|

市场调查报告书

商品编码

1721431

电动喇叭市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Motor Horn Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

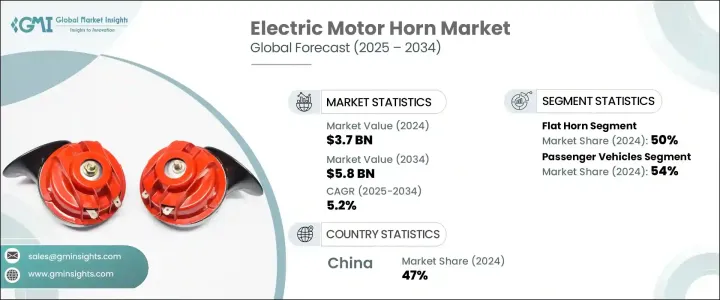

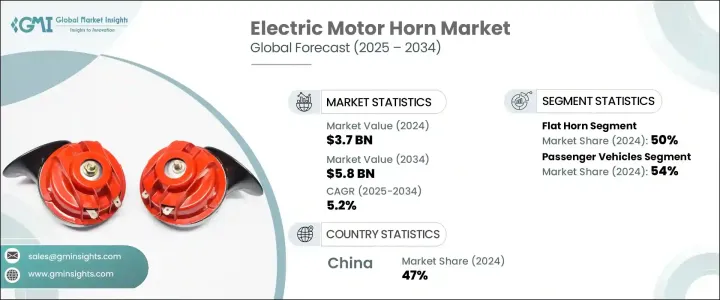

2024 年全球电动马达喇叭市场价值为 37 亿美元,预计到 2034 年将以 5.2% 的复合年增长率成长,达到 58 亿美元。这种稳定的成长得益于电动车 (EV) 的日益普及,这导致对电动马达喇叭的需求激增。与传统内燃机 (ICE) 汽车相比,电动车的运作噪音较小,需要高效、低噪音的警告系统才能符合安全标准。因此,声音警报系统对于行人和道路安全至关重要。随着电动车的普及,有关噪音污染和噪音排放标准的法规不断增加,促使製造商进行创新,生产不仅有效而且符合政府规定的喇叭。

随着新兴经济体实施更严格的道路安全法,全球市场正在转变。这一趋势推动了专为电动车设计的规范、低分贝电喇叭的需求。製造商面临越来越大的压力,需要开发适用于电动和混合动力汽车的节能、紧凑的喇叭系统,以满足安全和环境要求。随着对永续性的日益关注,降低功耗同时保持最佳声级已成为该行业面临的关键挑战和创新领域。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 37亿美元 |

| 预测值 | 58亿美元 |

| 复合年增长率 | 5.2% |

2024年,平板式电动马达喇叭部分占50%的市场。这些喇叭因其紧凑、节省空间的设计、坚固性和成本效益而受到青睐,成为摩托车、乘用车和轻型商用车的首选。它们的多功能性和易于整合性确保了它们在原始设备製造商 (OEM) 和售后市场供应商中继续占据主导地位。

2024 年,乘用车市场占据了 54% 的市场份额,预计 2025 年至 2034 年期间将以 5% 的复合年增长率稳步增长。这一成长是由印度和中国等新兴市场中乘用车日益普及所推动的。这些地区城市化、可支配收入和汽车拥有量的提高推动了对可靠且经济实惠的安全功能的需求。乘用车对电动马达喇叭的需求持续超过商用车和两轮车,巩固了其作为最大消费领域的地位。

2024年中国电动喇叭市场规模达7.56亿美元,占全球市场份额的47%。这种主导地位归因于汽车产量高、电动车的广泛采用以及政府支持的道路安全规定。对成本敏感的消费者正在推动当地对耐用、先进的喇叭系统的需求。此外,汽车保有率的提高也刺激了售后市场的成长,智慧低噪音喇叭解决方案进一步推动了需求。

全球电动马达喇叭市场的主要参与者包括海拉、松下、德昌电机、电装、UNO Minda、三叶、今仙电机工业、罗伯特博世、日本电产和 FIAMM 科技。为了保持竞争优势,各公司正在投资研发,以打造符合国际法规、具有可客製化声级的紧凑、低能耗喇叭。与电动车製造商建立策略合作伙伴关係、将业务扩展到高成长新兴市场以及开发与车辆电子设备整合的智慧喇叭系统是实现成长的关键策略。製造商也在提高当地的生产能力,以优化定价策略并透过售后分销管道满足日益增长的替换零件需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 电动车喇叭厂商

- 原始设备製造商 (OEM) 和一级供应商

- 售后市场经销商和零售商

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 价格传导至终端市场

- 主要材料价格波动

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 全球汽车产量的成长

- 世界各国政府都在强制执行车辆安全标准

- 电动车(EV)需求不断成长

- 电动喇叭的技术进步

- 产业陷阱与挑战

- 严格的噪音污染法规

- ADAS 和自动驾驶汽车的普及率不断提高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 扁平型喇叭

- 螺旋型喇叭

- 喇叭

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 两轮车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:按声压,2021 - 2034 年

