|

市场调查报告书

商品编码

1836677

飞机感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Aircraft Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

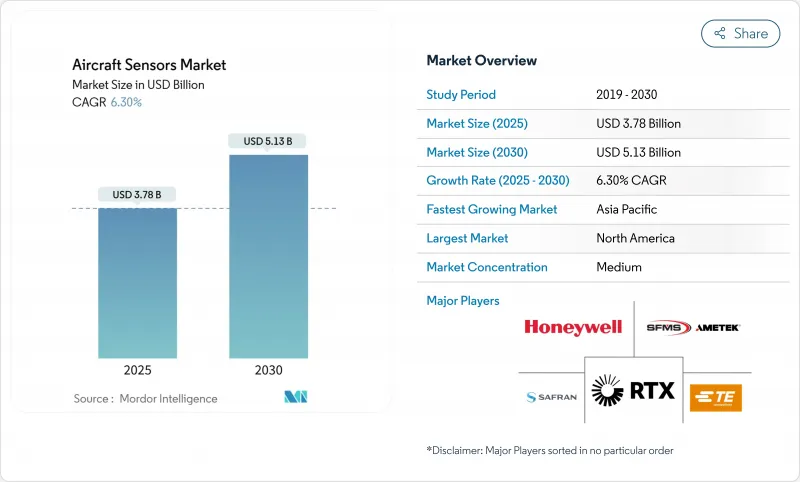

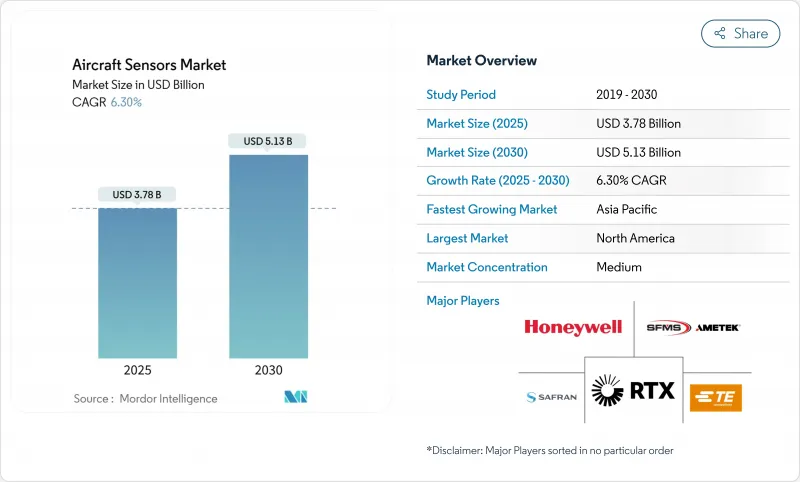

预计飞机感测器市场规模到 2025 年将达到 37.8 亿美元,到 2030 年将达到 51.3 亿美元,复合年增长率为 6.30%。

这一发展轨迹反映了飞机队的持续扩张、向线传操纵系统的转变以及预测性维护服务的日益普及。美国联邦航空管理局 (FAA) 于 2024 年收紧了航空防撞规则,迫使营运商升级其感测套件,发动机製造商也推出了支援燃烧永续航空燃料 (SAF) 的高温感测器。随着航空公司寻求降低气候引发湍流的风险,基于雷达的天气和危险规避产品发展势头强劲。国防买家加速了现代化进程,斥资 2.7 亿美元用于 F-22 猛禽的红外线升级,并扩大了依赖密集、强大感测器网路的自主平台的订单。将感测器硬体与云端分析相结合的供应商赢得了优质合同,但全球航太级半导体短缺延长了前置作业时间并提高了资格确认门槛。

全球飞机感测器市场趋势与洞察

线传和健康监测架构的采用正在加速

飞机专案已从机械联动转向电子飞行控制系统,该系统依赖三重冗余感测器来控制每个关键参数。柯林斯太空在F-35上展示了增强型电源和冷却系统,使其热容量翻倍,以支援密集型能耗的感测器负载。航空公司已整合了结构安全监控套件,结合即时感测器流的预测分析,可将停机时间减少30%。感测器融合软体将压力、惯性和雷达讯号整合成统一的飞行影像,从而提高自动驾驶仪的反应速度并实现单一驾驶员操作。

