|

市场调查报告书

商品编码

1716591

物联网微控制器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测IoT Microcontroller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

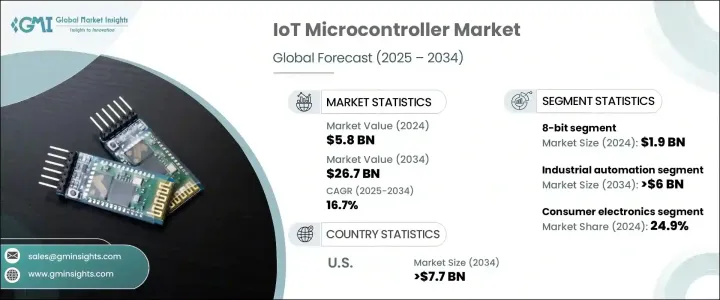

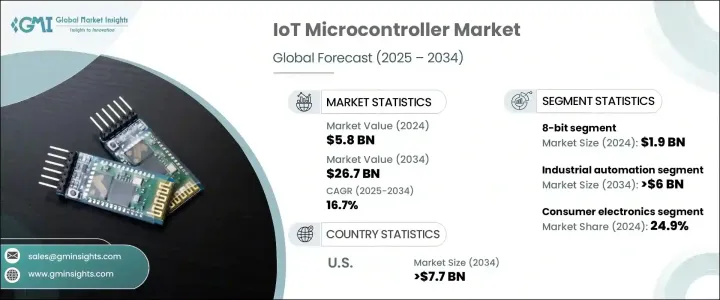

2024 年全球物联网微控制器市场规模达到 58 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 16.7%。这一增长得益于各行各业互联设备的快速普及以及工业自动化和智慧技术的持续进步。随着物联网设备的普及,对能够有效处理和管理资料的微控制器的需求激增。物联网微控制器旨在促进通讯和即时资料处理,在消费性电子、工业机械、医疗保健和智慧家庭生态系统等应用中发挥至关重要的作用。对能源效率的日益重视以及人工智慧驱动技术与物联网设备的整合进一步推动了对高性能微控制器的需求。

随着产业向数位转型过渡并采用工业 4.0 实践,对物联网微控制器的依赖预计将不断增加,以增强预测性维护、远端监控和流程最佳化。此外,5G 连接的出现和边缘运算的日益普及正在推动对能够即时管理复杂资料过程的更先进的微控制器的需求。对穿戴式装置、智慧家居设备和连网医疗保健解决方案的需求不断增长也促进了市场扩张。全球智慧城市和互联基础设施专案的发展进一步加强了物联网微控制器市场的成长轨迹。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 58亿美元 |

| 预测值 | 267亿美元 |

| 复合年增长率 | 16.7% |

市场按微控制器类型细分,包括 8 位元、16 位元和 32 位元。 8 位元微控制器市场凭藉其简单性、成本效益和低能耗,在 2024 年创造了 19 亿美元的收入。这些微控制器非常适合基本的物联网应用,尤其适合对电源效率要求严格的电池供电设备。智慧家庭设备、穿戴式装置和支援物联网的消费性电子产品的日益普及正在推动对 8 位元微控制器的需求,尤其是在智慧照明、遥控器和自动化系统等应用中。随着消费者寻求更实惠、更节能的解决方案,这些微控制器的需求预计将保持强劲。

物联网微控制器市场也按应用分类,主要领域包括工业自动化、智慧家庭设备、穿戴式装置、医疗设备、远端资讯处理和精准农业。预计到 2034 年,工业自动化将创造 60 亿美元的产值,成为最大的细分市场。智慧製造和工业 4.0 实践的广泛采用推动了物联网微控制器在汽车、航太和物流等领域的使用。这些微控制器有助于预测性维护,实现即时监控,并优化工业流程,提高整体营运效率并减少停机时间。

受智慧家庭技术和医疗保健系统需求不断增长的推动,美国物联网微控制器市场预计到 2034 年将创收 77 亿美元。各大公司持续大力投资提升微控制器效能,以满足先进物联网应用日益增长的需求。 《CHIPS法案》等政府措施旨在加强本地半导体製造,减少对外国供应链的依赖,并促进美国物联网微控制器市场的创新。这些努力有望使美国成为全球物联网微控制器领域的关键参与者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 连网设备的激增

- 无线通讯技术的进步

- 智慧家庭设备的普及率不断提高

- 物联网设备的快速普及

- 政府措施和智慧城市项目

- 产业陷阱与挑战

- 快速的技术变革

- 供应链中断

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品,2021 年至 2034 年

- 8 位元

- 16 位元

- 32 位元

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 工业自动化

- 智慧家庭设备

- 穿戴式装置

- 医疗器材

- 远端资讯处理

- 精准农业

- 其他的

第七章:市场估计与预测:依最终用途产业,2021 年至 2034 年

- 消费性电子产品

- 汽车

- 卫生保健

- 工业的

- 住宅

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Ambiq Micro, Inc.

- Analog Devices, Inc.

- ARM Holdings

- Broadcom Inc.

- Espressif Systems

- Holtek Semiconductor Inc

- Infineon Technologies AG

- Intel Corporation

- Marvell Technology Group Ltd.

