|

市场调查报告书

商品编码

1721462

甘蔗包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sugarcane Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

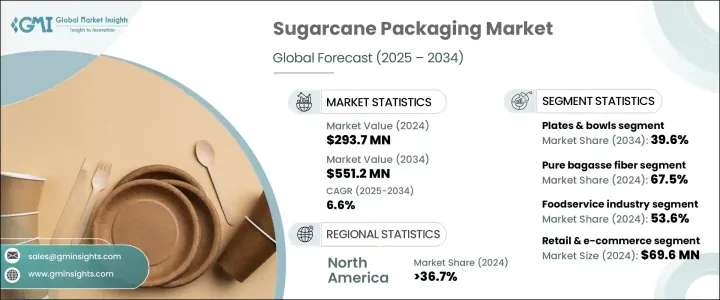

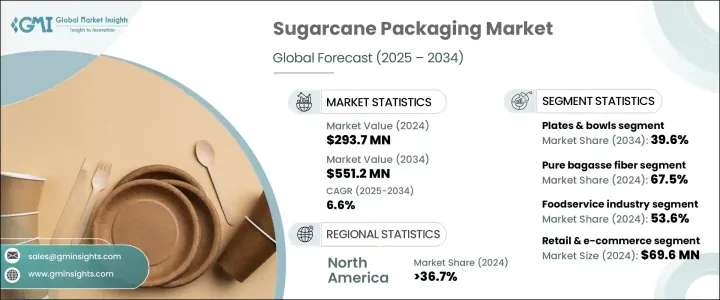

2024 年全球甘蔗包装市场价值为 2.937 亿美元,预计到 2034 年将以 6.6% 的复合年增长率成长,达到 5.512 亿美元。这一成长轨迹反映了全球在包装方面向永续和环保替代品的转变,其驱动力包括监管变化、消费者行为变化和企业环境策略。由于气候变迁和环境议题仍然备受关注,企业正积极以可再生、可堆肥的包装材料取代石油基包装。随着甘蔗渣基材料在各行业的普及,市场呈现强劲势头。消费者现在更倾向于支持符合绿色价值观的产品,而企业也透过优先考虑强化其 ESG 承诺的包装解决方案来回应。随着世界各国纷纷限制一次性塑胶的使用,并向各行业施压,要求它们减少浪费,甘蔗包装已成为一种创新、经济高效的解决方案,既符合性能目标,又符合永续发展目标。

甘蔗渣是甘蔗榨汁后剩下的纤维副产品,也是这种环保包装转变的核心。这种材料由纤维素、木质素和半纤维素组成,可自然生物降解和堆肥。随着纤维素奈米纤维和生物复合材料研究的不断发展,製造商正在开发具有更强耐用性和更广泛应用潜力的先进包装选择。改进的结构完整性、多功能性和环境效益吸引了从食品服务到零售等各行业的兴趣。这些创新不仅最大限度地减少了对环境的影响,而且还帮助公司遵守不断提高的永续发展基准和消费者期望。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.937亿美元 |

| 预测值 | 5.512亿美元 |

| 复合年增长率 | 6.6% |

在食品服务领域,盘子和碗在 2024 年占据了最大的收入份额,创造了 1.164 亿美元的收入。这些产品受到餐厅、餐饮服务和食品配送供应商的广泛青睐,因为它们具有防潮和防油的功能,同时又不影响可堆肥性。随着对便利、环保包装的需求不断增长,预计该领域将持续扩张。消费者和企业都在寻找既不牺牲品质又能为日常使用提供永续性的替代方案。

2024 年杯子和杯盖市场价值为 6,680 万美元,反映出速食连锁店、咖啡店和活动服务提供商对可堆肥饮料容器的快速采用。甘蔗杯具有强大的耐热性和防漏能力,适合盛装冷热饮品。随着消除塑胶垃圾的呼声日益高涨,整个饭店业的企业正在转向可生物降解的饮具,这将推动预测期内该领域的成长。

2024 年,美国甘蔗包装市场产值达到 8,820 万美元,并且正在获得显着发展势头,到 2034 年的复合年增长率将达到 6.3%。加州和纽约州等已实施一次性塑胶禁令的州的监管发展正在加速可堆肥替代品的采用。随着永续采购成为核心业务重点,美国正在巩固其作为甘蔗包装高潜力市场的地位。

推动全球市场成长的关键参与者包括 Ecolates、Huhtamaki、Pactiv Evergreen、Dart Container Corporation、Detmold Group 和 Berry Global Inc. 这些公司正在大力投资扩大其可堆肥产品组合、加强分销网络,并与快餐连锁店和零售品牌合作以确保长期合约。他们还专注于本地化製造和推进可生物降解材料研究,以有效扩大生产规模并满足不同的监管和客户需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商矩阵

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 产业衝击力

- 成长动力

- 日益增长的 ESG(环境、社会和治理)优先事项

- 政府措施和激励措施

- 消费者环保意识不断增强

- 提升品牌形象与市场差异化

- 增加对研发和永续製造的投资

- 产业陷阱与挑战

- 生产成本高

- 供应链和可扩展性问题

- 成长动力

- 波特的分析

- PESTEL分析

- 未来市场趋势

- 监管格局

第四章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 包包和小袋

- 盘子和碗

- 杯子和盖子

- 蛤壳/容器

- 其他的

第五章:市场估计与预测:依材料类型,2021 年至 2034 年

- 主要趋势

- 纯甘蔗渣纤维

- 混合甘蔗渣

第六章:市场估计与预测:依最终用途产业,2021 年至 2034 年

- 主要趋势

- 餐饮业

- 零售与电子商务

- 医疗保健领域

- 消费品

- 工业应用

第七章:市场估计与预测:按地区,2021–2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 日本

- 中国

- 印度

- 韩国

- 澳新银行

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 阿联酋

- 沙乌地阿拉伯

- 中东和非洲其他地区

第八章:公司简介

- Berry Global Inc.

