|

市场调查报告书

商品编码

1721631

工业电动车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

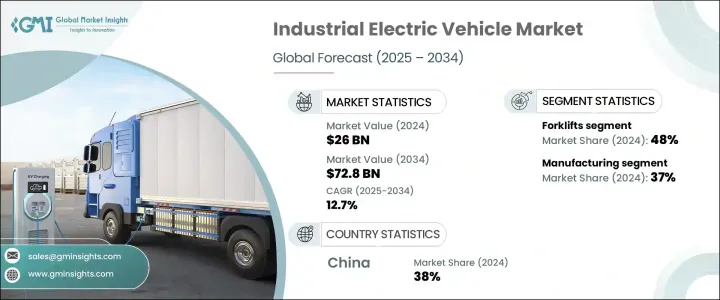

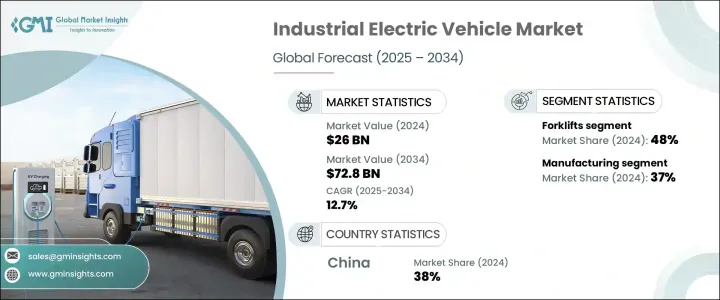

2024 年全球工业电动车市场价值为 260 亿美元,预计到 2034 年将以 12.7% 的复合年增长率成长,达到 728 亿美元。这一势头源于不断增强的环保意识、监管要求以及电动汽车友善工业服务中心等支持基础设施的发展。减少碳排放和营运成本的紧迫性日益增强,使得电动车成为传统内燃机的可行替代品。企业现在优先考虑物流和仓库营运的电气化,不仅是为了符合生态目标,也是为了实现长期成本效益。随着工业流程经历数位转型,全球市场对安静、零排放和自动化相容车辆的需求正在加速成长。电池技术的进步和成本的下降进一步增强了电动车的应用,使企业更容易转型,而不会影响性能或可扩展性。

在各种车辆类型中,堆高机占据了最大的市场份额,2024 年为 48%,预计到 2034 年将以超过 13% 的复合年增长率增长。由于对符合现代仓储和製造标准的智慧、低排放物料搬运解决方案的需求,堆高机在各行业的应用正在迅速成长。在应用方面,製造业在 2024 年占据 37% 的市场份额,占据主导地位,预计在预测期内复合年增长率将超过 13%。这种成长受到更清洁的生产要求、更严格的排放法规以及对能够与智慧工厂生态系统无缝整合的节能车队日益增长的需求的影响。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 260亿美元 |

| 预测值 | 728亿美元 |

| 复合年增长率 | 12.7% |

从动力方面来看,电池电动车(BEV)继续占据市场主导地位,这得益于其高能源效率、较低的总拥有成本以及对化石燃料的零依赖。这些车辆运作安静、维护成本低,是室内和封闭工业环境的理想选择。它们也更容易自动化,使其越来越适合工业 4.0 支援的操作。政府的激励措施和与排放相关的法规也使 BEV 成为各个工业领域的首选。

从区域来看,中国在 2024 年引领亚太工业电动车市场,占约 38% 的份额,创造近 45 亿美元的收入。该国强大的工业基础、政府对清洁能源转型的积极支持以及先进的电动车製造能力使其成为重要的市场参与者。仓储的快速自动化和积极的电气化目标继续推动区域需求,而促进智慧工厂基础设施建设的倡议则进一步加强了这一需求。

全球市场的主要参与者包括杭叉叉车、现代建筑设备、海斯特-耶鲁物料搬运、永恆力股份公司、凯傲集团、曼尼通、小松、三菱LOGISNEXT、三一电机和丰田。这些公司正在大力投资模组化电动车设计,扩大电池效率研发,并整合物联网和远端资讯处理进行即时诊断。他们的策略性努力还包括扩大本地生产和售后服务中心,以增强已开发经济体和新兴经济体的市场覆盖率和客户支援。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 经销商

- 最终用途

- 川普政府关税

- 供给侧影响(原料)

- 主要材料价格波动

- 生产成本影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 政府大力推动电动车发展

- 电动堆高机需求不断成长

- 电气技术的技术进步

- 製造业对工业车辆的需求不断增加

- 产业陷阱与挑战

- 工业电动车初始成本高

- 电池限制和停机时间

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 牵引车

- 堆高机

- 货柜搬运工

- 过道卡车

- 其他的

第六章:市场估计与预测:以推进方式,2021 - 2034 年

- 主要趋势

- 纯电动车(BEV)

- 插电式混合动力电动车(PHEV)

- 混合动力电动车(HEV)

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 製造业

- 仓储

- 货运与物流

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- Aisle Master

- Alke

- Anhui Heli

- Aprolis

- CLARK

- Crown Equipment

- Doosan Industrial Vehicle

- EP Equipment

- Hangcha Forklift

- Hyster-Yale Materials Handling

- Hyundai Construction Equipment

- Jungheinrich AG

- Kalmar Global

- KION Group

- Komatsu

- Manitou

- Mitsubishi Logisnext

- Motrec International

- Sany Electric

- Toyota Material Handling

The Global Industrial Electric Vehicle Market was valued at USD 26 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 72.8 billion by 2034. This momentum stems from rising environmental awareness, regulatory mandates, and the evolution of support infrastructure such as EV-friendly industrial service centers. The growing urgency to reduce carbon emissions and operating costs has positioned electric vehicles as a viable alternative to traditional internal combustion engines. Businesses are now prioritizing electrification in logistics and warehouse operations not only to align with eco-goals but also to leverage long-term cost efficiencies. As industrial processes undergo digital transformation, the demand for quiet, emission-free, and automation-compatible vehicles is accelerating across global markets. Advancements in battery technologies and falling costs have further strengthened the case for electric adoption, making it easier for businesses to transition without compromising performance or scalability.

Among vehicle types, forklifts held the largest market share at 48% in 2024 and are expected to expand at a CAGR of over 13% through 2034. Their application across industries is growing rapidly, driven by the need for smart, low-emission material handling solutions that align with modern warehousing and manufacturing standards. On the application front, the manufacturing segment led the market with a 37% share in 2024 and is projected to grow at over 13% CAGR through the forecast period. This growth is being shaped by cleaner production mandates, tighter emissions regulations, and the growing demand for energy-efficient vehicle fleets that can seamlessly integrate with smart factory ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26 Billion |

| Forecast Value | $72.8 Billion |

| CAGR | 12.7% |

By propulsion, Battery Electric Vehicles (BEVs) continue to dominate the market, supported by their high energy efficiency, lower total cost of ownership, and zero dependence on fossil fuels. These vehicles offer quiet operation and minimal maintenance and are ideal for indoor and enclosed industrial environments. They are also easier to automate, making them increasingly suitable for Industry 4.0-enabled operations. Government incentives and emission-related regulations are also making BEVs the preferred option across various industrial domains.

Regionally, China led the Asia Pacific industrial electric vehicle market in 2024, capturing around 38% share and generating nearly USD 4.5 billion in revenue. The country's strong industrial base, proactive government support for clean energy transitions, and advanced EV manufacturing capabilities have positioned it as a key market player. Rapid automation in warehousing and aggressive electrification goals continue to drive regional demand, further strengthened by initiatives that promote smart factory infrastructure.

Key players in the global market include Hangcha Forklift, Hyundai Construction Equipment, Hyster-Yale Materials Handling, Jungheinrich AG, KION Group, Manitou, Komatsu, MITSUBISHI LOGISNEXT, Sany Electric, and Toyota. These companies are heavily investing in modular electric vehicle designs, expanding R&D in battery efficiency, and integrating IoT and telematics for real-time diagnostics. Their strategic efforts also involve expanding local production and aftersales service hubs to enhance market reach and customer support across both developed and emerging economies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material providers

- 3.2.2 Component providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Trump administration tariffs

- 3.3.1 Supply-side impact (Raw Materials)

- 3.3.2 Price volatility in key materials

- 3.3.3 Production cost implications

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rise in government initiatives for electric vehicles

- 3.9.1.2 Increasing demand for battery-operated forklift

- 3.9.1.3 Technology advancement in electric technology

- 3.9.1.4 Increasing demand for industrial vehicle form manufacturing industry

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs of industrial electric vehicles

- 3.9.2.2 Battery limitations and downtime

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Tow tractors

- 5.3 Forklifts

- 5.4 Container handlers

- 5.5 Aisle trucks

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicles (BEV)

- 6.3 Plug-in Hybrid Electric Vehicles (PHEV)

- 6.4 Hybrid Electric Vehicles (HEV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Warehousing

- 7.4 Freight & logistics

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Aisle Master

- 9.2 Alke

- 9.3 Anhui Heli

- 9.4 Aprolis

- 9.5 CLARK

- 9.6 Crown Equipment

- 9.7 Doosan Industrial Vehicle

- 9.8 EP Equipment

- 9.9 Hangcha Forklift

- 9.10 Hyster-Yale Materials Handling

- 9.11 Hyundai Construction Equipment

- 9.12 Jungheinrich AG

- 9.13 Kalmar Global

- 9.14 KION Group

- 9.15 Komatsu

- 9.16 Manitou

- 9.17 Mitsubishi Logisnext

- 9.18 Motrec International

- 9.19 Sany Electric

- 9.20 Toyota Material Handling