|

市场调查报告书

商品编码

1721415

电动商用车 MRO(维修、维修、大修)市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Commercial Vehicle MRO (Maintenance, Repair, Overhaul) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

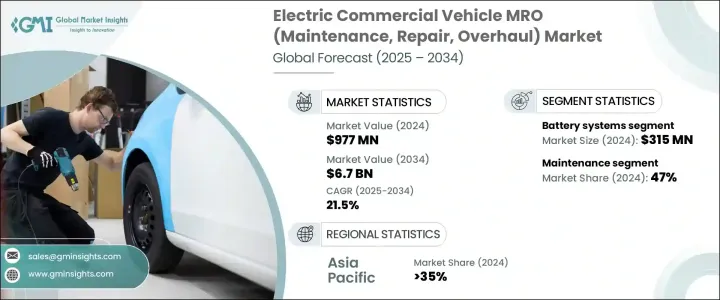

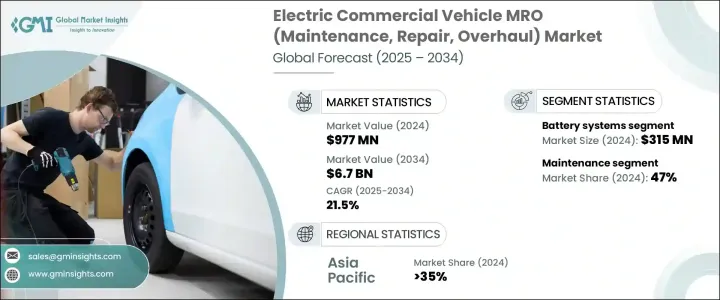

2024 年全球电动商用车 MRO 市场价值为 9.77 亿美元,预计到 2034 年将以 21.5% 的复合年增长率成长,达到 67 亿美元。随着电动商用车 (ECV) 在各个行业中得到越来越广泛的接受,该市场正在获得强劲发展势头。由于日益增长的环境问题、严格的排放法规以及政府支持的电动车激励措施,从内燃机 (ICE) 汽车到电动车的转变正在加速。车队正日益走向电气化,以实现永续发展目标并降低整体拥有成本。随着电动商用车不断渗透公共和私人交通系统,特别是在最后一英里配送、物流和公共交通等领域,对可靠、快速和专业化的 MRO 服务的需求正在迅速扩大。除了车辆维护之外,支援电动车的生态系统(包括充电基础设施和诊断工具)也在不断发展。对客製化维护程序、零件更换和基于软体的诊断的需求不断增长,增加了新的复杂性,促使 MRO 供应商采用下一代工具和技术,以在动态环境中保持竞争力。

推动这一市场扩张的一个重要因素是电动车充电基础设施的广泛发展,这直接支持了电动商用车的更广泛应用。随着越来越多的充电站出现,特别是在偏远或服务不足的地区,车队营运商发现从传统燃料驱动系统转向电动车越来越可行。维护这些基础设施(例如充电器、连接器、内部电缆和软体)进一步促进了对 MRO 服务日益增长的需求。随着电动车辆成为物流、配送和公共交通营运不可或缺的一部分,它们需要量身定制的维修和服务支持,从而推动北美、亚太、拉丁美洲、欧洲以及中东和非洲等地区的发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.77亿美元 |

| 预测值 | 67亿美元 |

| 复合年增长率 | 21.5% |

按组件划分,市场包括电动传动系统、热管理系统、充电系统、电池系统等。 2024 年,电池系统占 30% 的市场份额,价值 3.15 亿美元。这些部件对于车辆的行驶里程和效率至关重要,其性能直接影响正常运行时间。重复充电、暴露在极端温度下以及使用磨损通常会导致电池效能下降,需要定期评估并及时更换。车队营运商优先考虑电池健康状况,以避免代价高昂的停机,确保对提供专注电池管理服务的专业 MRO 供应商的需求稳定。

