|

市场调查报告书

商品编码

1721496

燃气涡轮机零件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gas Turbine Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

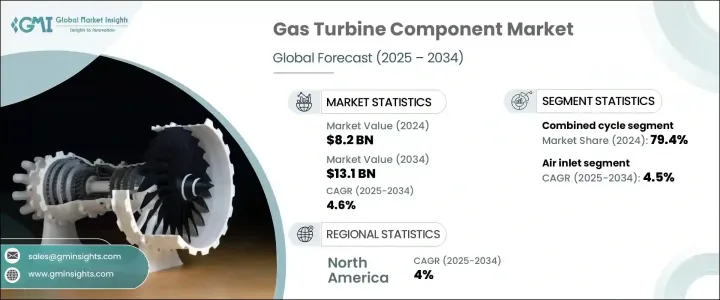

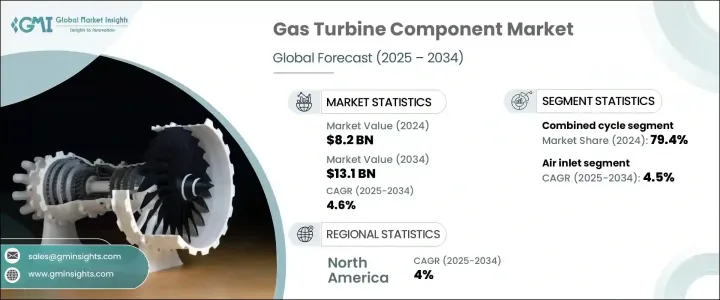

2024 年全球燃气涡轮机零件市场价值为 82 亿美元,预计到 2034 年将以 4.6% 的复合年增长率成长,达到 131 亿美元。这一成长主要得益于向低排放技术的转变,这增加了对高效涡轮机零件的需求,尤其是在调峰电厂和联合循环系统中。工业和公用事业领域现有燃气涡轮机基础设施的现代化和改造预计将推动先进零件的采用,从而提高燃气涡轮机的效率和性能。材料和设计的持续创新,特别是燃烧器、喷嘴和叶片的创新,在满足不断变化的排放标准方面发挥关键作用,同时也提高了涡轮机的整体性能。随着世界越来越重视更清洁、更灵活的发电,燃气涡轮机组件正成为能源基础设施现代化不可或缺的一部分。

航太工业的进步进一步加强了对高性能涡轮零件的需求,对单晶叶片和耐热合金的需求持续上升。分散式能源系统和备用电源解决方案的重要性日益增加,特别是在偏远或离网地区,这也推动了对可靠涡轮机组件的需求。这些系统通常与再生能源相结合,对于现代混合动力基础设施的发展至关重要。随着能源生产商寻求满足环境和营运需求,高品质涡轮机零件的重要性日益增加,使其成为更广泛的能源转型的关键。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 82亿美元 |

| 预测值 | 131亿美元 |

| 复合年增长率 | 4.6% |

到 2034 年,进气口组件部分的复合年增长率预计将达到 4.5%,因为它在保护涡轮机免受灰尘、湿气和工业污染物等环境污染方面发挥着至关重要的作用。这些零件对于保持涡轮机完整性、提高燃烧效率、减少维护需求以及最终降低营运成本至关重要。随着天然气基础设施在已开发市场和新兴市场不断扩张,特别是在专注于清洁能源转型的地区,对可靠的过滤系统的需求很高,以支持不断变化的能源格局。

在燃料灵活性和排放控制创新的推动下,开式循环涡轮机组件部分预计到 2034 年将以 4% 的复合年增长率成长。这些系统具有灵活性,使它们能够支援具有可再生输入的混合应用,同时遵守严格的碳减排法规。开式循环涡轮机在平衡间歇性再生能源方面继续发挥重要作用,这对大型公用事业项目至关重要。政府支持清洁能源的政策进一步增强了这些系统在不断变化的能源结构中的相关性。

2024 年,美国燃气涡轮机零件市场规模达到 5.769 亿美元,这得益于美国持续转型为更清洁、更高效的燃气涡轮机技术。燃气涡轮机因其能够快速响应需求变化、确保电网稳定、同时与太阳能和风能等可再生能源无缝结合而受到青睐。

全球燃气涡轮机零件市场的主要参与者包括 MAN Energy Solutions、Solar Turbines、Ansaldo Energia、Woodward、劳斯莱斯、三菱动力、苏兹勒、派克汉尼汾、IHI Corporation、GE Vernova、贝克休斯、西门子能源、MTU Aero Engines、瓦锡兰、Doncasters Group、Chromalloy 崎bine、Precine、trabine、Preciswions Group、Chromalloys、Warbine Electric、Precine、Precine) Limited。为了维持市场领先地位,这些公司专注于开发先进的合金、冷却技术和积层製造解决方案,以提高涡轮机的耐用性和运作效率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 川普政府关税对贸易和整体产业的影响

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依组件类型,2021 - 2034 年

- 主要趋势

- 进气口

- 压缩机

- 燃烧器

- 涡轮

- 燃油喷嘴

- 排气

- 辅助系统

- 其他的

第六章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 开放式循环

- 复合循环

第七章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 航改型

- 重负

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 发电厂

- 石油和天然气

- 加工厂

- 航空

- 海洋

- 其他的

第九章:市场规模及预测:依服务供应商,2021 - 2034 年

- 主要趋势

- OEM

- 非OEM

第 10 章:市场规模与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 荷兰

- 希腊

- 波兰

- 亚太地区

- 中国

- 澳洲

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 南非

- 阿尔及利亚

- 拉丁美洲

- 巴西

- 阿根廷

- 秘鲁

第 11 章:公司简介

- Ansaldo Energia

- Baker Hughes

- Bharat Heavy Electricals Limited (BHEL)

- Chromalloy Gas Turbine LLC

- Doncasters Group

- Doosan

- GE Vernova

- IHI Corporation

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Power

- MTU Aero Engines

- Parker Hannifin

- Precision Castparts

- Rolls-Royce

- Siemens Energy

- Solar Turbines

- Sulzer

- Wartsila

- Woodward

The Global Gas Turbine Component Market was valued at USD 8.2 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 13.1 billion by 2034. This growth is primarily fueled by the shift toward lower-emission technologies, increasing the demand for efficient turbine components, particularly in peaker plants and combined-cycle systems. The modernization and retrofitting of existing gas turbine infrastructure across industrial and utility sectors are expected to drive the adoption of advanced parts, enhancing turbine efficiency and performance. The continued innovation in materials and design, specifically in combustors, nozzles, and blades, plays a critical role in meeting evolving emission standards, while also improving overall turbine performance. As the world increasingly prioritizes cleaner, more flexible power generation, gas turbine components are becoming integral to the modernization of energy infrastructure.

The demand for high-performance turbine components is further strengthened by advancements driven by the aerospace industry, where the need for single-crystal blades and heat-resistant alloys continues to rise. The increasing importance of decentralized energy systems and backup power solutions, particularly in remote or off-grid locations, also fuels the need for reliable turbine components. These systems, often integrated with renewable energy sources, are vital to the development of modern hybrid power infrastructure. As energy producers seek to meet both environmental and operational demands, the importance of high-quality turbine components grows, making them essential to the broader energy transition.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.2 Billion |

| Forecast Value | $13.1 Billion |

| CAGR | 4.6% |

The air inlet component segment is expected to grow at a CAGR of 4.5% through 2034, owing to its vital role in safeguarding turbines from environmental contaminants such as dust, moisture, and industrial pollutants. These components are crucial in preserving turbine integrity, improving combustion efficiency, and reducing maintenance needs, ultimately lowering operational costs. As natural gas infrastructure expands in both developed and emerging markets, particularly in areas focused on clean energy transitions, reliable filtration systems are in high demand to support the evolving energy landscape.

The open-cycle turbine component segment is projected to grow at a CAGR of 4% through 2034, driven by innovations in fuel flexibility and emissions control. These systems offer flexibility, enabling them to support hybrid applications with renewable inputs while complying with stringent carbon reduction regulations. Open-cycle turbines continue to play a significant role in balancing intermittent renewable energy sources, making them vital to large-scale utility projects. Governments' policies supporting clean energy further enhance the relevance of these systems in the evolving energy mix.

In 2024, the U.S. Gas Turbine Component Market generated USD 576.9 million, fueled by the country's ongoing transition to cleaner, more efficient gas turbine technologies. Gas turbines are preferred for their ability to rapidly respond to demand changes, ensuring grid stability while integrating seamlessly with renewable energy sources like solar and wind.

Key players in the Global Gas Turbine Component Market include MAN Energy Solutions, Solar Turbines, Ansaldo Energia, Woodward, Rolls-Royce, Mitsubishi Power, Suzler, Parker Hannifin, IHI Corporation, GE Vernova, Baker Hughes, Siemens Energy, MTU Aero Engines, Wartsila, Doncasters Group, Chromalloy Gas Turbine, Doosan, Kawasaki Heavy Industries, Precision Castparts, and Bharat Heavy Electricals Limited. To maintain market leadership, these companies focus on developing advanced alloys, cooling technologies, and additive manufacturing solutions, boosting turbine durability and operational efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Impact of trump administration tariffs on trade & overall industry

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Air inlet

- 5.3 Compressor

- 5.4 Combustor

- 5.5 Turbine

- 5.6 Fuel nozzle

- 5.7 Exhaust

- 5.8 Auxiliary systems

- 5.9 Others

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Open cycle

- 6.3 Combined cycle

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Aero-derivative

- 7.3 Heavy duty

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Power plant

- 8.3 Oil & gas

- 8.4 Process plant

- 8.5 Aviation

- 8.6 Marine

- 8.7 Others

Chapter 9 Market Size and Forecast, By Service Provider, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Non-OEM

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Russia

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.3.7 Greece

- 10.3.8 Poland

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Australia

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Indonesia

- 10.4.6 Thailand

- 10.4.7 Malaysia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Qatar

- 10.5.4 Oman

- 10.5.5 Egypt

- 10.5.6 Turkey

- 10.5.7 Bahrain

- 10.5.8 Iraq

- 10.5.9 South Africa

- 10.5.10 Algeria

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Argentina

- 10.6.3 Peru

Chapter 11 Company Profiles

- 11.1 Ansaldo Energia

- 11.2 Baker Hughes

- 11.3 Bharat Heavy Electricals Limited (BHEL)

- 11.4 Chromalloy Gas Turbine LLC

- 11.5 Doncasters Group

- 11.6 Doosan

- 11.7 GE Vernova

- 11.8 IHI Corporation

- 11.9 Kawasaki Heavy Industries

- 11.10 MAN Energy Solutions

- 11.11 Mitsubishi Power

- 11.12 MTU Aero Engines

- 11.13 Parker Hannifin

- 11.14 Precision Castparts

- 11.15 Rolls-Royce

- 11.16 Siemens Energy

- 11.17 Solar Turbines

- 11.18 Sulzer

- 11.19 Wartsila

- 11.20 Woodward