|

市场调查报告书

商品编码

1716687

综合车辆健康管理 (IVHM) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Integrated Vehicle Health Management (IVHM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

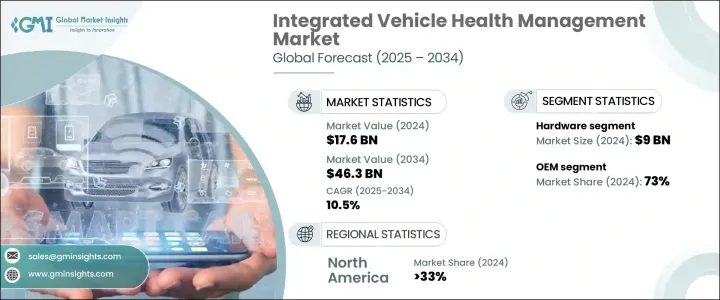

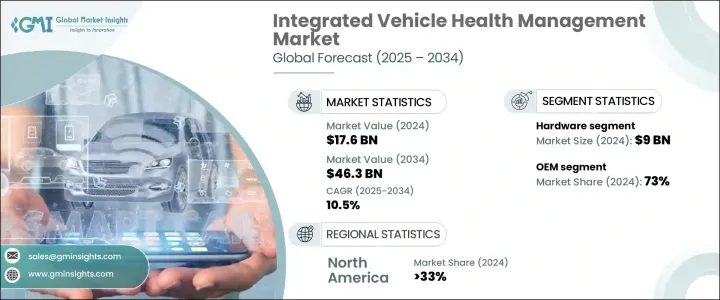

2024 年全球综合车辆健康管理市场价值为 176 亿美元,预计 2025 年至 2034 年期间的复合年增长率为 10.5%。这一扩张受到电动车 (EV) 的快速普及、连网汽车的兴起以及现代汽车对预测性维护日益增长的需求的推动。随着汽车技术变得越来越复杂,製造商和车队营运商正专注于即时车辆健康监测,以提高性能、延长使用寿命并减少停机时间。 IVHM 系统现在是汽车生态系统的重要组成部分,提供即时诊断、预测分析和主动维护解决方案。

汽车製造商正在整合先进的 IVHM 技术,以提高车辆效率、最大限度地减少故障并提高整体安全性。随着汽车产业向电气化转变,对电池健康监测解决方案的需求激增。电动和混合动力汽车需要持续追踪动力传动系统、电池电压和充电系统等重要零件。汽车电子设备日益复杂,加上自动驾驶技术的兴起,进一步增加了对复杂的 IVHM 解决方案的需求。汽车製造商、车队经理和服务供应商正在利用人工智慧分析和基于云端的平台来确保主动维护并最大限度地降低营运风险。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 176亿美元 |

| 预测值 | 463亿美元 |

| 复合年增长率 | 10.5% |

IVHM 市场分为硬体、软体和服务,其中硬体占据主导地位。 2024年,硬体占50%的市场份额,创造90亿美元的产值。感测器在监测车辆关键参数(包括引擎温度、轮胎压力和电池健康状况)方面发挥关键作用。这些组件支援即时诊断,确保关键系统以最佳方式运作。随着汽车产业的发展,对专为电动车和自动驾驶汽车设计的专用硬体的需求持续上升。

市场区隔还包括分销管道,其中原始设备製造商 (OEM) 占有相当大的份额。 2024 年,由于原始设备製造商在製造过程中将 IVHM 系统整合到车辆中,因此占据了 73% 的市场份额。这种无缝整合使得车辆从一开始就受益于先进的诊断、远端资讯处理和持续监控功能。原始设备製造商始终处于创新的前沿,满足电动车和连网汽车车主不断变化的需求。随着预测性维护和电池健康管理在电动车领域变得至关重要,製造商正在大力投资尖端 IVHM 解决方案。

2024 年美国综合车辆健康管理 (IVHM) 市场规模达 32 亿美元,占 33%。该国在汽车和航太领域的强大影响力推动了对 IVHM 技术的需求。与车辆安全、排放和维护相关的更严格的政府法规进一步加速了采用。此外,商业车队营运商和国防机构正在优先考虑预测性维护以提高营运效率。美国市场正在经历向数据驱动的车辆健康管理系统的快速转变,以确保整个运输行业的最佳性能、合规性和成本节约。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 平台提供者

- 软体供应商

- 服务提供者

- 配销通路

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 成本細項分析

- 监管格局

- 衝击力

- 成长动力

- 预测性维护的需求不断成长

- 电动车和连网汽车的需求增加

- 车辆复杂度不断增加

- 物联网和人工智慧的技术进步

- 监管要求和安全标准

- 产业陷阱与挑战

- 资料安全和隐私问题

- 与遗留系统整合的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 感应器

- 电子控制单元(ECU)

- 数据采集系统

- 通讯模组

- 远端资讯处理控制单元 (TCU)

