|

市场调查报告书

商品编码

1690703

东南亚国协能源储存:市场占有率分析、产业趋势与成长预测(2025-2030 年)ASEAN Energy Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

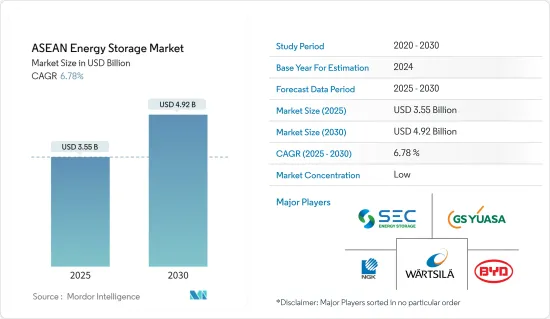

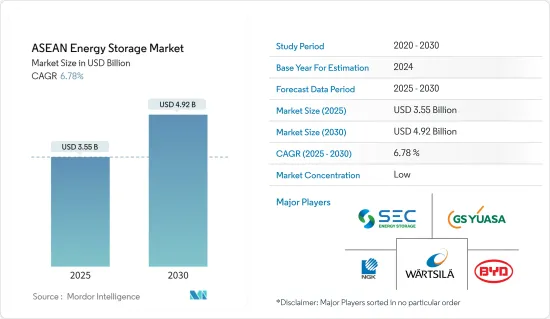

东南亚国协的能源储存市场规模预计在2025年为35.5亿美元,预计到2030年将达到49.2亿美元,预测期内(2025-2030年)的复合年增长率为6.78%。

2020年,受新冠疫情影响,柬埔寨、印尼、缅甸、菲律宾、越南等国的多个发电工程暂停建设,未来几年新增发电容量可能落后于计画。市场的主要驱动力是住宅和商业/工业领域对不断电系统的需求不断增加。然而,预计在预测期内,在东协地区建立大型能源储存设施所需的大量资金将成为市场发展的一大限制因素。

关键亮点

- 由于电动车市场的扩张以及住宅和商业领域对不间断电源的需求不断增长,预测期内电池市场可能会显着增长。

- 根据《巴黎协定》,世界各国正努力提高可再生能源在能源结构中的比重。例如,印尼已设定目标,2050年将可再生能源的比例提高到31%。太阳能等可再生能源的兴起很可能在不久的将来为能源储存设施带来机会,因为它可以为无法连接国家电网的偏远农村地区提供电力。

- 菲律宾在 2021 年占据了最大的市场占有率,预计在预测期内将继续保持相同的趋势。

东南亚国协能源储存市场趋势

电池能源储存领域预计将显着成长

- 电池能源储存系统(BESS)是东南亚国协一个快速崛起的市场领域。预计可再生能源消耗的增加将在预测期内大幅推动对 BESS 的需求。然而,儘管锂离子电池和BESS技术的成本下降,但人为的低关税水平和石化燃料补贴预计会使BESS技术在东南亚国协市场上的竞争力下降。

- 作为提高能源效率和减少该国港口排放计划的一部分,新加坡将于 2022 年 7 月安装一套大型电池系统。 2MW/2MWh 电池能源储存系统(BESS) 已安装在巴西班让码头,该码头是新加坡港务集团运营的四大主要设施之一。它也是智慧电网管理系统的一部分,该系统将使港口业务的能源效率提高 2.5%,并每年减少港口的二氧化碳排放1,000 吨(二氧化碳当量)。

- 在东协地区,印尼可再生能源装置容量成长迅速。到 2022 年,这一数字将达到 12,481 兆瓦,与前一年同期比较增加 8%,比 2013 年增加约 51%。 2023 年,Total Eren SA 将与印尼电力公司 PLN 合作建造 Tanah Laut计划,该项目将整合一个 70 兆瓦的风电场和 10 兆瓦时的电池储能係统。此类计划的开发必将在预测期内推动东南亚国协能源储存市场的成长。

- 同样,2022 年 6 月,总部位于新加坡的能源和城市发展集团胜科集团开始在裕廊岛建造一个 200MWh 的电池储存系统。新加坡能源市场管理局(EMA)于 5 月发布了一份意向书(EOI),计划建造 200MW 和 200MWh 的电池。

