|

市场调查报告书

商品编码

1721448

生物塑胶豪华包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bioplastic Luxury Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

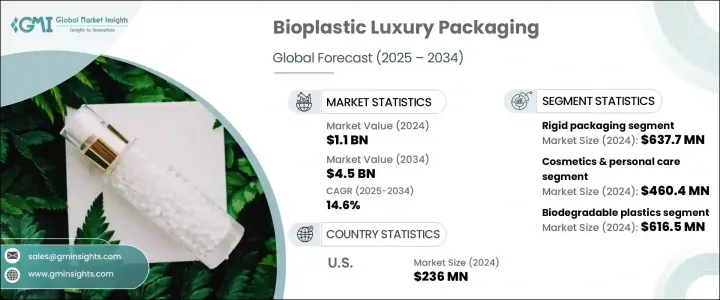

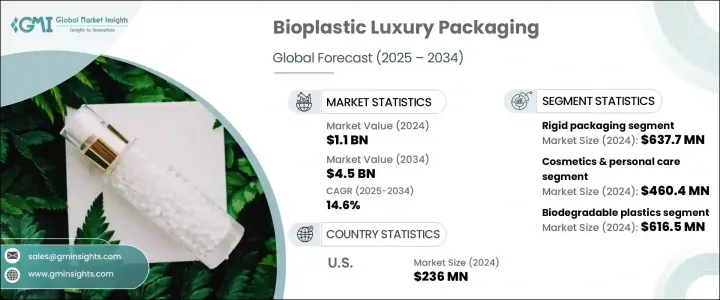

2024 年全球生物塑胶豪华包装市场价值为 11 亿美元,预计到 2034 年将以 14.6% 的复合年增长率成长,达到 45 亿美元。随着永续性成为消费者和监管机构的核心优先事项,全球各地的奢侈品牌正迅速转向环保解决方案。这一势头主要得益于对生物基原材料生产的投资不断增加以及塑胶禁令和环境法规的不断加强。各地区政府都在执行更严格的永续发展规定,迫使品牌探索既能减少环境影响又不损害品牌声誉的替代方案。

生物塑胶包装正在成为这一转变的有力答案,它将奢华的美学与环境责任的价值融为一体。消费者对永续、高效能包装解决方案的需求不断增长,正在加速该领域的创新。随着奢侈品消费者积极寻求环保选择,品牌正在透过提供优质包装解决方案来适应,这些解决方案不仅可以保护产品,还可以引起环保意识的买家的共鸣。因此,生物塑胶豪华包装正迅速成为全球奢侈品领域的主导趋势,推动对传统塑胶的可回收、可堆肥和生物基替代品的需求激增。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11亿美元 |

| 预测值 | 45亿美元 |

| 复合年增长率 | 14.6% |

生物塑胶豪华包装市场分为硬质包装和软质包装形式。硬质包装凭藉其坚固的设计、视觉吸引力以及可再填充应用的适用性,在该领域占据领先地位,预计到 2024 年将创造 6.377 亿美元的市场价值。香水、化妆品和珠宝盒等高端产品越来越多地使用生物PET、PHA和甘蔗衍生塑胶等刚性生物基材料。欧盟的一次性塑胶指令和生产者延伸责任 (EPR) 计画等监管框架进一步强化了这种转变,这些框架正在推动奢侈品牌采用可回收和可生物降解的替代品。

从终端使用产业来看,化妆品和个人护理产品占据生物塑胶豪华包装市场的最大份额,2024 年的价值为 4.604 亿美元。美容和护肤品牌在永续包装创新方面处于领先地位,并专注于符合环境标准和消费者偏好的可再填充容器和可生物降解薄膜。生物基 PET、PHA 和纤维素基薄膜等材料通常用于高端护肤品、化妆品和香水的包装,确保产品完整性,同时增强视觉吸引力。

预计到 2024 年,光是美国生物塑胶豪华包装市场就将创造 2.36 亿美元的产值,这得益于消费者意识的不断增强,以及美国《塑胶管理法案》和《EPR》授权等监管措施的加强。随着对环保包装的需求持续飙升,品牌正在迅速采用可生物降解和可回收的解决方案,以保持领先于环境合规性和市场预期。

全球市场领先的公司包括 Bio Futura、Biome Bioplastics、NatureWorks LLC、FKuR、Tetra Pak International SA、Stora Enso、Sealed Air Corporation、Constantia flexibles、Corbion、Genpak、Walki Group Oy、ITC Packaging、Novamont SpA、J. Landura Company、门长实业有限公司。这些参与者正在积极投资研发,扩大生物基材料的采用,并建立合作关係以开拓尖端、可持续的包装创新。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 扩大生物基原料生产

- 循环经济与回收创新投资

- 塑胶禁令和政府法规推动生物塑胶需求

- 生物基聚合物的进展

- 消费者对永续包装的偏好日益增长

- 产业陷阱与挑战

- 生产成本高

- 性能限制

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 可生物降解塑料

- 生物基、不可生物降解塑料

第六章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 硬质包装

- 软包装

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 化妆品和个人护理

- 时尚与配件

- 食品和饮料

- 消费性电子产品

- 奢侈品零售和礼品

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Amcor plc

- Bio Futura

- Biome Bioplastics

- Constantia Flexibles

- Corbion

- FKuR

- Futamura Group

- Genpak

- IIC AG

- ITC Packaging

- J. Landworth Company

- NatureWorks LLC

- Novamont SpA

- Sealed Air Corporation

- Stora Enso

- Tetra Pak International SA

- TIPA LTD

- Walki Group Oy

- Xiamen Changsu Industrial Co., Ltd.

The Global Bioplastic Luxury Packaging Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 4.5 billion by 2034. As sustainability becomes a core priority for both consumers and regulators, luxury brands across the globe are rapidly pivoting toward eco-conscious solutions. This momentum is largely driven by increasing investments in bio-based raw material production and the mounting wave of plastic bans and environmental regulations. Governments across regions are enforcing stricter sustainability mandates, compelling brands to explore alternatives that reduce their environmental footprint without compromising brand prestige.

Bioplastic packaging is emerging as a compelling answer to this shift, blending the aesthetics of luxury with the values of environmental responsibility. Growing consumer demand for sustainable, high-performance packaging solutions is accelerating innovation in the sector. With luxury consumers actively seeking eco-friendly options, brands are adapting by offering premium packaging solutions that not only protect products but also resonate with environmentally aware buyers. As a result, bioplastic luxury packaging is fast becoming a defining trend in the global luxury landscape, driving a surge in demand for recyclable, compostable, and bio-based alternatives to traditional plastic.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 14.6% |

The bioplastic luxury packaging market is segmented into rigid and flexible packaging formats. Rigid packaging leads the segment, generating USD 637.7 million in 2024, thanks to its sturdy design, visual appeal, and suitability for refillable applications. High-end products such as perfumes, cosmetics, and jewelry boxes increasingly use rigid bio-based materials like bio-PET, PHA, and sugarcane-derived plastics. This transition is further reinforced by regulatory frameworks like the European Union's Single-Use Plastics Directive and Extended Producer Responsibility (EPR) programs, which are pushing luxury brands to adopt recyclable and biodegradable alternatives.

On the basis of end-use industries, the cosmetics and personal care segment commands the largest share of the bioplastic luxury packaging market, valued at USD 460.4 million in 2024. Beauty and skincare brands are leading the charge in sustainable packaging innovation, with a strong focus on refillable containers and biodegradable films that align with both environmental standards and consumer preferences. Materials such as bio-based PET, PHA, and cellulose-based films are commonly used in the packaging of high-end skincare items, cosmetics, and perfumes, ensuring product integrity while enhancing visual appeal.

The U.S. Bioplastic Luxury Packaging Market alone is expected to generate USD 236 million in 2024, driven by growing awareness among consumers and reinforced by regulatory initiatives such as the U.S. Plastic Regulation Act and EPR mandates. As demand for eco-friendly packaging continues to soar, brands are rapidly adopting biodegradable and recyclable solutions to stay ahead of environmental compliance and market expectations.

Leading companies in the global market include Bio Futura, Biome Bioplastics, NatureWorks LLC, FKuR, Tetra Pak International S.A., Stora Enso, Sealed Air Corporation, Constantia Flexibles, Corbion, Genpak, Walki Group Oy, ITC Packaging, Novamont S.p.A., J. Landworth Company, Xiamen Changsu Industrial Co., Ltd., TIPA LTD, and Futamura Group. These players are actively investing in R&D, scaling up bio-based material adoption, and forming partnerships to pioneer cutting-edge, sustainable packaging innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of bio-based raw material production

- 3.2.1.2 Investment in circular economy & recycling innovation

- 3.2.1.3 Plastic bans & government regulations driving bioplastic demand

- 3.2.1.4 Advances in bio-based polymers

- 3.2.1.5 Growing consumer preference for sustainable packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Performance limitations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Biodegradable plastics

- 5.3 Bio-based, non-biodegradable plastics

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.3 Flexible packaging

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Cosmetics & personal care

- 7.3 Fashion & accessories

- 7.4 Food & beverages

- 7.5 Consumer electronics

- 7.6 Luxury retail & gifting

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Bio Futura

- 9.3 Biome Bioplastics

- 9.4 Constantia Flexibles

- 9.5 Corbion

- 9.6 FKuR

- 9.7 Futamura Group

- 9.8 Genpak

- 9.9 IIC AG

- 9.10 ITC Packaging

- 9.11 J. Landworth Company

- 9.12 NatureWorks LLC

- 9.13 Novamont S.p.A.

- 9.14 Sealed Air Corporation

- 9.15 Stora Enso

- 9.16 Tetra Pak International S.A.

- 9.17 TIPA LTD

- 9.18 Walki Group Oy

- 9.19 Xiamen Changsu Industrial Co., Ltd.