|

市场调查报告书

商品编码

1740760

飞机感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aircraft Sensors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

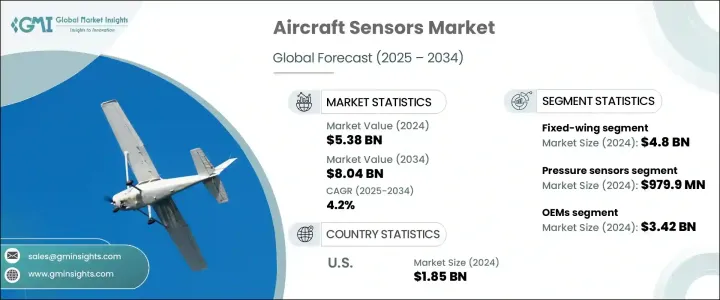

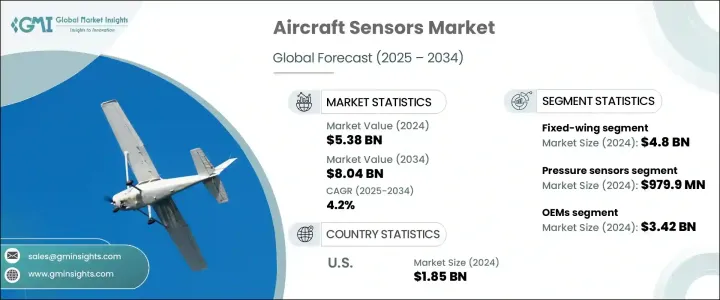

2024 年全球飞机感测器市场规模为 53.8 亿美元,预计到 2034 年将以 4.2% 的复合年增长率成长,达到 80.4 亿美元。推动这一成长的主要动力之一是航空业日益重视提高燃油效率,这导致对创新可靠的感测器技术的需求增加。这些感测器在优化飞机性能、提高安全性以及支援商用和军用航空中使用的先进系统方面发挥关键作用。然而,地缘政治紧张局势和贸易限制(包括对飞机感测器零件征收关税)已导致供应链严重中断。这些中断推高了许多感测器生产商的製造成本,并压缩了利润率,同时也导致飞机交付延迟。

近年来征收的关税对北美製造商的影响尤其严重,迫使一些公司将业务转移回国内。同时,欧洲供应商被迫重新评估和重组其供应链,导致短期效率低落。另一方面,亚洲製造商发展在地化能力,以减少对进口的依赖,这表明全球生产区域化趋势正在兴起。儘管回流有助于稳定供应链的某些环节,但整体市场对某些感测器技术的接受度有所放缓,尤其是在无人系统中使用的技术。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 53.8亿美元 |

| 预测值 | 80.4亿美元 |

| 复合年增长率 | 4.2% |

相较之下,在无人机 (UAV) 和电动垂直起降 (eVTOL) 等快速成长的领域,对感测器的需求激增。这些平台需要高度专业化的感测器来实现导航、避障和操作安全。随着这些技术日益普及,尤其是在城市和商业场景中,对超可靠和节能感测器的需求将持续成长。此外,自动化程度的提高和人工智慧的集成,正推动製造商开发更复杂的感测器系统,以支援自主功能和即时决策。

另一个主要成长动力在于航空公司和维修供应商实施的预测性维护计画。这些计划依靠物联网感测器即时监控飞机系统,检测磨损的早期迹象。这种方法显着减少了意外维护事件,并延长了飞机的使用寿命。测量振动、声音和腐蚀的传感器在监控老旧机队方面尤其有用。这些技术正在推动从被动维护到主动维护的转变,从而刺激了售后市场的需求。

同时,全球国防预算持续成长,刺激了对适用于下一代飞机的坚固耐用、高性能感测器的需求。军用飞机依赖雷达、电子战和热成像感测器等必须在极端条件下运作的先进技术。对隐形技术和无人机能力的投资不断增加,正在加速国防领域的感测器创新,使其成为更广泛的飞机感测器市场中成长最快的领域之一。

为了保持竞争力,製造商优先研发专为节油飞机和自动驾驶平台设计的轻量化、节能型感测器技术。随着各公司致力于满足无人机和自动驾驶的需求,基于MEMS和光达(LiDAR)系统的开发势头强劲。利用人工智慧驱动的物联网感测器来增强预测性维护能力也正成为关注的焦点,尤其是对于即将达到使用寿命的机队而言。

2024年,固定翼飞机感测器市场占总市场价值的48亿美元。由于这些飞机在商业和军事领域广泛应用,它们在全球需求中占据主导地位。此类感知器对于飞行控制、引擎监控和燃油管理至关重要。随着技术更先进的飞机的推出,轻型、数据驱动感测器的采用也加速发展。此外,高续航无人机在监视和军事行动中的应用日益广泛,进一步扩大了对高性能感测器系统的需求。

压力感知器对于维持座舱压力、引擎性能和液压系统的完整性至关重要,按感测器类型划分,其市场规模最大,2024 年估值达 9.799 亿美元。这些感测器广泛应用于所有类型的飞机,是航空业不可或缺的零件。技术进步使这些部件变得更小、更耐用、更节能,从而进一步提升了它们在现代飞机系统中的作用。

在终端用户方面, OEM细分市场在 2024 年占据市场主导地位,价值达 34.2 亿美元。这些原始设备製造商负责将高可靠性感测器整合到新开发的飞机系统中。他们专注于发动机诊断、航空电子设备和先进的飞行控制感知器。然而,认证延迟和原材料短缺等挑战持续影响着他们的营运效率。

从地区来看,美国在飞机感测器市场占据主导地位,2024 年估值达 18.5 亿美元。美国在航太创新领域的领导地位,得益于强大的製造能力和大量的国防投资,确保了对尖端感测器的强劲需求。监管框架也鼓励安全和预测性维护技术的持续改进,从而促进整体市场的成长。

竞争格局依然激烈,领先公司合计占48.5%的市占率。这些公司正投入资源,开发人工智慧增强型、可客製化且环保的感测器解决方案,以满足市场需求和不断发展的监管标准。他们的策略包括建立联盟、采用数位化製造流程以及实现产品线多元化,以支援从传统喷射机到新兴自动驾驶飞行器系统等各种飞机平台。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 对节油飞机的需求不断增加

- 无人机(UAV)和电动垂直起降飞机(eVTOL)的成长

- 预测性维护的采用率不断上升

- 军事现代化与太空探索

- 产业陷阱与挑战

- 研发成本高

- 严格的认证延迟

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依飞机类型,2021-2034

- 主要趋势

- 固定翼

- 旋翼机

第六章:市场估计与预测:按感测器类型,2021-2034

- 主要趋势

- 压力感测器

- 温度感测器

- 力传感器

- 扭力感测器

- 速度感测器

- 位置和位移感测器

- 液位感测器

- 接近感测器

- 流量感测器

- 光学感测器

- 运动感应器

- 雷达感测器

- GPS感应器

- 其他的

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 原始设备製造商

- 售后市场

- 国防和航太机构

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Honeywell International Inc.

- Safran SA

- Thales

- TE Connectivity

- Collins Aerospace

- RTX

- Meggitt PLC.

- AMETEK.Inc.

- Curtiss-Wright Corporation

- L3Harris Technologies, Inc.

- Saywell International

- Garmin Ltd.

- HBK, Inc

- PCB Piezotronics

- Kistler Group

- Bosch Sensortec GmbH

- Eaton

- Baker Hughes Company

- Humanetics

The Global Aircraft Sensors Market was valued at USD 5.38 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 8.04 billion by 2034. A major force behind this expansion is the aviation industry's increasing focus on improving fuel efficiency, which has led to higher demand for innovative and reliable sensor technologies. These sensors play a critical role in optimizing aircraft performance, enhancing safety, and supporting advanced systems used in both commercial and military aviation. However, geopolitical tensions and trade restrictions, including tariffs on aircraft sensor components, have caused significant supply chain disruptions. These disruptions have driven up manufacturing costs and strained profit margins for many sensor producers, while also leading to delays in aircraft deliveries.

Tariffs imposed in recent years particularly impacted North American manufacturers, prompting some companies to shift operations back domestically. Meanwhile, European suppliers were forced to reevaluate and restructure their supply chains, creating short-term inefficiencies. On the other hand, manufacturers in Asia developed local capabilities to reduce reliance on imports, signaling a global trend toward regionalizing production. Although reshoring helped stabilize some aspects of the supply chain, the overall market experienced slower uptake in certain sensor technologies, especially those used in unmanned systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.38 Billion |

| Forecast Value | $8.04 Billion |

| CAGR | 4.2% |

In contrast, demand for sensors has surged in rapidly growing segments such as unmanned aerial vehicles (UAVs) and electric vertical takeoff and landing (eVTOL) aircraft. These platforms require highly specialized sensors for navigation, obstacle avoidance, and operational safety. As these technologies become more prevalent, particularly in urban and commercial use cases, the need for ultra-reliable and energy-efficient sensors will continue to rise. Furthermore, increasing levels of automation and integration of artificial intelligence are pushing manufacturers to develop more sophisticated sensor systems that can support autonomous functions and real-time decision-making.

Another major growth driver lies in the implementation of predictive maintenance programs by airlines and maintenance providers. These programs rely on IoT-enabled sensors to monitor aircraft systems in real time, detecting early signs of wear and tear. This approach significantly reduces unexpected maintenance events and extends aircraft service life. Sensors that measure vibration, sound, and corrosion are particularly useful in monitoring older fleets. These technologies are enabling a shift from reactive to proactive maintenance, boosting demand in the aftermarket segment.

Meanwhile, defense budgets worldwide continue to rise, fueling demand for rugged, high-performance sensors suitable for next-generation aircraft. Military aircraft depend on advanced technologies such as radar, electronic warfare, and thermal imaging sensors that must operate in extreme conditions. Increased investments in stealth technologies and drone capabilities are accelerating sensor innovation in the defense sector, making it one of the fastest-growing areas within the broader aircraft sensors market.

To maintain competitiveness, manufacturers are prioritizing research and development in lightweight, energy-efficient sensor technologies tailored for fuel-efficient aircraft and autonomous platforms. The development of MEMS and LiDAR-based systems is gaining momentum as companies aim to meet the needs of UAVs and automated flight. Enhancing predictive maintenance capabilities using AI-powered IoT sensors is also becoming a central focus, especially for fleets approaching the end of their operational lifespan.

In 2024, the fixed-wing aircraft sensor segment accounted for USD 4.8 billion of the total market value. These aircraft dominate global demand due to their extensive use across both commercial and military applications. Sensors in this category are essential for flight control, engine monitoring, and fuel management. With the introduction of more technologically advanced aircraft, the adoption of lightweight, data-driven sensors has accelerated. Additionally, the growing use of high-endurance UAVs in surveillance and military operations has further amplified the need for high-performance sensor systems.

Pressure sensors, which are vital for maintaining cabin pressure, engine performance, and hydraulic system integrity, represented the largest share by sensor type with a valuation of USD 979.9 million in 2024. These sensors are a staple in aviation due to their wide application across all aircraft types. Technological advancements have made these components smaller, more durable, and more power-efficient, contributing to their expanding role in modern aircraft systems.

On the end-user front, the OEM segment led the market in 2024 with a value of USD 3.42 billion. These original equipment manufacturers are responsible for integrating high-reliability sensors into newly developed aircraft systems. They focus on engine diagnostics, avionics, and advanced flight control sensors. However, challenges such as certification delays and raw material shortages continue to impact their operational efficiency.

Regionally, the United States dominated the aircraft sensors market with a valuation of USD 1.85 billion in 2024. The country's leadership in aerospace innovation, driven by robust manufacturing capabilities and significant defense investments, ensures strong demand for cutting-edge sensors. Regulatory frameworks also encourage continuous improvement in safety and predictive maintenance technologies, contributing to overall market growth.

The competitive landscape remains intense, with leading companies holding a combined 48.5% market share. These firms are channeling resources into developing AI-enhanced, customizable, and eco-friendly sensor solutions, aligning with both market demand and evolving regulatory standards. Their strategies include forming alliances, adopting digital manufacturing processes, and diversifying their product lines to support various aircraft platforms, from traditional jets to emerging autonomous aerial systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand for fuel-efficient aircraft

- 3.3.1.2 Growth of unmanned aerial vehicles (UAVs) and eVTOLs

- 3.3.1.3 Rising adoption of predictive maintenance

- 3.3.1.4 Military modernization and space exploration

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High R&D costs

- 3.3.2.2 Stringent certification delays

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Fixed-wing

- 5.3 Rotary-wing

Chapter 6 Market Estimates & Forecast, By Sensor Type, 2021-2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Pressure sensors

- 6.3 Temperature sensors

- 6.4 Force sensors

- 6.5 Torque sensors

- 6.6 Speed sensors

- 6.7 Position & displacement sensors

- 6.8 Level sensors

- 6.9 Proximity sensors

- 6.10 Flow sensors

- 6.11 Optical sensors

- 6.12 Motion sensors

- 6.13 Radar sensors

- 6.14 Gps sensors

- 6.15 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 OEMs

- 7.3 Aftermarket

- 7.4 Defense & space agencies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Honeywell International Inc.

- 9.2 Safran S.A.

- 9.3 Thales

- 9.4 TE Connectivity

- 9.5 Collins Aerospace

- 9.6 RTX

- 9.7 Meggitt PLC.

- 9.8 AMETEK.Inc.

- 9.9 Curtiss-Wright Corporation

- 9.10 L3Harris Technologies, Inc.

- 9.11 Saywell International

- 9.12 Garmin Ltd.

- 9.13 HBK, Inc

- 9.14 PCB Piezotronics

- 9.15 Kistler Group

- 9.16 Bosch Sensortec GmbH

- 9.17 Eaton

- 9.18 Baker Hughes Company

- 9.19 Humanetics