|

市场调查报告书

商品编码

1782155

航空衍生型燃气涡轮机服务市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aeroderivative Gas Turbine Service Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

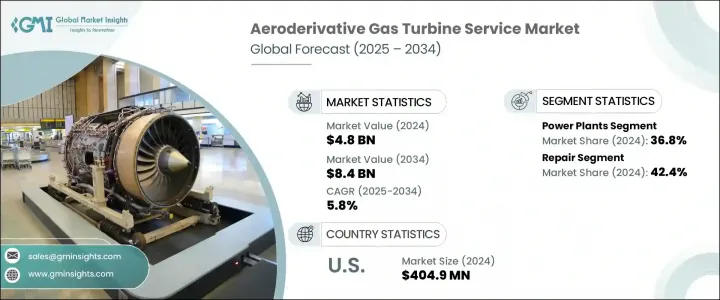

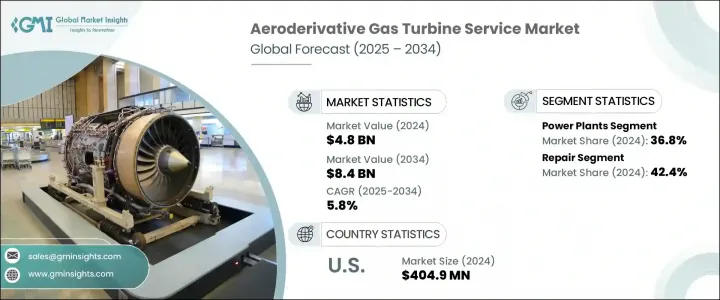

2024年,全球航改型燃气涡轮机服务市场规模达48亿美元,预计2034年将以9.2%的复合年增长率成长,达到84亿美元。人们越来越重视使用沼气和氨等低碳排放燃料来提高燃气涡轮机效率,这推动了市场发展势头。航改型燃气涡轮机最初设计用于航空领域,现已广泛应用于工业和发电领域,其维护、大修和维修等服务对于延长其使用寿命和维持尖峰效率至关重要。随着日益严格的环保政策要求降低二氧化碳和二氧化氮排放,营运商正在积极改造现有燃气涡轮机,为其配备燃料灵活的燃烧器和低排放燃烧器系统,而不是完全更换机组。

长期服务合约和风力涡轮机租赁安排也在最大限度地降低营运商的财务风险方面发挥着重要作用,它们提供了可预测的维护成本和保证的系统正常运行时间。许多风力涡轮机队,尤其是2005年之前部署的风力涡轮机队,其使用寿命已超过二十年,这引发了一波强劲的升级需求,预计随着全球风力涡轮机队进入关键的中后期生命週期,这一需求将在2026年至2030年之间达到峰值。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 48亿美元 |

| 预测值 | 84亿美元 |

| 复合年增长率 | 9.2% |

2024年,发电厂领域贡献了36.8%的份额,预计到2034年将以6%的复合年增长率成长。对排放监测和持续合规性(尤其是氮氧化物限值相关法规)的需求不断增长,延长了维护间隔,并加剧了服务需求。涡轮机的频繁循环,尤其是在峰值负载运行期间,加速了转子组件和燃料控制系统等部件的磨损,从而推动了对跨地区全面服务支援的需求。

维修服务领域在2024年占据42.4%的份额,预计2025年至2034年的复合年增长率将达到5.5%。等离子涂层、先进积层製造和精密焊接技术的日益普及,有助于延长涡轮机关键零件的使用寿命。这在海洋和石油天然气领域尤其重要,因为这些领域对耐腐蚀部件的需求正在激增,这将进一步增强服务组合,并刺激售后市场的需求。

2024年,美国航空衍生型燃气涡轮机服务市场占据89.6%的市场份额,规模达4.049亿美元。人口成长和尖峰负载上升带来的能源需求成长加速了航空衍生型燃气涡轮机的部署,这些涡轮机通常采用固定价格维护协议。国家政策支持和针对能源转型计画的资金投入,尤其是在政府支持的主要项目下,正推动人们对这些燃气涡轮机的兴趣,将其作为再生能源的重要备用解决方案。氢燃料和双燃料燃气涡轮机计画的扩张也鼓励了对技术人员培训、燃烧系统升级和密封件更换专案的投资,从而增强了对专业燃气涡轮机服务的需求。

产业顶尖企业包括西门子能源、曼恩能源解决方案、通用电气 Vernova、安萨尔多能源和三菱重工。为了提昇在航改型燃气涡轮机服务市场的竞争力,各企业正采取多管齐下的策略,并专注于生命週期支援、创新和在地化。主要企业正在投资数位诊断和预测性维护平台,以最大限度地减少燃气涡轮停机时间并提高服务响应速度。扩大全球服务中心和部署远端监控功能可以更快地解决服务问题。企业还与营运商合作签订长期服务合同,以提供成本可预测性和性能保证。专门的研发投资正在推动低氮氧化物燃烧器、耐腐蚀涂层和燃料弹性系统的开发,以符合清洁能源目标。员工培训计画正在加强,以满足混合动力和氢混合系统不断变化的技术需求,确保为下一代能源基础设施做好服务准备。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 按地区分析公司市场份额

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依服务,2021 - 2034 年

- 主要趋势

- 维护

- 维修

- 大修

- 其他的

第六章:市场规模及预测:依服务供应商,2021 - 2034 年

- 主要趋势

- OEM

- 非OEM

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 发电厂

- 石油和天然气

- 加工厂

- 航空

- 海洋

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 荷兰

- 芬兰

- 希腊

- 丹麦

- 罗马尼亚

- 波兰

- 瑞典

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 科威特

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 约旦

- 黎巴嫩

- 南非

- 奈及利亚

- 阿尔及利亚

- 肯亚

- 拉丁美洲

- 巴西

- 阿根廷

- 秘鲁

- 智利

第九章:公司简介

- Ansaldo Energia

- Centrax Gas Turbines

- Destinus Energy

- EthosEnergy

- GE Vernova

- JSC United Engine

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- MJB International

- MTU Aero Engines

- PROENERGY

- RWG

- Siemens Energy

- Solar Turbines

- Sulzer

- TRS SERVICES

- VERICOR

The Global Aeroderivative Gas Turbine Service Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 8.4 billion by 2034. Growing emphasis on improving turbine efficiency with lower carbon-emission fuels like biogas and ammonia is fueling market momentum. Aeroderivative turbines, originally engineered for aviation, are now widely adapted for industrial and power generation, and their servicing-including maintenance, overhauls, and repairs-is vital to prolong their lifespan and maintain peak efficiency. As tightening environmental policies demand lower CO2 and NO2 emissions, operators are actively retrofitting existing turbines with fuel-flexible combustors and low-emission burner systems instead of replacing units entirely.

Long-term service contracts and turbine leasing arrangements are also playing a significant role in minimizing financial risks for operators, offering predictable maintenance costs and guaranteed system uptime. Many turbine fleets, especially those deployed before 2005, have surpassed two decades of service life, creating a strong wave of upgrade demand that is expected to peak between 2026 and 2030 as global fleets enter critical mid-to-end-of-life cycles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 9.2% |

In 2024, the power plant segment contributed a 36.8% share and is forecast to grow at a CAGR of 6% through 2034. Increasing demand for emission monitoring and ongoing regulatory compliance, particularly related to NOx limits, is extending maintenance intervals and intensifying service needs. Frequent cycling of turbines, especially in peak load operations, is accelerating wear in components like rotor assemblies and fuel control systems, driving up the need for comprehensive service support across various geographies.

The repair services segment held a 42.4% share in 2024 and is anticipated to grow at a CAGR of 5.5% from 2025 to 2034. The rising adoption of plasma coatings, advanced additive manufacturing, and precision welding techniques is helping extend the operational life of critical components in turbines. This is particularly important in the marine and oil & gas sectors, where demand for corrosion-resistant parts is surging, further strengthening the service portfolio and fueling aftermarket demand.

United States Aeroderivative Gas Turbine Service Market held an 89.6% share in 2024 and recorded USD 404.9 million. Rising energy demand tied to population growth and peak load increases has accelerated the deployment of aeroderivative turbines, often under fixed-price maintenance agreements. National policy support and funding directed at energy transition initiatives, especially under major government-backed programs, are driving interest in these turbines as essential backup solutions for renewable sources. The expansion of hydrogen-fueled and dual-fuel turbine projects is also encouraging investment in technician training, combustion system upgrades, and seal replacement programs, strengthening the demand for specialized turbine servicing.

Top industry players include Siemens Energy, MAN Energy Solutions, GE Vernova, Ansaldo Energia, and Mitsubishi Heavy Industries. To enhance their competitiveness in the aeroderivative gas turbine service market, companies are adopting multi-pronged strategies focused on lifecycle support, innovation, and localization. Major players are investing in digital diagnostics and predictive maintenance platforms to minimize turbine downtime and boost service responsiveness. Expanding global service hubs and deploying remote monitoring capabilities allow for quicker resolution of service issues. Firms are also partnering with operators on long-term service contracts to provide cost predictability and performance guarantees. Specialized R&D investments are driving the development of low-NOx combustors, corrosion-resistant coatings, and fuel-flexible systems to align with clean energy goals. Workforce training programs are being ramped up to meet the evolving technical demands of hybrid and hydrogen-blended systems, ensuring service readiness for next-gen energy infrastructures.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Service, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Maintenance

- 5.3 Repair

- 5.4 Overhaul

- 5.5 Others

Chapter 6 Market Size and Forecast, By Service Provider, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Non-OEM

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Power plants

- 7.3 Oil & gas

- 7.4 Process plants

- 7.5 Aviation

- 7.6 Marine

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Denmark

- 8.3.10 Romania

- 8.3.11 Poland

- 8.3.12 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Australia

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Thailand

- 8.4.8 Malaysia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 Lebanon

- 8.5.12 South Africa

- 8.5.13 Nigeria

- 8.5.14 Algeria

- 8.5.15 Kenya

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Centrax Gas Turbines

- 9.3 Destinus Energy

- 9.4 EthosEnergy

- 9.5 GE Vernova

- 9.6 JSC United Engine

- 9.7 Kawasaki Heavy Industries

- 9.8 MAN Energy Solutions

- 9.9 Mitsubishi Heavy Industries

- 9.10 MJB International

- 9.11 MTU Aero Engines

- 9.12 PROENERGY

- 9.13 RWG

- 9.14 Siemens Energy

- 9.15 Solar Turbines

- 9.16 Sulzer

- 9.17 TRS SERVICES

- 9.18 VERICOR