|

市场调查报告书

商品编码

1716545

储能係统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Energy Storage Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球储能係统市场价值为 6,687 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 21.7%。随着全球能源格局继续向永续性和脱碳化发展,该市场正在呈指数级增长。随着各国致力于实现净零排放和气候目标,能源储存系统 (ESS) 正成为实现再生能源广泛应用的关键基础设施。政府和私营部门正在大力投资创新的 ESS 技术,以克服太阳能和风能的间歇性,同时确保电网的稳定性和可靠性。

从化石燃料发电到清洁能源的加速转变,对能够有效管理能源供需波动的储存解决方案产生了强烈的需求。全球快速的城市化、工业化和不断增长的电力消耗进一步推动了对先进能源储存解决方案的需求,使其成为现代化老化电网基础设施和确保不间断能源供应不可或缺的一部分。此外,屋顶太阳能和微电网等分散式能源系统的日益整合,正在推动对本地化能源储存的需求,以确保优化能源使用和成本效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6687亿美元 |

| 预测值 | 5.12兆美元 |

| 复合年增长率 | 21.7% |

能源储存系统对于维持能源供需平衡至关重要,尤其是在风能和太阳能等再生能源继续主导全球新增产能的情况下。 ESS 技术有助于提高能源效率和解决电网可靠性挑战,并在高峰需求或紧急情况下提供储存的能量。该领域最突出的技术之一是抽水蓄能,其工作原理是在发电过剩期间将水从较低的水库转移到较高的水库,并在需要时释放出来发电。抽水蓄能具有显着的长期储存能力,是将再生能源纳入国家电网的关键,使其成为现代能源储存组合的基石。随着人们对能源安全和环境永续性的担忧日益加剧,世界各国政府纷纷推出优惠政策和激励措施,促进先进储能係统的开发和部署,以减少对传统化石燃料的依赖,并增强能源弹性。

由于飓风等自然灾害发生频率的增加凸显了对有弹性且可靠的能源备用系统的需求,电能时移领域在 2024 年占据了 50.2% 的主导市场份额。此外,全球范围内电动车(EV)的快速普及大大增加了对强大能源储存的需求,以支援电动车充电基础设施和更智慧的能源管理解决方案。政府鼓励人们转向环保型交通方式的激励措施进一步推动了对符合脱碳目标的高效储存技术的需求。

在联邦政府对清洁能源转型和广泛太阳能发电设施的大力支持下,光是美国能源储存系统市场规模到 2024 年就将达到 1,067 亿美元。新兴经济体,尤其是亚太地区的新兴经济体,随着其加强向永续能源框架转型的力度,对具有成本效益且先进的 ESS 解决方案的需求正在飙升。中国和印度等国家正采取积极措施,加强再生能源与储能係统的整合,凸显了全球大规模采用储能係统的动能。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 抽水蓄能

- 电化学

- 锂离子

- 硫磺钠

- 铅酸

- 液流电池

- 其他的

- 机电

- 飞轮

- 压缩空气储能係统

- 热的

- 水

- 熔盐

- 脉衝编码调变

- 其他的

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 电能时移

- 供电能力

- 骇启动

- 再生能源产能稳定

- 频率调节

- 其他的

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- Abengoa SA

- Burns & McDonnell

- BYD Company Ltd.

- CALMAC

- Durapower Group

- Exide Technologies

- General Electric

- Hitachi Energy Ltd.