转向支援 SAF 的引擎可促进高精度发情侦测

由于SAF混合物会改变燃烧室的温度曲线,引擎製造商被要求指定能够承受1400°F(约740摄氏度)高温的热电偶,这几乎是传统感测器极限的三倍。美国能源局发起的「SAF大挑战」计画的目标是到2030年每年减少30亿加仑燃油,这正在刺激整个供应链对燃油品质和排放气体感测器的需求。航空公司正在部署配备SAF的数位燃油流量计和废气感测器,以检验税额扣抵所需的二氧化碳减排量。

航太级 ASIC 持续面临供应链紧缩

抗辐射处理器和混合讯号ASIC的前置作业时间已延长至40週,超过了疫情前12週的标准。航空业占全球晶片需求的不到2%,对代工厂来说并非优先发展领域。顾问公司报告称,66%的航太一级供应商正面临2025年资源配置短缺的困境。飞机製造商储备了安全关键型设备,但库存缓衝增加了营运成本需求,并推迟了改装计画。

报告中分析的其他驱动因素和限制因素

- 美国联邦航空管理局要求升级航空防撞系统

- 将驾驶员即服务平台纳入互联车队的主流

- 认证积压延迟了新感测器的设计和部署

細項分析

固定翼飞机专案将占据市场主导地位,在商用喷射机交付的推动下,到2024年将占据72.54%的飞机感测器市场。预计2030年,固定翼飞机感测器市场规模将超过30亿美元,复合年增长率为5.8%。其中,随着国防部为传统战斗机维修广域红外线、雷达和电子战套件,军用飞机感测器的年增长率达到8.30%。洛克希德马丁公司对F-22的升级改造,充分体现了360度被动监视的溢价。

旋翼机和倾斜式旋翼机队采用频谱摄影机和光达进行低空避障。柯林斯太空的感知感测系统实现了低能见度条件下的自动着陆。旋翼机和战斗机之间软体定义感测器处理器的互通性降低了非经常性工程成本,并加快了出口机型的上市时间。随着自主货运无人机的规模扩大,对轻型惯性和气压模组的需求将推动所有机型的飞机感测器市场扩张。

压力装置是皮托静压系统、环境控制和引擎油系统的支柱,其出货量保持稳定。然而,由于航空公司对先进的湍流预测和除冰建议功能的需求,雷达装置的复合年增长率达到9.75%,成长最快。预计到2030年,雷达飞机感测器市场规模将达到12亿美元,这反映了改装和Line-Fit项目的需求。 ACAS Xa的需求进一步推动了支线飞机空中监视雷达的需求。

Edge-AI 套件将雷达、光达和光学输入整合到一块基板,减少了 20% 的布线,并支援基于状态的天线校准。 MEMS加速计和接近检测器受益于汽车成本曲线,同时继续进行补充筛检以满足 RTCA DO-160 振动曲线。温度和流量感测器的设计人员增加了网路安全封装,以满足即将出台的 FAA 网路安全要求,这增加了组件成本,但巩固了长期业务收益前景。

区域分析

到2024年,北美将占全球需求的42.52%,这得益于各大航空公司增加的国防部支出以及飞机现代化宣传活动。国内感测器供应商利用其与美国联邦航空管理局(FAA)的早期合作,制定了相关标准,并在海外规则采用后提升了出口前景。然而,由于对海外晶片製造的依赖,华盛顿根据《晶片法案》(CHIPS Act)拨款520亿美元,用于增强国内微电子能力。

由于航空公司扩大窄体机队规模,以及各国政府资助本土感测器计画以降低出口管制风险,亚太地区录得最高成长率,达7.85%。预计到2043年,中国航空服务价值将达到610亿美元,超过所有其他国家市场。日本和韩国製造商合作开发用于城市空气动力移动车辆的MEMS惯性模组,印度则推进了其本土航空数据感测器蓝图,以支援支线喷射机计划。

欧洲继续保持技术领先地位,实施严格的永续性和网路安全规则,促进了感测器领域的创新。泰雷兹完成了对科巴姆航空航太通讯公司的收购,透过感测器和安全资料链路的组合增强了其航空电子设备产品组合。欧洲航空安全局与美国联邦航空管理局的协调促进了相互认可的核准,但供应商仍遵循各自的文件流程。该地区强调了SAF检验设备和非二氧化碳排放监测,这是Fit-for-55气候方案的一部分。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 加速采用电传操纵与健康监测架构