按服务类型细分,市场包括维护、维修和大修,其中维护在 2024 年将占据 47% 的份额。儘管电动车辆的机械部件比传统车辆少,但它们需要精确的维护,例如软体诊断、煞车检查和零件校准。定期维护对于延长车辆寿命、提高安全性和优化性能仍然至关重要。车队营运商严重依赖预防性维护计划,该计划提供可预测的成本和最小的中断,为服务提供者提供稳定的收入来源。

2024 年,中国电动商用车 MRO 市场规模达 9,210 万美元。强劲的国内生产、政策支援和快速的车队部署使中国成为全球领先者。蓬勃发展的城市配送、公共运输和物流行业继续提升对强大、技术支援的 MRO 服务的需求——从诊断到复杂的维修。

戴姆勒、Element Fleet Management、ATS Euromaster、BP Pulse、Ferdotti Motor Services、斯堪尼亚、Lion Electric、MAN Global、Merchants Fleet 和沃尔沃等主要产业参与者正在扩大其 MRO 产品组合。这些公司正在建立专门的电动车服务中心,加强技术人员培训计划,并利用远端资讯处理进行预测性维护。与汽车製造商和车队营运商的策略合作伙伴关係有助于他们确保高效的服务交付。人工智慧诊断和远端监控正在成为加速维修週期和最大限度地减少车辆停机时间的标准工具。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原始设备製造商

- 独立服务提供者

- 零件供应商

- 技术提供者

- 最终用途

- 利润率分析

- 技术与创新格局

- 专利分析

- 案例研究

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 电动商用车队的采用率不断提高

- 扩大充电基础设施

- 电动车和电池成本下降

- 对清洁和永续交通的需求增加

- 产业陷阱与挑战

- 电动商用车初始成本高

- 熟练劳动力有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 轻型商用车

- 平均血红素 (MCV)

- 丙型肝炎病毒

第六章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 电池系统

- 热管理系统

- 充电系统

- 电动传动系统

- 其他的

第七章:市场估计与预测:按服务,2021 - 2034 年

- 主要趋势

- 维护

- 维修

- 大修

第八章:市场估计与预测:按服务供应商,2021 - 2034 年

- 主要趋势

- OEM服务中心

- 独立服务提供者

- 舰队维护作业

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- ATS Euromaster

- BP Pulse

- Daimler

- Element Fleet Management

- Ferdotti Motor Services

- Kerlin Bus Sales & Leasing

- Lightning eMotors

- Lion Electric

- MAN Global

- Merchants Fleet

- Northeastern Bus Rebuilders

- Orange EV

- Scania

- Sonny Merryman

- Transdev

- VDL Company

- VEV Services Limited

- Volvo

- WattEV

- YES EU

The Global Electric Commercial Vehicle MRO Market was valued at USD 977 million in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 6.7 billion by 2034. The market is gaining robust momentum as electric commercial vehicles (ECVs) become more widely accepted across various industries. The shift from internal combustion engine (ICE) vehicles to electric alternatives is accelerating due to rising environmental concerns, stringent emissions regulations, and government-backed EV incentives. Fleets are increasingly moving toward electrification to meet sustainability goals and reduce the total cost of ownership. As electric commercial vehicles continue to penetrate public and private transport systems, especially in sectors such as last-mile delivery, logistics, and public transit, the demand for reliable, fast, and specialized MRO services is expanding rapidly. Alongside vehicle maintenance, the ecosystem supporting ECVs-including charging infrastructure and diagnostic tools-is also evolving. The rising need for customized maintenance programs, parts replacement, and software-based diagnostics has added new layers of complexity, driving MRO providers to adopt next-gen tools and technologies to remain competitive in a dynamic landscape.

A significant contributor to this market expansion is the widespread development of EV charging infrastructure, which directly supports greater adoption of electric commercial vehicles. As more charging stations emerge, particularly in remote or underserved regions, fleet operators find it increasingly feasible to switch from traditional fuel-powered systems to electric mobility. Maintaining this infrastructure-such as chargers, connectors, internal cabling, and software-further contributes to the growing demand for MRO services. As ECVs become integral to logistics, delivery, and public transport operations, they require tailored repair and service support, pushing growth across regions including North America, Asia Pacific, Latin America, Europe, and the Middle East & Africa.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $977 Million |

| Forecast Value | $6.7 Billion |

| CAGR | 21.5% |

By component, the market includes electric drivetrain, thermal management systems, charging systems, battery systems, and others. In 2024, battery systems held a dominant 30% market share, valued at USD 315 million. These components are critical to a vehicle's range and efficiency, and their performance directly impacts operational uptime. Repeated charging cycles, exposure to extreme temperatures, and usage wear often degrade batteries, prompting routine assessments and timely replacements. Fleet operators prioritize battery health to avoid costly downtimes, ensuring steady demand for expert MRO providers that offer focused battery management services.

Segmented by service type, the market includes maintenance, repair, and overhaul, with maintenance commanding a 47% share in 2024. Even though ECVs have fewer mechanical components than traditional vehicles, they require precise care such as software diagnostics, brake inspections, and component calibration. Scheduled maintenance remains essential to prolonging vehicle life, enhancing safety, and optimizing performance. Fleet operators rely heavily on preventive maintenance programs, which provide predictable costs and minimal disruptions, supporting a consistent revenue stream for service providers.

China's Electric Commercial Vehicle MRO Market generated USD 92.1 million in 2024. Strong domestic production, policy support, and rapid fleet deployment have made the country a global frontrunner. Its booming urban delivery, public transport, and logistics sectors continue to elevate the need for robust, tech-enabled MRO services-from diagnostics to complex repairs.

Key industry players such as Daimler, Element Fleet Management, ATS Euromaster, BP Pulse, Ferdotti Motor Services, Scania, Lion Electric, MAN Global, Merchants Fleet, and Volvo are expanding their MRO portfolios. These companies are establishing dedicated EV service centers, enhancing technician training programs, and leveraging telematics for predictive maintenance. Strategic partnerships with automakers and fleet operators help them ensure efficient service delivery. AI-powered diagnostics and remote monitoring are becoming standard tools to accelerate repair cycles and minimize vehicle downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Original equipment manufacturers

- 3.2.2 Independent service providers

- 3.2.3 Component suppliers

- 3.2.4 Technology providers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Case study

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increased adoption of electric commercial fleets

- 3.9.1.2 Expansion of charging infrastructure

- 3.9.1.3 Declining costs of electric vehicles and batteries

- 3.9.1.4 Rise in demand for clean and sustainable transportation

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High Initial cost of electric commercial vehicles

- 3.9.2.2 Limited availability of skilled workforce

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 LCV

- 5.3 MCV

- 5.4 HCV

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Battery systems

- 6.3 Thermal management systems

- 6.4 Charging system

- 6.5 Electric drivetrain

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Maintenance

- 7.3 Repair

- 7.4 Overhaul

Chapter 8 Market Estimates & Forecast, By Service Provider, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEM service centers

- 8.3 Independent service providers

- 8.4 Fleet maintenance operations

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ATS Euromaster

- 10.2 BP Pulse

- 10.3 Daimler

- 10.4 Element Fleet Management

- 10.5 Ferdotti Motor Services

- 10.6 Kerlin Bus Sales & Leasing

- 10.7 Lightning eMotors

- 10.8 Lion Electric

- 10.9 MAN Global

- 10.10 Merchants Fleet

- 10.11 Northeastern Bus Rebuilders

- 10.12 Orange EV

- 10.13 Scania

- 10.14 Sonny Merryman

- 10.15 Transdev

- 10.16 VDL Company

- 10.17 VEV Services Limited

- 10.18 Volvo

- 10.19 WattEV

- 10.20 YES EU