|

市场调查报告书

商品编码

1716645

二手收藏品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Second-hand Collectibles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

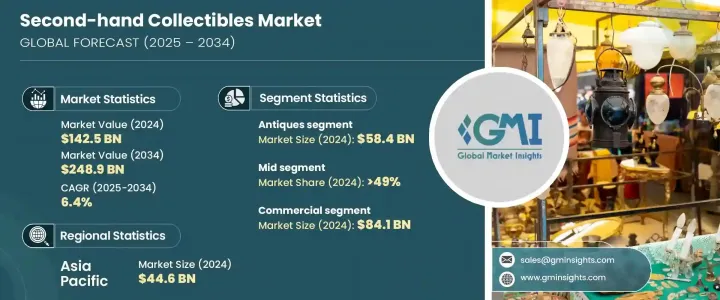

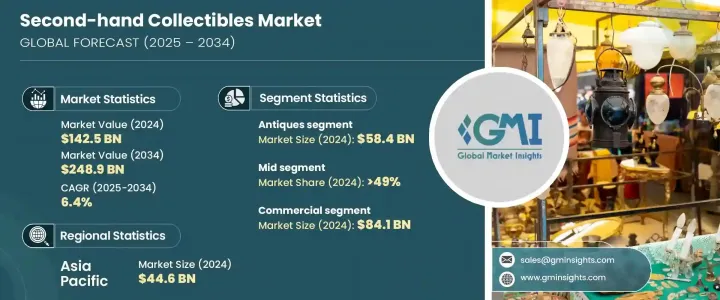

2024 年全球二手收藏品市场价值为 1,425 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 6.4%。这个快速扩张的市场受到人们对永续消费的日益增长的偏好、对循环经济的认识的提高以及对独特、实惠且具有环境效益的物品的需求不断增长的推动。随着消费者越来越意识到减少浪费和永续发展,二手收藏品市场获得了显着的发展势头,吸引了经验丰富的收藏家和新时代的购物者。

线上转售平台、社交商务和专用市场应用程式的普及度激增,进一步简化了二手收藏品的买卖流程,使消费者比以往更容易获得来自世界各地的各种物品。人们现在不再只关注所有权,而是对收藏品所蕴含的故事和历史意义更感兴趣。从限量版玩具到稀有邮票和古董文物,二手收藏品不仅代表许多人的热情,也是明智的投资选择。此外,由于经济不确定性促使消费者寻求更具成本效益的购买选择,二手收藏品的可负担性和独特性正成为主要卖点。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1425亿美元 |

| 预测值 | 2489亿美元 |

| 复合年增长率 | 6.4% |

二手收藏品市场分为多个类别,包括古董、玩具、漫画书、邮票、运动纪念品和其他小众领域。其中,古董在2024年创造了584亿美元的产值,预计2025年至2034年的复合年增长率为6.7%。受历史工艺和文化意义的永恆吸引力的推动,古董继续占据市场主导地位。收藏家尤其对那些反映独特时代、风格和艺术性的古董感兴趣,现在许多这样的物品可以透过线上市场和传统拍卖行的结合更容易获得。全球平台上经过鑑定和评估的古董越来越多,这使得爱好者和投资者更容易购买高价值物品,推动了该领域的上升趋势。

按价格范围分析,中端市场在 2024 年占据了 49% 的市场份额,收藏品的价格通常在 50 美元到 500 美元之间。这个细分市场吸引了寻求在可负担性和独家性之间取得平衡的买家的注意,使其成为收藏品领域最具活力的领域之一。古董玩具、收藏卡和限量版纪念品占据了这一领域的主要份额,尤其是 eBay 和 Etsy 等平台继续为中檔买家提供各种抢手商品。小众兴趣团体和线上社群的兴起也促进了这一领域的增长,使收藏家能够更轻鬆地发现和交换有价值的藏品。

从地区来看,亚太地区占 31.3% 的份额,2024 年创造了 446 亿美元的收入。这一强劲的地区表现归因于可支配收入的增加、快速的城市化以及对古典和现代收藏品根深蒂固的文化欣赏。历史和艺术底蕴深厚的国家对优质收藏品的需求正在激增,包括稀有邮票、古代绘画和古董文物。亚太地区收藏家的品味不断变化,加上透过线上平台进入国际市场的管道不断改善,继续巩固该地区在全球二手收藏品领域的突出地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 重要新闻和倡议

- 製造商

- 经销商

- 零售商

- 成长动力

- 古董投资潜力不断成长

- 收藏品购买平台日益壮大

- 增加可支配收入

- 收藏爱好日益流行

- 产业陷阱与挑战

- 仿冒品和伪造品

- 进出口限制

- 成长动力

- 成长潜力分析

- 消费者行为分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 古董

- 玩具

- 硬币

- 漫画书

- 邮票

- 体育纪念品

- 其他的

第六章:市场估计与预测:依价格区间,2021-2034

- 主要趋势

- 低的

- 中

- 高的

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 个人

- 商业的

- 博物馆

- 机构

- 其他(饭店、餐厅等)

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 离线

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- BiddingForGood

- Bonhams

- Christie's

- ComicConnect

- eBay

- Golden Auctions

- Hakes Auctions

- Heritage Auctions

- Invaluable

- Julien's Auctions

- Lelands

- PWCC Marketplace

- RR Auction

- Skinner, Inc.

- Sotheby's

The Global Second-hand Collectibles Market was valued at USD 142.5 billion in 2024 and is projected to grow at a CAGR of 6.4% between 2025 and 2034. This rapidly expanding market is fueled by a rising preference for sustainable consumption, heightened awareness of the circular economy, and the growing demand for unique, affordable items that also offer environmental benefits. As consumers become increasingly conscious of waste reduction and sustainability, the second-hand collectibles market has gained significant traction, appealing to both seasoned collectors and new-age shoppers.

The surge in popularity of online resale platforms, social commerce, and dedicated marketplace apps has further simplified the process of buying and selling pre-owned collectibles, making it easier than ever for consumers to access a broad variety of items from across the globe. People are now looking beyond mere ownership and are more interested in the stories and historical significance attached to collectible pieces. From limited-edition toys to rare stamps and antique artifacts, second-hand collectibles represent not only a passion for many but also a smart investment option. Moreover, as economic uncertainties prompt consumers to seek more cost-effective purchasing options, the affordability and exclusivity of pre-owned collectibles are becoming major selling points.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $142.5 Billion |

| Forecast Value | $248.9 Billion |

| CAGR | 6.4% |

The market for second-hand collectibles is divided into various categories, including antiques, toys, comic books, stamps, sports memorabilia, and other niche segments. Among these, antiques generated USD 58.4 billion in 2024 and are projected to grow at a CAGR of 6.7% from 2025 to 2034. Antiques continue to dominate the market, driven by the timeless appeal of historical craftsmanship and cultural significance. Collectors are particularly drawn to antique pieces that reflect unique eras, styles, and artistry, and many of these items are now more accessible through a combination of online marketplaces and traditional auction houses. The growing availability of authenticated and appraised antique pieces across global platforms has made it easier for enthusiasts and investors alike to purchase high-value items, fueling the segment's upward trajectory.

When analyzed by price range, the mid segment accounted for 49% of the market share in 2024, with collectibles typically priced between USD 50 and USD 500. This segment has captured the attention of buyers seeking a balance between affordability and exclusivity, making it one of the most dynamic areas within the collectibles landscape. Vintage toys, collectible cards, and limited-edition memorabilia dominate this segment, especially as platforms like eBay and Etsy continue to offer a wide selection of sought-after items for mid-range buyers. The rise of niche interest groups and online communities has also contributed to the growth of this segment, enabling collectors to discover and exchange valuable pieces more easily.

Regionally, Asia-Pacific held a 31.3% share and generated USD 44.6 billion in 2024. This strong regional performance is attributed to increasing disposable incomes, rapid urbanization, and a deep-rooted cultural appreciation for both classical and modern collectibles. Countries rich in history and artistry are witnessing surging demand for premium collectibles, including rare stamps, ancient paintings, and vintage artifacts. The evolving tastes of collectors across Asia-Pacific, combined with improved access to international markets through online platforms, continue to reinforce the region's prominent position in the global second-hand collectibles landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.3 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Key news & initiatives

- 3.5 Manufacturers

- 3.6 Distributors

- 3.7 Retailers

- 3.7.1 Growth drivers

- 3.7.1.1 Growing investment potentials of antiques

- 3.7.1.2 Growing platforms for buying collectibles

- 3.7.1.3 Increasing disposable income

- 3.7.1.4 Growing trend of collection as a hobby

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Counterfeits and forgeries

- 3.7.2.2 Import/export restrictions

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Consumer Behavior analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Antiques

- 5.3 Toys

- 5.4 Coins

- 5.5 Comic books

- 5.6 Stamps

- 5.7 Sports memorabilia

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Low

- 6.3 Mid

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Individual

- 7.3 Commercial

- 7.3.1 Museum

- 7.3.2 Institutions

- 7.3.3 Others (Hotels, Restaurants, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 BiddingForGood

- 10.2 Bonhams

- 10.3 Christie's

- 10.4 ComicConnect

- 10.5 eBay

- 10.6 Golden Auctions

- 10.7 Hakes Auctions

- 10.8 Heritage Auctions

- 10.9 Invaluable

- 10.10 Julien's Auctions

- 10.11 Lelands

- 10.12 PWCC Marketplace

- 10.13 RR Auction

- 10.14 Skinner, Inc.

- 10.15 Sotheby's