|

市场调查报告书

商品编码

1716565

汽车闭环电流感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Closed Loop Current Transducer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

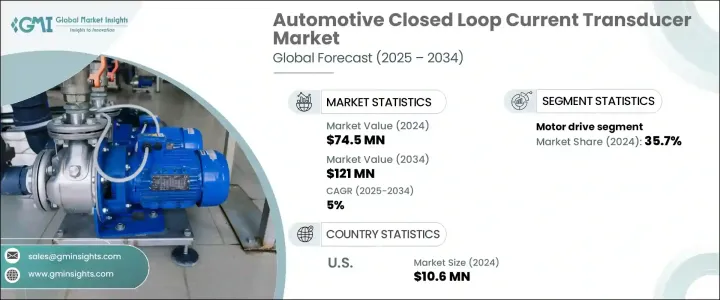

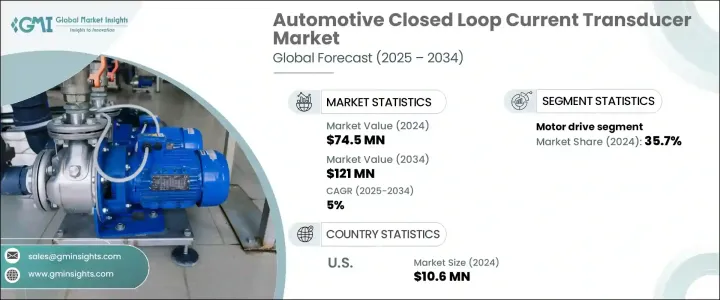

2024 年全球汽车闭环电流感测器市场规模达到 7,450 万美元,预计 2025 年至 2034 年期间复合年增长率将稳定在 5%。电动和混合动力汽车的日益普及推动了这一扩张,因为闭环电流感测器在确保高压车辆系统的安全和效率方面发挥关键作用。随着向永续移动性的转变,这些先进的部件在现代汽车工程中变得不可或缺。人们对电气化的日益关注以及对节能解决方案的需求激增,正在推动製造商创新和增强感测器技术以满足行业需求。政府支持电动车普及的激励措施,加上技术进步,进一步推动了市场的发展。随着汽车製造商增加下一代电动车的产量,对高性能电流感测器的需求将会上升,这使得该产业成为汽车产业发展的关键贡献者。

汽车闭环电流感测器广泛用于马达驱动器、电池管理系统、转换器、逆变器和不间断电源 (UPS)。在这些应用中,马达驱动器占据市场主导地位,到 2024 年将占总份额的 35.7%。电动车产量的激增以及政府的利好政策推动了对强大的马达驱动系统的需求,而这种系统需要可靠的电流感测器才能实现最佳性能。这些设备对于保护马达驱动器免受潜在的过流损坏至关重要,随着电动车变得越来越普及,过流损坏已成为业界日益关注的问题。透过确保功率调节的精度并提高整体系统效率,闭环电流感测器在各种汽车应用中得到了广泛的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7450万美元 |

| 预测值 | 1.21亿美元 |

| 复合年增长率 | 5% |

受政府强力推动、旨在加速电动车普及的倡议的推动,美国汽车闭环电流感测器市场规模到 2024 年将达到 1,060 万美元。此外,国内对电动车电池生产的日益重视在市场扩张中发挥关键作用。电动车销量的成长,加上对再生能源的日益重视,进一步扩大了对这些先进电流感测器的需求。这一趋势在亚太地区尤为明显,该地区对清洁能源解决方案和永续交通的大力推动正在推动市场显着成长。随着汽车产业继续向电气化转变,对高精度、可靠电流感测器的需求预计将成长,从而增强其在全球汽车生态系统中的重要性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 马达驱动

- 转换器和逆变器

- 电池管理

- UPS和开关电源

- 其他的

第六章:市场规模及预测:依地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第七章:公司简介

- ABB

- Howard Butler

- Infineon Technologies

- Johnson Controls

- LEM

- NK Technologies

- Phoenix Contact

- Siemens

- Texas Instruments

- Topstek

The Global Automotive Closed Loop Current Transducer Market reached USD 74.5 million in 2024 and is expected to witness steady CAGR of 5% between 2025 and 2034. The increasing adoption of electric and hybrid vehicles is fueling this expansion, as closed-loop current transducers play a critical role in ensuring the safety and efficiency of high-voltage vehicle systems. With the transition toward sustainable mobility, these advanced components are becoming indispensable in modern automotive engineering. The growing focus on electrification and the surge in demand for energy-efficient solutions are pushing manufacturers to innovate and enhance transducer technologies to meet industry needs. Government incentives supporting electric vehicle adoption, coupled with technological advancements, are further propelling the market forward. As automakers ramp up production of next-generation electric vehicles, the demand for high-performance current transducers is poised to rise, making this sector a key contributor to the evolving automotive landscape.

Automotive closed-loop current transducers are extensively used in motor drives, battery management systems, converters, inverters, and uninterruptible power supplies (UPS). Among these applications, motor drives dominate the market, accounting for 35.7% of the total share in 2024. The surge in electric vehicle production, along with favorable government policies, is driving the demand for robust motor drive systems that require reliable current transducers for optimal performance. These devices are crucial for safeguarding motor drives against potential overcurrent damage, a rising concern in the industry as electric vehicles become more prevalent. By ensuring precision in power regulation and enhancing overall system efficiency, closed-loop current transducers are gaining widespread adoption across various automotive applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $74.5 Million |

| Forecast Value | $121 Million |

| CAGR | 5% |

The U.S. automotive closed-loop current transducer market reached USD 10.6 million in 2024, bolstered by strong government initiatives aimed at accelerating electric vehicle adoption. Additionally, the increasing emphasis on domestic electric vehicle battery production is playing a pivotal role in market expansion. The rise in electric vehicle sales, coupled with a growing commitment to renewable energy, is further amplifying the demand for these advanced current transducers. This trend is particularly evident in the Asia Pacific region, where a robust push for clean energy solutions and sustainable transportation is driving significant growth in the market. As the automotive industry continues its shift toward electrification, the demand for high-precision, reliable current transducers is expected to grow, reinforcing their importance in the global automotive ecosystem.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Motor Drive

- 5.3 Converter & Inverter

- 5.4 Battery Management

- 5.5 UPS & SMPS

- 5.6 Others

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 ABB

- 7.2 Howard Butler

- 7.3 Infineon Technologies

- 7.4 Johnson Controls

- 7.5 LEM

- 7.6 NK Technologies

- 7.7 Phoenix Contact

- 7.8 Siemens

- 7.9 Texas Instruments

- 7.10 Topstek