|

市场调查报告书

商品编码

1716579

生物基石脑油市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bio-based Naphtha Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

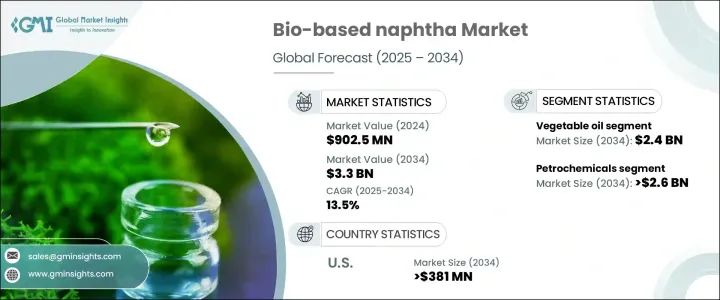

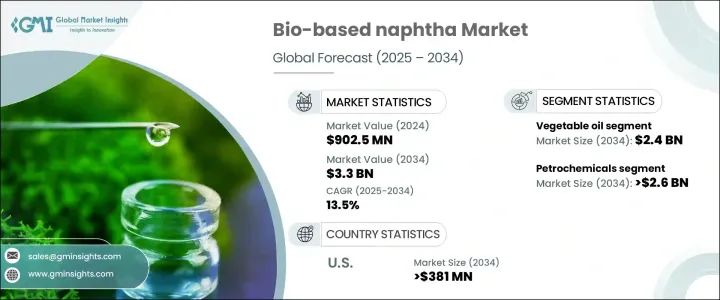

2024 年全球生物基石脑油市场价值为 9.025 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 13.5%。这一快速扩张是由多个行业对永续燃料替代品的需求不断增长所推动的。随着世界各地的企业和政府强调碳中和和更清洁的能源,生物基石脑油正成为传统化石燃料的可行替代品。这种环保替代品源自于植物油和生物质等可再生资源,越来越多地被运输、石化和塑胶製造等行业所采用。全球努力减少温室气体排放,加上更严格的环境法规,大大促进了生物基石脑油的普及。

近年来,主要产业参与者和政策制定者加快了对再生原料的投资,以实现永续发展目标。公司正在转变生产模式,整合生物基石脑油,利用其较低的碳足迹以及与现有炼油和石化基础设施的兼容性。人们对环境问题的认识不断增强以及生物燃料的经济效益进一步加强了市场的扩张。此外,炼油技术的进步和政府对生物基产品的补贴增加,使得生物石脑油更容易取得且更具成本效益,从而鼓励其得到更广泛的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.025亿美元 |

| 预测值 | 33亿美元 |

| 复合年增长率 | 13.5% |

生物基石脑油市场主要分为植物油及生质基石脑油。由于植物油的丰富性和可再生性,预计到 2034 年植物油市场规模将达到 24 亿美元。与其他生物质来源相比,植物油更容易采购,对环境的影响也更小,因此製造商更青睐植物油。在石脑油生产中使用植物油有助于减少塑胶和化学品的碳足迹,使其成为旨在实现永续发展目标的企业有吸引力的原料选择。

在应用方面,石化领域预计在 2025 年至 2034 年期间的复合年增长率为 12%,到 2034 年将创造 26 亿美元的产值。生物基石脑油在石化生产中的使用日益增多,很大程度上归因于其能够减少碳排放,同时能够无缝整合到现有的生产设施中。製造商正在积极转向生物基石脑油,以遵守严格的环境法规并满足日益增长的绿色产品需求。这种转变支持产业的长期成长,同时帮助企业达到全球永续发展基准。

预计 2025 年至 2034 年间,美国生物基石脑油市场将以 12% 的复合年增长率成长,到 2034 年将达到 3.81 亿美元。由于再生能源的强劲生产和消费,美国仍然是生物燃料领域的主导者。对乙醇、生质柴油和再生柴油等生物燃料(来自植物油和废弃物)的日益依赖,大大促进了该国生物基石脑油的扩张。政府的激励措施和严格的环境政策进一步支持了市场成长,使美国成为生物基石脑油创新和发展的重要枢纽。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 再生柴油和燃料的需求不断增长