- 转向支援 SAF 的引擎可促进高精度热感感

- 美国联邦航空管理局要求升级飞机防撞能力

- 将驾驶员即服务平台纳入互联车队的主流

- 透过积层製造降低感测器外壳的单位成本

- 利用支援边缘 AI 的自校准感测器降低 MRO 成本

- 市场限制

- 航太级 ASIC 的供应链持续面临压力

- 认证积压推迟了新的传感器设计

- 网路强化要求推高了组件成本

- MEMS IMU 出口限制趋严

- 价值链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场规模及成长预测(金额)

- 按飞机类型

- 固定翼飞机

- 商用飞机

- 窄体飞机

- 宽体飞机

- 支线喷射机

- 商务及通用航空

- 公务机

- 轻型飞机

- 军用机

- 战斗机

- 运输机

- 特殊任务飞机

- 旋翼机

- 商用直升机

- 军用直升机

- 固定翼飞机

- 依感测器类型

- 压力

- 温度

- 位置

- 流动

- 扭力

- 雷达

- 加速计

- 接近感测器

- 其他感测器

- 按用途

- 燃料、液压和气压系统

- 发动机和辅助动力装置(APU)

- 客舱和货物环境控制

- 飞行控制系统

- 飞行甲板

- 起落架系统

- 武器系统

- 其他的

- 按最终用户

- OEM

- 售后市场/MRO

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 墨西哥

- 其他南美

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 以色列

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- TE Connectivity Corporation

- Honeywell International Inc.

- Meggitt PLC

- AMETEK Aerospace, Inc.

- Thales Group

- Collins Aerospace(RTX Corporation)

- Curtiss-Wright Corporation

- Safran SA

- Hydra-Electric Company

- PCB Piezotronics, Inc.(Amphenol Corporation)

- Precision Sensors(United Electric Controls)

- Moog Inc.

- Garmin Ltd.

- TT Electronics plc

- Woodward, Inc.

- EMCORE Corporation

- Bosch General Aviation Technology GmbH(Robert Bosch GmbH)

- Eaton Corporation plc

- Crane Company

第七章 市场机会与未来展望

The aircraft sensors market size stood at USD 3.78 billion in 2025 and is forecasted to climb to USD 5.13 billion by 2030, advancing at a 6.30% CAGR.

This trajectory reflects sustained fleet expansion, the migration to fly-by-wire control systems, and rising adoption of predictive maintenance services. Operators are compelled to upgrade sensing suites after the Federal Aviation Administration (FAA) tightened airborne collision-avoidance rules in 2024, while engine makers introduced higher-temperature sensors that support sustainable aviation fuel (SAF) combustion. Radar-based weather and hazard-avoidance products gained momentum as carriers sought to mitigate climate-driven turbulence risk. Military buyers accelerated modernization, funding a USD 270 million infrared upgrade for the F-22 Raptor and expanding orders for autonomous platforms that depend on dense, rugged sensor networks. Suppliers that combined sensor hardware with cloud analytics captured premium contracts, yet global shortages of aerospace-grade semiconductors stretched lead times and intensified qualification hurdles.

Global Aircraft Sensors Market Trends and Insights

Accelerated Adoption of Fly-by-Wire and Health-Monitoring Architectures

Aircraft programs shifted from mechanical linkages to electronic flight-control systems that rely on triple-redundant sensors for every critical parameter. Collins Aerospace demonstrated its Enhanced Power and Cooling System on the F-35, doubling thermal capacity to support energy-intensive sensor loads. Airlines integrated structural-health-monitoring suites that cut downtime by 30% when combined with predictive analytics from real-time sensor streams. Sensor fusion software stitched pressure, inertial, and radar feeds into a unified flight picture, improving autopilot responsiveness and enabling single-pilot operations.

Shift to SAF-Ready Engines Driving High-Accuracy Thermal Sensing

SAF blends alter combustor temperature profiles, prompting engine makers to specify thermocouples capable of surviving 1,400°F environments-nearly triple the limit of erstwhile transducers. The US Department of Energy's SAF Grand Challenge targeted 3 billion gallons of annual output by 2030, stimulating demand for fuel-quality and emissions sensors across supply chains. Airlines are deploying SAF-equipped digital fuel-flow meters and exhaust-gas sensors to verify carbon-reduction claims required for tax credits.

Persistent Supply-Chain Crunch of Aerospace-Grade ASICs

Lead times for radiation-tolerant processors and mixed-signal ASICs lengthened to 40 weeks, overshadowing pre-pandemic norms of 12 weeks. Aviation represented less than 2% of global chip demand, leaving it low on foundry priority lists. Consultancies reported that 66% of aerospace Tier-1s struggled with allocation shortfalls in 2025. Airframers stocked safety-critical devices, yet inventory buffers raised working-capital needs and delayed retrofit schedules.

Other drivers and restraints analyzed in the detailed report include:

- FAA Mandate on Airborne Collision-Avoidance Upgrades

- Mainstream Drivers-as-a-Service Platforms for Connected Fleets

- Certification Backlog Slowing New Sensor Design-ins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixed-wing programs dominated demand, capturing 72.54% of the aircraft sensors market share in 2024 on the strength of commercial jet deliveries. The aircraft sensors market size for fixed-wing applications is projected to exceed USD 3 billion by 2030 at a 5.8% CAGR. Within that total, military aviation sensors are advancing 8.30% annually as defense ministries retrofit legacy fighters with wide-area infrared, radar, and electronic-warfare suites. Lockheed Martin's F-22 upgrade illustrated the premium paid for 360-degree passive surveillance.

Rotorcraft and tilt-rotor fleets embraced multispectral cameras and lidar for obstacle avoidance during low-altitude operations. Collins Aerospace's perception-sensing system enabled automated landing in degraded visual conditions. Cross-pollination of software-defined sensor processors between rotorcraft and fighter jets cut non-recurring engineering costs, compressing time-to-market for export variants. As autonomous cargo drones scale, demand for lightweight inertial and barometric modules will reinforce the expansion of the aircraft sensors market across all airframe classes.

Pressure devices remained foundational underlying pitot-static, environmental-control, and engine-oil systems with stable, high-volume shipments. Still, radar units registered the steepest growth at 9.75% CAGR as airlines sought advanced turbulence prediction and de-icing advisory features. The aircraft sensors market size for radar is forecast to reach USD 1.2 billion by 2030, reflecting both retrofit and line-fit programs. ACAS Xa requirements further boosted airborne surveillance radars for regional jets.

Edge-AI packages integrated radar, lidar, and optical inputs on a single board, reducing wiring by 20% and enabling condition-based antenna calibration. MEMS accelerometers and proximity detectors benefited from automotive cost curves yet continued to undergo supplemental screening to meet RTCA DO-160 vibration profiles. Temperature and flow sensor designers added cybersecurity wrappers to satisfy imminent FAA network-security mandates, raising bill-of-materials cost but cementing long-term service revenue prospects.

The Aircraft Sensors Market Report is Segmented by Aircraft Type (Fixed-Wing and Rotary-Wing), Sensor Type (Temperature, Pressure, Position, Flow, Torque, Radar, and More), Application (Fuel, Hydraulic and Pneumatic Systems, Engine and Auxiliary Power Unit (APU), and More), End User (OEM and Aftermarket/MRO), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.52% of global demand in 2024, benefiting from major airlines' elevated Pentagon outlays and fleet-modernization campaigns. Domestic sensor suppliers leveraged early engagement with the FAA to shape standards, enhancing export prospects once rules were adopted abroad. Yet the reliance on offshore chip fabrication prompted Washington to allocate USD 52 billion under the CHIPS Act to bolster local microelectronics capacity.

Asia-Pacific recorded the highest growth rate at 7.85% CAGR as carriers expanded narrowbody fleets and governments funded Indigenous sensor programs to mitigate export-control risks. China's aviation services value was forecast to hit USD 61 billion by 2043, eclipsing every single country market. Japanese and Korean manufacturers collaborated on MEMS inertial modules for urban-air-mobility vehicles, while India advanced roadmaps for domestically produced air-data sensors to support regional jet projects.

Europe remained a technology bellwether, enforcing stringent sustainability and cybersecurity rules that fostered sensor innovation. Thales completed the Cobham Aerospace Communications acquisition, reinforcing avionics portfolios that blend sensors and secure datalinks. EASA's harmonization with the FAA facilitated reciprocal acceptance of approvals, but suppliers still navigated separate documentation streams. The region emphasized SAF validation instrumentation and non-CO2 emissions monitoring as part of its Fit-for-55 climate package.

