|

市场调查报告书

商品编码

1721469

协作机器人市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Collaborative Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

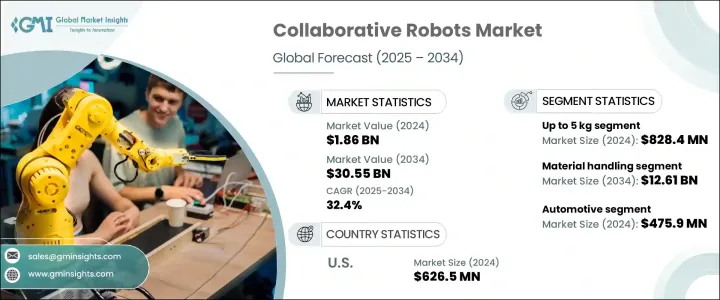

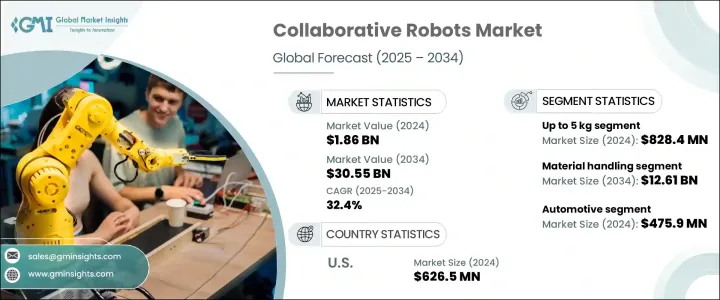

2024 年全球协作机器人市场价值为 18.6 亿美元,预计到 2034 年将以 32.4% 的复合年增长率成长,达到 305.5 亿美元。这一显着的成长轨迹反映了人们对智慧自动化日益增长的重视以及人机协作在现代製造环境中不断演变的作用。随着工业部门优先考虑提高生产力、成本效率和劳动力安全,协作机器人(通常称为 cobots)正在成为寻求优化营运的企业的首选解决方案。这些机器人经过精心设计,可以与人类工人一起安全运行,为动态生产线提供灵活性、适应性和精确性。

随着工业 4.0 原则越来越被接受,企业越来越多地将协作机器人与人工智慧、物联网和机器学习技术相结合,以建立灵活且能够响应不断变化的市场需求的智慧工厂。数位转型的趋势不仅重塑了传统的工作流程,而且还将协作机器人定位为解决劳动力短缺和简化重复性或危险任务的重要工具。此外,随着中小型企业 (SME) 寻求在全球市场上保持竞争力,他们正在采用经济实惠且用户友好的机器人解决方案来减少停机时间并加快产品上市时间。政府对智慧製造计画的支持,以及人机介面 (HMI) 系统的创新,继续推动各行各业协作机器人的部署。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18.6亿美元 |

| 预测值 | 305.5亿美元 |

| 复合年增长率 | 32.4% |

依照有效载重能力,市场分为 5 公斤以下、5-10 公斤、10-25 公斤和 25 公斤以上的类别。酬载能力高达 5 公斤的机器人领域引领市场,2024 年估值达 8.284 亿美元。这些协作机器人广泛应用于组装、品质检查和包装等轻型任务,非常适合进军自动化领域的中小企业。它们体积小、成本低、操作直观,对于转型为自动化流程的产业来说,是一个有吸引力的切入点。

协作机器人应用于各种领域,包括物料搬运、焊接、焊焊、分配、组装、拆卸和加工。其中,物料搬运领域预计到 2034 年将创造 126.1 亿美元的产值。协作机器人透过自动化拣货、包装和堆迭等功能来提高物流和仓储效率。它们整合了机器视觉系统和先进的感测器,使它们能够准确地执行重复性任务,同时确保工人的安全。

2024 年美国协作机器人市场规模达到 6.265 亿美元,体现了其在自动化创新领域的领导地位。美国的公司正在透过提供只需要极少技术专长的即插即用机器人系统来简化采用流程,使得即使是小型企业也能自动化。

主要参与者包括 Universal Robots A/S、ABB、FANUC America Corporation、KUKA AG 和 Yaskawa America, Inc.,他们都在继续投资人工智慧整合、竞争性定价策略和新兴市场的扩张,以加强其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 需要提高生产力和营运效率

- 越来越关注工作场所的安全和合规性

- 各行业劳动力短缺加剧

- 工业4.0的快速成长

- 产业陷阱与挑战

- 高资本投入

- 开发中国家采用率低

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依酬载,2021-2034

- 主要趋势

- 最多 5 公斤

- 5-10公斤

- 10-25公斤

- 超过25公斤

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 物料处理

- 组装和拆卸

- 焊接和焊焊

- 分配

- 加工

- 其他的

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 汽车

- 电子产品

- 金属与机械加工

- 塑胶和聚合物

- 食品和饮料

- 家具和设备

- 卫生保健

- 后勤

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Universal Robots A/S

- ABB

- FANUC America Corporation

- KUKA AG

- Yaskawa America, Inc.

- Techman Robot Inc.

- Doosan Robotics Co., Ltd.

- Rethink Robotics

- DENSO WAVE INCORPORATED

- OMRON Corporation

- Hanwha Group

- Staubli International AG

- ROBOTICS TECHNOLOGY CO., LTD

The Global Collaborative Robots Market was valued at USD 1.86 billion in 2024 and is estimated to grow at a CAGR of 32.4% to reach USD 30.55 billion by 2034. This remarkable growth trajectory reflects the rising emphasis on intelligent automation and the evolving role of human-robot collaboration in modern manufacturing environments. As industrial sectors prioritize enhanced productivity, cost efficiency, and workforce safety, collaborative robots-commonly known as cobots-are becoming a preferred solution for businesses seeking to optimize their operations. These robots are engineered to operate safely alongside human workers, offering flexibility, adaptability, and precision in dynamic production lines.

With the growing acceptance of Industry 4.0 principles, companies are increasingly integrating cobots with AI, IoT, and machine learning technologies to build smart factories that are agile and responsive to shifting market demands. The trend toward digital transformation is not only reshaping traditional workflows but also positioning cobots as a vital tool for addressing labor shortages and streamlining repetitive or hazardous tasks. Moreover, as small and medium-sized enterprises (SMEs) look to stay competitive in the global marketplace, they are embracing affordable and user-friendly robotic solutions to reduce downtime and accelerate time-to-market. Government support for smart manufacturing initiatives, alongside innovations in human-machine interface (HMI) systems, continues to fuel the momentum behind cobot deployment across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.86 Billion |

| Forecast Value | $30.55 Billion |

| CAGR | 32.4% |

In terms of payload capacity, the market is segmented into up to 5 kg, 5-10 kg, 10-25 kg, and above 25 kg categories. The segment for robots with up to 5 kg payload capacity led the market, reaching a valuation of USD 828.4 million in 2024. These cobots are widely adopted for light-duty tasks such as assembly, quality inspection, and packaging, making them highly suitable for SMEs venturing into automation. Their compact footprint, low cost, and intuitive operation make them an attractive entry point for industries transitioning to automated processes.

Collaborative robots are deployed in various applications, including material handling, welding, soldering, dispensing, assembly, disassembly, and processing. Among these, the material handling segment is projected to generate USD 12.61 billion by 2034. Cobots enhance logistics and warehousing efficiency by automating functions like picking, packing, and palletizing. They integrate machine vision systems and advanced sensors that allow them to perform repetitive tasks with accuracy while ensuring worker safety.

The U.S. Collaborative Robots Market reached USD 626.5 million in 2024, reflecting its leadership in automation innovation. Companies in the U.S. are simplifying adoption by offering plug-and-play robotic systems that require minimal technical expertise, making automation accessible even to smaller businesses.

Key players include Universal Robots A/S, ABB, FANUC America Corporation, KUKA AG, and Yaskawa America, Inc., all of whom continue to invest in AI integration, competitive pricing strategies, and expansion across emerging markets to strengthen their global footprint.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Need to enhance productivity and operational efficiency

- 3.2.1.2 Growing focus on workplace safety and compliance

- 3.2.1.3 Rising labor shortages across various industries

- 3.2.1.4 Rapid growth of Industry 4.0

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment

- 3.2.2.2 Low adoption rate in developing countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Payload, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Up to 5 kg

- 5.3 5-10 kg

- 5.4 10-25 kg

- 5.5 More than 25 kg

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Material handling

- 6.3 Assembling & dissembling

- 6.4 Welding & soldering

- 6.5 Dispensing

- 6.6 Processing

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Electronics

- 7.4 Metals & machining

- 7.5 Plastics & polymers

- 7.6 Food & beverages

- 7.7 Furniture & equipment

- 7.8 Healthcare

- 7.9 Logistics

- 7.10 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Universal Robots A/S

- 9.2 ABB

- 9.3 FANUC America Corporation

- 9.4 KUKA AG

- 9.5 Yaskawa America, Inc.

- 9.6 Techman Robot Inc.

- 9.7 Doosan Robotics Co., Ltd.

- 9.8 Rethink Robotics

- 9.9 DENSO WAVE INCORPORATED

- 9.10 OMRON Corporation

- 9.11 Hanwha Group

- 9.12 Staubli International AG

- 9.13 ROBOTICS TECHNOLOGY CO., LTD