- 因此,鑑于上述情况,预计电池能源储存领域在预测期内将大幅成长。

菲律宾可望主导市场

- 可再生能源发电是一种间歇性电力来源,因此有必要储存多余的发电量。该国的目标是到2030年使可再生能源占其发电结构的35%,到2040年达到50%,这相当于到2030年风能和太阳能约15吉瓦。截至2022年,菲律宾的可再生能源装置容量将达到约7,670兆瓦,其中大部分将是水力发电和地热能。

- 对可再生能源计划的投资可能会为该国的能源储存市场铺平道路。 2023年,菲律宾能源部(DOE)推出了新的能源储存市场规则和措施,此前一个月,政府允许外国企业100%拥有可再生能源资产。改革后,中国企业集团承诺在菲律宾可再生和能源领域投资137亿美元。

- 2022年,SN Aboitiz电力集团(SNAP)完成了位于伊莎贝拉省拉蒙市Magat水力发电厂的20MW容量BESS计划的最终投资决策。该国正在开发类似的计划,这将有助于发展东协的能源储存市场。

- 2022年4月,菲律宾投资者所有的电力公司Aboitiz Power和挪威可再生能源集团Scatec与日立能源签署了一份EPC合同,将建设一个20兆瓦/20兆瓦时的电池储能係统,目标是在2024年运作。两家公司的合资企业SN Aboitiz Power Group(SNAP)已对位于菲律宾北部伊莎贝拉省拉蒙的360兆瓦马加特水电站的电池储能係统(BESS)计划做出最终投资决定。

- 由于所有这些原因,预计菲律宾将在预测期内主导东南亚国协能源储存市场。

东南亚国协能源储存产业概况

东南亚国协的能源储存市场区隔程度适中。市场的主要企业包括(不分先后顺序)GS Yuasa Corporation、Wartsila Oyj Abp、比亚迪、SEC Battery Company 和 NGK Insulators Ltd.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2028 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 住宅、商业和工业消费者对电力的需求不断增长

- 非计划停电和电网不稳定推动对能源储存解决方案的需求

- 限制因素

- 缺乏投资可能会阻碍能源储存市场的成长

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 抽水蓄能发电

- 电池储存系统

- 其他的

- 应用

- 住宅

- 商业和工业

- 地区

- 印尼

- 越南

- 菲律宾

- 马来西亚

- 其他东南亚国协

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- GS Yuasa Corporation

- Wartsila Oyj Abp

- BYD Co. Ltd.

- SEC Battery Company

- Contemporary Amperex Technology Co. Ltd.(CATL)

- NGK Insulators Ltd.

- LG Chem Ltd.

第七章 市场机会与未来趋势

- 政府提高可再生能源产能的长期倡议

The ASEAN Energy Storage Market size is estimated at USD 3.55 billion in 2025, and is expected to reach USD 4.92 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

In 2020, due to the COVID-19 pandemic, many power projects were halted because of pandemic, namely in Cambodia, Indonesia, Myanmar, Philippines, and Vietnam, which is likely to cause the capacity additions to fall behind schedule in the coming years. The primary driver for the market includes the rising demand for uninterrupted power supply in both residential, and commercial and industrial sectors. However, the requirement of high capital to set up a large-scale energy storage facility in ASEAN region is expected to act as a major restraint for the market studied during the forecast period..

Key Highlights

- With the expansion of the electric vehicle market and growing demand for uninterrupted power supply, both in the residential and commercial sectors, batteries are likely to witness significant growth in the market during the forecast period.

- In line with the Paris agreement, countries around the globe are putting effort to increase renewable energy share in its energy mix. For instance, Indonesia has set a target to increase its renewable share to 31% by 2050. An increase in renewable energy like solar PV to power isolated grids in rural villages, inaccessible to the national grid, is likely to create an opportunity for the energy storage facilities in the near future.

- Philippines held the largest market share in 2021 and is expected to continue the same trend during the forecast period.

ASEAN Energy Storage Market Trends

Battery Energy Storage Segment Expected to Witness Significant Growth

- Battery Energy Storage Systems (BESS) is a rapidly emerging market segment in ASEAN countries. The rise in renewable energy consumption is expected to boost BESS demand during the forecast period significantly. However, despite the falling costs of lithium-ion batteries and BESS technology, artificially low tariff levels and fossil fuel subsidies are expected to reduce the competitiveness of BESS technologies in the ASEAN market.

