|

市场调查报告书

商品编码

1740746

手术头盔市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Surgical Helmet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

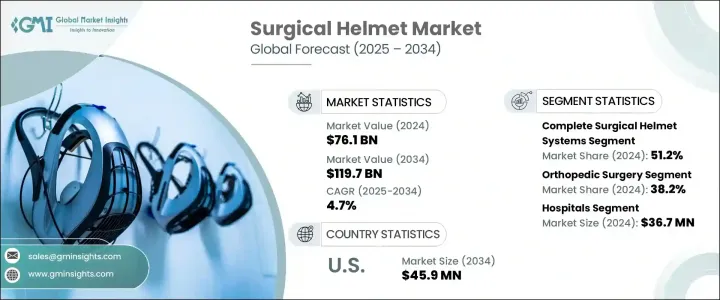

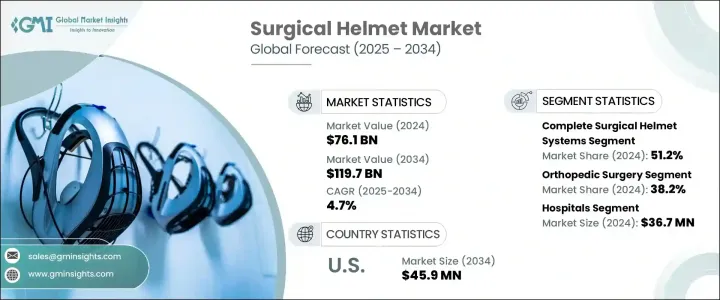

2024 年全球手术头盔市场价值为 7,610 万美元,预计到 2034 年将以 4.7% 的复合年增长率增长至 1.197 亿美元。这一增长主要源于对更安全手术环境的需求不断增长,以及全球复杂医疗程序的不断增加。随着外科手术实践的不断发展,人们越来越重视能够最大限度地降低手术过程中污染和感染风险的防护设备。手术头盔已成为手术室规程的重要组成部分,旨在保持无菌并提供先进的防护功能。这些头盔不仅覆盖外科医生的头部,还通常配备其他功能,如内置照明、通风系统和动力供气装置,从而提高外科医生在长时间手术中的安全性和舒适度。

全球范围内手术损伤发生率的上升显着影响了市场扩张。紧急手术(尤其是涉及创伤的手术)数量的增加,加剧了对有效防护装备的需求。随着手术量的攀升,对能够确保手术空间无菌和无污染的头盔的需求也随之增长。此外,手术头盔设计和技术的改进使其在高风险手术环境中更易于日常使用,也更有效率。这些现代头盔不仅可以保护手术人员免受空气传播的病原体和体液的侵害,还可以透过整合人体工学和视觉增强功能,减轻长时间手术过程中的疲劳。製造商正在开发具有更好气流、更高可视性和轻质材料的先进型号,所有这些都旨在提升用户体验,同时保持严格的卫生标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7610万美元 |

| 预测值 | 1.197亿美元 |

| 复合年增长率 | 4.7% |

就产品类型而言,完整的手术头盔系统在2024年占据全球市场份额的51.2%,占据主导地位。其主导地位源自于其一体化设计,能够提供全面的保护。这些头盔通常覆盖整个头部和上身,形成密封屏障,最大限度地降低交叉污染的可能性。此外,整合LED照明的款式也进一步提升了其受欢迎程度,在严苛的手术环境中,该照明能够提供更佳的可视性。这项附加功能不仅提高了手术的精准度,也减轻了手术团队的视觉压力。

市场也呈现出基于应用的明显细分。 2024年,骨科手术是最大的应用领域,占了38.2%的市场。关节重建、脊椎矫正和其他肌肉骨骼疾病相关手术的日益增多,进一步推动了这项需求。这些手术通常耗时较长,且感染风险较高,因此防护头盔成为手术室装备的重要组成部分。已开发经济体和新兴经济体中此类手术的增多,凸显了手术头盔在现代医学中的重要角色。

从终端使用情况来看,医院成为主导细分市场,2024 年市场规模达 3,670 万美元。与其他医疗机构相比,医院通常会进行更多手术,这自然会导致手术头盔的消耗量更高。此外,医院更有可能遵守严格的感染控制法规,其中许多法规要求使用个人防护装备。随着资金和基础设施资源的增加,医院可以投资更高品质的手术头盔,从而巩固其市场领导地位。

美国手术头盔市场预计将经历显着成长,预计到2034年收入将达到4,590万美元。美国广泛的外科手术活动和严格的手术安全监管框架将进一步推动这一需求。美国医疗保健产业持续重视感染控制和安全措施,使手术头盔成为手术室的标准配备。医疗基础设施和安全技术投资的不断增加也进一步推动了这一趋势。

全球市场竞争激烈,成熟品牌和新进者都在努力创新和改进产品。 Zimmer Biomet、Stryker、MAXAIR Systems、Ecolab 和 THI Total Healthcare Innovation 等领先企业共占据约 30% 的市占率。这些公司正在投资先进的通风技术、防雾技术和整合式面罩等功能,以提高舒适度、可视性和整体手术性能。由于创新仍然是市场竞争力的核心,製造商不断升级其产品,以满足不断变化的手术要求和监管标准。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 外科手术数量不断增加

- 道路和运动事故数量不断增加

- 手术头盔的技术进步

- 日益重视感染控制

- 产业陷阱与挑战

- 先进安全帽成本高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 完整的手术头盔系统

- 带LED

- 不含 LED

- 通风手术头盔

- 其他产品类型

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 骨科手术

- 神经外科

- 心臟手术

- 耳鼻喉手术

- 一般外科

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心(ASC)

- 专科诊所

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- AresAir

- Beijing ZKSK Technology

- Ecolab

- Kaiser Technology

- Maharani Medicare

- MAXAIR Systems

- Prodancy

- Stryker

- THI Total Healthcare Innovation

- Zimmer Biomet

The Global Surgical Helmet Market was valued at USD 76.1 million in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 119.7 million by 2034. This growth is largely driven by the increasing demand for safer surgical environments and the rising number of complex medical procedures being performed worldwide. As surgical practices continue to evolve, there's a growing emphasis on protective equipment that minimizes the risk of contamination and infection during operations. Surgical helmets have become an essential part of operating room protocols, designed to maintain sterility and offer advanced protective features. These helmets not only cover the surgeon's head but often come equipped with additional functionalities such as built-in lighting, ventilation systems, and powered air supply mechanisms, enhancing both safety and surgeon comfort during long procedures.

Market expansion is significantly influenced by the increased global incidence of injuries requiring surgery. The rising number of emergency surgeries, particularly those involving trauma, has amplified the need for effective protective gear. As surgical volumes climb, so does the demand for headgear that can ensure a sterile and contamination-free operating space. Additionally, improvements in surgical helmet design and technology have made them more accessible and effective for daily use in high-risk surgical environments. These modern helmets not only shield the surgical staff from airborne pathogens and bodily fluids but also reduce fatigue during long procedures by integrating ergonomic and visual enhancements. Manufacturers are responding by developing advanced models with better airflow, improved visibility, and lightweight materials, all aimed at enhancing user experience while maintaining strict hygiene standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $76.1 Million |

| Forecast Value | $119.7 Million |

| CAGR | 4.7% |

In terms of product type, complete surgical helmet systems took the lead in 2024, accounting for 51.2% of the global market. Their dominance is due to the all-in-one nature of these systems, which offer comprehensive protection. These helmets typically cover the entire head and upper body, creating a sealed barrier that minimizes the chances of cross-contamination. Their popularity is further boosted by the availability of variations featuring integrated LED lighting, which supports better visibility in challenging surgical environments. This added feature not only improves the precision of procedures but also reduces visual strain on the surgical team.

The market also shows strong segmentation based on application. Orthopedic surgeries represented the largest application area in 2024, capturing a 38.2% market share. The growing number of procedures related to joint reconstruction, spinal corrections, and other musculoskeletal conditions is fueling this demand. These surgeries often involve long hours and carry a high risk of exposure to infection, making protective headgear a crucial component of operating room gear. The increased frequency of such procedures across both developed and emerging economies highlights the essential role of surgical helmets in modern medicine.

Based on end-use settings, hospitals emerged as the dominant segment, accounting for USD 36.7 million in 2024. Hospitals typically perform a larger volume of surgeries compared to other healthcare facilities, which naturally translates to higher consumption of surgical helmets. Additionally, hospitals are more likely to follow stringent infection control regulations, many of which mandate the use of personal protective equipment. With more financial and infrastructural resources at their disposal, hospitals can invest in higher-quality surgical helmets, reinforcing their leadership position in the market.

The U.S. surgical helmet market is projected to experience considerable growth, with revenues expected to reach USD 45.9 million by 2034. The demand is bolstered by the country's extensive surgical activity and strict regulatory framework regarding surgical safety. The U.S. healthcare sector continues to prioritize infection control and safety measures, making surgical helmets a standard component in operating rooms. This trend is further supported by increasing investments in medical infrastructure and safety technologies.

The global market is competitive, with both established brands and new entrants striving to innovate and improve product offerings. Leading players such as Zimmer Biomet, Stryker, MAXAIR Systems, Ecolab, and THI Total Healthcare Innovation collectively hold around 30% of the market share. These companies are investing in features like advanced ventilation, anti-fog technologies, and integrated face shields to enhance comfort, visibility, and overall surgical performance. As innovation remains central to market competitiveness, manufacturers are constantly upgrading their products to meet evolving surgical requirements and regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing number of surgical procedures

- 3.2.1.2 Increasing number of road and sports accidents

- 3.2.1.3 Technological advancements in surgical helmets

- 3.2.1.4 Rising emphasis on infection control

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with advanced helmets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Complete surgical helmet systems

- 5.2.1 With LED

- 5.2.2 Without LED

- 5.3 Ventilated surgical helmets

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Orthopedic surgery

- 6.3 Neurosurgery

- 6.4 Cardiac surgery

- 6.5 ENT surgery

- 6.6 General surgery

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers (ASCs)

- 7.4 Specialty clinics

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AresAir

- 9.2 Beijing ZKSK Technology

- 9.3 Ecolab

- 9.4 Kaiser Technology

- 9.5 Maharani Medicare

- 9.6 MAXAIR Systems

- 9.7 Prodancy

- 9.8 Stryker

- 9.9 THI Total Healthcare Innovation

- 9.10 Zimmer Biomet