- TE Connectivity Corporation

- Honeywell International Inc.

- Meggitt PLC

- AMETEK Aerospace, Inc.

- Thales Group

- Collins Aerospace (RTX Corporation)

- Curtiss-Wright Corporation

- Safran SA

- Hydra-Electric Company

- PCB Piezotronics, Inc. (Amphenol Corporation)

- Precision Sensors (United Electric Controls)

- Moog Inc.

- Garmin Ltd.

- TT Electronics plc

- Woodward, Inc.

- EMCORE Corporation

- Bosch General Aviation Technology GmbH (Robert Bosch GmbH)

- Eaton Corporation plc

- Crane Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated adoption of fly-by-wire and health-monitoring architectures

- 4.2.2 Shift to SAF-ready engines driving high-accuracy thermal sensing

- 4.2.3 FAA mandate on airborne collision-avoidance upgrades

- 4.2.4 Mainstream drivers-as-a-service platforms for connected fleets

- 4.2.5 Additive-manufactured sensor housings reducing unit cost

- 4.2.6 Edge-AI-enabled self-calibrating sensors lowering MRO spend

- 4.3 Market Restraints

- 4.3.1 Persistent supply-chain crunch of aerospace-grade ASICs

- 4.3.2 Certification backlog slowing new sensor design-ins

- 4.3.3 Cyber-hardening requirements inflating BOM cost

- 4.3.4 Export-control tightening on MEMS IMUs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Aircraft Type

- 5.1.1 Fixed-Wing

- 5.1.1.1 Commercial Aviation

- 5.1.1.1.1 Narrowbody Aircraft

- 5.1.1.1.2 Widebody Aircraft

- 5.1.1.1.3 Regional TJets

- 5.1.1.2 Business and General Aviation

- 5.1.1.2.1 Business Jets

- 5.1.1.2.2 Light Aircraft

- 5.1.1.3 Military Aviation

- 5.1.1.3.1 Fighter Aircraft

- 5.1.1.3.2 Transport Aircraft

- 5.1.1.3.3 Special Mission Aircraft

- 5.1.2 Rotary-Wing

- 5.1.2.1 Commercial Helicopters

- 5.1.2.2 Military Helicopters

- 5.1.1 Fixed-Wing

- 5.2 By Sensor Type

- 5.2.1 Pressure

- 5.2.2 Temperature

- 5.2.3 Position

- 5.2.4 Flow

- 5.2.5 Torque

- 5.2.6 Radar

- 5.2.7 Accelerometers

- 5.2.8 Proximity

- 5.2.9 Other Sensors

- 5.3 By Application

- 5.3.1 Fuel,Hydraulic and Pneumatic Systems

- 5.3.2 Engine and Auxiliary Power Unit (APU)

- 5.3.3 Cabin and Cargo Environmental Controls

- 5.3.4 Flight Control Systems

- 5.3.5 Flight Decks

- 5.3.6 Landing Gear Systems

- 5.3.7 Weapon Systems

- 5.3.8 Others

- 5.4 By End User

- 5.4.1 OEM

- 5.4.2 Aftermarket/MRO

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Mexico

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 France

- 5.5.3.3 Germany

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arbaia

- 5.5.5.1.2 Israel

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TE Connectivity Corporation

- 6.4.2 Honeywell International Inc.

- 6.4.3 Meggitt PLC

- 6.4.4 AMETEK Aerospace, Inc.

- 6.4.5 Thales Group

- 6.4.6 Collins Aerospace (RTX Corporation)

- 6.4.7 Curtiss-Wright Corporation

- 6.4.8 Safran SA

- 6.4.9 Hydra-Electric Company

- 6.4.10 PCB Piezotronics, Inc. (Amphenol Corporation)

- 6.4.11 Precision Sensors (United Electric Controls)

- 6.4.12 Moog Inc.

- 6.4.13 Garmin Ltd.

- 6.4.14 TT Electronics plc

- 6.4.15 Woodward, Inc.

- 6.4.16 EMCORE Corporation

- 6.4.17 Bosch General Aviation Technology GmbH (Robert Bosch GmbH)

- 6.4.18 Eaton Corporation plc

- 6.4.19 Crane Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment