|

市场调查报告书

商品编码

1940582

智慧锁:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Smart Lock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

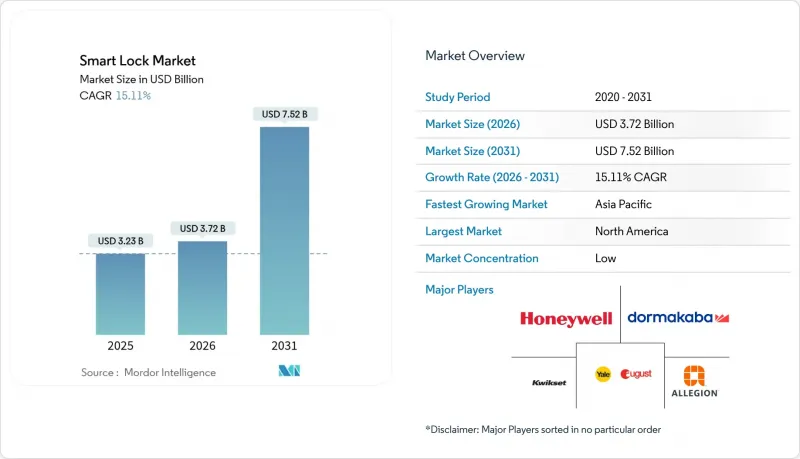

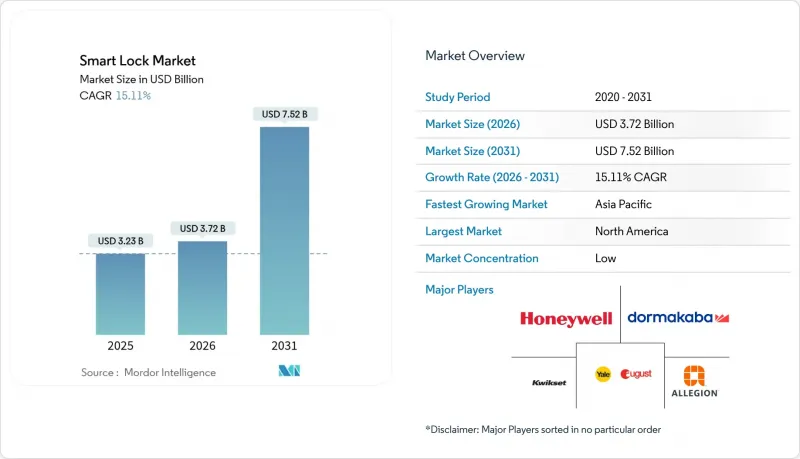

2025年智慧锁市场价值为32.3亿美元,预计到2031年将达到75.2亿美元,高于2026年的37.2亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 15.11%。

这项前景主要受多种因素驱动,包括日益成熟的智慧家庭平台、日益增长的都市区安全隐患以及物联网连接性的扩展,从而实现远端门禁。 Matter 和 Thread 标准的互通性进步正在消除许多整合障碍,而生物识别感测器价格的下降则扩展了住宅和轻型商业应用的功能集。儘管半导体短缺导致的价格上涨构成短期不利因素,但保险折扣和更低的总体拥有成本 (TCO) 将继续推动机械锁的替换。活性化的收购活动表明,现有的门禁控制领导企业正在积极布局,以确保规模、分销管道和核心技术。

全球智慧锁市场趋势与洞察

智慧家庭生态系统的快速普及

随着用户对统一设备控制的偏好日益增长,智慧门锁整合已成为连网家庭领域首批升级之一。耶鲁、Schlage 和 Level 共同推出的 Matter over Thread 平台打破了厂商锁定,并将电池续航时间延长至 12 个月以上。语音助理已在美国 70% 的家庭中普及,加速了语音门锁的普及。预计到 2026 年,Thread 1.4 的广泛应用将使新产品无需额外网关即可连接到现有网络,从而进一步增强生态系统的整合。

都市区窃盗增多,安全隐患日益严重

都市区犯罪模式令住宅高度警惕,数据显示,83%的入侵者在入室行窃前会检查安防系统。将智慧门锁与影像认证结合,可消除传统系统常见的15秒警报响应延迟。 Lockly的脸部认证引擎目前可在1.5秒内侦测出诈欺性人脸,并触发即时警报以遏止机会主义犯罪。生物识别和PIN码的多因素组合为高密度住宅高层建筑增加了一层额外的安全保障,因为在这些地方,匿名性往往是入室盗窃的温床。

网路安全与骇客攻击漏洞

备受瞩目的安全漏洞事件暴露了主流产品中生物识别绕过和可复製NFC标籤的问题。一家消费者组织的测试发现,85.7%的晶片启动设备至少有一项严重缺陷。目前,供应商提供端对端加密和双因素认证,但硬体设计的碎片化使得通用修补程式难以维护。连接标准联盟(Connectivity Standards Alliance)内的产业组织正在製定基准要求,但实施上的差异导致网路安全风险持续居高不下。

细分市场分析

到2025年,插销锁将占总收入的45.12%,反映出住宅普遍信赖其坚固耐用的品质。这一份额在智慧锁硬体市场中占比最大。由于饭店和办公室对符合《美国残障人士法案》(ADA)的要求,拉桿式门锁系统将实现15.18%的复合年增长率,成为增长最快的产品,这表明其操作简便性在高人流量环境中极具吸引力。

追求隐藏升级的消费者对改装锁心的需求日益增长,这类锁芯可以将电子元件隐藏在现有外壳内,例如Level的隐形锁芯。挂锁式智慧型装置适用于户外工业应用场景,但由于防风雨改造成本较高,目前仍属于小众市场。儘管智慧锁的持续小型化将模糊产品类别的界限,但预计到2031年,插销式智慧锁仍将占据智慧锁市场的主导地位。

截至2025年,蓝牙智慧锁以61.68%的市占率占据市场领先地位。智慧型手机与智慧锁配对的便利性使其适用于路由器连接不稳定的租赁房屋。然而,通讯范围和网状网路方面的限制使其不适用于多用户住宅。

受Matter认证和Silicon Labs超低功耗SoC的推动,Zigbee-Thread协定栈预计将以16.74%的复合年增长率成长。 Wi-Fi仍被广泛应用于电池密集、云端优先的部署场景,这些场景优先考虑直接远端控制。超宽频(UWB)等新兴技术可实现免手动精准操作,但在出货量扩大之前,它们仍将被归类为「其他」类别。通讯协定标准化程度的提高正在减少分散化,这一趋势将推动智慧锁市场的整体普及。

智慧锁市场按锁类型(插销锁、拉桿锁等)、通讯技术(蓝牙、Wi-Fi等)、认证方式(密码/小键盘、生物识别(指纹、人脸)等)、最终用户(住宅、商业办公等)和地区进行细分。市场预测以美元计价。

区域分析

预计到2025年,北美将占总收入的37.05%,这主要得益于智慧家庭的早期普及、有利的建筑规范以及智慧安防产品最高可达10%的保险折扣。在美国,由于开发商将智慧门锁视为标准配置,维修需求正在推动市场成长。加拿大也将紧随其后,受益于类似的建筑规范和宽频普及率。

亚太地区预计将实现最高的复合年增长率(CAGR),达到15.42%,反映出快速的都市区和中产阶级可支配收入的成长。中国在智慧家庭出货量方面主导,印度住宅自动化市场预计将成长39.79%,智慧门锁在消费者的升级清单中名列前茅。在日本,人口老化推动了对非接触式门禁解决方案的需求,这些方案有助于老年人保持独立生活能力。

欧洲在能源效率指令和强而有力的隐私监管的推动下,正稳步推动智慧门锁的发展。先进的加密要求推高了开发成本,但也促使企业推出符合GDPR要求的差异化产品。中东和非洲地区目前规模虽小,但受益于新房地产计划中嵌入的智慧城市投资,这为智慧门锁市场的未来发展奠定了坚实的基础,并为其提供了重要的市场应用路径。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 智慧家庭生态系统的快速普及

- 都市区窃盗增多,安全隐患日益严重

- 智慧型手机和物联网的普及使得远端存取成为可能。

- 根据《建筑标准法》推广非接触式节能门

- Airbnb式出租房对自动化访客的需求

- 智慧门锁可享住宅保险折扣

- 市场限制

- 网路安全与骇客攻击漏洞

- 初始设备和安装成本溢价

- 电池寿命和维护问题是消费者关注的问题。

- 维修计划中通讯协定之间的互通性差距

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 对影响市场的宏观经济因素进行评估

第五章 市场规模与成长预测

- 按锁类型

- 门栓

- 槓桿手柄

- 挂锁

- 其他的

- 透过通讯技术

- Bluetooth

- Wi-Fi

- Zigbee

- 其他的

- 透过身份验证方法

- PIN码/小键盘

- 生物识别(指纹、脸部)

- RFID/NFC卡

- 其他的

- 最终用户

- 住宅

- 销售办事处

- 住宿设施和短期租赁

- 工业和基础设施

- 按地区

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ASSA ABLOY(Yale, August)

- Allegion plc(Schlage)

- Spectrum Brands Holdings(Kwikset)

- dormakaba Group

- Honeywell International

- SALTO Systems

- U-TEC(ULTRALOQ)

- Lockly

- Master Lock

- Nuki Home Solutions

- Netatmo(Legrand)

- SimpliSafe

- Samsung SDS

- Aqara(Xiaomi)

- Eufy Security(Anker)

- Level Home

- Tedee

- Hanman International

- Panasonic Life Solutions

- Xiaomi Mi Smart Home

第七章 市场机会与未来展望

The smart lock market was valued at USD 3.23 billion in 2025 and estimated to grow from USD 3.72 billion in 2026 to reach USD 7.52 billion by 2031, at a CAGR of 15.11% during the forecast period (2026-2031).

The outlook highlights the convergence of maturing smart-home platforms, rising urban security concerns, and expanding IoT connectivity that favors remote door access. Interoperability progress through the Matter and Thread standards now removes many integration barriers, while declining biometric sensor prices are broadening feature sets across both residential and light-commercial models. Price increases linked to semiconductor shortages are a near-term headwind, yet insurance premium discounts and total-cost-of-ownership savings continue to encourage replacement of mechanical locks. Intensifying acquisition activity shows established access-control leaders positioning to secure scale, channel reach, and core technology.

Global Smart Lock Market Trends and Insights

Rapid Adoption of Smart-Home Ecosystems

Growing preference for unified device control makes smart lock integration one of the first upgrades in connected homes. Matter-over-Thread launches by Yale, Schlage, and Level are removing vendor lock-in and extending battery life to more than 12 months. Voice assistants already reside in 70% of United States households, which accelerates voice-enabled locking. Scheduled Thread 1.4 adoption by 2026 will let new products join existing networks without additional hubs, further tightening ecosystem stickiness.

Rising Burglary and Safety Concerns in Urban Areas

Urban crime patterns have raised homeowner vigilance, and data show 83% of burglars survey security setups before entry. Integrating a smart lock with video verification closes the 15-second alarm response gap common in legacy systems. Lockly's facial recognition engine now flags unauthorized faces in 1.5 seconds, sending real-time alerts that deter opportunistic crime. Multi-factor combinations of biometrics and PINs add layered protection for dense residential high-rises where anonymity often aids break-ins.

Cyber-Security and Hacking Vulnerabilities

High-profile breaches have exposed biometric bypasses and cloneable NFC tags in mainstream models. Tests by one consumer association found 85.7% of chip-activated units exhibited at least one critical flaw. Vendors now ship end-to-end encryption and two-factor log-ins, yet fragmented hardware designs make universal patching hard to maintain. Industry groups within the Connectivity Standards Alliance are drafting baseline requirements, but wide variation in implementation keeps cyber-risk elevated.

Other drivers and restraints analyzed in the detailed report include:

- Smartphone and IoT Proliferation Enabling Remote Access

- Building-Code Push for Keyless Energy-Efficient Doors

- Up-Front Device and Installation Cost Premium

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deadbolts retained 45.12% of 2025 revenue, reflecting widespread homeowner confidence in their physical robustness. This share equates to the largest slice of the smart lock market size for hardware formats. Lever handle systems achieved the leading 15.18% CAGR due to ADA compliance needs in hotels and offices, demonstrating how ease-of-operation appeals to high-traffic settings.

Consumers seeking discreet upgrades have driven interest in retrofit cylinders that hide electronics inside existing housings, exemplified by Level's invisible mechanism. Padlock-style smart devices service out-door industrial use cases but remain niche because of weather-proofing costs. Continuous miniaturization will likely blur category boundaries, though deadbolts are expected to keep a commanding presence through 2031 in the smart lock market.

Bluetooth held 61.68% share in 2025, translating into the top position within the smart lock market share for connectivity. Its phone-to-lock pairing simplicity favors rental properties where router access is uncertain. Range and mesh limitations, however, make it less suited to multi-unit dwellings.

The Zigbee-Thread stack is projected for a 16.74% CAGR, propelled by Matter certification and Silicon Labs' ultra-low-power SoCs. Wi-Fi continues in cloud-first deployments that prioritize direct remote control despite battery drain. Emerging ultra-wideband adds hands-free precision but sits within the "Others" bucket until shipping volumes scale. Across protocols, standardization is shrinking fragmentation, a trend that will raise the overall smart lock market adoption curve.

Smart Lock Market is Segmented by Lock Type (Deadbolt, Lever Handle, and More), Communication Technology (Bluetooth, Wi-Fi, and More), Authentication Method (Pin-Code / Keypad, Biometric (Fingerprint, Face), and More), End User (Residential, Commercial Offices, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 37.05% of 2025 revenue due to early smart-home adoption, favorable codes, and insurance discounts of up to 10% for connected security. The United States drives renovation demand as developers view smart locks as standard amenity packages. Canada follows, leveraging similar building norms and broadband penetration.

Asia-Pacific is set for the highest 15.42% CAGR, reflecting rapid urban migration and growing middle-class disposable income. China leads smart-home shipments, while India's residential automation pipeline shows a 39.79% expansion outlook that positions smart locks near the top of consumer upgrade lists. Japan's aging demographic attracts contactless door solutions supporting senior independence.

Europe posts steady progression anchored by energy-efficiency directives and strong privacy oversight. Advanced encryption requirements raise development costs yet promote differentiated offerings that comply with GDPR. The Middle East and Africa, though smaller today, benefit from smart-city investments baked into greenfield real-estate projects, enabling leapfrog adoption paths that raise the future baseline of the smart lock market.

- ASSA ABLOY (Yale, August)

- Allegion plc (Schlage)

- Spectrum Brands Holdings (Kwikset)

- dormakaba Group

- Honeywell International

- SALTO Systems

- U-TEC (ULTRALOQ)

- Lockly

- Master Lock

- Nuki Home Solutions

- Netatmo (Legrand)

- SimpliSafe

- Samsung SDS

- Aqara (Xiaomi)

- Eufy Security (Anker)

- Level Home

- Tedee

- Hanman International

- Panasonic Life Solutions

- Xiaomi Mi Smart Home

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of smart-home ecosystems

- 4.2.2 Rising burglary and safety concerns in urban areas

- 4.2.3 Smartphone and IoT proliferation enabling remote access

- 4.2.4 Building-code push for keyless energy-efficient doors

- 4.2.5 Airbnb-style rentals demanding automated guest access

- 4.2.6 Home-insurance premium discounts for connected locks

- 4.3 Market Restraints

- 4.3.1 Cyber-security and hacking vulnerabilities

- 4.3.2 Up-front device and installation cost premium

- 4.3.3 Battery-life / maintenance anxieties among consumers

- 4.3.4 Inter-protocol interoperability gaps in retrofit projects

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Lock Type

- 5.1.1 Deadbolt

- 5.1.2 Lever Handle

- 5.1.3 Padlock

- 5.1.4 Others

- 5.2 By Communication Technology

- 5.2.1 Bluetooth

- 5.2.2 Wi-Fi

- 5.2.3 Zigbee

- 5.2.4 Others

- 5.3 By Authentication Method

- 5.3.1 Pin-Code / Keypad

- 5.3.2 Biometric (Fingerprint, Face)

- 5.3.3 RFID / NFC Card

- 5.3.4 Others

- 5.4 By End-user

- 5.4.1 Residential

- 5.4.2 Commercial Offices

- 5.4.3 Hospitality and Short-term Rentals

- 5.4.4 Industrial and Infrastructure

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.2.5 Egypt

- 5.5.5.2.6 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ASSA ABLOY (Yale, August)

- 6.4.2 Allegion plc (Schlage)

- 6.4.3 Spectrum Brands Holdings (Kwikset)

- 6.4.4 dormakaba Group

- 6.4.5 Honeywell International

- 6.4.6 SALTO Systems

- 6.4.7 U-TEC (ULTRALOQ)

- 6.4.8 Lockly

- 6.4.9 Master Lock

- 6.4.10 Nuki Home Solutions

- 6.4.11 Netatmo (Legrand)

- 6.4.12 SimpliSafe

- 6.4.13 Samsung SDS

- 6.4.14 Aqara (Xiaomi)

- 6.4.15 Eufy Security (Anker)

- 6.4.16 Level Home

- 6.4.17 Tedee

- 6.4.18 Hanman International

- 6.4.19 Panasonic Life Solutions

- 6.4.20 Xiaomi Mi Smart Home

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment