|

市场调查报告书

商品编码

1750348

协作製造机器人市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Collaborative Manufacturing Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

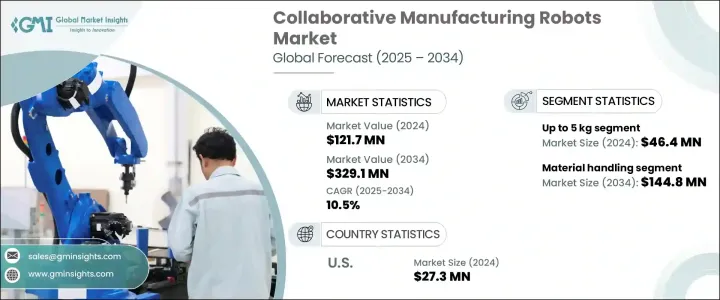

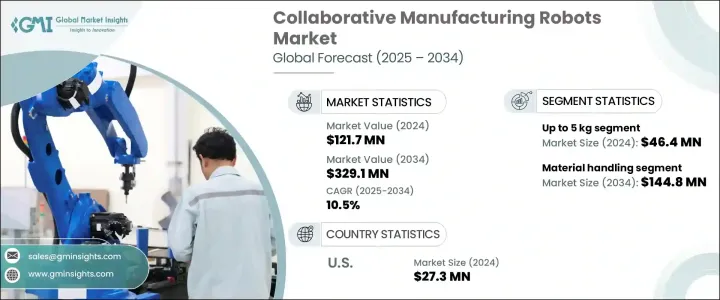

2024年,全球协作製造机器人市场规模达1.217亿美元,预计到2034年将以10.5%的复合年增长率成长,达到3.291亿美元。这得归功于各行各业自动化程度的提升,透过与人类协同工作,机器人能够同时提高生产力和安全性。这种转变源自于企业对灵活、可扩展的自动化解决方案日益增长的需求,尤其是在中小企业中。中小企业越来越多地采用经济高效的可程式协作机器人(cobot)作为自动化手段,而无需大量的前期投资。由于资源有限,中小企业认为这些机器人是提高生产力并维持较低资本支出的理想解决方案。

协作机器人能够无缝整合到现有工作流程中,并灵活地处理各种任务,使其成为寻求保持竞争力的小型企业的理想之选。这些机器人可以处理重复性、单调性或体力劳动,从而解放人类员工,让他们专注于更复杂、更具创造性或更具决策性的职责。透过自动化日常功能,协作机器人有助于改善营运工作流程,减少人为错误,并确保产出一致性。这种转变不仅提高了任务的速度和精确度,也减轻了员工的身体负担,降低了工伤和疲劳的风险。因此,企业可以透过提高员工敬业度来维持更高的生产力水准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.217亿美元 |

| 预测值 | 3.291亿美元 |

| 复合年增长率 | 10.5% |

市场根据有效载荷能力细分为 5 公斤以下、5-10 公斤、10-25 公斤和 25 公斤以上等类别。 2024 年,5 公斤以下细分市场创造了 4,640 万美元的市场规模,预计到 2034 年将以 9.6% 的复合年增长率成长。此类协作机器人在电子和製药等需要精密操作的行业中备受青睐,这些行业通常执行组装、拾取和测试等轻量级任务。其紧凑的设计也使其成为空间受限环境的理想选择,可提供灵活的自动化解决方案。协作机器人能够精确地处理较小的有效载荷,这对于寻求经济高效且可靠自动化方案的中小企业来说至关重要。

2024年,物料搬运领域占据41.5%的市场份额,预计2034年将达到1.448亿美元,这得益于物流和仓储效率日益增长的重要性。协作机器人已被证明在物料搬运方面非常高效,能够快速且准确地执行分类、包装、堆迭和运输货物等任务。随着各行各业努力优化供应链并降低劳动成本,协作机器人被视为实现这些关键功能自动化的关键工具。在精准度、速度以及能够在人类附近操作至关重要的产业中,物料搬运领域对协作机器人的需求尤其强劲。

美国协作製造机器人市场在2024年创收2,730万美元,预计到2034年将以11%的复合年增长率成长,这得益于建筑业的蓬勃发展以及自动化技术的广泛应用。从製造业到物流业等各行各业对自动化的大力推动,使美国成为协作机器人的主要市场。数位化趋势的不断增长以及对更智慧、更灵活的製造系统的需求将在未来几年继续推动对协作机器人的需求。

全球协作製造机器人产业的知名公司包括 ABB 机器人、AUBO 机器人、斗山机器人、FANUC 公司、库卡机器人、Rethink 机器人、史陶比尔机器人、Techman 机器人、优傲机器人和安川马达。在协作製造机器人市场,各公司都致力于透过创新和扩张来提升其市场地位。关键策略包括持续的产品开发、收购和合作。优傲机器人和 ABB 机器人等公司正在大力投资研发,以推出可提高效率和灵活性的新功能。安川电机和库卡机器人等其他公司则透过开发具有更大有效载荷能力和更强整合能力的协作机器人来增强其产品供应。他们还透过与行业领导者进行策略合作和扩大分销网络来提高市场渗透率,尤其是在自动化应用正在加速发展的新兴市场。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对贸易的影响

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 衝击力

- 成长动力

- 製造业对自动化的需求不断成长

- 劳动成本上升和技术工人短缺

- 提高投资报酬率和营运灵活性

- 政府支持措施和工业 4.0 的采用

- 产业陷阱与挑战

- 初始整合和部署成本高

- 安全问题和监管合规标准

- 成长动力

- 技术与创新格局

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 消费者产品采用

- 首选配销通路

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依酬载,2021 年至 2034 年

- 主要趋势

- 最多 5 公斤

- 5-10公斤

- 10-25公斤

- 超过25公斤

第六章:市场估计与预测:依组件,2021 年至 2034 年

- 主要趋势

- 硬体

- 软体

第七章:市场估计与预测:依移动性,2021 年至 2034 年

- 主要趋势

- 固定式

- 移动的

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 大型企业

- 中小企业(SME)

第九章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 物料处理

- 组装和拆卸

- 焊接和焊焊

- 分配

- 加工

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- ABB Robotics

- AUBO Robotics

- Doosan Robotics

- FANUC Corporation

- KUKA Robotics

- Rethink Robotics

- Staubli Robotics

- Techman Robot

- Universal Robots

- Yaskawa Electric Corporation

The Global Collaborative Manufacturing Robots Market was valued at USD 121.7 million in 2024 and is estimated to grow at a CAGR of 10.5% to reach USD 329.1 million by 2034, driven by the rise in automation across various industries, which enhances both productivity and safety by working alongside humans. This shift is driven by the increasing need for flexible, scalable automation solutions, especially among small and medium-sized enterprises (SMEs). Small and medium-sized enterprises (SMEs) are increasingly adopting cost-effective programmable collaborative robots (cobots) as a means of automation without requiring a significant upfront investment. With their limited resources, SME find these robots an ideal solution to enhance productivity while keeping capital expenditure low.

The ability of cobots to seamlessly integrate into existing workflows and their flexibility in handling various tasks make them an attractive option for smaller businesses looking to stay competitive. These robots can handle tasks that are repetitive, monotonous, or physically taxing, freeing up human workers to concentrate on more complex, creative, or decision-making responsibilities. By automating routine functions, cobots help improve operational workflows, reduce human error, and ensure consistent output. This shift not only enhances the speed and precision of tasks but also reduces the physical strain on employees, lowering the risk of workplace injuries and fatigue. As a result, businesses can maintain higher productivity levels with a more engaged workforce.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $121.7 Million |

| Forecast Value | $329.1 Million |

| CAGR | 10.5% |

The market is segmented by payload capacity into categories such as up to 5 kg, 5-10 kg, 10-25 kg, and more than 25 kg. In 2024, the up-to-5 kg segment generated USD 46.4 million and is expected to grow at a CAGR of 9.6% by 2034. Cobots in this category are favored in industries requiring precision, such as electronics and pharmaceuticals, where lightweight tasks like assembly, pick-and-place, and testing are common. Their compact design also makes them ideal for space-constrained environments, offering flexible automation solutions. The ability of cobots to handle smaller payloads with precision makes them invaluable to SME seeking cost-effective and reliable automation options.

The material handling segment held a 41.5% share in 2024, and it is expected to reach USD 144.8 million by 2034, driven by the growing importance of efficiency in logistics and warehousing. Cobots have proven to be highly effective in material handling, performing tasks such as sorting, packing, palletizing, and transporting goods with speed and accuracy. As industries strive to optimize their supply chains and reduce labor costs, cobots are seen as a key tool in automating these critical functions. The demand for cobots in material handling is particularly strong in industries where precision, speed, and the ability to operate near human workers are crucial.

United States Collaborative Manufacturing Robots Market generated USD 27.3 million in 2024 and is expected to grow at a CAGR of 11% through 2034, driven by the robust construction industry, along with the widespread adoption of automation technologies. The strong push toward automation across a variety of industries, from manufacturing to logistics and beyond, has made the U.S. a prime market for collaborative robots. The increasing trend of digitalization and the need for smarter, more flexible manufacturing systems will continue to drive demand for cobots in the years ahead.

Prominent companies in the Global Collaborative Manufacturing Robots Industry include ABB Robotics, AUBO Robotics, Doosan Robotics, FANUC Corporation, KUKA Robotics, Rethink Robotics, Staubli Robotics, Techman Robot, Universal Robots, and Yaskawa Electric Corporation. In the collaborative manufacturing robots market, companies are focusing on enhancing their market position through innovation and expansion. Key strategies include continuous product development, acquisitions, and partnerships. Firms like Universal Robots and ABB Robotics are investing heavily in R&D to introduce new features that improve efficiency and flexibility. Others, such as Yaskawa Electric Corporation and KUKA Robotics, are enhancing their product offerings by developing cobots with increased payload capacities and greater integration capabilities. Strategic collaborations with industry leaders and expanding distribution networks are also being used to increase market penetration, especially in emerging markets where automation adoption is accelerating.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2018 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1 Impact on trade

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.2 Price volatility in key materials

- 3.3.3 Supply chain restructuring

- 3.3.4 Production cost implications

- 3.3.5 Demand-side impact (selling price)

- 3.3.6 Price transmission to end markets

- 3.3.7 Market share dynamics

- 3.3.8 Consumer response patterns

- 3.3.9 Key companies impacted

- 3.4 Strategic industry responses

- 3.4.1 Supply chain reconfiguration

- 3.4.2 Pricing and product strategies

- 3.4.3 Policy engagement

- 3.5 Outlook and future considerations

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and future considerations

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for automation in manufacturing

- 3.8.1.2 Increasing labor costs and skilled labor shortages

- 3.8.1.3 Enhanced ROI and flexibility in operations

- 3.8.1.4 Supportive government initiatives and Industry 4.0 adoption

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High initial integration and deployment costs

- 3.8.2.2 Safety concerns and regulatory compliance standards

- 3.8.1 Growth drivers

- 3.9 Technology & innovation landscape

- 3.10 Consumer buying behavior analysis

- 3.10.1 Demographic trends

- 3.10.2 Factors affecting buying decision

- 3.10.3 Consumer product adoption

- 3.10.4 Preferred distribution channel

- 3.11 Growth potential analysis

- 3.12 Regulatory landscape

- 3.13 Pricing analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Payload, 2021 – 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Up to 5 kg

- 5.3 5-10 kg

- 5.4 10-25 kg

- 5.5 More than 25 kg

Chapter 6 Market Estimates & Forecast, By Component, 2021 – 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

Chapter 7 Market Estimates & Forecast, By Mobility, 2021 – 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Stationary

- 7.3 Mobile

Chapter 8 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 Small & medium enterprises (SME)

Chapter 9 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 Material handling

- 9.3 Assembling & dissembling

- 9.4 Welding & soldering

- 9.5 Dispensing

- 9.6 Processing

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)(Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 ABB Robotics

- 11.2 AUBO Robotics

- 11.3 Doosan Robotics

- 11.4 FANUC Corporation

- 11.5 KUKA Robotics

- 11.6 Rethink Robotics

- 11.7 Staubli Robotics

- 11.8 Techman Robot

- 11.9 Universal Robots

- 11.10 Yaskawa Electric Corporation