- 车载诊断 (OBD) 端口

- 软体

- 诊断软体

- 预测软体

- 资料管理软体

- 使用者介面(UI)软体

- 服务

- 安装和整合服务

- 维护和维修服务

- 咨询服务

第六章:市场估计与预测:按通路,2021 - 2034 年

- 主要趋势

- OEM

- 服务中心

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 诊断

- 预测

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 商业和国防航空

- 汽车

- 海洋

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Acellent Technologies

- Aptiv

- Boeing

- Caterpillar

- Cummins

- General Electric

- Honeywell

- IBM

- Intangles Lab

- Iotasmart

- Lockheed Martin

- Michelin

- North Atlantic Industries

- OnStar

- Robert Bosch GmbH

- Rockwell Collins

- Rolls Royce

- Sibros Technologies Inc

- TATA Elxsi

- ZF Friedrichshafen

The Global Integrated Vehicle Health Management Market was valued at USD 17.6 billion in 2024 and is expected to grow at a CAGR of 10.5% between 2025 and 2034. This expansion is fueled by the rapid adoption of electric vehicles (EVs), the rise of connected cars, and the increasing need for predictive maintenance in modern automobiles. As automotive technologies become more sophisticated, manufacturers and fleet operators are focusing on real-time vehicle health monitoring to enhance performance, extend lifespan, and reduce downtime. IVHM systems are now a critical component of the automotive ecosystem, offering real-time diagnostics, predictive analytics, and proactive maintenance solutions.

Automakers are integrating advanced IVHM technologies to enhance vehicle efficiency, minimize breakdowns, and improve overall safety. With the automotive industry shifting toward electrification, the demand for battery health monitoring solutions has surged. Electric and hybrid vehicles require continuous tracking of vital components like drivetrains, battery voltage, and charging systems. The growing complexity of automotive electronics, coupled with the rise of autonomous driving technologies, further amplifies the need for sophisticated IVHM solutions. Automakers, fleet managers, and service providers are leveraging AI-powered analytics and cloud-based platforms to ensure proactive maintenance and minimize operational risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.6 Billion |

| Forecast Value | $46.3 Billion |

| CAGR | 10.5% |

The IVHM market is categorized into hardware, software, and services, with hardware dominating the landscape. In 2024, hardware accounted for a 50% market share, generating USD 9 billion. Sensors play a pivotal role in monitoring key vehicle parameters, including engine temperature, tire pressure, and battery health. These components enable real-time diagnostics, ensuring that critical systems function optimally. As the automotive industry advances, demand for specialized hardware designed for EVs and autonomous vehicles continues to rise.

Market segmentation also includes distribution channels, with original equipment manufacturers (OEMs) holding a significant share. In 2024, OEMs controlled 73% of the market as they integrated IVHM systems into vehicles during manufacturing. This seamless incorporation allows vehicles to benefit from advanced diagnostics, telematics, and continuous monitoring capabilities from the outset. OEMs remain at the forefront of innovation, addressing the evolving needs of electric and connected vehicle owners. With predictive maintenance and battery health management becoming crucial in the EV segment, manufacturers are investing heavily in cutting-edge IVHM solutions.

The U.S. Integrated Vehicle Health Management (IVHM) Market generated USD 3.2 billion in 2024, accounting for a 33% share. The country's strong presence in the automotive and aerospace sectors drives demand for IVHM technologies. Stricter government regulations related to vehicle safety, emissions, and maintenance further accelerate adoption. Additionally, commercial fleet operators and defense agencies are prioritizing predictive maintenance to enhance operational efficiency. The U.S. market is witnessing a rapid shift toward data-driven vehicle health management systems, ensuring optimal performance, compliance, and cost savings across the transportation industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Platform provider

- 3.2.2 Software provider

- 3.2.3 Service provider

- 3.2.4 Distribution channel

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Cost breakdown analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growing demand for predictive maintenance

- 3.9.1.2 Increase in demand for EVs and connected vehicle

- 3.9.1.3 Increasing vehicle complexity

- 3.9.1.4 Technological advancements in IoT and AI

- 3.9.1.5 Regulatory requirements and safety standards

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Data security and privacy concerns

- 3.9.2.2 Complexity of integration with legacy systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Electronic Control Units (ECUs)

- 5.2.3 Data acquisition systems

- 5.2.4 Communication modules

- 5.2.5 Telematics Control Units (TCUs)

- 5.2.6 On-board diagnostics (OBD) ports

- 5.3 Software

- 5.3.1 Diagnostics software

- 5.3.2 Prognostic software

- 5.3.3 Data management software

- 5.3.4 User Interface (UI) software

- 5.4 Service

- 5.4.1 Installation and integration services

- 5.4.2 Maintenance and repair services

- 5.4.3 Consulting services

Chapter 6 Market Estimates & Forecast, By Channel, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Service center

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Diagnostics

- 7.3 Prognostics

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Commercial & defense aviation

- 8.3 Automotive

- 8.4 Marine

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Acellent Technologies

- 10.2 Aptiv

- 10.3 Boeing

- 10.4 Caterpillar

- 10.5 Cummins

- 10.6 General Electric

- 10.7 Honeywell

- 10.8 IBM

- 10.9 Intangles Lab

- 10.10 Iotasmart

- 10.11 Lockheed Martin

- 10.12 Michelin

- 10.13 North Atlantic Industries

- 10.14 OnStar

- 10.15 Robert Bosch GmbH

- 10.16 Rockwell Collins

- 10.17 Rolls Royce

- 10.18 Sibros Technologies Inc

- 10.19 TATA Elxsi

- 10.20 ZF Friedrichshafen