|

市场调查报告书

商品编码

1851886

智慧锁:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Smart Lock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

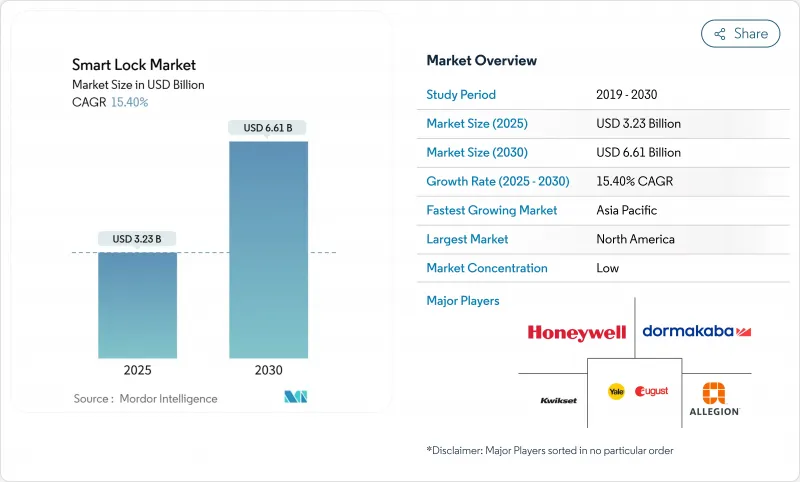

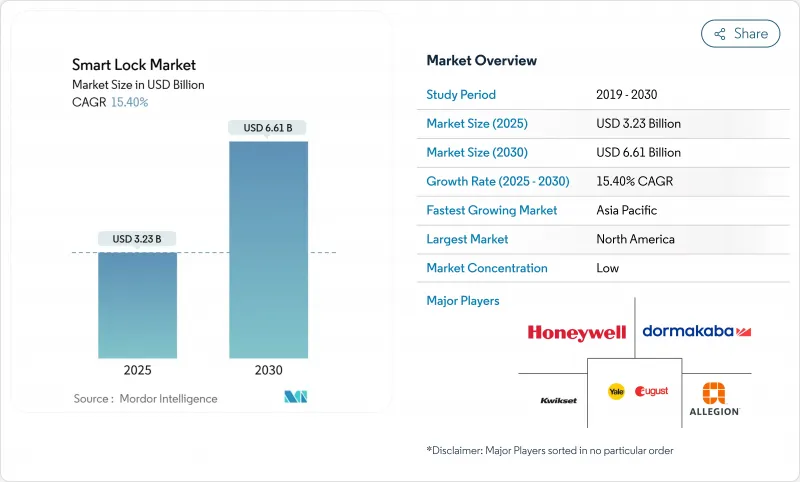

预计到 2025 年,智慧锁市场规模将达到 32.3 亿美元,到 2030 年将达到 66.1 亿美元,复合年增长率为 15.40%。

展望报告重点指出,日趋成熟的智慧家庭平台、日益增长的都市区安全隐患以及不断扩展的物联网连接将共同推动远端门禁的发展。 Matter 和 Thread 标准的进步提升了互通性,消除了许多整合障碍;同时,生物辨识感测器价格的下降也拓展了住宅和轻型商用门锁的功能。儘管半导体短缺导致的价格上涨构成了直接的阻力,但保险折扣和整体拥有成本的降低将继续推动机械锁的更换。随着领先的门禁控制公司积极布局以确保规模、管道覆盖和核心技术,收购活动正在增加。

全球智慧锁市场趋势与洞察

智慧家庭生态系统的快速普及

智慧门锁整合是连网家庭首批升级之一。耶鲁、Schlage 和 Level 共同推出的 Matter-over-Thread 技术打破了厂商锁定,并将电池续航时间延长至 12 个月以上。语音助理已在美国70% 的家庭中普及,加速了语音门锁的普及。预计到 2026 年,Thread 1.4 的发布将允许新产品无需额外中心即可加入现有网络,进一步增强生态系统的凝聚力。

人们越来越关注都市区的盗窃和安全问题

都市区犯罪模式的演变促使房主提高警惕,数据显示,83%的窃贼在入侵前会先探查安防设定。将智慧门锁与视讯检验结合,弥补了旧有系统15秒警报回应时间的不足。 Lockly的脸部辨识引擎可在1.5秒内辨识出可疑人脸,并发出即时警报,有效震慑伺机犯案的犯罪者。生物识别和密码的多因素组合,为人口密集的高层住宅大楼增添了一层额外的安全保障,因为在这些场所,匿名性往往是入室盗窃的诱因。

网路安全与骇客攻击漏洞

备受瞩目的资料外洩事件暴露了主流产品中存在的生物识别绕过和可复製NFC标籤漏洞。一家消费者组织的测试发现,85.7%的晶片启动设备至少有一项严重缺陷。儘管厂商现在提供端对端加密和双重登入功能,但硬体设计的碎片化使得维护通用修补程式变得困难。连接标准联盟(Connectivity Standards Alliance)行业组织正在製定基准要求,但实际执行情况差异很大,使得网路安全风险日益增加。

细分市场分析

到2024年,插销锁将占总销售额的45.7%,这充分反映了房主对其物理坚固性的信任。这一份额在智慧锁硬体市场中占据最大比例。槓桿式门把手系统将以15.6%的复合年增长率领跑,这主要得益于酒店和办公室对ADA(美国残疾人法案)合规性的需求,也体现了操作便利性在高人流量环境中的吸引力。

寻求隐藏升级的消费者正转向改造锁芯,例如Level的隐形锁芯,这种锁芯将电子元件隐藏在现有锁体内部。挂锁式智慧型装置适用于户外工业应用场景,但由于防水成本较高,目前仍属于小众产品。儘管小型化趋势将模糊产品类别的界限,但预计到2030年,插销式智慧锁仍将主导智慧锁市场。

蓝牙将在智慧锁市场占据主导地位,预计2024年将占据62.3%的市场。对于路由器接入不稳定的租赁房产来说,手机与智慧锁的简单配对非常有利。然而,通讯和网状网路覆盖范围的限制使其不适用于多用户住宅。

受Matter认证和Silicon Labs超低功耗SoC的推动,Zigbee-Thread协定栈预计将以17.2%的复合年增长率成长。儘管Wi-Fi存在耗电问题,但其云端优先部署模式仍优先考虑直接远端控制。新兴的超宽频技术提高了免持作业的精准度,但在出货量扩大之前,仍将归类为「其他」类别。在通讯协定层面,标准化正在减少分散化,从而推动整个智慧锁市场的普及。

智慧锁市场按锁类型(插销锁、拉桿锁等)、通讯技术(蓝牙、Wi-Fi等)、认证方式(密码/小键盘、生物辨识(指纹、人脸)等)、最终用户(住宅、商业办公等)和地区进行细分。市场预测以美元计价。

区域分析

预计到2024年,北美将占据37.7%的市场份额,这主要得益于智慧家庭的早期普及、有利的法规以及配备智慧安防系统可享有高达10%的保险折扣。美国正在推动翻新需求,因为开发人员已将智慧门锁视为标准配套设施。加拿大也将紧随其后,利用类似的建筑规范和广泛的宽频接入。

亚太地区将以15.9%的复合年增长率领跑,反映出快速的都市区和中阶可支配所得的成长。中国将引领智慧家庭出货量,印度的智慧家庭产品线预计将成长39.79%,智慧门锁也位列消费者升级清单之首。在日本,随着人口老化,非接触式门锁解决方案正日益受到关注,以帮助老年人保持独立生活能力。

在能源效率指令和强而有力的隐私监管的支持下,欧洲正稳步推动智慧门锁的发展。进阶加密要求虽然增加了开发成本,但也有助于交付符合GDPR要求的差异化产品。中东和非洲虽然目前规模较小,但正受益于待开发区房地产计划中嵌入的智慧城市投资,从而实现了跨越式发展,提高了未来智慧门锁市场的基准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 智慧家庭生态系统的快速普及

- 都市区入室窃盗案增多,安全隐患增加

- 智慧型手机和物联网的普及使得远端存取成为可能

- 根据《建筑标准法》推广免钥匙节能门

- 寻求自动化房客存取权限的Airbnb式出租房屋

- 智能锁家庭保险折扣

- 市场限制

- 网路安全与骇客攻击漏洞

- 领先设备和安装费用的溢价

- 消费者关注电池寿命和维护问题

- 改装计划中的通讯协定互通性差距

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按锁类型

- 门栓

- 槓桿手柄

- 挂锁

- 其他的

- 透过通讯技术

- Bluetooth

- Wi-Fi

- Zigbee

- 其他的

- 透过身份验证方法

- PIN码/小键盘

- 生物辨识技术(指纹、脸部)

- RFID/NFC卡

- 其他的

- 最终用户

- 住房

- 商业办公

- 饭店和短期租赁

- 工业和基础设施

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ASSA ABLOY(Yale, August)

- Allegion plc(Schlage)

- Spectrum Brands Holdings(Kwikset)

- dormakaba Group

- Honeywell International

- SALTO Systems

- U-TEC(ULTRALOQ)

- Lockly

- Master Lock

- Nuki Home Solutions

- Netatmo(Legrand)

- SimpliSafe

- Samsung SDS

- Aqara(Xiaomi)

- Eufy Security(Anker)

- Level Home

- Tedee

- Hanman International

- Panasonic Life Solutions

- Xiaomi Mi Smart Home

第七章 市场机会与未来展望

The smart lock market stands at a valuation of USD 3.23 billion in 2025 and is forecast to reach USD 6.61 billion by 2030, reflecting a 15.40% CAGR.

The outlook highlights the convergence of maturing smart-home platforms, rising urban security concerns, and expanding IoT connectivity that favors remote door access. Interoperability progress through the Matter and Thread standards now removes many integration barriers, while declining biometric sensor prices are broadening feature sets across both residential and light-commercial models. Price increases linked to semiconductor shortages are a near-term headwind, yet insurance premium discounts and total-cost-of-ownership savings continue to encourage replacement of mechanical locks. Intensifying acquisition activity shows established access-control leaders positioning to secure scale, channel reach, and core technology.

Global Smart Lock Market Trends and Insights

Rapid Adoption of Smart-Home Ecosystems

Growing preference for unified device control makes smart lock integration one of the first upgrades in connected homes. Matter-over-Thread launches by Yale, Schlage, and Level are removing vendor lock-in and extending battery life to more than 12 months. Voice assistants already reside in 70% of United States households, which accelerates voice-enabled locking. Scheduled Thread 1.4 adoption by 2026 will let new products join existing networks without additional hubs, further tightening ecosystem stickiness.

Rising Burglary and Safety Concerns in Urban Areas

Urban crime patterns have raised homeowner vigilance, and data show 83% of burglars survey security setups before entry. Integrating a smart lock with video verification closes the 15-second alarm response gap common in legacy systems. Lockly's facial recognition engine now flags unauthorized faces in 1.5 seconds, sending real-time alerts that deter opportunistic crime. Multi-factor combinations of biometrics and PINs add layered protection for dense residential high-rises where anonymity often aids break-ins.

Cyber-Security and Hacking Vulnerabilities

High-profile breaches have exposed biometric bypasses and cloneable NFC tags in mainstream models. Tests by one consumer association found 85.7% of chip-activated units exhibited at least one critical flaw. Vendors now ship end-to-end encryption and two-factor log-ins, yet fragmented hardware designs make universal patching hard to maintain. Industry groups within the Connectivity Standards Alliance are drafting baseline requirements, but wide variation in implementation keeps cyber-risk elevated.

Other drivers and restraints analyzed in the detailed report include:

- Smartphone and IoT Proliferation Enabling Remote Access

- Building-Code Push for Keyless Energy-Efficient Doors

- Up-Front Device and Installation Cost Premium

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Deadbolts retained 45.7% of 2024 revenue, reflecting widespread homeowner confidence in their physical robustness. This share equates to the largest slice of the smart lock market size for hardware formats. Lever handle systems achieved the leading 15.6% CAGR due to ADA compliance needs in hotels and offices, demonstrating how ease-of-operation appeals to high-traffic settings.

Consumers seeking discreet upgrades have driven interest in retrofit cylinders that hide electronics inside existing housings, exemplified by Level's invisible mechanism. Padlock-style smart devices service out-door industrial use cases but remain niche because of weather-proofing costs. Continuous miniaturization will likely blur category boundaries, though deadbolts are expected to keep a commanding presence through 2030 in the smart lock market.

Bluetooth held 62.3% share in 2024, translating into the top position within the smart lock market share for connectivity. Its phone-to-lock pairing simplicity favors rental properties where router access is uncertain. Range and mesh limitations, however, make it less suited to multi-unit dwellings.

The Zigbee-Thread stack is projected for a 17.2% CAGR, propelled by Matter certification and Silicon Labs' ultra-low-power SoCs. Wi-Fi continues in cloud-first deployments that prioritize direct remote control despite battery drain. Emerging ultra-wideband adds hands-free precision but sits within the "Others" bucket until shipping volumes scale. Across protocols, standardization is shrinking fragmentation, a trend that will raise the overall smart lock market adoption curve.

Smart Lock Market is Segmented by Lock Type (Deadbolt, Lever Handle, and More), Communication Technology (Bluetooth, Wi-Fi, and More), Authentication Method (Pin-Code / Keypad, Biometric (Fingerprint, Face), and More), End User (Residential, Commercial Offices, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 37.7% of 2024 revenue due to early smart-home adoption, favorable codes, and insurance discounts of up to 10% for connected security. The United States drives renovation demand as developers view smart locks as standard amenity packages. Canada follows, leveraging similar building norms and broadband penetration.

Asia-Pacific is set for the highest 15.9% CAGR, reflecting rapid urban migration and growing middle-class disposable income. China leads smart-home shipments, while India's residential automation pipeline shows a 39.79% expansion outlook that positions smart locks near the top of consumer upgrade lists. Japan's aging demographic attracts contactless door solutions supporting senior independence.

Europe posts steady progression anchored by energy-efficiency directives and strong privacy oversight. Advanced encryption requirements raise development costs yet promote differentiated offerings that comply with GDPR. The Middle East and Africa, though smaller today, benefit from smart-city investments baked into greenfield real-estate projects, enabling leapfrog adoption paths that raise the future baseline of the smart lock market.

- ASSA ABLOY (Yale, August)

- Allegion plc (Schlage)

- Spectrum Brands Holdings (Kwikset)

- dormakaba Group

- Honeywell International

- SALTO Systems

- U-TEC (ULTRALOQ)

- Lockly

- Master Lock

- Nuki Home Solutions

- Netatmo (Legrand)

- SimpliSafe

- Samsung SDS

- Aqara (Xiaomi)

- Eufy Security (Anker)

- Level Home

- Tedee

- Hanman International

- Panasonic Life Solutions

- Xiaomi Mi Smart Home

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of smart-home ecosystems

- 4.2.2 Rising burglary and safety concerns in urban areas

- 4.2.3 Smartphone and IoT proliferation enabling remote access

- 4.2.4 Building-code push for keyless energy-efficient doors

- 4.2.5 Airbnb-style rentals demanding automated guest access

- 4.2.6 Home-insurance premium discounts for connected locks

- 4.3 Market Restraints

- 4.3.1 Cyber-security and hacking vulnerabilities

- 4.3.2 Up-front device and installation cost premium

- 4.3.3 Battery-life / maintenance anxieties among consumers

- 4.3.4 Inter-protocol interoperability gaps in retrofit projects

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Lock Type

- 5.1.1 Deadbolt

- 5.1.2 Lever Handle

- 5.1.3 Padlock

- 5.1.4 Others

- 5.2 By Communication Technology

- 5.2.1 Bluetooth

- 5.2.2 Wi-Fi

- 5.2.3 Zigbee

- 5.2.4 Others

- 5.3 By Authentication Method

- 5.3.1 Pin-Code / Keypad

- 5.3.2 Biometric (Fingerprint, Face)

- 5.3.3 RFID / NFC Card

- 5.3.4 Others

- 5.4 By End-user

- 5.4.1 Residential

- 5.4.2 Commercial Offices

- 5.4.3 Hospitality and Short-term Rentals

- 5.4.4 Industrial and Infrastructure

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.2.5 Egypt

- 5.5.5.2.6 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ASSA ABLOY (Yale, August)

- 6.4.2 Allegion plc (Schlage)

- 6.4.3 Spectrum Brands Holdings (Kwikset)

- 6.4.4 dormakaba Group

- 6.4.5 Honeywell International

- 6.4.6 SALTO Systems

- 6.4.7 U-TEC (ULTRALOQ)

- 6.4.8 Lockly

- 6.4.9 Master Lock

- 6.4.10 Nuki Home Solutions

- 6.4.11 Netatmo (Legrand)

- 6.4.12 SimpliSafe

- 6.4.13 Samsung SDS

- 6.4.14 Aqara (Xiaomi)

- 6.4.15 Eufy Security (Anker)

- 6.4.16 Level Home

- 6.4.17 Tedee

- 6.4.18 Hanman International

- 6.4.19 Panasonic Life Solutions

- 6.4.20 Xiaomi Mi Smart Home

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment