|

市场调查报告书

商品编码

1716678

边缘人工智慧市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Edge AI Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

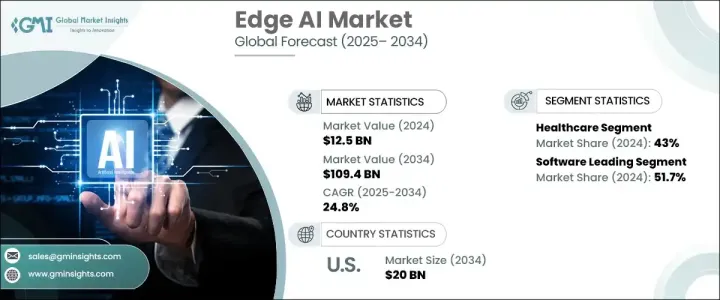

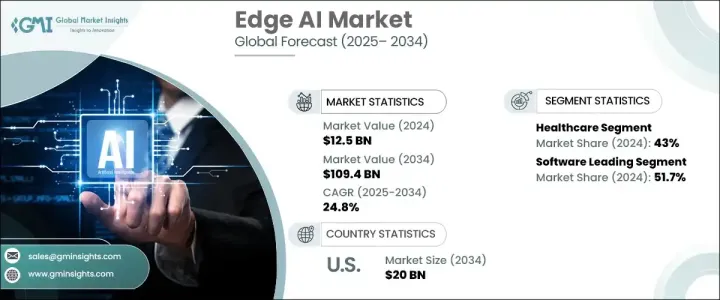

全球边缘人工智慧市场在 2024 年的价值为 125 亿美元,预计在 2025 年至 2034 年期间将以 24.8% 的强劲复合年增长率扩张,这得益于对智慧、分散式运算解决方案的需求的快速增长。随着各行各业不断拥抱数位转型,边缘人工智慧正在成为一种改变游戏规则的技术,它使企业能够直接在源头处理和分析资料,从而减少延迟、提高安全性并最大限度地减少对云端基础设施的依赖。物联网设备日益普及,加上对 5G 和人工智慧晶片组的投资不断增加,进一步推动了医疗保健、製造、零售、汽车和电信等关键领域对边缘人工智慧的采用。

企业正在优先考虑能够实现即时决策和自动化的解决方案,尤其是在产业转向工业 4.0 和人工智慧驱动的生态系统的情况下。边缘 AI 解决方案在实现更快洞察、减少营运瓶颈和提供个人化体验方面发挥着至关重要的作用。对高效、安全地处理边缘设备产生的海量资料的需求日益增长,这也促使企业大力投资可在设备上运行而无需依赖持续云连接的人工智慧演算法。此外,人工智慧处理器和专用边缘人工智慧硬体的进步使得这些解决方案对于各种规模的企业来说更易于存取、更具成本效益且更具可扩展性。随着资料隐私问题日益严重,越来越多的组织开始转向边缘人工智慧来确保资料的安全处理和法规遵循,进一步增强了市场的成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 125亿美元 |

| 预测值 | 1094亿美元 |

| 复合年增长率 | 24.8% |

边缘人工智慧市场涵盖多个终端产业,包括医疗保健、製造业、银行和金融服务、政府、零售、电信、运输和物流。其中,医疗保健在 2024 年占据全球市场主导地位,占有 43% 的份额,因为边缘人工智慧将继续彻底改变病患照护。医疗保健提供者正在使用人工智慧穿戴装置、远端监控系统和先进的诊断工具来实现即时患者追踪、自动医学影像分析和更快的临床决策。这些创新不仅改善了患者的治疗效果,还简化了操作并降低了医疗成本。

根据组件,市场细分为软体、硬体和服务,其中软体占 2024 年总市场份额的 51.7%。软体解决方案日益突出,这归因于它们在部署人工智慧模型、促进即时分析和确保边缘资料安全方面发挥的关键作用。人工智慧软体框架对于使边缘设备能够独立处理和分析资料、支援人工智慧模型更新以及在不依赖云端的情况下优化系统性能至关重要,可以满足对即时智慧洞察日益增长的需求。

预计到 2034 年,美国边缘人工智慧市场规模将达到 200 亿美元,这得益于美国在医疗保健、智慧城市和工业自动化领域广泛采用人工智慧。领先的科技巨头和半导体公司大力开发人工智慧晶片和边缘平台,再加上政府推动人工智慧创新和基础设施现代化的倡议,正在加速成长。 5G、物联网和云端边缘整合的快速发展继续塑造美国边缘人工智慧部署的动态生态系统

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 硬体提供者

- 软体供应商

- 云端服务供应商

- 託管服务提供者

- 最终用途

- 供应商格局

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 案例研究

- 监管格局

- 衝击力

- 成长动力

- 边缘设备在各个终端应用领域的采用率不断提高

- 人工智慧技术投资不断增加

- 5G网路的普及率不断提高

- 云端运算技术的采用激增

- 产业陷阱与挑战

- 隐私和安全问题

- 互通性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依组件,2021 年至 2034 年

- 主要趋势

- 硬体

- 图形处理单元 (GPU)

- 专用积体电路(ASIC),

- 中央处理器(CPU)

- 现场可程式闸阵列(FPGA)

- 软体

- 服务

- 培训与咨询

- 支援与维护

- 系统整合与测试

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 视讯监控

- 远端监控

- 预测性维护

- 其他的

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 製造业

- 卫生保健

- 英国标准与製造工业联合会

- 政府

- 零售与电子商务

- 电信

- 运输与物流

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- Anagog

- Amazon

- ADLINK

- Clearblade

- Cloudera

- Dell

- Gorilla Technology

- Huawei

- IBM

- Intel

- Microsoft

- MediaTek

- Mavenir System

- Nutanix

- Nvidia

- Synaptics

- Qualcomm

- Veea

- Xilinx

The Global Edge AI Market, valued at USD 12.5 billion in 2024, is projected to expand at a robust CAGR of 24.8% from 2025 to 2034, driven by the rapid surge in demand for intelligent, decentralized computing solutions. As industries continue to embrace digital transformation, edge AI is emerging as a game-changing technology that enables businesses to process and analyze data directly at the source - reducing latency, improving security, and minimizing dependency on cloud infrastructures. The increasing penetration of IoT devices, coupled with growing investments in 5G and AI chipsets, is further fueling the adoption of edge AI across critical sectors, including healthcare, manufacturing, retail, automotive, and telecommunications.

Companies are prioritizing solutions that empower real-time decision-making and automation, particularly as industries shift toward Industry 4.0 and AI-driven ecosystems. Edge AI solutions are playing a crucial role in enabling faster insights, reducing operational bottlenecks, and delivering personalized experiences. The growing need to handle massive amounts of data generated by edge devices efficiently and securely has also prompted enterprises to invest heavily in AI algorithms that can run on-device without relying on continuous cloud connectivity. Moreover, advancements in AI processors and dedicated edge AI hardware are making these solutions more accessible, cost-effective, and scalable for businesses of all sizes. As data privacy concerns escalate, organizations are increasingly turning to edge AI for secure data handling and regulatory compliance, further strengthening market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.5 Billion |

| Forecast Value | $109.4 Billion |

| CAGR | 24.8% |

The edge AI market spans several end-use industries, including healthcare, manufacturing, banking and financial services, government, retail, telecommunications, transportation, and logistics. Among these, healthcare dominated the global market with a 43% share in 2024, as AI at the edge continues to revolutionize patient care. Healthcare providers are using AI-powered wearables, remote monitoring systems, and advanced diagnostics tools to enable real-time patient tracking, automated medical image analysis, and faster clinical decision-making. These innovations not only improve patient outcomes but also streamline operations and reduce healthcare costs.

Based on components, the market is segmented into software, hardware, and services, with software accounting for 51.7% of the total market share in 2024. The rising prominence of software solutions is attributed to their critical role in deploying AI models, facilitating real-time analytics, and ensuring data security at the edge. AI software frameworks are essential for enabling edge devices to process and analyze data independently, support AI model updates, and optimize system performance without cloud reliance, addressing the growing need for instant, intelligent insights.

The U.S. edge AI market is anticipated to reach USD 20 billion by 2034, backed by the country's widespread adoption of AI across healthcare, smart cities, and industrial automation. The strong presence of leading tech giants and semiconductor companies developing AI chips and edge platforms, coupled with government initiatives promoting AI innovation and infrastructure modernization, is accelerating growth. Rapid advancements in 5G, IoT, and cloud-edge integration continue to shape a dynamic ecosystem for edge AI deployment in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Hardware providers

- 3.1.2 Software providers

- 3.1.3 Cloud service providers

- 3.1.4 Managed service provider

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing adoption of edge devices across various end use verticals

- 3.9.1.2 Growing investment in AI technology

- 3.9.1.3 Growing adoption of 5G network

- 3.9.1.4 Surging adoption of cloud computing technology

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Privacy and security concerns

- 3.9.2.2 Interoperability issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Graphics Processing Unit (GPU)

- 5.2.2 Application Specific Integrated Circuit (ASIC),

- 5.2.3 Central Processing Unit (CPU)

- 5.2.4 Field-Programmable Gate Array (FPGA)

- 5.3 Software

- 5.4 Service

- 5.4.1 Training & consulting

- 5.4.2 Support & maintenance

- 5.4.3 System integration and testing

Chapter 6 Market Estimates & Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Video surveillance

- 6.3 Remote monitoring

- 6.4 Predictive maintenance

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Healthcare

- 7.4 BSFI

- 7.5 Government

- 7.6 Retail & e-commerce

- 7.7 Telecommunication

- 7.8 Transport & logistics

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Anagog

- 9.2 Amazon

- 9.3 ADLINK

- 9.4 Clearblade

- 9.5 Cloudera

- 9.6 Dell

- 9.7 Google

- 9.8 Gorilla Technology

- 9.9 Huawei

- 9.10 IBM

- 9.11 Intel

- 9.12 Microsoft

- 9.13 MediaTek

- 9.14 Mavenir System

- 9.15 Nutanix

- 9.16 Nvidia

- 9.17 Synaptics

- 9.18 Qualcomm

- 9.19 Veea

- 9.20 Xilinx