|

市场调查报告书

商品编码

1721537

工业机械市场机会、成长动力、产业趋势分析及2025-2034年预测Industrial Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

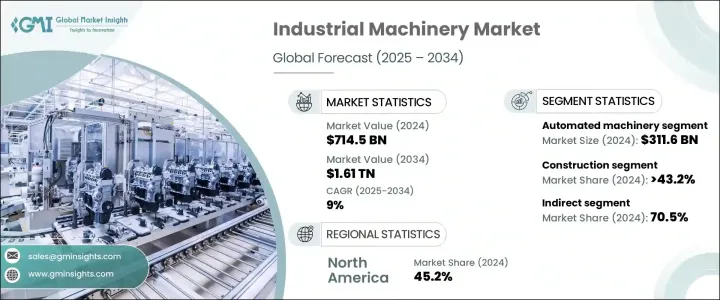

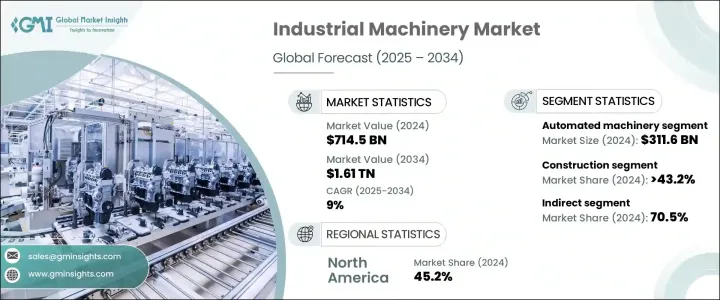

2024 年全球工业机械市场价值为 7,145 亿美元,预计到 2034 年将以 9% 的复合年增长率成长,达到 1.61 兆美元。随着全球各地的公司采用下一代技术来提高製造效率并保持领先于市场需求,工业机械产业正在快速发展。由工业 4.0 驱动的智慧製造已成为寻求提高生产力、节省成本和加快週转时间的製造商关注的核心领域。自动化、机器人和人工智慧彻底改变了工厂车间的运作方式,实现了资料、机器和即时决策过程的无缝整合。从汽车、航太到消费品和製药等行业都在增加对支持更高产量和改进品质控制的智慧机械的投资。同时,对永续生产实践和资源优化日益增长的需求正在推动各行各业采用符合全球绿色倡议的精密、环保机器。这种持续的转变正在塑造一个高度竞争和创新驱动的工业格局,製造商优先考虑敏捷性、可扩展性和客製化,以满足不断变化的消费者期望。

2024 年自动化机械市场规模达 3,116 亿美元,预计到 2034 年将维持强劲势头,复合年增长率达 9.3%。企业正逐渐从劳力密集方法转向全自动化解决方案,以减少错误、提高效率并降低营运成本。随着人工智慧驱动的系统和机器人技术变得越来越普及,製造商正在利用它们进行预测性维护、即时监控和流程优化。这些技术帮助产业即使在动盪的环境中也能保持连续性,同时提高整体产出品质。先进的自动化不仅仅是一种削减成本的工具,它已经成为旨在扩大营运规模、快速响应不断变化的市场需求并提供一致性能的公司的战略资产。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7145亿美元 |

| 预测值 | 1.61兆美元 |

| 复合年增长率 | 9% |

在应用方面,建筑业在 2024 年占据了 43.2% 的市场份额,预计到 2034 年将以 9.4% 的复合年增长率增长。全球基础设施的繁荣,加上城市化和大型公共工程的兴起,正在推动对起重机、装载机和挖土机等重型机械的需求。政府和私人开发商正在加大对智慧城市项目、再生能源设施和现代交通系统的投资,所有这些都需要可靠、高效能的设备。建筑公司正在寻求坚固耐用、技术先进的机器,这些机器能够有效地处理复杂任务并帮助满足紧迫的期限,从而进一步推动设备的采用。

2024年北美的工业机械市场规模为3,227亿美元,占全球工业机械市场的45.2%。由于完善的製造业生态系统、强大的供应链网络以及主要行业参与者的存在,该地区继续保持领先地位。在熟练劳动力、尖端技术和有利的经济改革的支持下,这里的创新蓬勃发展。回流努力和自动化投资的增加进一步巩固了北美作为全球製造业强国的地位。

全球工业机械市场的领导者包括 ASML、GEA、伊利诺伊工具厂、英格索兰、霍尼韦尔国际、CNH Industrial、阿特拉斯·科普柯、Brandt Industries、卡特彼勒、AGCO、ESCO、迪尔、日立建机、阿法拉伐和盖尔道。这些公司正在透过采用自动化、人工智慧整合和数位转型来巩固其市场地位。许多公司都瞄准工业活动不断成长的新兴市场,并与技术提供者和原始设备製造商建立策略联盟,以提供满足现代工业需求的客製化下一代机械。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 对部队的影响

- 成长动力

- 提高农业作业机械化程度

- 不断增加的基础设施支出

- 智慧包装解决方案的采用率不断上升

- 全球化浪潮推动食品加工产业发展

- 製造业的成长

- 产业陷阱与挑战

- 健康和安全问题

- 缺乏熟练劳动力和技术人员

- 成长动力

- 成长潜力分析

- 定价分析

- 技术进步

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按运营,2021 - 2034 年(十亿美元)

- 主要趋势

- 自动化机械

- 半自动化机械

- 手动机械

- 机器人机械

第六章:市场估计与预测:按应用,2021 - 2034 年(十亿美元)

- 主要趋势

- 农业

- 建造

- 包装

- 食品加工

- 矿业

- 半导体製造

- 其他的

第七章:市场估计与预测:按配销通路,2021 - 2034 年(十亿美元)

- 主要趋势

- 直销

- 间接销售

第八章:市场估计与预测:按地区,2021 - 2034 年(十亿美元)

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 玛米亚

- 阿联酋

- 南非

- 沙乌地阿拉伯

第九章:公司简介

- AGCO

- Alfa Laval

- ASML

- Atlas Copco

- Brandt Industries

- Caterpillar

- CNH Industrial

- Deere

- ESCO

- GEA

- Gerdau

- Hitachi Construction Machinery

- Honeywell International

- Illinois Tool Works

- Ingersoll Rand

The Global Industrial Machinery Market was valued at USD 714.5 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 1.61 trillion by 2034. The industrial machinery sector is rapidly evolving as companies worldwide embrace next-gen technologies to enhance manufacturing efficiency and stay ahead of market demands. Smart manufacturing, driven by Industry 4.0, has become a core focus area for manufacturers seeking improved productivity, cost savings, and faster turnaround times. Automation, robotics, and AI have revolutionized how operations run on the factory floor, allowing seamless integration of data, machines, and real-time decision-making processes. Industries ranging from automotive and aerospace to consumer goods and pharmaceuticals are ramping up investments in intelligent machinery that supports higher throughput and improved quality control. At the same time, the growing demand for sustainable production practices and resource optimization is pushing industries to adopt precision-based, eco-friendly machines that align with global green initiatives. This ongoing transformation is shaping a highly competitive and innovation-driven industrial landscape, where manufacturers prioritize agility, scalability, and customization to meet shifting consumer expectations.

Automated machinery accounted for USD 311.6 billion in 2024 and is projected to maintain robust momentum with an estimated CAGR of 9.3% through 2034. Businesses are increasingly moving away from labor-intensive methods toward fully automated solutions that reduce errors, boost efficiency, and cut operating costs. As AI-driven systems and robotics become more accessible, manufacturers are leveraging them for predictive maintenance, real-time monitoring, and process optimization. These technologies are helping industries maintain continuity even in volatile conditions, while enhancing overall output quality. Advanced automation is not just a cost-cutting tool-it's become a strategic asset for companies aiming to scale operations, respond quickly to changing market needs, and deliver consistent performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $714.5 Billion |

| Forecast Value | $1.61 Trillion |

| CAGR | 9% |

In terms of applications, the construction industry held a dominant 43.2% market share in 2024 and is projected to grow at a 9.4% CAGR through 2034. The global infrastructure boom, coupled with the rise of urbanization and large-scale public works, is fueling demand for heavy-duty machinery like cranes, loaders, and excavators. Governments and private developers are ramping up investments in smart city projects, renewable energy facilities, and modern transport systems, all of which require reliable, high-performance equipment. Construction companies are seeking rugged, technologically advanced machines that can handle complex tasks efficiently and help meet tight deadlines, further driving equipment adoption.

North America generated USD 322.7 billion in 2024, holding a 45.2% share of the global industrial machinery market. The region continues to lead, thanks to its well-established manufacturing ecosystem, strong supply chain networks, and presence of major industry players. Innovation thrives here, supported by a skilled workforce, cutting-edge technologies, and favorable economic reforms. Reshoring efforts and rising investments in automation further reinforce North America's position as a global manufacturing powerhouse.

Leading players in the global industrial machinery market include ASML, GEA, Illinois Tool Works, Ingersoll Rand, Honeywell International, CNH Industrial, Atlas Copco, Brandt Industries, Caterpillar, AGCO, ESCO, Deere, Hitachi Construction Machinery, Alfa Laval, and Gerdau. These companies are strengthening their market positions by embracing automation, AI integration, and digital transformation. Many are targeting emerging markets with rising industrial activity and forging strategic alliances with tech providers and OEMs to deliver tailored, next-gen machinery that meets modern industry demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact on forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing mechanization of farming operations

- 3.9.1.2 Escalating infrastructure spending

- 3.9.1.3 Rising adoption of smart packaging solutions

- 3.9.1.4 Surging globalization to trigger the food processing sector

- 3.9.1.5 Growth of the manufacturing sector

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Health and safety concerns

- 3.9.2.2 Lack of skilled labor and technicians

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Pricing Analysis

- 3.12 Technological advancements

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Automated machinery

- 5.3 Semi-automated machinery

- 5.4 Manual machinery

- 5.5 Robotic machinery

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Agriculture

- 6.3 Construction

- 6.4 Packaging

- 6.5 Food processing

- 6.6 Mining

- 6.7 Semiconductor manufacturing

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Indirect sales

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MAMEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 AGCO

- 9.2 Alfa Laval

- 9.3 ASML

- 9.4 Atlas Copco

- 9.5 Brandt Industries

- 9.6 Caterpillar

- 9.7 CNH Industrial

- 9.8 Deere

- 9.9 ESCO

- 9.10 GEA

- 9.11 Gerdau

- 9.12 Hitachi Construction Machinery

- 9.13 Honeywell International

- 9.14 Illinois Tool Works

- 9.15 Ingersoll Rand