|

市场调查报告书

商品编码

1721559

住宅智慧锁市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Residential Smart Lock Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

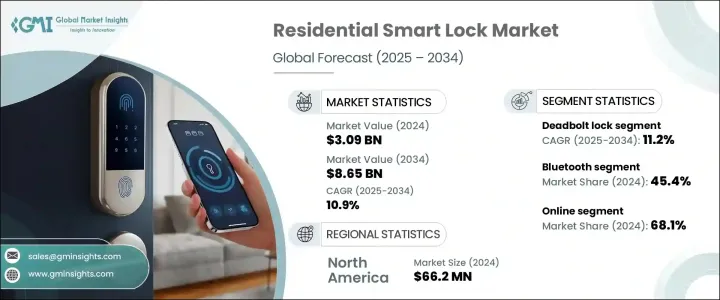

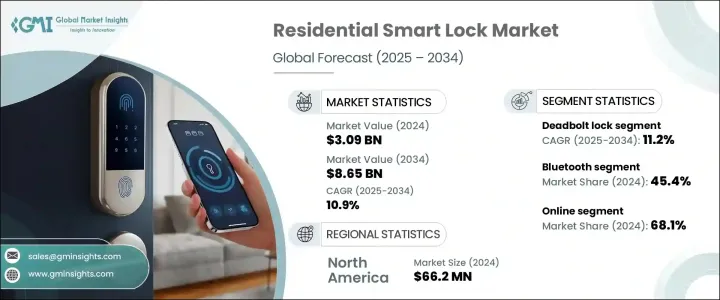

2024 年全球住宅智慧锁市场价值为 30.9 亿美元,预计到 2034 年将以 10.9% 的复合年增长率成长,达到 86.5 亿美元。在向智慧家庭生态系统快速转变的推动下,随着房主越来越重视便利性和安全性,市场正在获得发展动力。人们对入室盗窃和入室抢劫的担忧日益加剧,促使消费者从传统的锁系统升级到先进的智慧锁解决方案,这种解决方案不仅可以提供增强的安全性,还提供无钥匙进入和远端控制功能。随着城市人口的成长和智慧城市计画的全球扩张,对互联家居解决方案的需求持续上升。

技术进步,加上技术娴熟人口的不断增长,推动了住宅智慧锁的普及。这些系统可以轻鬆地与语音助理、监视摄影机和家庭自动化平台集成,为用户提供对家庭安全的集中控制。智慧型手机普及率的提高和互联网基础设施的改善也加速了这些设备的全球普及。此外,Airbnb 等租赁平台的日益普及使得智慧锁成为非接触式远端访客存取的首选解决方案,进一步扩大了其吸引力和实用性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 30.9亿美元 |

| 预测值 | 86.5亿美元 |

| 复合年增长率 | 10.9% |

市场依产品类型分类,包括槓桿手把、挂锁、门闩锁等。其中,2024 年门闩锁市场价值为 13.7 亿美元,预计预测期内复合年增长率为 11.2%。消费者更喜欢插销锁,因为它们结构坚固,功能先进。与传统锁相比,这些锁具有更高的抗强行闯入能力,并且配备了蓝牙、Wi-Fi 和生物识别等技术。智慧锁具有远端存取和免钥匙进入功能,既方便又安心,成为现代家庭的首选。

根据连接性,市场分为 Wi-Fi、蓝牙、Z-Wave 和其他。蓝牙领域在 2024 年占据 45.4% 的份额,并有望大幅成长。蓝牙技术以其低功耗和经济实惠而闻名,它允许用户透过智慧型手机控制访问,使其成为需要无缝整合和可靠性且无需持续互联网连接的消费者的理想选择。蓝牙智慧锁的可及性和能源效率正在推动其在住宅用户中越来越受欢迎。

2024 年,北美占据全球市场主导地位,占有 36.1% 的份额,这归功于该地区先进的基础设施和智慧家居设备的广泛采用。美国和加拿大的消费者正在积极投资安全升级,尤其是与家庭自动化系统相容的安全升级。生物辨识存取、行动警报和远端锁定等功能正在影响整个地区的购买决策。

全球住宅智慧锁市场的主要参与者包括小米公司、Gantner Electronic GmbH、霍尼韦尔国际公司、Allegion Plc、Amadas Inc.、Salto Systems SL、Assa Abloy AB、Avent Security、Onity Inc.、Nord-Lock International AB、Spectrum Brands, Inc.、三星电子有限公司、ZegaTeco、三星电子有限公司, Home.这些公司专注于产品创新、策略合作和扩大分销管道。他们在研发方面的投资旨在增强与智慧家庭平台的兼容性,并确保为现代房主提供顶级的安全解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 零售商

- 对部队的影响

- 成长动力

- 全球智慧锁的普及率不断提高

- 安全担忧加剧

- 智慧型手机使用率增加

- 增强功能与传统锁定係统的集成

- 产业陷阱与挑战

- 不断变化的消费者需求

- 高成本投资

- 成长动力

- 成长潜力分析

- 技术进步

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品类型,2021 - 2034 年(百万美元)

- 主要趋势

- 插销锁

- 槓桿手柄

- 挂锁

- 其他的

第六章:市场估计与预测:按解锁机制,2021 - 2034 年(百万美元)

- 主要趋势

- 键盘

- 触控萤幕

- 基于应用程式

- 杂交种

- 生物识别

- 其他的

第七章:市场估计与预测:按连结类型,2021 - 2034 年(百万美元)

- 主要趋势

- 无线上网

- 蓝牙

- Z-波

- 其他的

第八章:市场估计与预测:依价格区间,2021 - 2034 年(百万美元)

- 主要趋势

- 低(100 美元)

- 中(100-300美元)

- 高(>300 美元)

第九章:市场估计与预测:按最终用途,2021 - 2034 年(百万美元)

- 主要趋势

- 共管公寓

- 独立住宅

- 公寓

- 其他(度假屋等)

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年(百万美元)

- 主要趋势

- 线上通路

- 电子商务

- 公司网站

- 线下通路

- 专卖店

- 大型零售商店

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年(百万美元)

- 主要趋势

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 玛米亚

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十二章:公司简介

- Allegion Plc

- Amadas Inc.

- Assa Abloy AB

- August Home Inc.

- Avent Security

- Gantner Electronic GmbH

- Honeywell International Inc.

- Megadoorlock Technology Co., Ltd.

- Nord-Lock International AB

- Onity Inc.

- Salto Systems SL

- Samsung Electronics Co. Ltd.

- Spectrum Brands, Inc.

- Xiaomi Corporation

- ZKTeco USA

The Global Residential Smart Lock Market was valued at USD 3.09 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 8.65 billion by 2034. Driven by a rapid shift toward smart home ecosystems, this market is gaining traction as homeowners increasingly prioritize both convenience and security. Rising concerns over break-ins and home invasions are prompting consumers to upgrade from traditional locking systems to advanced smart lock solutions that provide not only enhanced security but also keyless access and remote control features. As urban populations grow and smart city projects expand globally, the demand for connected home solutions continues to rise.

Technological advancements, combined with a growing tech-savvy population, are fueling the adoption of residential smart locks. These systems can be easily integrated with voice assistants, surveillance cameras, and home automation platforms, offering users centralized control of their home security. Increasing penetration of smartphones and improved internet infrastructure are also accelerating the global adoption of these devices. Furthermore, the growing popularity of rental platforms like Airbnb has made smart locks a go-to solution for contactless, remote guest access, further widening their appeal and utility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.09 Billion |

| Forecast Value | $8.65 Billion |

| CAGR | 10.9% |

The market is categorized by product type, including lever handles, padlocks, deadbolt locks, and others. Among these, the deadbolt lock segment generated USD 1.37 billion in 2024 and is anticipated to expand at a CAGR of 11.2% through the forecast period. Consumers prefer deadbolt locks for their robust build quality and advanced features. These locks provide higher resistance to forced entry compared to traditional options and are now equipped with technologies like Bluetooth, Wi-Fi, and biometrics. With remote access and keyless entry functionalities, smart deadbolt locks offer both convenience and peace of mind, making them a preferred choice for modern households.

Based on connectivity, the market is segmented into Wi-Fi, Bluetooth, Z-Wave, and others. The Bluetooth segment held a 45.4% share in 2024 and is positioned for substantial growth. Known for its low power consumption and affordability, Bluetooth technology allows users to control access via smartphones, making it an ideal fit for consumers who demand seamless integration and reliability without the need for constant internet connectivity. The accessibility and energy efficiency of Bluetooth-enabled smart locks are driving their popularity among residential users.

North America dominated the global market with a 36.1% share in 2024, attributed to the region's advanced infrastructure and widespread adoption of smart home devices. Consumers across the U.S. and Canada are actively investing in security upgrades, especially those compatible with home automation systems. Features like biometric access, mobile alerts, and remote locking are influencing purchasing decisions across the region.

Major players in the global residential smart lock market include Xiaomi Corporation, Gantner Electronic GmbH, Honeywell International Inc., Allegion Plc, Amadas Inc., Salto Systems S.L., Assa Abloy AB, Avent Security, Onity Inc., Nord-Lock International AB, Spectrum Brands, Inc., Samsung Electronics Co. Ltd., ZKTeco USA, Megadoorlock Technology Co., Ltd., and August Home Inc. These companies are focusing on product innovation, strategic collaborations, and expanding distribution channels. Their investments in R&D are aimed at enhancing compatibility with smart home platforms and ensuring top-tier security solutions for modern homeowners.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increase in adoption of smart locks on a global scale

- 3.10.1.2 Rise in security concerns

- 3.10.1.3 Increased use of smartphones

- 3.10.1.4 Integration of enhanced features with traditional lock systems

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Evolving consumer demands

- 3.10.2.2 High-cost investments

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Technological advancements

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Key trends

- 5.2 Deadbolt lock

- 5.3 Lever handle

- 5.4 Padlock

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Unlocking Mechanism, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Key trends

- 6.2 Keyboard

- 6.3 Touchscreen

- 6.4 App based

- 6.5 Hybrid

- 6.6 Biometric

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Connectivity Type, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Key trends

- 7.2 Wi-Fi

- 7.3 Bluetooth

- 7.4 Z-wave

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Key trends

- 8.2 Low (100$)

- 8.3 Mid (100$-300$)

- 8.4 High (>300$)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Key trends

- 9.2 Condominium

- 9.3 Individual houses

- 9.4 Apartments

- 9.5 Others (vacation homes, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 10.1 Key trends

- 10.2 Online channels

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline channels

- 10.3.1 Specialty stores

- 10.3.2 Mega retail stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 The U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MAMEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Allegion Plc

- 12.2 Amadas Inc.

- 12.3 Assa Abloy AB

- 12.4 August Home Inc.

- 12.5 Avent Security

- 12.6 Gantner Electronic GmbH

- 12.7 Honeywell International Inc.

- 12.8 Megadoorlock Technology Co., Ltd.

- 12.9 Nord-Lock International AB

- 12.10 Onity Inc.

- 12.11 Salto Systems S.L.

- 12.12 Samsung Electronics Co. Ltd.

- 12.13 Spectrum Brands, Inc.

- 12.14 Xiaomi Corporation

- 12.15 ZKTeco USA