- In July 2022, a large-scale battery system was installed in Singapore as part of a project to increase energy efficiency and reduce emissions from the country's seaports. The 2 MW/2MWh battery energy storage system (BESS) was deployed at Pasir Panjang Terminal, one of four major facilities operated by PSA Singapore. It is also part of the smart grid management system, which can improve the energy efficiency of port operations by 2.5 percent and reduce the port's carbon footprint by 1,000 metric tonnes of CO2 equivalent per year.

- In the ASEAN region, Indonesia is witnessing rapid growth in renewable energy installed capacity. It stood at 12481 MW in 2022, an increase of 8% from the previous year and approx 51% from 2013. In 2023, Total Eren SA got associated with PLN, an Indonesian power utility, to construct The Tanah Laut project consisting of a 70 MW wind power plant integrated with a 10 MWh Battery Energy Storage System that would produce approx. 158 GWh of electricity. The development of such projects would undoubtedly help the ASEAN energy storage market to grow in the forecast period.

- Similarly, In June 2022, Singapore-based energy and urban development group Sembcorp began building 200 MWh of battery storage systems on Jurong Island. The Singapore Energy Markets Authority (EMA) issued an expression of interest (EOI) in May to build 200 MW and 200 MWh of battery storage.

- Therefore, owing to the above points, the battery energy storage segment is expected to grow significantly during the forecast period.

Philippines Expected to Dominate the Market

- Renewable energy is an intermittent source that requires storage for surplus electricity generation. The country is targeting renewables to make up 35% of the generation mix by 2030 and 50% by 2040, which equates to about 15 GW of wind and solar by 2030. The Philippines has about 7670 MW of installed renewable energy capacity as of 2022, where the majority of that is hydroelectric and geothermal energy.

- Investments in renewable energy projects likely pave the way for energy storage markets in the country. In 2023, the Philippines Department of Energy (DOE) devised new market rules and policies for energy storage, a month after the government permitted 100% foreign ownership of renewable energy assets. Following the reform, a group of Chinese companies committed to investing USD 13.7 billion in the country's renewable and energy sectors.

- In 2022, SN Aboitiz Power Group (SNAP) completed its final investment decision for a BESS project of 20 MW capacity located at the Magat Hydropower plant in Ramon, Isabela. 'The energy storage project is expected to commence operation in 2024. Similar projects are being developed in the country, which would benefit the development of the energy storage market in ASEAN.

- In April 2022, Philippines investor-owned utility AboitizPower, and Norwegian renewables group Scatec signed an EPC agreement with Hitachi Energy for it to build a 20 MW/20MWh battery storage system, set to go online in 2024. The joint venture (JV) between the companies, SN Aboitiz Power Group (SNAP), has made the final investment decision on the battery energy storage system (BESS) project at the 360 MW Magat hydropower plant in Ramon, Isabela, in the north Philippines.

- Therefore, owing to the above points, the Philippines is expected to dominate the ASEAN energy storage market during the forecast period.

ASEAN Energy Storage Industry Overview

The ASEAN energy storage market is moderately fragmented. Some of the key players in the market include (in no particular order) GS Yuasa Corporation, Wartsila Oyj Abp, BYD Co. Ltd., SEC Battery Company, and NGK Insulators Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growth in Power Demand from Residential, Commercial and Industrial Consumers

- 4.5.1.2 Unscheduled Power Outages and Grid Instability would Demand Energy Storage Solutions

- 4.5.2 Restraints

- 4.5.2.1 Lack of Investments could Hamper the Growth of Energy Storage Market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Pumped-Hydro Storage

- 5.1.2 Battery Energy Storage Systems

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Vietnam

- 5.3.3 Philippines

- 5.3.4 Malaysia

- 5.3.5 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa Corporation

- 6.3.2 Wartsila Oyj Abp

- 6.3.3 BYD Co. Ltd.

- 6.3.4 SEC Battery Company

- 6.3.5 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.3.6 NGK Insulators Ltd.

- 6.3.7 LG Chem Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term Government Policies to Add Renewable Energy Capacity