|

市场调查报告书

商品编码

1721491

玻璃和铝容器包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Glass and Aluminum Containers Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

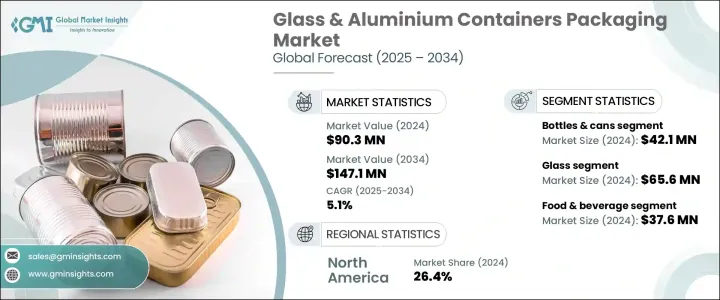

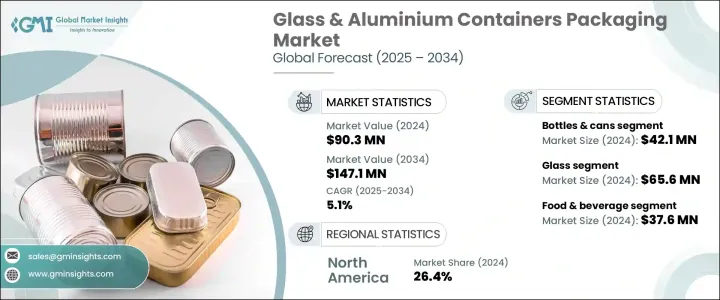

2024 年全球玻璃和铝容器包装市场价值为 9,030 万美元,预计将以 5.1% 的复合年增长率成长,到 2034 年达到 1.471 亿美元。随着永续性成为各行各业的决定性力量,对环保包装的需求正在迅速增长。消费者不再只是寻求功能性——他们正在积极选择符合其环境价值观的产品。这种行为转变促使品牌优先考虑减少碳足迹和促进循环经济实践的包装形式。玻璃和铝完全可回收再利用,引领这场绿色革命。电子商务的激增提高了人们对健康和卫生的关注,而对塑胶使用的监管压力不断增加,进一步加剧了向永续包装的转变。

食品饮料、化妆品和製药等行业正在进行这种转变,不仅是为了满足合规标准,也是为了赢得消费者的信任。品牌现在将包装视为一种战略资产,它传达了品牌对地球的承诺并提高了客户忠诚度。随着创新提高成本效益和美观度,玻璃和铝容器正在成为高端产品和日常产品的首选。随着生产技术的发展,製造商能够提供更强大、更轻、更实惠的解决方案,以实现零浪费目标。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9030万美元 |

| 预测值 | 1.471亿美元 |

| 复合年增长率 | 5.1% |

托盘和铝箔容器的需求正在稳步增长,预计 2025 年至 2034 年的复合年增长率为 5.3%。铝箔容器在食品配送和即食餐领域的需求强劲,这主要是因为其具有出色的耐热性、轻质结构和高可回收性。这些好处确保食物在储存和运输过程中保持新鲜,同时符合永续发展目标。同时,玻璃托盘因其微波炉安全特性和高檔外观,在高端包装领域越来越受欢迎。随着消费者偏好转向便利、卫生和环保意识,这两种形式都在扩展到多样化的商业用途。

预计到 2034 年,仅在铝包装领域的复合年增长率就将达到 3.8%。铝因其强度高、重量轻以及透过阻挡空气、湿气和污染物来保护产品完整性的能力而受到讚誉,正在成为食品、饮料和药品包装的首选。旨在减少塑胶垃圾的全球政策正在加速向铝的转变,特别是随着回收基础设施和技术的不断改进。这些进步提高了铝在整个生命週期内的成本效益和永续性,使其成为大规模应用的实用选择。

预计到 2034 年,美国玻璃和铝容器包装市场规模将达到 3,220 万美元。日益增强的环保意识和针对塑胶垃圾的政策驱动行动正在推动这一趋势。联邦计画和地方对一次性塑胶的禁令正在鼓励製造商采用可回收、低碳的包装形式。更薄但更耐用的玻璃和优化的铝回收製程等创新正在帮助企业在实现绿色目标的同时减少排放和成本。

包括 Ball Corporation、Verallia、Ardagh Group、Crown Holdings 和 OI Glass(欧文斯-伊利诺伊州)在内的主要参与者正在积极投资绿色技术和循环经济计划。这些公司正在扩大生产能力,推出可回收产品线,并与品牌进行策略合作,共同开发永续包装解决方案。透过自动化、减少浪费和生态高效流程,他们在与不断发展的监管框架保持一致的同时,为下一代包装设定了新的基准。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 永续包装需求不断成长

- 严格的环境法规

- 回收技术的进步

- 不断增长的饮料和製药行业

- 优质美观

- 产业陷阱与挑战

- 生产和运输成本高

- 易碎性和处理问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 玻璃

- 铝

第六章:市场估计与预测:依货柜类型,2021 年至 2034 年

- 主要趋势

- 瓶子和罐子

- 罐子

- 托盘/铝箔容器

- 管子

- 小瓶/安瓿瓶

第七章:市场估计与预测:依最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 个人护理和化妆品

- 製药

- 工业和化学品

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- OI Glass (Owens-Illinois)

- Ardagh Group

- Verallia

- BA Glass

- Vitro

- Gerresheimer

- Heinz-Glas

- Nihon Yamamura Glass Co.

