|

市场调查报告书

商品编码

1721495

生物骇客市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Biohacking Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

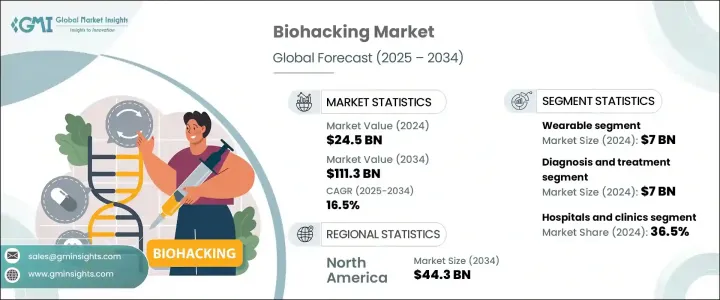

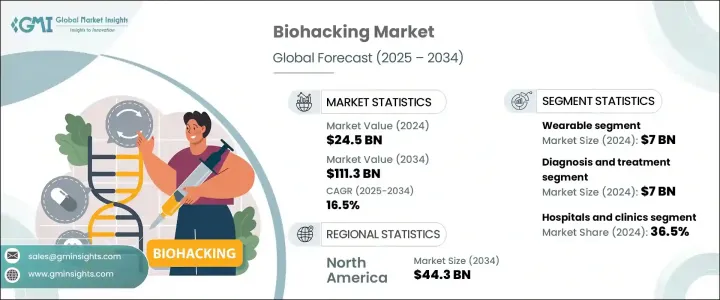

2024 年全球生物骇客市场价值为 245 亿美元,预计到 2034 年将以 16.5% 的复合年增长率成长,达到 1,113 亿美元。生物骇客正在成为科学、技术和自我提升交叉领域的变革趋势。它为个人提供透过个人化介入来控制其身心健康的工具。从营养和睡眠优化到基因工程和植入式设备,生物骇客的范围很广且不断发展。推动这项运动的因素是消费者日益转向预防性医疗保健和性能优化。

人们不再等待症状出现,而是使用即时资料和先进的健康工具来预防问题并改善生活品质。随着医疗保健变得越来越个人化,对创新解决方案的需求也在不断增长,这些解决方案允许使用者以自己的方式监测、分析和微调他们的生物功能。慢性病的增多、医疗成本的上涨以及可负担的可穿戴技术的普及,正在加速全球生物骇客实践的采用。社群媒体、线上健康社群和鼓励实验和知识共享的 DIY 生物学团体进一步放大了这一趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 245亿美元 |

| 预测值 | 1113亿美元 |

| 复合年增长率 | 16.5% |

穿戴式科技领域在 2024 年创造了 70 亿美元的产值,预计到 2034 年将以 16.8% 的复合年增长率成长。越来越多的用户开始使用智慧手錶、健身手环和智慧戒指来追踪睡眠週期、心率、大脑活动和日常表现水平等重要指标。这些设备即时提供个人化见解,帮助用户识别趋势、做出明智的决定并调整日常生活以获得更好的健康结果。透过提供持续的追踪和可操作的回馈,穿戴式科技正在成为个人寻求提升健康和保健之旅的重要工具。检测生理或认知状态的早期变化的能力使用户能够儘早干预、调整习惯并预防潜在的健康问题。

在应用方面,诊断和治疗领域在 2024 年创造了 70 亿美元的收入,占了 28.4% 的市场份额。糖尿病和心血管疾病等慢性病在全球的负担日益加重,促使使用者寻求对自身健康的更多控制。透过先进的感测器和家庭监测工具,生物骇客可以追踪血糖水平、荷尔蒙波动、血压等。这种即时资料存取支援早期检测,鼓励预防性护理,并减少对传统医疗保健访问的依赖。它使用户能够根据精确的健康资料改变行为和生活方式,从而显着降低长期健康风险。

2023 年,美国生物骇客市场产值达 79 亿美元。该国慢性病发病率高,持续推动先进生物骇客工具的需求。来自医疗机构、生物技术公司和新创企业的尖端研究推动了整个领域的创新。公司越来越关注疾病预防、个人化健康解决方案和下一代技术开发。

全球生物骇客产业的一些知名参与者包括 Neuralink、Oura Health Oy、WHOOP、Cyborg Nest、Muse、Cronometer、OpenBCI、Senseonics、Synbiota、Thync Global、Viome Life Science、Fitbit、TrackMyStack、Nuanic、OsteoStrong 和 Proteus Digital Health。为了保持竞争力,这些公司大力投资研发,推出下一代穿戴式设备,扩大产品线,并整合人工智慧驱动的健康平台。在这个快速成长的领域,策略合作伙伴关係、市场扩张和数位创新仍然是吸引消费者和提升品牌价值的关键。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率上升

- 生物骇客技术进步

- 穿戴式装置需求不断成长

- 提高健康意识

- 产业陷阱与挑战

- 先进设备成本高昂

- 缺乏熟练的专业人员

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 穿戴

- 穿戴式神经技术

- 大浦环

- 缪斯头带

- 其他穿戴式装置

- 植入物

- 血液检测植入物

- Circadia植入物

- 心臟和血管植入物

- 其他植入物

- 基因改造试剂盒

- 聪明药

- 补充品

- 行动应用程式

- 其他产品

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 合成生物学

- 基因工程

- 法医学

- 诊断和治疗

- 药物检测

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 製药和生物技术公司

- 法医实验室

- 学术和研究机构

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Cyborg Nest

- Cronometer

- Fitbit

- Muse

- Nuanic

- Neuralink

- OpenBCI

- OsteoStrong

- Oura Health Oy

- Proteus Digital Health

- TrackMyStack

- Thync Global

- Synbiota

- Senseonics

- Viome Life Science

- WHOOP

The Global Biohacking Market was valued at USD 24.5 billion in 2024 and is estimated to grow at a CAGR of 16.5% to reach USD 111.3 billion by 2034. Biohacking is emerging as a transformative trend at the intersection of science, technology, and self-improvement. It offers individuals the tools to take control of their physical and mental well-being through personalized interventions. From nutrition and sleep optimization to genetic engineering and implantable devices, the spectrum of biohacking is broad and constantly evolving. What's fueling this movement is the growing consumer shift toward preventive healthcare and performance optimization.

People are no longer waiting for symptoms to act-they're using real-time data and advanced health tools to preempt issues and enhance quality of life. As healthcare becomes more individualized, demand is rising for innovative solutions that allow users to monitor, analyze, and fine-tune their biological functions on their own terms. The rise in chronic illnesses, increasing healthcare costs, and growing access to affordable wearable tech are accelerating the adoption of biohacking practices worldwide. This trend is further amplified by social media, online health communities, and DIY biology groups that encourage experimentation and knowledge sharing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.5 Billion |

| Forecast Value | $111.3 Billion |

| CAGR | 16.5% |

The wearable technology segment generated USD 7 billion in 2024 and is projected to grow at a CAGR of 16.8% through 2034. Users are increasingly turning to smartwatches, fitness bands, and smart rings to track vital metrics like sleep cycles, heart rate, brain activity, and daily performance levels. These devices offer personalized insights in real-time, helping users identify trends, make informed decisions, and tweak their daily routines for better health outcomes. By providing continuous tracking and actionable feedback, wearable tech is becoming an essential tool for individuals looking to upgrade their health and wellness journeys. The ability to detect early changes in physiological or cognitive states gives users the power to intervene early, adjust habits, and stay ahead of potential health concerns.

In terms of application, the diagnosis and treatment segment generated USD 7 billion and held a 28.4% market share in 2024. The growing global burden of chronic conditions like diabetes and cardiovascular disease is pushing users to seek more control over their health. Through advanced sensors and home-based monitoring tools, biohackers can track glucose levels, hormone fluctuations, blood pressure, and more. This real-time data access supports early detection, encourages preventative care, and reduces dependency on traditional healthcare visits. It empowers users to make behavior and lifestyle changes based on precise health data, significantly lowering long-term health risks.

The United States Biohacking Market generated USD 7.9 billion in 2023. The country's high incidence of chronic conditions continues to drive demand for advanced biohacking tools. Cutting-edge research from healthcare institutions, biotech firms, and startups fuels innovation across the space. Companies are increasingly focused on disease prevention, personalized health solutions, and next-gen technology development.

Some of the prominent players in the Global Biohacking Industry include Neuralink, Oura Health Oy, WHOOP, Cyborg Nest, Muse, Cronometer, OpenBCI, Senseonics, Synbiota, Thync Global, Viome Life Science, Fitbit, TrackMyStack, Nuanic, OsteoStrong, and Proteus Digital Health. To stay competitive, these companies are heavily investing in research and development, launching next-gen wearable devices, expanding their product lines, and integrating AI-driven health platforms. Strategic partnerships, market expansion, and digital innovation remain key to engaging consumers and elevating brand value in this fast-growing space.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Technological advancements in biohacking

- 3.2.1.3 Growing demand for wearable devices

- 3.2.1.4 Increasing health awareness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of advanced devices

- 3.2.2.2 Lack of skilled professionals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable

- 5.2.1 Wearable neurotech

- 5.2.2 Oura ring

- 5.2.3 Muse headband

- 5.2.4 Other wearables

- 5.3 Implants

- 5.3.1 Blood test implant

- 5.3.2 Circadia implant

- 5.3.3 Cardiac and vascular implants

- 5.3.4 Other implants

- 5.4 Gene modification kits

- 5.5 Smart drugs

- 5.6 Supplements

- 5.7 Mobile apps

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Synthetic biology

- 6.3 Genetic engineering

- 6.4 Forensic science

- 6.5 Diagnosis and treatment

- 6.6 Drug testing

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Pharmaceutical and biotechnology companies

- 7.4 Forensic laboratories

- 7.5 Academic and research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cyborg Nest

- 9.2 Cronometer

- 9.3 Fitbit

- 9.4 Muse

- 9.5 Nuanic

- 9.6 Neuralink

- 9.7 OpenBCI

- 9.8 OsteoStrong

- 9.9 Oura Health Oy

- 9.10 Proteus Digital Health

- 9.11 TrackMyStack

- 9.12 Thync Global

- 9.13 Synbiota

- 9.14 Senseonics

- 9.15 Viome Life Science

- 9.16 WHOOP