- Mediatek Inc.

- Microchip Technology Inc.

- Nuvoton Technology Corporation

- NXP Semiconductors NV

- Renesas Electronics Corporation

- ROHM Semiconductor Co., Ltd.

- Seiko Epson Corporation

- Silicon Laboratories

- STMicroelectronics

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

The Global IoT Microcontroller Market reached USD 5.8 billion in 2024 and is expected to grow at a CAGR of 16.7% between 2025 and 2034. This growth is fueled by the rapid proliferation of connected devices across industries and the ongoing advancements in industrial automation and smart technologies. As the adoption of IoT-enabled devices accelerates, the demand for microcontrollers that can efficiently process and manage data has surged. IoT microcontrollers, designed to facilitate communication and real-time data processing, play a crucial role in powering applications across consumer electronics, industrial machinery, healthcare, and smart home ecosystems. The growing emphasis on energy efficiency and the integration of AI-driven technologies into IoT devices further boost the demand for high-performance microcontrollers.

As industries transition toward digital transformation and embrace Industry 4.0 practices, the reliance on IoT microcontrollers to enhance predictive maintenance, remote monitoring, and process optimization is expected to escalate. Moreover, the emergence of 5G connectivity and the increasing popularity of edge computing are driving the need for more advanced microcontrollers capable of managing complex data processes in real time. The rising demand for wearables, smart home devices, and connected healthcare solutions is also contributing to market expansion. The evolution of smart cities and connected infrastructure projects worldwide further strengthens the growth trajectory of the IoT microcontroller market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $26.7 Billion |

| CAGR | 16.7% |

The market is segmented by the type of microcontroller, with 8-bit, 16-bit, and 32-bit variants. The 8-bit microcontroller market generated USD 1.9 billion in 2024, benefiting from its simplicity, cost-effectiveness, and low energy consumption. These microcontrollers are ideal for basic IoT applications, making them particularly well-suited for battery-operated devices where power efficiency is essential. The increasing adoption of smart home devices, wearables, and IoT-enabled consumer electronics is driving the demand for 8-bit microcontrollers, especially in applications such as smart lighting, remote controls, and automation systems. As consumers seek more affordable and energy-efficient solutions, the demand for these microcontrollers is expected to remain strong.

The IoT microcontroller market is also categorized by application, with major segments including industrial automation, smart home devices, wearables, medical devices, telematics, and precision farming. Industrial automation is expected to generate USD 6 billion by 2034, making it the largest segment. The widespread adoption of smart manufacturing and Industry 4.0 practices has propelled the use of IoT microcontrollers in sectors such as automotive, aerospace, and logistics. These microcontrollers facilitate predictive maintenance, enable real-time monitoring, and optimize industrial processes, enhancing overall operational efficiency and reducing downtime.

The U.S. IoT microcontroller market is projected to generate USD 7.7 billion by 2034, driven by increasing demand for smart home technologies and healthcare systems. Major companies continue to invest heavily in enhancing microcontroller performance to meet the growing requirements of advanced IoT applications. Government initiatives, such as the CHIPS Act, aim to strengthen local semiconductor manufacturing, reduce reliance on foreign supply chains, and foster innovation in the U.S. IoT microcontroller market. These efforts are expected to position the United States as a key player in the global IoT microcontroller landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 The proliferation of connected devices

- 3.2.1.2 Advancements in wireless communication technologies

- 3.2.1.3 Increased adoption of smart home devices

- 3.2.1.4 Rapid adoption of IoT devices

- 3.2.1.5 Government initiatives and smart city projects

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rapid technological changes

- 3.2.2.2 Supply chain disruptions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Product, 2021 – 2034 (USD Million)

- 5.1 8 Bit

- 5.2 16 Bit

- 5.3 32 Bit

Chapter 6 Market estimates & forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Industrial automation

- 6.2 Smart home devices

- 6.3 Wearable devices

- 6.4 Medical devices

- 6.5 Telematics

- 6.6 Precision farming

- 6.7 Others

Chapter 7 Market estimates & forecast, By End Use Industry, 2021 – 2034 (USD Million)

- 7.1 Consumer electronics

- 7.2 Automotive

- 7.3 Healthcare

- 7.4 Industrial

- 7.5 Residential

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ambiq Micro, Inc.

- 9.2 Analog Devices, Inc.

- 9.3 ARM Holdings

- 9.4 Broadcom Inc.

- 9.5 Espressif Systems

- 9.6 Holtek Semiconductor Inc

- 9.7 Infineon Technologies AG

- 9.8 Intel Corporation

- 9.9 Marvell Technology Group Ltd.

- 9.10 Mediatek Inc.

- 9.11 Microchip Technology Inc.

- 9.12 Nuvoton Technology Corporation

- 9.13 NXP Semiconductors N.V.

- 9.14 Renesas Electronics Corporation

- 9.15 ROHM Semiconductor Co., Ltd.

- 9.16 Seiko Epson Corporation

- 9.17 Silicon Laboratories

- 9.18 STMicroelectronics

- 9.19 Texas Instruments Incorporated

- 9.20 Toshiba Electronic Devices & Storage Corporation