- Ball Corporation

- Crown Holdings

- Trivium Packaging

- Can-Pack Group

- Toyo Seikan Group

- Silgan Holdings

The Global Glass & Aluminum Containers Packaging Market was valued at USD 90.3 million in 2024 and is estimated to grow at a CAGR of 5.1% to reach at USD 147.1 million by 2034. As sustainability becomes a defining force across industries, the demand for eco-friendly packaging is rapidly accelerating. Consumers are no longer just looking for functionality-they are actively choosing products that align with their environmental values. This behavioral shift is prompting brands to prioritize packaging formats that reduce carbon footprints and foster circular economy practices. Glass and aluminum, being fully recyclable and reusable, are leading this green revolution. The surge in e-commerce heightened focus on health and hygiene, and increasing regulatory pressures against plastic use are further intensifying the shift toward sustainable packaging.

Industries such as food and beverage, cosmetics, and pharmaceuticals are making this transition not only to meet compliance standards but also to earn consumer trust. Brands now view packaging as a strategic asset that communicates their commitment to the planet and drives customer loyalty. With innovations improving cost-efficiency and aesthetics, glass and aluminum containers are becoming the go-to choice for both premium and everyday products. As production technologies evolve, manufacturers are able to offer stronger, lighter, and more affordable solutions that align with zero-waste goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $90.3 Million |

| Forecast Value | $147.1 Million |

| CAGR | 5.1% |

The demand for trays and foil containers is increasing steadily, with projections indicating a CAGR of 5.3% from 2025 to 2034. Aluminum foil containers are seeing strong uptake across the food delivery and ready-to-eat meal segments, primarily due to their excellent thermal resistance, lightweight structure, and high recyclability. These benefits ensure food remains fresh during storage and transit while aligning with sustainability goals. At the same time, glass trays are gaining momentum in high-end packaging due to their microwave-safe properties and premium look. With consumer preferences shifting toward convenience, hygiene, and eco-consciousness, both formats are expanding into diverse commercial use cases.

The aluminum packaging segment alone is anticipated to witness a CAGR of 3.8% through 2034. Praised for its strength, low weight, and ability to safeguard product integrity by blocking air, moisture, and contaminants, aluminum is becoming a top choice for food, beverage, and pharmaceutical packaging. Global policies aimed at reducing plastic waste are accelerating the shift to aluminum, especially as recycling infrastructure and technologies continue to improve. These advancements enhance aluminum's cost-effectiveness and sustainability across its lifecycle, making it a practical choice for large-scale applications.

The U.S. Glass & Aluminum Containers Packaging Market is forecasted to reach USD 32.2 million by 2034. Growing environmental awareness and policy-driven action against plastic waste are fueling this trend. Federal programs and local bans on single-use plastics are encouraging manufacturers to adopt recyclable, low-carbon packaging formats. Innovations such as thinner yet more durable glass and optimized aluminum recycling processes are helping companies cut emissions and costs while meeting green targets.

Major players, including Ball Corporation, Verallia, Ardagh Group, Crown Holdings, and O-I Glass (Owens-Illinois), are actively investing in green technologies and circular economy initiatives. These companies are scaling up production capabilities, introducing recyclable product lines, and engaging in strategic collaborations with brands to co-develop sustainable packaging solutions. Through automation, waste reduction, and eco-efficient processes, they are setting new benchmarks in next-generation packaging while aligning with evolving regulatory frameworks.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable packaging

- 3.2.1.2 Stringent environmental regulations

- 3.2.1.3 Advancements in recycling technology

- 3.2.1.4 Growing beverage and pharmaceutical industries

- 3.2.1.5 Premium and aesthetic appeal

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and transportation costs

- 3.2.2.2 Breakability and Handling Issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn & million units)

- 5.1 Key trends

- 5.2 Glass

- 5.3 Aluminum

Chapter 6 Market Estimates and Forecast, By Container Type, 2021 – 2034 ($ Mn & million units)

- 6.1 Key trends

- 6.2 Bottles & Cans

- 6.3 Jars

- 6.4 trays/foil containers

- 6.5 tubes

- 6.6 Vials/ampoules

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 ($ Mn & million units)

- 7.1 Key trends

- 7.2 Food & Beverage

- 7.3 Personal Care & Cosmetics

- 7.4 Pharmaceuticals

- 7.5 Industrial & Chemicals

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & million units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 O-I Glass (Owens-Illinois)

- 9.2 Ardagh Group

- 9.3 Verallia

- 9.4 BA Glass

- 9.5 Vitro

- 9.6 Gerresheimer

- 9.7 Heinz-Glas

- 9.8 Nihon Yamamura Glass Co.

- 9.9 Ball Corporation

- 9.10 Crown Holdings

- 9.11 Trivium Packaging

- 9.12 Can-Pack Group

- 9.13 Toyo Seikan Group

- 9.14 Silgan Holdings