|

市场调查报告书

商品编码

1716657

动物饲料添加剂市场机会、成长动力、产业趋势分析及2025-2034年预测Animal Feed Additives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

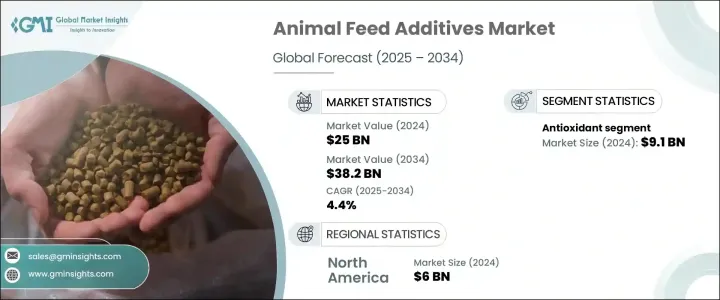

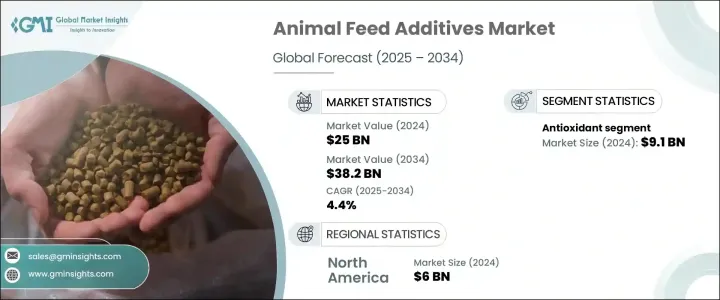

2024 年全球动物饲料添加剂市场规模达 250 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.4%。饲料添加剂可提高牲畜饲料的营养价值并提高整体动物生产力。这些物质包括维生素、胺基酸、酵素、抗氧化剂和益生菌,在提高牲畜健康和生产效率方面发挥着至关重要的作用。随着全球人口的成长,对高品质肉类产品的需求也随之增加,推动了对有效饲料解决方案的需求。随着对动物福利的日益关注,农民正在寻求强化饲料产品,以确保家禽、猪、牛、水产养殖和其他牲畜类别更好的消化、营养吸收和整体表现。

对提高饲料效率的关注增加了人们对各种添加剂的兴趣,包括酵素、甜味剂和益生菌。这些产品可以增强消化率、促进肠道健康、改善免疫功能,进而提高动物的生产力。此外,畜牧业在生产肉类、乳製品和其他农产品方面的重要性日益增加,特别是在火鸡、肉鸡、猪、肉牛和乳牛等领域。快速的城市化、不断增长的食品和饮料行业以及不断扩大的食品服务业进一步促进了对动物饲料添加剂的需求不断增长,尤其是在北美。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 250亿美元 |

| 预测值 | 382亿美元 |

| 复合年增长率 | 4.4% |

市场根据产品类型进行细分,其中抗氧化剂占有相当大的份额。 2024 年,抗氧化剂部门创造了 91 亿美元的收入。北美对动物营养和福祉的日益关注促进了维生素部门的成长。生产者和农民越来越多地投资强化饲料产品,以确保牲畜获得更好的性能和更高的产量所需的必需营养素。动物生产力的提高会提高肉类、牛奶和蛋类的产量,进而增强饲料添加剂市场。维生素A、D、E和B复合物在牲畜中发挥重要的生理功能,进一步推动了强化饲料的采用。

饲料添加剂技术的进步以及更严格的动物福利法规正在促进市场的成长。生产商正在转向强化饲料解决方案,以满足日益增长的动物性蛋白质需求,同时确保可持续和高效的畜牧业生产。立法改革和饲料品质标准意识的提高进一步支持了这一转变,促进了强化饲料配方的采用。

北美引领全球动物饲料添加剂市场,2024 年的营收将达到 60 亿美元。家禽产业尤其受益于鸡肉产品需求的成长。维生素、矿物质、胺基酸、酵素和益生菌等添加剂在优化饲料利用率、改善肠道健康和提高家禽生产力方面发挥关键作用。无抗生素鸡肉生产的日益增长、高品质蛋白质消费量的增加以及严格的食品安全法规是推动市场成长的主要动力。此外,不断发展的饲料配方政策以及对永续和有机家禽养殖的高度关注正在进一步加强市场地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 动物性蛋白质需求不断成长

- 关注动物健康与营养

- 抗生素使用限制

- 产业陷阱与挑战

- 原物料价格波动

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 抗氧化剂

- 颜料

- 酵素

- 口味

- 甜味剂

- 益生菌

- 维生素

第六章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第七章:公司简介

- Adm

- Alltech

- Basf

- Biomin Holdings

- Cargill

- Dr. Eckel

- Dsm

- Dupont

- Impextraco

- Iptsa

- Kemin Industries

- Lucta

- Miavit

- Novus International

- Nutreco

- Nutriad

The Global Animal Feed Additives Market reached USD 25 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Feed additives enhance the nutritional value of livestock feed and improve overall animal productivity. These substances include vitamins, amino acids, enzymes, antioxidants, and probiotics, playing a crucial role in boosting livestock health and production efficiency. As global populations rise, the demand for high-quality meat products increases, driving the need for effective feed solutions. With growing attention to animal welfare, farmers are seeking fortified feed products to ensure better digestion, nutrient absorption, and overall performance in poultry, swine, cattle, aquaculture, and other livestock categories.

The focus on improving feed efficiency has amplified interest in a diverse range of additives, including enzymes, sweeteners, and probiotics. These products enhance digestibility, promote gut health, and improve immune function, which, in turn, increases animal productivity. Additionally, the livestock sector's importance in producing meat, dairy, and other agricultural products is increasing, particularly in segments like turkeys, broilers, swine, beef, and dairy cattle. Rapid urbanization, the growing food and beverage industry, and expanding food service sectors further contribute to the rising demand for animal feed additives, particularly in North America.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25 Billion |

| Forecast Value | $38.2 Billion |

| CAGR | 4.4% |

The market is segmented based on product type, with antioxidants holding a significant share. The antioxidant segment generated USD 9.1 billion in revenue in 2024. The growing focus on animal nutrition and well-being in North America is contributing to the growth of the vitamins segment. Producers and farmers are increasingly investing in fortified feed products to ensure that livestock receive the essential nutrients required for better performance and higher yields. Enhanced animal productivity leads to increased production of meat, milk, and eggs, strengthening the market for feed additives. Vitamins such as A, D, E, and B complexes perform vital physiological functions in livestock, further driving the adoption of fortified feeds.

Technological advancements in feed additives, along with stricter animal welfare regulations, are fostering growth in the market. Producers are shifting towards fortified feed solutions to meet rising demands for animal protein while ensuring sustainable and efficient livestock production. This transition is further supported by legislative reforms and increasing awareness of feed quality standards, promoting the adoption of enhanced feed formulations.

North America leads the global animal feed additives market, generating USD 6 billion in revenue in 2024. The poultry sector, in particular, is benefiting from the rising demand for chicken products. Additives such as vitamins, minerals, amino acids, enzymes, and probiotics play a critical role in optimizing feed utilization, improving gut health, and boosting poultry productivity. The growing shift toward antibiotic-free chicken production, higher consumption of high-quality protein, and stringent food safety regulations are the primary drivers fueling the market's growth. Moreover, evolving feed formulation policies and a heightened focus on sustainable and organic poultry farming are further strengthening the market position.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Base estimates and calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news and initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for animal protein

- 3.6.1.2 Focus on animal health and nutrition

- 3.6.1.3 Restrictions on antibiotic use

- 3.6.2 Industry pitfalls and challenges

- 3.6.2.1 volatile raw material prices

- 3.6.2.2 stringent regulatory requirements

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Antioxidant

- 5.3 Pigments

- 5.4 Enzymes

- 5.5 Flavors

- 5.6 Sweeteners

- 5.7 Probiotics

- 5.8 Vitamins

Chapter 6 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Netherlands

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 South Korea

- 6.5 Latin America

- 6.5.1 Brazil

- 6.5.2 Mexico

- 6.5.3 Argentina

- 6.6 Middle East and Africa

- 6.6.1 Saudi Arabia

- 6.6.2 South Africa

- 6.6.3 UAE

Chapter 7 Company Profiles

- 7.1 Adm

- 7.2 Alltech

- 7.3 Basf

- 7.4 Biomin Holdings

- 7.5 Cargill

- 7.6 Dr. Eckel

- 7.7 Dsm

- 7.8 Dupont

- 7.9 Impextraco

- 7.10 Iptsa

- 7.11 Kemin Industries

- 7.12 Lucta

- 7.13 Miavit

- 7.14 Novus International

- 7.15 Nutreco

- 7.16 Nutriad