|

市场调查报告书

商品编码

1716578

消费性电子市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Consumer Electronics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

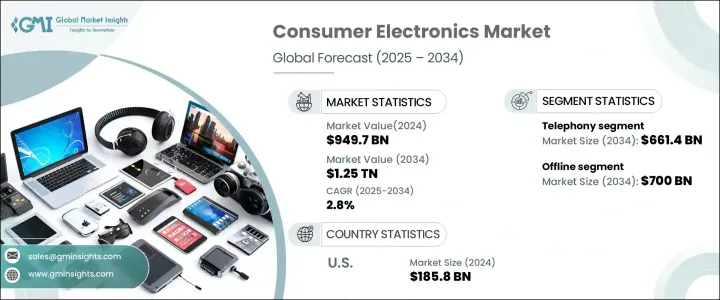

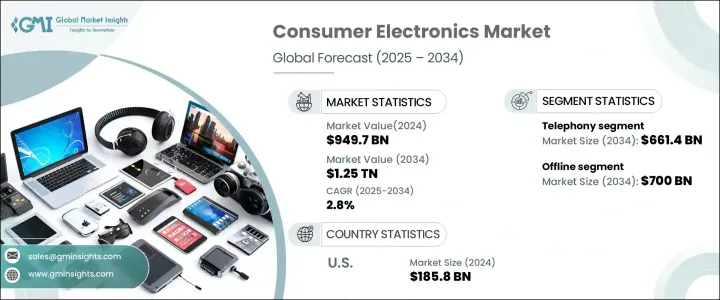

2024 年全球消费性电子产品市场价值为 9,497 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 2.8%。这一稳定成长得益于智慧型手机的日益普及和电信技术的进步。消费者正在接受支援更快网路速度的设备,尤其是那些与 5G 网路相容的设备,它们提供卓越的连接性和无缝的性能。随着智慧家庭技术的发展,市场持续扩大。智慧电视、游戏週边设备和物联网设备等产品已成为现代家庭的必需品,促进了智慧生态系统的快速普及。

此外,人工智慧语音助理、家庭安全解决方案和节能智慧设备的出现正在改变消费者与家庭的互动方式,从而推动整个市场的发展。扩增实境 (AR) 和虚拟实境 (VR) 技术日益增长的影响力正在增强游戏、娱乐和专业应用方面的使用者体验,进一步推动对创新消费性电子产品的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9497亿美元 |

| 预测值 | 1.25兆美元 |

| 复合年增长率 | 2.8% |

随着游戏的主流吸引力不断飙升,它已成为消费性电子市场的主要成长动力。游戏机和配件需求的激增创造了一个蓬勃发展的生态系统,消费者寻求互联和高效能的设备来增强他们的游戏体验。随着越来越多的人采用先进的游戏技术,消费性电子产业正在迅速扩张以满足这种不断变化的需求。云端游戏和订阅平台的日益普及也在塑造游戏产业的未来,促进尖端游戏机和周边设备的生产。

市场按产品类型细分,包括电话、计算、电视、广播、多媒体、游戏设备、电视週边设备和无人机。在行动服务用户不断增长的推动下,电话业务在 2024 年创造了 4,980 亿美元的收入。价格实惠的智慧型手机使行动连线更加便捷,尤其是在新兴市场,推动了该业务的持续成长。随着消费者寻求提供更快速度、低延迟和增强功能的设备,5G 技术的快速融合进一步加速了智慧型手机的普及。

从分销通路来看,消费性电子产品市场分为线上和线下两部分。 2024 年,线下部分占了 70.6% 的市场份额,预计到 2034 年将达到 7,000 亿美元。儘管网上购物越来越流行,但实体零售店在消费性电子产品分销中仍然发挥关键作用。这些商店提供个人化咨询、互动展示和实践体验,帮助消费者做出明智的购买决定。零售商透过整合扩增实境、提供店内演示和提供专家指导来增强客户体验,确保实体店在不断发展的零售格局中保持相关性。

美国消费性电子产品市场在 2024 年创造了 1,858 亿美元的产值,预计 2025 年至 2034 年期间的复合年增长率为 2.6%。该国的经济环境表明,2022 年至 2023 年期间消费者支出将增加 8.5%,这表明该行业前景光明。随着可支配收入的增加和技术创新继续吸引消费者,预计电子产品的需求将保持强劲,从而支持该行业的整体成长轨迹。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 技术进步

- 消费需求不断成长

- 可支配所得不断成长

- 智慧型装置日益普及

- 产业陷阱与挑战

- 激烈的价格竞争

- 供应链中断

- 成长动力

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 首选价格范围

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 电话

- 计算

- 电视、广播与多媒体

- 游戏装置

- 电视週边设备

- 无人机

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

第七章:市场估计与预测:按价格,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市/大卖场

- 专卖店

- 大型零售商店

- 便利商店(百货、独立店)

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十章:公司简介

- Apple Inc.

