|

市场调查报告书

商品编码

1721605

口袋门市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pocket Door Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

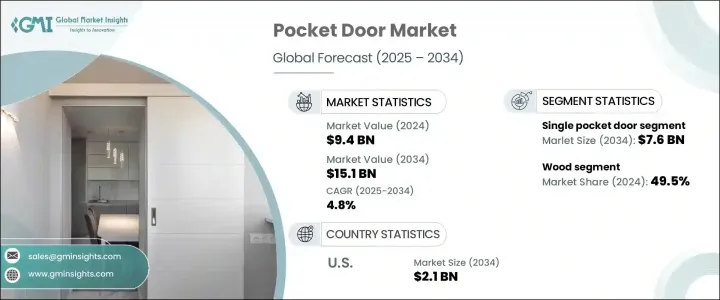

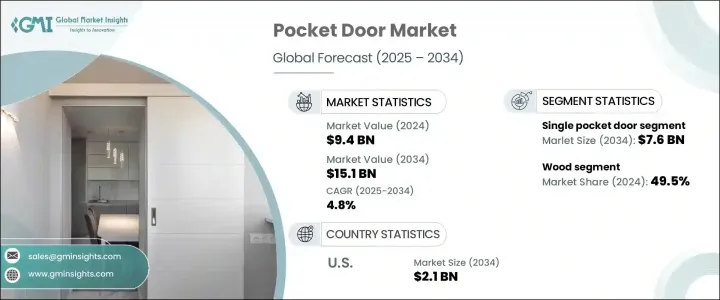

2024 年全球口袋门市场价值为 94 亿美元,预计到 2034 年将以 4.8% 的复合年增长率成长,达到 151 亿美元。随着越来越多的人优先考虑智慧、节省空间的室内空间,住宅和商业环境中对口袋门的需求都在稳步上升。这些滑动门可以巧妙地融入墙壁空腔中,而无需旋转打开,从而提供了一种时尚实用的解决方案,可以最大限度地利用地面空间。紧凑的城市生活、简约的美学和多功能房间布局的转变正在推动一波设计创新浪潮,而口袋门正是这波浪潮的中心。消费者正在寻找无缝的设计元素,不仅可以从视觉上提升室内装饰,还可以优化每一吋空间。随着灵活的平面图成为现代建筑的标准,这些门正成为重要的建筑特征。无论是根据需求连接或分隔房间、改善交通流量或创造整洁的环境,滑动门都证明了其价值。随着建筑和装修趋势继续倾向于更聪明、更适应性的布局,口袋门市场在未来几年将进一步蓬勃发展。

2024 年,单口袋门市场产值达 47 亿美元,预计到 2034 年将达到 76 亿美元。这些门在浴室、壁橱和小卧室等紧凑空间中尤其常见,在这些空间中节省面积最为重要。与传统的铰链门不同,单口袋门可以滑入墙壁并释放可用空间,同时保持区域清洁和实用。双开口袋门在开放式平面图中越来越受欢迎,特别是在需要较大入口以在房间之间实现无缝流动的住宅和办公室中。单边口袋门具有更大的设计灵活性和易于安装的特点,正在成为追求客製化布局的设计师的首选。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 94亿美元 |

| 预测值 | 151亿美元 |

| 复合年增长率 | 4.8% |

按材质划分,木材在 2024 年占据市场主导地位,占有 49.5% 的份额。木质口袋门凭藉其自然的外观、多功能性以及适应各种装饰风格的能力,仍然是房主和设计师的首选。凭藉出色的隔音效果和温暖的外观,它们非常适合卧室、家庭办公室和阅读角落等安静区域。买家还可以选择使用各种染色和饰面来个性化木门,以匹配其室内主题。木材的适应性和永恆的吸引力继续支持其在传统和现代室内设计中的成长。

2024年,美国折迭门市场规模达13.6亿美元,预计2034年将达21亿美元。持续的城市化、蓬勃发展的房地产市场和商业房地产开发为折迭门的安装创造了有利条件。开发商和建筑师越来越依赖这些门来满足大都会对高效、现代化空间日益增长的需求。

全球口袋门市场的主要参与者包括 Hafele、Crown Industrial、Larsen & Shaw Limited、Amba Products、Raydoor、Johnson Hardware、Colonial Elegance Inc.、Marwin Company、Hafele America Co.、Sun Mountain, Inc.、Klein USA、Andersen Windows & Doors、REE-HHTEC Co.、Sun Mountain, Inc.、Klein USA、Andersen Windows & Doors、REE-HHTECHTEC、Scurssea, Ltd.、Scurez。塑造竞争格局的关键策略包括持续的产品创新、扩大环保和可客製化的产品线以及与房地产开发商和室内设计师建立合作伙伴关係。该公司也在改善其线上形象和电子商务平台,以满足 DIY 买家的需求并简化客户旅程。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 原料分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 快速的城市化和生活方式的改变

- 酒店业蓬勃发展

- 增加消费支出

- 增加可支配收入

- 产业陷阱与挑战

- 安装复杂性

- 维护要求

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 单扇口袋门

- 双口袋门

- 单侧口袋门

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 木头

- 玻璃

- 铝

- 乙烯基塑料

- 其他(钢、玻璃纤维)

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 商业和工业

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 电子商务网站

- 公司自有网站

- 离线

- 专卖店

- 百货公司

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Amba Products

- Andersen Windows & Doors

- Colonial Elegance Inc.

- Crown Industrial

- Eclisse

- Hafele

- Hafele America Co.

- Johnson Hardware

- Klein USA

- Larsen & Shaw Limited

- Marwin Company

- Raydoor

- REE-TECH Industrial Co., Ltd.

- Saima Sicurezza SpA

- Sun Mountain, Inc.

The Global Pocket Door Market was valued at USD 9.4 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 15.1 billion by 2034. As more people prioritize smart, space-saving interiors, the demand for pocket doors is steadily rising across both residential and commercial settings. These sliding doors disappear neatly into wall cavities instead of swinging open, offering a sleek and practical solution to maximize floor space. The shift toward compact urban living, minimalist aesthetics, and multifunctional room layouts is driving a wave of design innovation-and pocket doors are right at the center of it. Consumers are looking for seamless design elements that not only elevate interiors visually but also optimize every inch of space. With flexible floor plans becoming the norm in modern construction, these doors are turning into an essential architectural feature. Whether it's about connecting or separating rooms on demand, improving traffic flow, or creating clutter-free environments, pocket doors are proving their worth. As construction and renovation trends continue leaning into smarter, more adaptable layouts, the pocket door market is set to thrive further in the coming years.

In 2024, the single-pocket door segment generated USD 4.7 billion and is projected to reach USD 7.6 billion by 2034. These doors are especially common in compact spaces like bathrooms, closets, and small bedrooms, where saving square footage matters most. Unlike traditional hinged doors, single-pocket doors slide into the wall and free up usable space while keeping the area clean and functional. Double pocket doors are gaining popularity in open-concept floor plans, especially in homes and offices where larger entryways are needed to create a seamless flow between rooms. Unilateral pocket doors, offering more design flexibility and ease of installation, are becoming the go-to choice for designers aiming for customized layouts.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.4 Billion |

| Forecast Value | $15.1 Billion |

| CAGR | 4.8% |

By material, wood dominated the market in 2024, accounting for a 49.5% share. Wooden pocket doors remain a top choice for homeowners and designers alike, thanks to their natural look, versatility, and ability to fit into a wide range of decor styles. With excellent sound insulation and a warm finish, they are ideal for quiet zones such as bedrooms, home offices, and reading nooks. Buyers are also drawn to the option of personalizing wood doors with various stains and finishes to match their interior themes. Wood's adaptability and timeless appeal continue to support its growth in both traditional and modern interiors.

The U.S. Pocket Door Market reached USD 1.36 billion in 2024 and is expected to generate USD 2.1 billion by 2034. Ongoing urbanization, a booming housing market, and commercial real estate development are creating favorable conditions for pocket door installations. Developers and architects are increasingly relying on these doors to meet the growing need for efficient, modern spaces in metropolitan areas.

Major players in the global pocket door market include Hafele, Crown Industrial, Larsen & Shaw Limited, Amba Products, Raydoor, Johnson Hardware, Colonial Elegance Inc., Marwin Company, Hafele America Co., Sun Mountain, Inc., Klein USA, Andersen Windows & Doors, REE-TECH Industrial Co., Ltd., Eclisse, and Saima Sicurezza S.p.A. Key strategies shaping the competitive landscape include continuous product innovation, expanding eco-friendly and customizable product lines, and forming partnerships with real estate developers and interior designers. Companies are also improving their online presence and e-commerce platforms to cater to DIY buyers and streamline the customer journey.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Raw material analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rapid urbanization and lifestyle changes

- 3.7.1.2 Growing hospitality sector

- 3.7.1.3 Increasing consumer spending

- 3.7.1.4 Increasing disposable income

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Installation complexity

- 3.7.2.2 Maintenance requirements

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Single pocket door

- 5.3 Double pocket door

- 5.4 Unilateral pocket door

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Glass

- 6.4 Aluminum

- 6.5 Vinyl

- 6.6 Others (steel, fiberglass)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce websites

- 8.2.2 Company-owned websites

- 8.3 Offline

- 8.3.1 Specialty stores

- 8.3.2 Departmental stores

- 8.3.3 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amba Products

- 10.2 Andersen Windows & Doors

- 10.3 Colonial Elegance Inc.

- 10.4 Crown Industrial

- 10.5 Eclisse

- 10.6 Hafele

- 10.7 Hafele America Co.

- 10.8 Johnson Hardware

- 10.9 Klein USA

- 10.10 Larsen & Shaw Limited

- 10.11 Marwin Company

- 10.12 Raydoor

- 10.13 REE-TECH Industrial Co., Ltd.

- 10.14 Saima Sicurezza S.p.A.

- 10.15 Sun Mountain, Inc.