满足不断变化的消费者期望的卓越创新。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 成分分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 智慧型手机普及率上升

- 技术进步

- 频繁推出新款智慧型手机

- 产业陷阱与挑战

- 仿冒配件

- 竞争激烈的市场

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 耳机

- 充电器和数据线

- 行动电源

- 保护套

- 其他的

第六章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 离线

第七章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Anker Power Core

- Apple Inc.

- Aukey

- Belkin International Inc.

- Bose Corporation

- Groove Made Walnut

- Harman International Industries

- Incipio LLC

- Logitech International SA

- Plantronics, Inc.

- Samsung Electronics Co., Ltd.

- SanDisk

- Sony Corporation

- Xiaomi Corporation

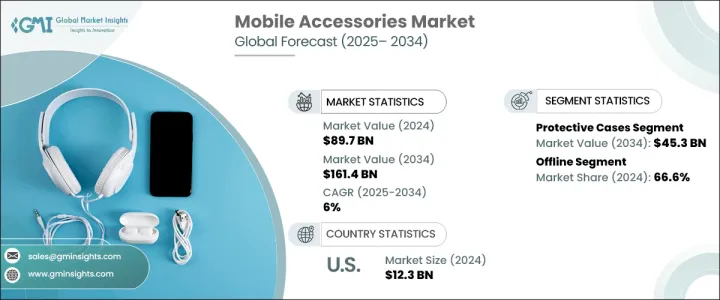

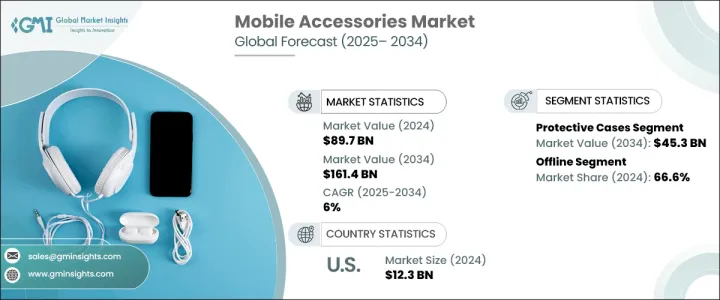

The Global Mobile Accessories Market reached USD 89.7 billion in 2024 and is projected to expand at a steady CAGR of 6% between 2025 and 2034. With smartphones becoming an indispensable part of daily life, the demand for mobile accessories is witnessing a significant surge worldwide. The constant evolution of mobile technology, coupled with the rising trend of smartphone personalization, is creating substantial opportunities for mobile accessory manufacturers. From stylish protective cases to high-performance audio devices, consumers are increasingly seeking accessories that not only enhance functionality but also reflect their style. The growing adoption of premium smartphones with advanced features is fueling the need for compatible, high-quality accessories.

Besides, technological advancements like fast-charging solutions, wireless and Bluetooth-enabled devices, and smart wearables are reshaping the market, compelling companies to innovate continually. As more users embrace 5G-enabled smartphones and IoT-connected devices, the demand for next-generation accessories is expected to rise sharply. The integration of AI and voice-controlled functionalities in mobile accessories is also gaining traction, catering to tech-savvy consumers looking for seamless, smart experiences. Furthermore, sustainability is emerging as a key focus, with consumers showing a preference for eco-friendly accessories, prompting manufacturers to explore recyclable and biodegradable materials for product development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $89.7 Billion |

| Forecast Value | $161.4 Billion |

| CAGR | 6% |

The rise of cutting-edge innovations such as wireless charging pads, Bluetooth headsets, and advanced mobile gaming accessories continues to propel market growth. Companies are offering a broad range of products embedded with modern features that promote greater personalization and functionality. This shift toward more customized and technology-driven accessories not only increases consumer satisfaction but also boosts the frequency of usage, fueling ongoing demand.

The market is segmented by product type into earphones and headphones, chargers and cables, power banks, protective cases, and other accessories. Among these, protective cases held a significant share, generating USD 26.9 billion in 2024, and are projected to generate USD 45.3 billion by 2034. As smartphones become more expensive and feature-rich, the demand for protective cases that safeguard devices from accidental drops, scratches, and damage remains robust. With designs ranging from rugged armor cases to sleek, minimalist covers, this segment continues to see strong consumer interest. Alongside protective cases, earphones and headphones form a major part of the market, as users seek immersive audio experiences. Features like noise-canceling, ergonomic designs, and enhanced sound quality drive the demand for these products among music enthusiasts, gamers, and professionals alike.

Distribution of mobile accessories is divided between online and offline channels, with offline sales accounting for 66.6% of the market share in 2024. Offline channels allow customers to physically assess and test products before purchase, supported by in-store assistance, enhancing trust and satisfaction.

The U.S. Mobile Accessories Market alone was valued at USD 12.3 billion in 2024, fueled by a large user base eager to adopt the latest technologies. The strong purchasing power of North American consumers fosters a growing preference for premium, feature-rich mobile accessories, encouraging brands to deliver superior innovations that meet evolving consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Ingredient analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising smartphone adaptation

- 3.7.1.2 Technological advancements

- 3.7.1.3 Frequent launches of new smartphones

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Counterfeits accessories

- 3.7.2.2 Highly competitive market

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By product Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Earphones & headphones

- 5.3 Chargers & cables

- 5.4 Power bank

- 5.5 Protective cases

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Online

- 6.3 Offline

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Anker Power Core

- 8.2 Apple Inc.

- 8.3 Aukey

- 8.4 Belkin International Inc.

- 8.5 Bose Corporation

- 8.6 Google

- 8.7 Groove Made Walnut

- 8.8 Harman International Industries

- 8.9 Incipio LLC

- 8.10 Logitech International S.A.

- 8.11 Plantronics, Inc.

- 8.12 Samsung Electronics Co., Ltd.

- 8.13 SanDisk

- 8.14 Sony Corporation

- 8.15 Xiaomi Corporation