- 生物塑胶和弹性体市场的扩张

- 产业陷阱与挑战

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场规模及预测:依来源,2021-2034

- 主要趋势

- 植物油

- 生物质

第六章:市场规模及预测:依应用,2021-2034

- 主要趋势

- 石化产品

- 汽油

- 生物苯

- 生物酚

- 其他的

第七章:市场规模及预测:依下游应用,2021-2034

- 主要趋势

- 生物聚乙烯(Bio-PE)

- 生物聚丙烯(Bio-PP)

- 生物聚氯乙烯(Bio-PVC)

- 其他的

第八章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Diamond Green Diesel

- Eni

- Euglena

- Gevo

- Kaidi Finland

- Neste

- Phillips 66

- Repsol

- Shell

- UPM Biofuels

The Global Bio-Based Naphtha Market was valued at USD 902.5 million in 2024 and is projected to grow at a CAGR of 13.5% between 2025 and 2034. This rapid expansion is fueled by the rising demand for sustainable fuel alternatives across multiple industries. As businesses and governments worldwide emphasize carbon neutrality and cleaner energy sources, bio-based naphtha is emerging as a viable replacement for traditional fossil fuels. Derived from renewable sources like vegetable oils and biomass, this eco-friendly alternative is increasingly adopted by industries such as transportation, petrochemicals, and plastics manufacturing. The global push toward reducing greenhouse gas emissions, combined with stricter environmental regulations, has significantly contributed to the growing adoption of bio-based naphtha.

In recent years, major industry players and policymakers have accelerated investments in renewable feedstocks to meet sustainability targets. Companies are shifting their production models to integrate bio-based naphtha, leveraging its lower carbon footprint and compatibility with existing refining and petrochemical infrastructure. The growing awareness of environmental issues and the economic benefits of bio-based fuels further strengthen the market's expansion. Additionally, advancements in refining technology and increasing government subsidies for bio-based products have made bio-naphtha more accessible and cost-effective, thereby encouraging wider adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $902.5 Million |

| Forecast Value | $3.3 Billion |

| CAGR | 13.5% |

The bio-based naphtha market is categorized primarily into vegetable oil and biomass-based sources. The vegetable oil segment is anticipated to reach USD 2.4 billion by 2034, driven by the abundance and renewable nature of vegetable oils. Manufacturers prefer vegetable oils due to their ease of sourcing and lower environmental impact compared to other biomass sources. The use of vegetable oils in naphtha production helps reduce the carbon footprint of plastics and chemicals, making them an attractive feedstock option for businesses aiming to achieve sustainability goals.

In terms of application, the petrochemical segment is expected to grow at a CAGR of 12% between 2025 and 2034, generating USD 2.6 billion by 2034. The increasing use of bio-based naphtha in petrochemical production is largely attributed to its ability to reduce carbon emissions while seamlessly integrating into existing production facilities. Manufacturers are actively transitioning to bio-based naphtha to comply with stringent environmental regulations and cater to the rising demand for greener products. This shift supports long-term industry growth while helping companies meet global sustainability benchmarks.

U.S. bio-based naphtha market is forecasted to grow at a CAGR of 12% between 2025 and 2034, reaching USD 381 million by 2034. The United States remains a dominant player in the biofuels sector, benefiting from its robust production and consumption of renewable energy sources. The increasing reliance on biofuels such as ethanol, biodiesel, and renewable diesel-sourced from vegetable oils and waste products-has significantly contributed to the expansion of bio-based naphtha in the country. Government incentives and the adoption of stringent environmental policies further support market growth, positioning the U.S. as a critical hub for bio-based naphtha innovation and development.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand for renewable diesel & fuel

- 3.6.1.2 Expansion of the bioplastics & elastomers market

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating prices of raw materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Vegetable oils

- 5.3 Biomass

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Petrochemicals

- 6.3 Gasoline

- 6.4 Bio benzene

- 6.5 Bio phenol

- 6.6 Others

Chapter 7 Market Size and Forecast, By Downstream Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bio polyethylene (Bio-PE)

- 7.3 Bio polypropylene (Bio-PP)

- 7.4 Bio polyvinyl chloride (Bio-PVC)

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Diamond Green Diesel

- 9.2 Eni

- 9.3 Euglena

- 9.4 Gevo

- 9.5 Kaidi Finland

- 9.6 Neste

- 9.7 Phillips 66

- 9.8 Repsol

- 9.9 Shell

- 9.10 UPM Biofuels