- Johnson Controls

- LG Energy Solution

- McDermott

- Narada Power Source Co. Ltd

- Panasonic Corporation

- Samsung SDI Co., Ltd

- SCHMID Group

- Siemens

- Sinohydro Corporation

- Toshiba Corporation

- Voith GmbH & Co. KGaA

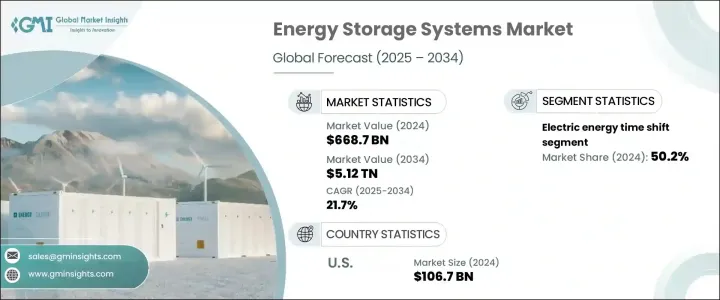

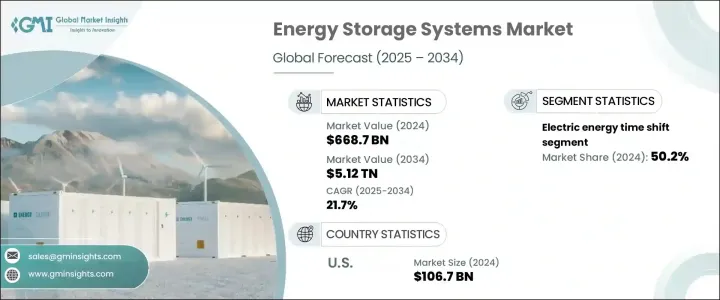

The Global Energy Storage Systems Market, valued at USD 668.7 billion in 2024, is projected to expand at a CAGR of 21.7% between 2025 and 2034. The market is witnessing exponential growth as the global energy landscape continues to evolve toward sustainability and decarbonization. With nations committing to net-zero emissions and climate goals, energy storage systems (ESS) are emerging as critical infrastructure for enabling the widespread adoption of renewable energy. Governments and private sectors are investing heavily in innovative ESS technologies to overcome the intermittent nature of solar and wind power while ensuring grid stability and reliability.

The accelerating shift from fossil fuel-based power generation to clean energy sources has created a strong demand for storage solutions that can efficiently manage fluctuations in energy supply and demand. Rapid urbanization, industrialization, and growing electricity consumption worldwide are further fueling the need for advanced energy storage solutions, making them indispensable for modernizing aging grid infrastructure and ensuring uninterrupted energy access. Additionally, the rising integration of decentralized energy systems, such as rooftop solar and microgrids, is driving the need for localized energy storage to ensure optimized energy usage and cost efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $668.7 Billion |

| Forecast Value | $5.12 Trillion |

| CAGR | 21.7% |

Energy storage systems are essential for maintaining the balance between energy supply and demand, particularly as renewable energy sources like wind and solar continue to dominate new capacity additions worldwide. ESS technologies are instrumental in improving energy efficiency and addressing grid reliability challenges, providing stored energy during peak demand or emergencies. One of the most prominent technologies in this space is pumped hydro storage, which works by transferring water from a lower reservoir to a higher one during periods of excess energy generation and releasing it to generate electricity when needed. Pumped hydro offers significant long-duration storage capabilities and is key to integrating renewable power into national grids, making it a cornerstone of modern energy storage portfolios. As concerns over energy security and environmental sustainability rise, governments across the globe are introducing favorable policies and incentives that promote the development and deployment of advanced energy storage systems to reduce dependency on conventional fossil fuels and strengthen energy resilience.

The electric energy time-shift segment accounted for a dominant 50.2% market share in 2024, as the growing frequency of natural disasters such as hurricanes underscores the need for resilient and reliable energy backup systems. Furthermore, the rapid adoption of electric vehicles (EVs) worldwide is significantly increasing the demand for robust energy storage to support EV charging infrastructure and smarter energy management solutions. Government incentives encouraging the shift to eco-friendly transportation options are further boosting demand for efficient storage technologies that align with decarbonization goals.

The U.S. Energy Storage Systems Market alone reached USD 106.7 billion in 2024, driven by strong federal support for clean energy transitions and widespread solar power installations. Emerging economies, especially in Asia-Pacific, are witnessing soaring demand for cost-effective and advanced ESS solutions as they intensify efforts to transition to sustainable energy frameworks. Countries like China and India are taking proactive steps to enhance renewable integration with ESS, highlighting a global momentum toward large-scale energy storage adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Pumped hydro

- 5.3 Electro-chemical

- 5.3.1 Lithium-ion

- 5.3.2 Sodium sulphur

- 5.3.3 Lead acid

- 5.3.4 Flow battery

- 5.3.5 Others

- 5.4 Electro-mechanical

- 5.4.1 Flywheel

- 5.4.2 CAES

- 5.5 Thermal

- 5.5.1 Water

- 5.5.2 Molten salt

- 5.5.3 PCM

- 5.5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Electric energy time shift

- 6.3 Electric supply capacity

- 6.4 Black start

- 6.5 Renewable capacity firming

- 6.6 Frequency regulation

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Abengoa S.A.

- 8.3 Burns & McDonnell

- 8.4 BYD Company Ltd.

- 8.5 CALMAC

- 8.6 Durapower Group

- 8.7 Exide Technologies

- 8.8 General Electric

- 8.9 Hitachi Energy Ltd.

- 8.10 Johnson Controls

- 8.11 LG Energy Solution

- 8.12 McDermott

- 8.13 Narada Power Source Co. Ltd

- 8.14 Panasonic Corporation

- 8.15 Samsung SDI Co., Ltd

- 8.16 SCHMID Group

- 8.17 Siemens

- 8.18 Sinohydro Corporation

- 8.19 Toshiba Corporation

- 8.20 Voith GmbH & Co. KGaA