|

市场调查报告书

商品编码

1721454

可重复使用的电子商务包装市场机会、成长动力、产业趋势分析与 2025 - 2034 年预测Reusable E-Commerce Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

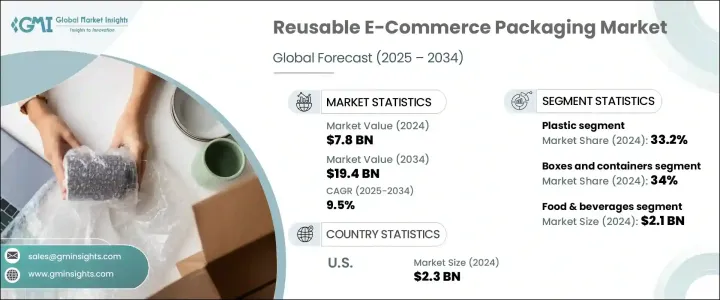

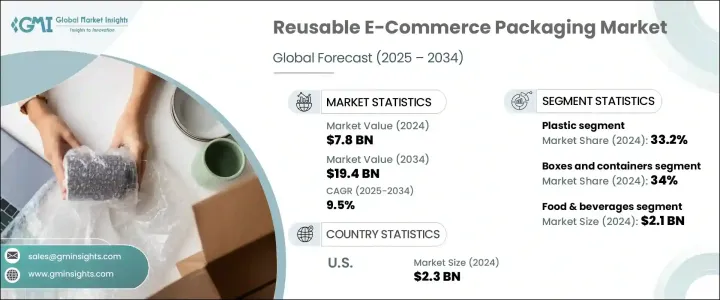

2024 年全球可重复使用电子商务包装市场价值为 78 亿美元,预计到 2034 年将以 9.5% 的复合年增长率增长至 194 亿美元。随着全球电子商务格局继续以前所未有的速度发展,对可持续高效包装解决方案的需求正在迅速增长。可重复使用的包装因其能够最大限度地减少浪费、降低长期成本并满足消费者对环保做法日益增长的期望,在网路零售商中越来越受欢迎。从一次性包装到可重复使用替代品的转变反映了该行业对循环经济原则的更广泛承诺。

城市化、数位素养的提高以及线上购物频率的增加等主要趋势进一步扩大了对符合品牌价值和监管标准的耐用且经济高效的包装的需求。电子商务平台越来越重视能够提供更好的退货货物流、易于处理和高产品保护的包装设计,同时确保永续性。技术进步,特别是数位追踪和自动化领域的进步,正在推动这一转变。利用人工智慧和机器学习进行物流优化的公司正在实现週转时间的缩短和资源配置的改善。可重复使用的包装解决方案不仅可以降低营运成本,还可以支援长期环境目标,使其成为面向未来的零售商的策略性投资。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 78亿美元 |

| 预测值 | 194亿美元 |

| 复合年增长率 | 9.5% |

这一增长是由电子商务领域的快速扩张、逆向物流和追踪技术的进步以及对可持续包装解决方案日益增长的需求所推动的。随着电子商务公司面临越来越大的减少环境影响的压力,可重复使用的包装已成为经济高效且环保的选择。使用 RFID 和二维码的增强追踪系统正在提高包裹回收率,而人工智慧驱动的物流管理正在简化营运。这些创新可协助零售商有效管理退货週期、降低营运成本并支持永续发展目标。

市场按材料细分,塑胶由于其耐用性、重量轻和成本效益,将在 2024 年占据 33.2% 的份额。高品质可重复使用塑胶可以承受多次使用循环而不会出现明显降解,使其成为大规模应用的理想选择。此外,可回收生物基塑胶的采用也进一步推动了需求。

就包装类型而言,盒子和容器部分在 2024 年占据了 34% 的份额,因为它们具有坚固性、可堆迭性以及在电子、时尚和食品服务等行业的适应性。可折迭和模组化设计的创新提高了其物流效率,使其成为致力于永续发展的品牌的首选。

2024 年,美国可重复使用电子商务包装市场价值为 23 亿美元。美国市场的成长受到严格的永续发展法规、企业环保措施和环保意识的消费者的支持。领先的零售商正在积极采用可重复使用的包装解决方案,以最大限度地减少浪费。此外,美国先进的物流基础设施,加上技术驱动的追踪系统,为市场的发展做出了巨大贡献,使该地区成为全球主要参与者。

全球可重复使用电子商务包装市场的主要参与者包括 ORBIS Corporation、DS Smith、THIMM Group、Stora Enso 和 Corplex。关键策略包括专注于永续材料创新以开发环保包装解决方案。公司正在投资研发以提高包装材料的耐用性和可重复使用性。与物流公司的合作与伙伴关係有助于改善逆向供应链和回收率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 电子商务产业的扩张

- 消费者对永续性的需求不断增长

- 不断增长的投资和伙伴关係

- 改进的逆向物流和追踪技术

- 严格的环境法规

- 产业陷阱与挑战

- 初期投资成本高

- 复杂的逆向物流

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 纸和纸板

- 塑胶

- 金属

- 其他的

第六章:市场估计与预测:依包装类型,2021 年至 2034 年

- 主要趋势

- 盒子和容器

- 邮件和信封

- 包包

- 托盘和板条箱

- 其他的

第七章:市场估计与预测:依最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 个人护理和化妆品

- 电学

- 服装和时尚

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳新银行

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Corplex

- DS Smith

- DW Reusables

- EcoEnclose

- LimeLoop

- Movopack

- ORBIS Corporation

- Packhelp

- Packoorang AS

- PalletBiz

- Rehrig Pacific Company

- RePack

- RepeatPack Ltd

- Stora Enso

- THIMM Group GmbH + Co. KG

The Global Reusable E-Commerce Packaging Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 19.4 billion by 2034. As the global e-commerce landscape continues to evolve at an unprecedented pace, the demand for sustainable and efficient packaging solutions is rising rapidly. Reusable packaging is gaining significant traction among online retailers due to its ability to minimize waste, cut long-term costs, and meet growing consumer expectations for environmentally responsible practices. The shift from single-use packaging to reusable alternatives reflects a broader industry commitment to circular economy principles.

Key trends such as urbanization, rising digital literacy, and the increasing frequency of online purchases are further amplifying the need for durable and cost-efficient packaging that aligns with both brand values and regulatory standards. E-commerce platforms are increasingly prioritizing packaging designs that offer improved return logistics, easy handling, and high product protection, all while ensuring sustainability. Technological advancements, particularly in digital tracking and automation, are fueling this transition. Companies leveraging AI and machine learning for logistics optimization are seeing improved turnaround times and better resource allocation. Reusable packaging solutions not only reduce operational costs but also support long-term environmental goals, making them a strategic investment for future-ready retailers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $19.4 Billion |

| CAGR | 9.5% |

This growth is driven by the rapid expansion of the e-commerce sector, advancements in reverse logistics and tracking technologies, and the increasing demand for sustainable packaging solutions. As e-commerce companies face growing pressure to reduce environmental impacts, reusable packaging has emerged as a cost-effective and eco-friendly option. Enhanced tracking systems using RFID and QR codes are improving package recovery rates, while AI-driven logistics management is streamlining operations. These innovations help retailers manage return cycles efficiently, reduce operational costs, and support sustainability goals.

The market is segmented by material, with the plastics segment generating a 33.2% share in 2024 due to their durability, lightweight nature, and cost efficiency. High-quality reusable plastics can endure multiple use cycles without significant degradation, making them ideal for large-scale applications. Additionally, the adoption of recyclable bio-based plastics is further boosting the demand.

In terms of packaging types, the boxes and containers segment held a 34% share in 2024 because of their robustness, stackability, and adaptability across industries such as electronics, fashion, and food services. Innovations in foldable and modular designs enhance their logistical efficiency, making them a preferred choice for brands committed to sustainability.

U.S. Reusable E-Commerce Packaging Market was valued at USD 2.3 billion in 2024. The market's growth in the U.S. is supported by stringent sustainability regulations, corporate environmental initiatives, and eco-conscious consumers. Leading retailers are actively adopting reusable packaging solutions to minimize waste. Additionally, the advanced logistics infrastructure in the U.S., bolstered by technology-driven tracking systems, contributes significantly to the market's development, positioning the region as a key player globally.

Key players in the Global Reusable E-Commerce Packaging Market include ORBIS Corporation, DS Smith, THIMM Group, Stora Enso, and Corplex. Key strategies include focusing on sustainable material innovation to develop eco-friendly packaging solutions. Companies are investing in research & development to enhance the durability and reusability of packaging materials. Collaborations and partnerships with logistics firms help improve reverse supply chains and recovery rates.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of e-commerce industry

- 3.2.1.2 Rising consumer demand for sustainability

- 3.2.1.3 Growing investments and partnerships

- 3.2.1.4 Improved reverse logistics and tracking technology

- 3.2.1.5 Stringent environmental regulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Complex reverse logistics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Paper & paperboard

- 5.3 Plastic

- 5.4 Metal

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Boxes and containers

- 6.3 Mailers and envelopes

- 6.4 Bags

- 6.5 Pallets and crates

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Pharmaceuticals

- 7.4 Personal care & cosmetics

- 7.5 Electronics & electricals

- 7.6 Apparel and fashion

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Corplex

- 9.2 DS Smith

- 9.3 DW Reusables

- 9.4 EcoEnclose

- 9.5 LimeLoop

- 9.6 Movopack

- 9.7 ORBIS Corporation

- 9.8 Packhelp

- 9.9 Packoorang AS

- 9.10 PalletBiz

- 9.11 Rehrig Pacific Company

- 9.12 RePack

- 9.13 RepeatPack Ltd

- 9.14 Stora Enso

- 9.15 THIMM Group GmbH + Co. KG