- BioPak

- Dart Container Corporation

- Detmold Group

- ECO Guardian

- Ecolates

- good natured Products Inc.

- Good Start Packaging

- GreenLine Paper Co.

- Huhtamaki

- Material Motion, Inc.

- Packman

- Pactiv Evergreen

- PAKKA

- Pappco Greenware

- TedPack Company Limited

- Vegware Ltd

The Global Sugarcane Packaging Market was valued at USD 293.7 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 551.2 million by 2034. This growth trajectory reflects a global shift toward sustainable and eco-conscious alternatives in packaging, driven by regulatory changes, changing consumer behavior, and corporate environmental strategies. As climate change and environmental concerns remain front and center, businesses are actively replacing petroleum-based packaging with renewable, compostable options. The market is seeing robust momentum as sugarcane bagasse-based materials gain ground across industries. Consumers are now more inclined to support products that align with green values, and enterprises are responding by prioritizing packaging solutions that reinforce their ESG commitments. With countries around the world adopting restrictions on single-use plastics and putting pressure on industries to cut down waste, sugarcane packaging has emerged as an innovative, cost-effective solution that aligns with both performance and sustainability goals.

Bagasse, the fibrous byproduct left after juice extraction from sugarcane, is at the core of this eco-friendly packaging shift. Comprising cellulose, lignin, and hemicellulose, this material is naturally biodegradable and compostable. As research continues to evolve around cellulose nanofibers and bio-composite materials, manufacturers are developing advanced packaging options with enhanced durability and broader application potential. The improved structural integrity, versatility, and environmental benefits are attracting interest from industries ranging from food service to retail. These innovations are not only minimizing environmental impact but also helping companies comply with rising sustainability benchmarks and consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $293.7 Million |

| Forecast Value | $551.2 Million |

| CAGR | 6.6% |

In the food service sector, plates and bowls accounted for the largest revenue share in 2024, generating USD 116.4 million. These products are widely favored by restaurants, catering services, and food delivery providers because they offer moisture and grease resistance without compromising compostability. As the demand for convenient, eco-friendly packaging continues to grow, this segment is expected to witness consistent expansion. Consumers and businesses alike are looking for alternatives that do not sacrifice quality while delivering sustainable performance for everyday use.

The cups and lids segment was valued at USD 66.8 million in 2024, reflecting a rapid uptake of compostable beverage containers by fast food chains, coffee shops, and event service providers. The strong heat resistance and leak-proof capabilities of sugarcane-based cups make them suitable for both hot and cold beverages. With a growing push to eliminate plastic waste, businesses across the hospitality sector are transitioning to biodegradable drinkware, fueling segment growth over the forecast period.

The United States Sugarcane Packaging Market generated USD 88.2 million in 2024 and is gaining significant traction, expanding at a CAGR of 6.3% through 2034. Regulatory developments in states like California and New York, which have implemented bans on single-use plastics, are accelerating the adoption of compostable alternatives. As sustainable procurement becomes a core business focus, the U.S. is solidifying its position as a high-potential market for sugarcane-based packaging.

Key players driving growth in the global market include Ecolates, Huhtamaki, Pactiv Evergreen, Dart Container Corporation, Detmold Group, and Berry Global Inc. These companies are heavily investing in expanding their compostable product portfolios, strengthening distribution networks, and partnering with fast-food chains and retail brands to secure long-term contracts. They're also focusing on localized manufacturing and advancing biodegradable material research to scale production efficiently and meet diverse regulatory and customer demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing ESG (Environmental, Social, and Governance) Priorities

- 3.7.1.2 Government Initiatives and Incentives

- 3.7.1.3 Growing Consumer Environmental Awareness

- 3.7.1.4 Enhanced Brand Image and Market Differentiation

- 3.7.1.5 Increased Investment in R&D and Sustainable Manufacturing

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High production Costs

- 3.7.2.2 Supply Chain and Scalability Issues

- 3.7.1 Growth drivers

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Mn & kilotons)

- 4.1 Key trends

- 4.2 Bags & Pouches

- 4.3 Plates & Bowls

- 4.4 Cups & Lids

- 4.5 Clamshells/Containers

- 4.6 Others

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Mn & kilotons)

- 5.1 Key trends

- 5.2 Pure bagasse fiber

- 5.3 Blended bagasse

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Mn & kilotons)

- 6.1 Key trends

- 6.2 Foodservice industry

- 6.3 Retail & E-Commerce

- 6.4 Healthcare sector

- 6.5 Consumer goods

- 6.6 Industrial applications

Chapter 7 Market Estimates and Forecast, By Region, 2021– 2034 (USD Mn & kilotons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 UAE

- 7.6.3 Saudi Arabia

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Berry Global Inc.

- 8.2 BioPak

- 8.3 Dart Container Corporation

- 8.4 Detmold Group

- 8.5 ECO Guardian

- 8.6 Ecolates

- 8.7 good natured Products Inc.

- 8.8 Good Start Packaging

- 8.9 GreenLine Paper Co.

- 8.10 Huhtamaki

- 8.11 Material Motion, Inc.

- 8.12 Packman

- 8.13 Pactiv Evergreen

- 8.14 PAKKA

- 8.15 Pappco Greenware

- 8.16 TedPack Company Limited

- 8.17 Vegware Ltd