- Dell Technologies

- HP Inc.

- Huawei Technologies

- Lenovo Group

- LG Electronics

- Microsoft Corp.

- Panasonic Corporation

- Samsung Electronics

- Sony Group Corporation

The Global Consumer Electronics Market was valued at USD 949.7 billion in 2024 and is expected to grow at a CAGR of 2.8% between 2025 and 2034. This steady growth is fueled by the increasing adoption of smartphones and advancements in telecommunication technologies. Consumers are embracing devices that support faster internet speeds, especially those compatible with 5G networks, which offer superior connectivity and seamless performance. As smart home technologies gain momentum, the market continues to expand. Products such as smart TVs, gaming peripherals, and IoT-connected devices have become essential in modern households, contributing to the rapid proliferation of smart ecosystems.

Moreover, the emergence of AI-powered voice assistants, home security solutions, and energy-efficient smart devices is transforming how consumers interact with their homes, boosting the overall market. The growing influence of augmented reality (AR) and virtual reality (VR) technologies is enhancing user experiences across gaming, entertainment, and professional applications, further propelling the demand for innovative consumer electronics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $949.7 Billion |

| Forecast Value | $1.25 Trillion |

| CAGR | 2.8% |

Gaming has emerged as a major growth driver for the consumer electronics market as its mainstream appeal continues to soar. The surge in demand for gaming consoles and accessories has created a thriving ecosystem where consumers seek interconnected and high-performance devices to enhance their gaming experiences. As more people adopt advanced gaming technologies, the consumer electronics sector is expanding rapidly to cater to this evolving demand. The increased adoption of cloud gaming and subscription-based platforms is also shaping the future of the gaming industry, encouraging the production of cutting-edge consoles and peripherals.

The market is segmented by product type, encompassing telephony, computing, TV, radio, multimedia, gaming equipment, TV peripherals, and drones. The telephony segment, driven by rising mobile service subscriptions, generated USD 498 billion in 2024. Affordable smartphones have made mobile connectivity more accessible, particularly in emerging markets, fueling this segment's continued growth. The rapid integration of 5G technology has further accelerated smartphone adoption as consumers seek devices that offer faster speeds, low latency, and enhanced features.

In terms of distribution channels, the consumer electronics market is divided into online and offline segments. The offline segment accounted for 70.6% of the market share in 2024 and is projected to reach USD 700 billion by 2034. Despite the increasing prevalence of online shopping, physical retail stores continue to play a pivotal role in the distribution of consumer electronics. These stores offer personalized consultations, interactive displays, and hands-on experiences that help consumers make informed purchasing decisions. Retailers are enhancing customer experiences by integrating augmented reality, offering in-store demonstrations, and providing expert guidance, ensuring that brick-and-mortar stores remain relevant in the evolving retail landscape.

The U.S. consumer electronics market generated USD 185.8 billion in 2024, with a projected CAGR of 2.6% between 2025 and 2034. The country's economic environment, marked by an 8.5% increase in consumer spending from 2022 to 2023, points to a promising outlook for the sector. As disposable incomes rise and technological innovations continue to captivate consumers, the demand for electronic products is expected to remain strong, supporting the overall growth trajectory of the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements

- 3.2.1.2 Increasing consumer demand

- 3.2.1.3 Growing disposable income

- 3.2.1.4 Rising popularity of smart devices

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Intense price competition

- 3.2.2.2 Supply chain disruptions

- 3.2.1 Growth drivers

- 3.3 Consumer buying behavior analysis

- 3.3.1 Demographic trends

- 3.3.2 Factors affecting buying decision

- 3.3.3 Consumer product adoption

- 3.3.4 Preferred distribution channel

- 3.3.5 Preferred price range

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Telephony

- 5.3 Computing

- 5.4 TV, Radio & Multimedia

- 5.5 Gaming equipment

- 5.6 TV peripheral devices

- 5.7 Drones

Chapter 6 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Supermarkets/Hypermarkets

- 8.3.2 Specialty stores

- 8.3.3 Mega retail stores

- 8.3.4 Convenience stores (departmental, independent)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Apple Inc.

- 10.2 Dell Technologies

- 10.3 HP Inc.

- 10.4 Huawei Technologies

- 10.5 Lenovo Group

- 10.6 LG Electronics

- 10.7 Microsoft Corp.

- 10.8 Panasonic Corporation

- 10.9 Samsung Electronics

- 10.10 Sony Group Corporation