- 主要趋势

- 高达 110 dB

- 110 分贝至 118 分贝

- 大于118分贝

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Chief Enterprises

- CHINT Automotive

- Denso

- FIAMM Technologies

- Grote Industries

- HELLA

- Imasen Electric Industrial

- Jindong Electronic Technology

- Johnson Electric

- MARUKO KEIHOKI

- MITSUBA

- Miyamoto Electric Horn

- Nidec

- Oriental Motor

- Panasonic

- Robert Bosch

- Roots Industries India Limited

- SEGER Horns

- UNO Minda

- Wolo Manufacturing

The Global Electric Motor Horn Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 5.8 billion by 2034. This steady growth is fueled by the increasing adoption of Electric Vehicles (EVs), which have generated a surge in demand for electric motor horns. EVs, which operate quietly compared to traditional internal combustion engine (ICE) vehicles, require efficient, low-noise warning systems to meet safety standards. As a result, audible alert systems have become critical for pedestrian and road safety. Alongside the growing adoption of EVs, rising regulations on noise pollution and sound emission standards are pushing manufacturers to innovate and produce horns that are not only effective but also compliant with government mandates.

The global market is witnessing a shift as emerging economies enforce stricter road safety laws. This trend is driving the demand for regulated, low-decibel electric horns designed specifically for EVs. Manufacturers are under increasing pressure to develop energy-efficient, compact horn systems suitable for electric and hybrid vehicles, which meet both safety and environmental requirements. With a rising focus on sustainability, reducing power consumption while maintaining optimal sound levels has become a key challenge and innovation area for the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 5.2% |

In 2024, the flat-type electric motor horns segment accounted for 50% of the market share. These horns are favored for their compact, space-saving design, robustness, and cost-efficiency, making them the preferred choice for motorcycles, passenger cars, and light commercial vehicles. Their versatility and ease of integration ensure their continued dominance in the market, both among original equipment manufacturers (OEMs) and aftermarket suppliers.

The passenger vehicle segment held a 54% share of the market in 2024 and is expected to grow steadily at a 5% CAGR between 2025 and 2034. This growth is driven by the increasing popularity of passenger cars in emerging markets such as India and China. Rising urbanization, disposable income, and vehicle ownership in these regions fuel the demand for reliable and affordable safety features. The demand for electric motor horns in passenger vehicles continues to surpass that of commercial vehicles and two-wheelers, solidifying its position as the largest consumer segment.

China electric motor horn market generated USD 756 million in 2024, accounting for 47% of the global market share. This dominance is attributed to high automotive production volumes, widespread EV adoption, and government-backed road safety mandates. Cost-sensitive consumers are driving the local demand for durable, advanced horn systems. Additionally, the increasing vehicle ownership rate is spurring aftermarket growth, with intelligent low-noise horn solutions further boosting demand.

Key players in the Global Electric Motor Horn Market include HELLA, Panasonic, Johnson Electric, Denso, UNO Minda, MITSUBA, Imasen Electric Industrial, Robert Bosch, Nidec, and FIAMM Technologies. To maintain a competitive edge, companies are investing in research and development to create compact, low-energy horns with customizable sound levels that adhere to international regulations. Strategic partnerships with EV automakers, expanding operations into high-growth emerging markets, and the development of smart horn systems integrated with vehicle electronics are key strategies for growth. Manufacturers are also enhancing local production capacities to optimize pricing strategies and meet the increasing demand for replacement parts through aftermarket distribution channels.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Electric motor horn manufacturers

- 3.2.4 Original equipment manufacturers (OEMs) and tier 1 suppliers

- 3.2.5 Aftermarket distributors and retailers

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.1.1 Supply chain restructuring

- 3.3.2.1.2 Price transmission to end markets

- 3.3.2.1 Price volatility in key materials

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 The rise in global automobile production

- 3.9.1.2 Governments worldwide are mandating vehicle safety standards

- 3.9.1.3 Growing demand for electric vehicles (EVs)

- 3.9.1.4 Technological advancements in electric motor horns

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Stringent noise pollution regulations

- 3.9.2.2 Increasing adoption of ADAS & autonomous vehicles

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Flat type horn

- 5.3 Spiral type horn

- 5.4 Trumpet

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Two-Wheelers

- 6.4 Commercial vehicles

- 6.4.1 Light Commercial Vehicles (LCV)

- 6.4.2 Medium Commercial Vehicle (MCV)

- 6.4.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Sound Pressure, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Up to 110 dB

- 7.3 110 dB to 118 dB

- 7.4 Greater than 118 dB

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Chief Enterprises

- 10.2 CHINT Automotive

- 10.3 Denso

- 10.4 FIAMM Technologies

- 10.5 Grote Industries

- 10.6 HELLA

- 10.7 Imasen Electric Industrial

- 10.8 Jindong Electronic Technology

- 10.9 Johnson Electric

- 10.10 MARUKO KEIHOKI

- 10.11 MITSUBA

- 10.12 Miyamoto Electric Horn

- 10.13 Nidec

- 10.14 Oriental Motor

- 10.15 Panasonic

- 10.16 Robert Bosch

- 10.17 Roots Industries India Limited

- 10.18 SEGER Horns

- 10.19 UNO Minda

- 10.20 Wolo Manufacturing