|

市场调查报告书

商品编码

1687328

马达:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Electric Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

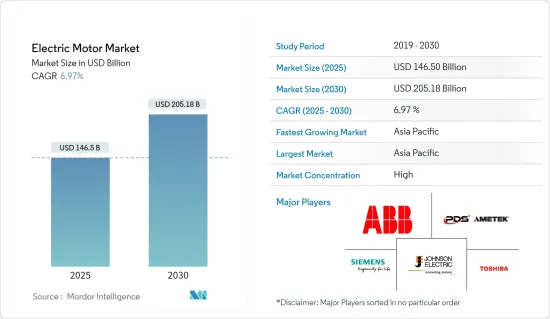

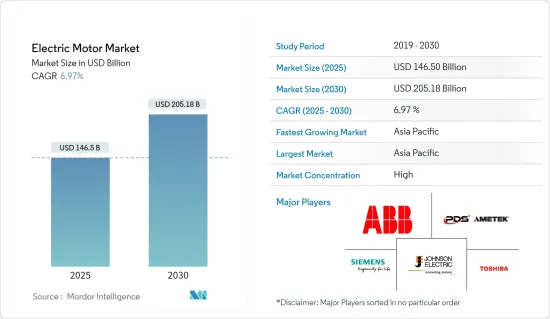

马达市场规模预计在 2025 年为 1,465 亿美元,预计到 2030 年将达到 2051.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.97%。

主要亮点

- 从中期来看,马达在住宅应用中的使用增加、电动车的普及以及各种工业流程自动化程度的提高等因素预计将推动马达市场的发展。

- 另一方面,恶劣的营运条件导致的使用寿命缩短以及原材料价格波动等市场限制预计将阻碍市场成长。

- 然而,马达技术的进步为市场带来了巨大的机会。例如,轴流和轮内发电等新兴技术越来越受欢迎。轴向马达技术具有许多优势,包括更高的功率和扭矩密度以及易于整合到各种应用中的薄饼式设计。

- 由于目前工业领域的进步,预计亚太地区将在预测期内成为市场的王牌。

马达市场趋势

汽车产业的成长

- 由于人们越来越多地转向使用电动车作为清洁的交通方式,预计汽车产业在预测期内将显着成长。

- 随着中国、美国、日本、韩国和欧洲的电动车销售快速成长,马达的需求预计将呈指数级增长。由于各国政府推出的推广电动车的奖励、普通购车者环保意识的增强以及燃料价格的上涨,全球电动车销售量呈指数级增长。

- 其他因素包括电动车的营业成本低于传统内燃机汽车 (ICE),以及中国和欧盟政府宣布将在 2035 年前禁止 ICE 出行。

- 一些政府已采取倡议增加电动车的销售量。政府也为製造商提供补贴和机会,以建立内部电池和马达製造工厂。中国、印度、法国、英国等国都宣布计画在2040年前逐步淘汰汽油和柴油车。例如,欧盟于2022年10月宣布,将从2035年起禁止在欧盟成员国销售新的内燃机汽车。

- 据联邦汽车运输局称,近年来,德国新註册的电动车数量大幅增加。 2022年迄今,印度已註册470,559辆新电动车,与前一年同期比较增长32.19%。

- 预计这些发展将在预测期内加速工业领域对马达的需求。

亚太地区预计将主导市场成长

- 亚太地区是马达产业的最佳举办地,由于工业部门的快速成长,预计未来几年该地区仍将保持主导地位。该地区的汽车、化工、化肥和石化等行业正在稳步成长,预计将为全球马达製造商提供巨大的成长机会。

- 中国一直是全球製造业的驱动力。中国在钢铁、化工、电力和水泥工业领域居世界领先地位,在石化和精製工业领域也主要企业。在中国,多个新的工业计划正在排队等待加入该国的工业组合。

- 近期,中国政府核准了一个有外国公司参与的新炼油厂计划。 2022年1月,由阿美主导的合资企业做出最终投资决定,在中国东北地区开发大型综合炼油和石化计画。新的综合大楼将建在盘镇市。预计该项目将于 2024 年运作,产能为 30 万桶/天。

- 印度是世界第二大粗钢生产国,并且仍在成长。 2023年4月,新日本製铁株式会社(NSC)宣布计画在印度奥里萨邦建立世界上最大的钢铁厂。投资金额约1.02亿印度卢比。该公司已与 LN Mittal 领导的安赛乐米塔尔 (Arcelor Mittal) 合作在奥里萨邦开展业务。

- 2023年1月,新日铁和安赛乐米塔尔的合资企业AMNS印度公司获得奥里萨邦政府核准,将在该国建设一项价值46.8亿美元的钢铁厂计划。该工厂的年生产量约为700万吨。

- 这些发展将在未来几年对马达市场产生巨大影响。

马达产业概况

马达市场比较分散。市场的主要企业(不分先后顺序)包括 ABB 有限公司、AMETEK 公司、德昌电机控股有限公司、西门子股份公司和东芝公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 2028 年市场规模与需求预测(美元)

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 住宅马达的使用增加

- 电动车日益普及

- 限制因素

- 原物料价格波动

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 依马达类型

- AC

- DC

- 按电压

- 小于1kV

- 1kV至6kV之间

- 6kV以上

- 按应用

- 住宅

- 商业的

- 车

- 工业的

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- ABB Ltd.

- AMETEK Inc.

- Regal Rexnord Corporation

- Robert Bosch GmbH

- Johnson Electric Holdings Limited

- Siemens AG

- Rockwell Automation

- TECO-Westinghouse Motor Company

- Toshiba Corp.

- Weg SA

- Nidec Corporation

- Hitachi Ltd.

第七章 市场机会与未来趋势

- 马达技术进步

简介目录

Product Code: 61333

The Electric Motor Market size is estimated at USD 146.50 billion in 2025, and is expected to reach USD 205.18 billion by 2030, at a CAGR of 6.97% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing residential usage of the electric motor, increasing adoption of electric vehicles, and increasing automation in various industrial processes, are expected to drive the electric motor market.

- On the other hand, the restraints like the life expectancy of these assets due to harsh operating conditions and fluctuating prices of raw materials are expected to hamper the market growth.

- Nevertheless, the technological developments for the advancement of electric motor technology create tremendous opportunities for the market. For example, emerging technologies like axial flux, in-wheel, etc., are gaining popularity. Axial flux motor technology offers numerous benefits like increased power and torque density and a pancake form factor ideal for integration in various scenarios.

- The Asia-Pacific region is expected to ace the market during the forecast period due to the progress in the industrial sector currently witnessed.

Electric Motors Market Trends

Automotive Segment to Witness Growth

- The automotive segment is estimated to witness significant growth during the forecast period owing to the increasing transition towards electric vehicles as a cleaner source of transportation.

- The demand for electric motors is expected to increase exponentially, owing to the rapid growth of electric vehicle sales across China, the United States, Japan, South Korea, and Europe. Electric vehicle sales are rising exponentially worldwide due to government incentives offered by various Governments to promote electromobility, increasing environmental consciousness amongst general car buyers, and rising fuel prices.

- It is also due to lower operating costs provided by electric vehicles than traditional internal combustion engine (ICE) vehicles and announcements by the governments of China and the EU to ban ICE mobility by 2035.

- The government across several countries is adopting initiatives to increase the sales of electric vehicles. The government also provides subsidies and opportunities for manufacturers to install battery and motor manufacturing plants in-house. Countries such as China, India, France, and the United Kingdom have announced plans to phase out the petrol and diesel vehicles industry entirely before 2040. For instance, in October 2022, European Union announced the ban on selling new ICE vehicles from 2035 in EU member states.

- According to Federal Motor Transport Authority, Germany has seen a significant increase in the number of new electric cars registered in recent years. So far, in 2022, 470,559 new electric cars have been registered, representing a growth of 32.19% compared with the previous year's figures.

- Such developments are expected to accelerate the demand for electric motors in the industrial sector during the forecast period.

Asia-Pacific Expected to Dominate the Market Growth

- Asia-Pacific is the best host for the electric motors industry and is expected to continue its dominance in the coming years on account of rapid growth in the industrial sector. Industries such as automotive, chemical, fertilizers, and petrochemical are witnessing steady growth in the region, which is expected to offer tremendous growth opportunities for the global electric motor players.

- China has been instrumental in driving the manufacturing sector globally. The country is the global leader in the steel, chemical, power, and cement industries, among the top players in the petrochemical and refining industries. Several new industrial projects are queued up in the country to get added to the national industry portfolio.

- Recently, the Chinese government approved new refinery projects with foreign companies' participation. In January 2022, an Aramco-led joint venture took the final investment decision to develop a major integrated refinery and petrochemical complex in Northeast China. The new complex will be located in Panjin City. It is expected to be operational by 2024, with a capacity of 300,000 BPD.

- India is the second-largest producer of crude steel at the global level, and the progress is still on. In April 2023, Nippon Steel Corporation (NSC) announced its plan to set up the world's largest steel plant facility in Odisha, India. The company will invest around INR 1.02 lakh crore. The company already has a presence in Odisha with LN Mittal-led Arcelor Mittal.

- In January 2023, AMNS India, a joint venture between Nippon Steel and Arcelor Mittal, received approval for a USD 4.68 billion steel plant project from the government of Odisha. The annual production capacity of the plant will be around 7 million tons.

- Such developments will likely overwhelmingly impact the electric motor market in the coming years.

Electric Motors Industry Overview

The electric motor market is fragmented. Some of the major companies in the market (not in any particular order) include ABB Ltd. AMETEK Inc., Johnson Electric Holdings Limited, Siemens AG, and Toshiba Corp., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Residential Usage of the Electric Motor

- 4.5.1.2 Rising Adoption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Fluctuating Prices of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Motor Type

- 5.1.1 AC

- 5.1.2 DC

- 5.2 Voltage

- 5.2.1 Less than 1 kV

- 5.2.2 Between 1kV-6kV

- 5.2.3 Higher than 6 kV

- 5.3 Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Automotive

- 5.3.4 Industrial

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 AMETEK Inc.

- 6.3.3 Regal Rexnord Corporation

- 6.3.4 Robert Bosch GmbH

- 6.3.5 Johnson Electric Holdings Limited

- 6.3.6 Siemens AG

- 6.3.7 Rockwell Automation

- 6.3.8 TECO-Westinghouse Motor Company

- 6.3.9 Toshiba Corp.

- 6.3.10 Weg SA

- 6.3.11 Nidec Corporation

- 6.3.12 Hitachi Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Developments for the Advancement of Electric Motor

02-2729-4219

+886-2-2729-4219