|

市场调查报告书

商品编码

1644540

微控制器 (MCU):全球市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Microcontroller (MCU) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

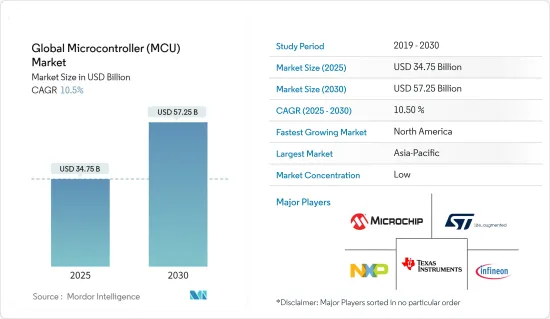

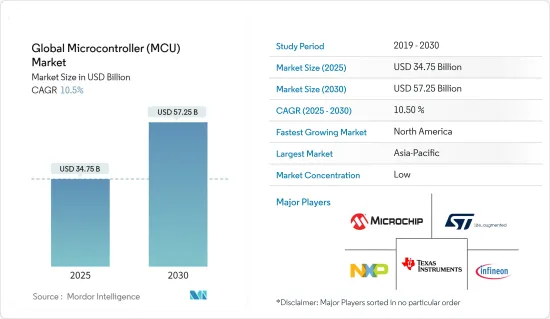

预计 2025 年全球微控制器 (MCU) 市场规模为 347.5 亿美元,到 2030 年将达到 572.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.5%。

主要亮点

- 微控制器 (MCU) 可作为运算单元并管理各种周边设备和嵌入式系统。这些系统涵盖家用电器、汽车、机器人和工业设备。透过整合处理单元、输入/输出 (I/O) 连接埠、片上储存和无线通讯模组等组件,微控制器 (MCU) 可根据特定功能进行客製化。微控制器 (MCU) 使用量的快速增长主要是由于对感测器进行资料收集和操作监控的依赖性日益增强。这些设备针对每个应用程式单独编程,并实现操作序列内的无缝资料交换。

- 微控制器(MCU)在机器人、汽车、家用电器和医疗设备中广泛使用。它价格实惠、节能高效、尺寸小巧,是嵌入式系统的理想选择。除了这些领域之外,微控制器还广泛应用于许多行业,包括家庭自动化、製造业、汽车、智慧型能源、通讯和物联网 (IoT) 部署。

- 物联网 (IoT) 的兴起、对经济高效和节能运算的需求以及无线通讯技术的进步等因素正在推动微控制器的普及。随着越来越多的企业利用物联网实现数位转型,物联网微控制器的前景仍然光明。随着物联网技术的发展,这些微控制器将在推动许多物联网应用的连接性和智慧化方面发挥关键作用。

- 旨在为世界提供连网设备的物联网应用的技术进步将推动对微控制器 (MCU) 的需求。在短距离物联网设备爆炸性成长的推动下,爱立信预测,2022年至2028年间,全球连网装置数量将成长近一倍,2028年将达到287.2亿台。这一市场的扩张可能会进一步受到消费者和企业领域物联网应用日益普及的推动,凸显对节能、高效能连网产品的需求。

- 全球微控制器(MCU)市场的分析包括适用于各种应用的 4 位元、8 位元、16 位元和 32 位元微控制器(MCU)等各种类别。微控制器(MCU)市场的一个特点是行业领导者定期推出新产品。例如,2023 年 3 月,义法半导体推出了搭载 Arm Cortex-M33 核心的 STM32WBA52 微控制器 (MCU),面向便携式医疗设备、感测器和智慧家居等应用。

- 预计汽车和消费电子产业将推动微控制器(MCU)市场的显着成长。微控制器 (MCU) 对于管理汽车引擎、变速箱和煞车等系统至关重要。此外,对电动车 (EV) 和自动驾驶的投资不断增加以及电动车销量的激增也推动了成长。除了汽车应用外,微控制器对于智慧型手机和平板电脑等消费性电子产品也至关重要,而 5G 和物联网技术的采用正在刺激需求。

- 具有先进架构的微控制器无法直接与更强大的设备交互,并且由于执行能力有限而面临操作限制。由于它们是使用互补型金属氧化物半导体 (CMOS) 技术建构的,因此也容易受到静电损坏。

- COVID-19 疫情严重扰乱了所调查市场的供应链和生产。然而,由于数位化和自动化,供应链正在显示出復苏的迹象。主要成长动力包括全球数位化投资、5G 技术的推出以及对资料中心的强劲投资。受电子产品需求成长、5G 智慧型手机的推出以及高效能运算 (HPC) 持续强劲成长的推动,预计到年终市场将进一步显着成长。

全球微控制器 (MCU) 市场趋势

汽车占很大市场占有率

- 预计预测期内汽车微控制器(MCU)市场将大幅扩张。微控制器 (MCU) 是一种小型电子元件,对于管理和控制汽车内的各种系统至关重要。这些低功耗积体电路专为嵌入式系统中的即时资料处理和控製而设计。微控制器(MCU)在汽车领域的应用范围包括高级驾驶辅助系统(ADAS)和防锁死煞车系统(ABS)、安全气囊控制、娱乐系统和变速箱控制。

- 自动化程度的提高和更严格的安全法规遵守正在推动微控制器 (MCU) 市场的成长。微控制器 (MCU) 处理感测器资料、促进电子系统之间的通讯并管理致动器以提高汽车性能、安全性和便利性。目标商标产品製造商 (OEM) 通常会在一辆普通车辆中安装约 25-35 个电控系统(ECU)。这些配备有微控制器 (MCU) 的 ECU统筹动力传动系统、悬吊和煞车等功能。

- 近年来,汽车产业对于电子元件的依赖程度越来越高,导致车载微控制器的需求激增。电动车(EV)、联网汽车和自动驾驶技术的兴起促进了这个市场的扩张。此外,消费者对提高安全性、舒适性和娱乐性的需求不断增长,推动了对先进微控制器 (MCU) 解决方案的需求。

- 在全球范围内,受新能源/电动车 (NEV) 快速成长和自动驾驶技术进步的推动,对微控制器 (MCU) 的需求正在上升。国际能源总署(IEA)预测,到2030年,净零情境的电动车销量将占汽车总销量的65%左右。为实现此目标,2023年至2030年间,电动车销量需要以平均每年25%的速度成长,届时全球电动车保有量预计将接近3.5亿辆。

- 中国、日本、印度、美国和欧盟等国家正大力投资扩大电动车(EV)的生产。这些努力可能会促进汽车产业对马达控制单元(MCU)的需求。随着联网汽车和电动车的出现,微控制器为车辆各个部件之间的通讯提供动力,实现了车对车 (V2V)通讯和无线 (OTA) 更新等功能。

- 为了满足汽车领域对微控制器的快速成长的需求,许多公司正在积极投资产品创新。 2024 年 5 月,英飞凌科技针对汽车电池管理领域推出了 PSoC 4 高压精密模拟 (HVPA)-144K 微控制器 (MCU)。这款尖端的微控制器(MCU)在单一晶片上整合了精密模拟和高压子系统,并符合 ISO26262 标准,可实现现代汽车中高效、安全的电池管理。

- 此外,2024 年 4 月,英飞凌科技股份公司宣布了 2023 年汽车半导体市场强劲的成长轨迹。该公司的成功很大程度上归功于其 AURIX 和 TRAVEO 微控制器 (MCU) 系列。这些系列正在引领汽车产业走向自主性、连结性和电气化的未来,拥有增强的动力、性能和基于人工智慧的建模和网路安全等尖端功能。

亚太地区市场将显着成长

- 亚太地区已成为半导体製造和半导体设备生产的重要中心。该地区是主要电子和汽车公司的所在地,在汽车、工业自动化、製药、消费性电子和机器人等不同行业中发挥关键作用。

- 增加对消费电子领域的投资,尤其是在印度和中国等国家,可能会促进市场成长。 GSMA预测,到2025年,印度将成为全球第二大智慧型手机市场,使用中的设备数量将达到10亿支。此外,到 2025 年,印度预计将拥有 9.2 亿独立行动用户,其中 8,800 万人将使用 5G 上网。爱立信指出,印度的智慧型手机用户份额将从 2023 年的 82% 上升至 2029 年的 93%,到 2029 年该地区的行动用户数量将达到 12.7 亿。

- 此外,亚太地区国家电动车销量的快速成长预计将推动电动车领域的投资,从而推动市场成长。例如,中国在电动车的生产和消费方面处于全球领先地位。华为预测,到2030年,自动驾驶汽车将占全球新车销售的10%以上。预测期结束时,中国的电动车普及率将增加25%。预计这一增长将推动各国对 ADAS(高级驾驶辅助系统)半导体以及微控制器(MCU)的需求。

- 在需求激增和政府积极措施的推动下,印度正处于电动车 (EV) 市场大幅成长的风口浪尖。该国制定了雄心勃勃的目标,到 2030 年,电动车销售将达到私家车占 30%、商用车占 70%、公车占 40%、两轮和三轮车占 80%。这项宏伟目标将使印度在 2030 年道路上电动车保有量达到 8,000 万辆。此外,印度还计划根据「印度製造」计划实现电动车 100% 的国内生产。公路运输和公路部很自豪地宣布,在不到九个月的时间内,电动车销量将在 2023 年突破 100 万辆。

- 根据印度汽车经销商协会联合会(FADA)的资料,印度电动车销量与前一年同期比较增49.25%,达到1,529,947辆,高于上年的1,025,063辆。电动商用车表现出色,成长114.16%,销量从2022年的2,649辆跃升至2023年的5,673辆。电动乘用车也将实现令人瞩目的成长,到 2023 年将达到 82,105 辆,比 2022 年的 38,240 辆成长 114.71%。该地区电动车需求和销量的激增有望提振 MCU 市场。

- 亚太地区凭藉着多元化的产业供应链,长期以来一直是全球经济成长的关键地区。该地区拥有印度、中国和日本等主要工业基地,在全球舞台上占有重要地位。地方政府正积极透过整合先进技术来增强工业生产能力。随着医疗保健和通讯等领域的投资激增,市场预计将进一步扩大。

全球微控制器 (MCU) 产业概况

微控制器 (MCU) 市场由 Analog Devices、STMicroelectronics 和 NXP Semiconductors 等公司主导。需求量最大的电子元件是微控制器(MCU),它在许多主要产业中有着广泛的应用,包括医疗保健、IT 和通讯、军事和国防、汽车和消费。领先的供应商不断改进其产品,并采用不同的策略来占领市场。製造商正在寻求与其他品牌建立策略合作伙伴关係并进行联合产品开发以解决问题。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- 评估宏观经济趋势对市场的影响

- 技术简介

第五章 市场动态

- 市场驱动因素

- 物联网 (IoT) 的出现

- 各行业数位化进程

- 市场挑战/限制

- 供应链中断

- 近期微型计算机价格下跌

第六章 市场细分

- 按产品

- 8 位元

- 16 位元

- 32 位元

- 按应用

- 航太和国防

- 家电

- 车

- 工业的

- 卫生保健

- 资料处理和通讯

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors

- STMicroelectronics

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- Cypress Semiconductor Corporation

- Toshiba Electronic Devices & Storage Corporation

- Intel Corporation

- Zilog Inc.

- Analog Devices Inc.

- Broadcom Inc.

- ON Semiconductor

第八章投资分析

第九章:市场的未来

The Global Microcontroller Market size is estimated at USD 34.75 billion in 2025, and is expected to reach USD 57.25 billion by 2030, at a CAGR of 10.5% during the forecast period (2025-2030).

Key Highlights

- Microcontrollers act as computing units, managing a diverse array of peripherals and embedded systems. These systems range from household appliances and vehicles to robots and industrial equipment. By integrating components like processor units, input/output (I/O) ports, on-chip storage, and wireless communication modules, microcontrollers can be customized for specific functions. A primary driver for the surge in microcontroller use is the increasing dependence on sensors for data collection and operational oversight. Programmed for distinct applications, these devices enable seamless data exchange within operational sequences.

- Microcontrollers are prevalent in robotics, automotive, consumer electronics, and medical devices. Their affordability, energy efficiency, and compact size make them the go-to choice for embedded systems. Beyond these fields, microcontrollers find applications across a spectrum of industries, including home automation, manufacturing, automotive, smart energy, communications, and Internet of Things (IoT) deployments.

- Factors like the rise of the Internet of Things (IoT), the demand for cost-effective energy-efficient computing, and advancements in wireless communication technologies are propelling the popularity of microcontrollers. With companies increasingly leveraging IoT for digital transformation, the outlook for IoT microcontrollers remains bright. As IoT technologies evolve, these microcontrollers will be pivotal in enhancing connectivity and intelligence across a multitude of IoT applications.

- Technological strides in IoT applications, aiming to deliver interconnected devices globally, are set to boost the demand for microcontrollers (MCUs). Ericsson forecasted a near doubling of globally connected devices from 2022 to 2028, driven by a surge in short-range IoT devices, projected to reach 28.72 billion by 2028. This market expansion may be further supported by the rising adoption of IoT in both consumer and enterprise sectors, emphasizing the need for energy-efficient, high-performance connected products.

- The global microcontroller (MCU) market analysis encompasses various categories, including 4- and 8-bit, 16-bit, and 32-bit microcontrollers tailored for diverse applications. A hallmark of the microcontroller market is the regular introduction of new products by leading industry players. For instance, in March 2023, STMicroelectronics launched the STM32WBA52 microcontrollers, driven by the Arm Cortex-M33 core, targeting applications in portable medical devices, sensors, and smart homes.

- Significant growth in the microcontroller market is expected to be driven by the automotive and consumer electronics sectors. Microcontrollers are vital for managing systems like the engine, transmission, and brakes in automobiles. Growth is further bolstered by rising investments in electric vehicles (EVs), autonomous driving, and surging EV sales. Beyond automotive, microcontrollers are integral to consumer electronics, including smartphones and tablets, with demand spurred by the adoption of 5G and IoT technologies.

- Microcontrollers, with their advanced architecture, cannot directly interface with higher-powered devices and face operational limitations due to restricted execution capabilities. Built using complementary metal-oxide-semiconductor (CMOS) technology, they are also vulnerable to static charge damage.

- The COVID-19 pandemic significantly disrupted the supply chain and production of the market studied. However, the supply chain has shown signs of recovery with digitalization and automation. Key growth drivers include global investments in digitization, the rollout of 5G technologies, and robust investments in data centers. By the close of 2022, the market was poised for even more pronounced growth, spurred by heightened electronics demand, 5G smartphone ramp-up, and the enduring strength of high-performance computers (HPCs).

Global Microcontroller (MCU) Market Trends

Automotive to Hold Significant Market Share

- The automotive microcontroller market is poised for significant expansion during the forecast period. Microcontrollers, compact electronic components, are pivotal in managing and regulating various systems within automobiles. These low-power integrated circuits are tailored for embedded systems' real-time data processing and control. Applications of microcontrollers in the automotive sector span advanced driver assistance systems (ADAS) and anti-lock braking systems (ABS) to airbag control, entertainment systems, and gearbox control.

- Advancements in automation and strict adherence to safety regulations are propelling the growth of the microcontroller market. Microcontrollers enhance a vehicle's performance, safety, and convenience by processing sensor data, facilitating communication between electronic systems, and managing actuators. Original equipment manufacturers (OEMs) typically embed around 25 to 35 electronic control units (ECUs) in standard vehicles. These ECUs, powered by microcontrollers, oversee functions like the powertrain, suspension, brakes, and more.

- In recent years, the automotive industry's growing reliance on electronic components has led to a surge in demand for automotive microcontrollers. The rise of electric vehicles (EVs), connected cars, and autonomous driving technologies has been instrumental in this market's expansion. Furthermore, escalating consumer demands for enhanced safety, comfort, and entertainment have intensified the need for advanced microcontroller solutions.

- Globally, the demand for microcontrollers is set to rise, driven by the surge in new energy/electric vehicles (NEVs) and advancements in autonomous driving. The International Energy Agency (IEA) projects that electric car sales in the Net Zero Scenario could constitute about 65% of total car sales by 2030. To meet this target, electric car sales must grow at an average rate of 25% annually from 2023 to 2030, leading to an anticipated global electric car stock of nearly 350 million vehicles by 2030.

- Countries including China, Japan, India, the United States, and several EU states are heavily investing in boosting electric vehicle (EV) production. Such initiatives are likely to escalate the demand for Motor Control Units (MCUs) in the automotive industry. The advent of connected cars and EVs has empowered microcontrollers to bolster communication between various vehicle components, enabling features like vehicle-to-vehicle (V2V) communication and over-the-air (OTA) updates.

- Numerous companies are actively investing in product innovations in response to the surging demand for microcontrollers in the automotive realm. In May 2024, Infineon Technologies launched the PSoC 4 High Voltage Precision Analog (HVPA)-144K microcontroller, tailored for the automotive battery management sector. This state-of-the-art microcontroller integrates high-precision analog and high-voltage subsystems on a single chip and meets ISO26262 standards, ensuring efficient and secure battery management in modern vehicles.

- Additionally, in April 2024, Infineon Technologies AG announced its robust growth trajectory in the automotive semiconductors market for 2023. The company's success is largely attributed to its AURIX and TRAVEO microcontroller families. These families are steering the automotive industry toward a future of autonomy, connectivity, and electrification, boasting enhanced power, performance, and cutting-edge features like AI-based modeling and cybersecurity.

Asia-Pacific to Experience Significant Market Growth

- Asia-Pacific has solidified its status as a pivotal hub for semiconductor manufacturing and the production of semiconductor-based devices. Home to leading electronics and automotive firms, the region plays a vital role across diverse industries, including automotive, industrial automation, pharmaceuticals, consumer electronics, and robotics.

- Growing investments in the consumer electronics sector, particularly in countries like India and China, are set to propel market growth. GSMA forecasts India will rank as the world's second-largest smartphone market by 2025, with a projected 1 billion devices in use. By 2025, India is also expected to have 920 million unique mobile subscribers, 88 million of whom will be on 5G. Ericsson notes that the share of smartphone subscriptions in India will rise from 82% in 2023 to 93% by 2029, with total mobile subscriptions in the region hitting 1.27 billion by 2029.

- Furthermore, surging EV sales and investments in the EV sector across APAC nations are anticipated to fuel market growth. For example, China stands out as a global leader in EV production and consumption. Huawei forecasts that by 2030, autonomous vehicles will account for over 10% of global new vehicle sales. China's EV penetration is set to rise by 25% by the end of the forecast period. This growth is expected to boost demand for semiconductors in advanced driver-assistance systems (ADAS) and, consequently, for microcontrollers (MCUs) across various countries.

- India is on the brink of significant market growth, spurred by surging demand for electric vehicles (EVs) and proactive government initiatives. The nation aims for ambitious EV sales targets by 2030: 30% for private cars, 70% for commercial vehicles, 40% for buses, and a striking 80% for two- and three-wheelers. This ambition translates to a goal of 80 million EVs on Indian roads by 2030. Further underscoring its commitment, India strives for 100% local EV production under the 'Make in India' initiative. The Ministry of Road Transport and Highways proudly announced surpassing 1 million EV sales in under nine months in 2023, a feat that took the entirety of 2022.

- Data from the Federation of Automobile Dealers' Association (FADA) highlights a robust 49.25% Y-o-Y surge in India's electric vehicle sales, totaling 1,529,947 units in 2023, up from 1,025,063 units the previous year. E-commercial vehicles saw a remarkable 114.16% increase, with sales jumping from 2,649 units in 2022 to 5,673 in 2023. Electric passenger vehicles also showcased impressive growth, reaching 82,105 units in 2023, a 114.71% rise from the 38,240 units sold in 2022. Such surging EV demand and sales in the region are poised to bolster the market for MCUs.

- Asia-Pacific has long been a cornerstone of global economic growth, thanks to its diverse industrial supply chains. With major industrial hubs in countries like India, China, and Japan, the region is a dominant player on the world stage. Regional governments are actively enhancing industrial manufacturing capabilities by integrating advanced technologies. As investments surge in sectors like healthcare and communications, the market is poised for further expansion.

Global Microcontroller (MCU) Industry Overview

The microcontroller (MCU) market is dominated by players like Analog Devices, STMicroelectronics, and NXP Semiconductors. The most in-demand electronic components are the microcontrollers, which have a wide range of applications across many key industry verticals: healthcare, IT and telecommunications, military and defense, automotive, and consumer. The major providers are in the process of the constant evolution of products, following different strategies to capture the market. The players are looking forward to strategic collaboration with other brands and joint product developments to come up with problem-solving solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Internet of Things (IoT)

- 5.1.2 Increasing digitalization across industries

- 5.2 Market Challenges/Restraints

- 5.2.1 Disruptions in supply chain

- 5.2.2 Declining prices of microcontrollers in recent years

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 8-bit

- 6.1.2 16-bit

- 6.1.3 32-bit

- 6.2 By Application

- 6.2.1 Aerospace and Defense

- 6.2.2 Consumer Electronics and Home Appliances

- 6.2.3 Automotive

- 6.2.4 Industrial

- 6.2.5 Healthcare

- 6.2.6 Data Processing and Communication

- 6.2.7 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Microchip Technology Inc.

- 7.1.3 NXP Semiconductors

- 7.1.4 STMicroelectronics

- 7.1.5 Texas Instruments Incorporated

- 7.1.6 Renesas Electronics Corporation

- 7.1.7 Cypress Semiconductor Corporation

- 7.1.8 Toshiba Electronic Devices & Storage Corporation

- 7.1.9 Intel Corporation

- 7.1.10 Zilog Inc.

- 7.1.11 Analog Devices Inc.

- 7.1.12 Broadcom Inc.

- 7.1.13 ON Semiconductor